Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Whitepaper In Four Minutes — Ripple

This article is part of a weekly series called infourminutes. They publish a summary of crypto or blockchain whitepaper every week. Please subscribe here.

Introduction:

Ripple is a cryptocurrency, which aims to enable “fast, scalable, and stable” and nearly free cross-border payments of any size with no chargebacks through their real-time gross settlement system (RTGS), currency exchange, and remittance network.

First released in 2012, Ripple fundamentally differs from Bitcoin.

The later relies on a network of “miners” who run code that validates transactions and keeps the network secure. The network incentivizes the miners by rewarding them with bitcoins as incentives.

But in case of Ripple, “mining” does not generate new coins. All of the 100 billion coins (XRP) were released by the network in 2012. The creators of the XRP coins kept 20 billion and gave the rest to the company.

Since then, Ripple has been methodically distributing tokens to its clients, but it still holds nearly 50 billion in an escrow account.

Who are these clients?

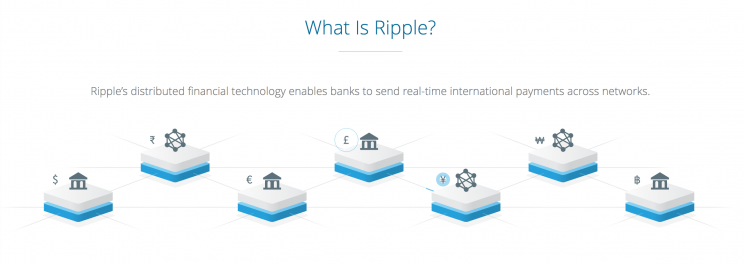

Essentially, banks and regulated financial institutions. Ripple’s distributed open-source internet protocol consensus ledger helps its clients to integrate Ripple into their own systems.

A Simple & Real-World Example of How Ripple Works

On Jan, 2018, Ripple partnered with MoneyGram (a cross-border money transfer company) who are now using XRP to speed up and reduce the cost of transferring money by using Ripple’s xRapid payment network.

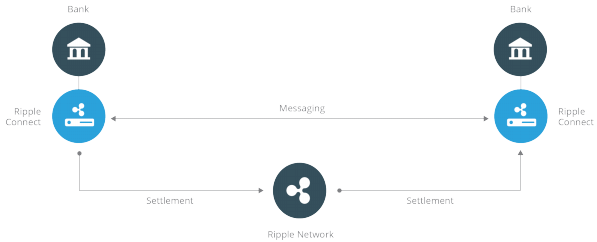

Ripple transfer between banks.

The status quo is that when you send money (in one currency; USD for example) to another currency (let’s say, Indian Rupees) using MoneyGram or banks, this conversion takes several business days and involves multiple stakeholders who get their cut.

Ripple changes this by acting as a central currency, XRP.

So now if you were to send USD to your friend in India (INR), the US bank would trade USD for XRP and then trade XRP for INR.

Ripple acts a central currency.

The reverse process would happen from the Indian bank receiving the USD.

How does Ripple Differ from Bitcoin or Ethereum?

Ripple’s protocol consensus algorithm differs from Bitcoin’s full node and Ethereum’s smart contracts.

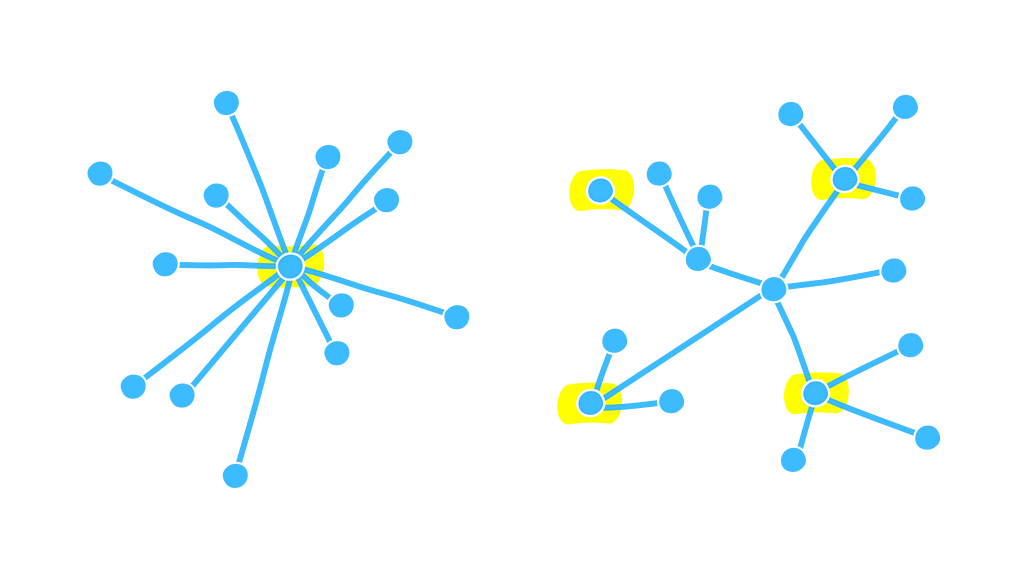

Ripple validates transactions and recommends its clients to use a list of identified, trusted participants to validate their transactions. Also, known as the Unique Node List (UNL); each server maintains a unique node list — a set of other trusted nodes. Only the votes of the other members of the UNL of are considered when determining consensus (as opposed to every node on the network in case of Bitcoin).

Thus, the UNL represents a subset of the network which when taken collectively, is trusted not to collude in an attempt to defraud the network.

Thus, this gives Ripple larger control over XRP’s inner workings.

Is it truly decentralized then?

Cryptocurrencies started with a philosophy against centralized governing institutions who currently control the bulk of the global financial industry. Ripple is considered to be another form of centralization as majority of coins are held by the owners and consensus is determined by a fixed set of nodes.

Centralized/Decentralized

But XRP was never meant to be another Bitcoin.

Ripple’s big bet is that XRP will become a “bridge currency” that financial institutions use to settle cross-border payments faster and more cheaply than they do now using global payment networks with its fees and slower process.

Bitcoin can also do cross-border payments, but it can only settle 7 transactions per second. Ethereum can settle around 150 smart contracts per second. Ripple, on the other hand, claims it can settle 1,500 transactions per second: 24 hours a day, seven days a week, 52 weeks a year.

Good to know about the Ripple Consensus Algorithm (RPCA):

The Ripple Consensus Ledger (the thing that all of Ripple’s clients are using) is designed to allow value transfer between different currencies with a sort of hopping between different market makers.

This happens without the utility of any XRP. XRP tokens were designed as a way for many market makers to make a paring with — thus allowing for many transactions to occur with only one hop: Currency 1 → XRP → Currency 2.

Conclusion:

Unlike Bitcoin, Ethereum, Dash, and other Alt-coins, Ripple is recognized as a legal tender by several governments, which gives it instant liquidity via financial institution, as well as purchasing power over material goods.

References:

This story was written by Ankurman Shrestha, and was originally published on infourminutes.

To read the weekly summary of whitepapers, please subscribe to the mailing list.

Are you on Twitter? Please follow us to stay updated.

Whitepaper In Four Minutes — Ripple was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.