Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin‘s swift climb above $64,000 has put most of the industry green. Alongside the rest of the market, Bitcoin reversed weeks of negative performance upon news of the assassination attempt of former US President Donald Trump.

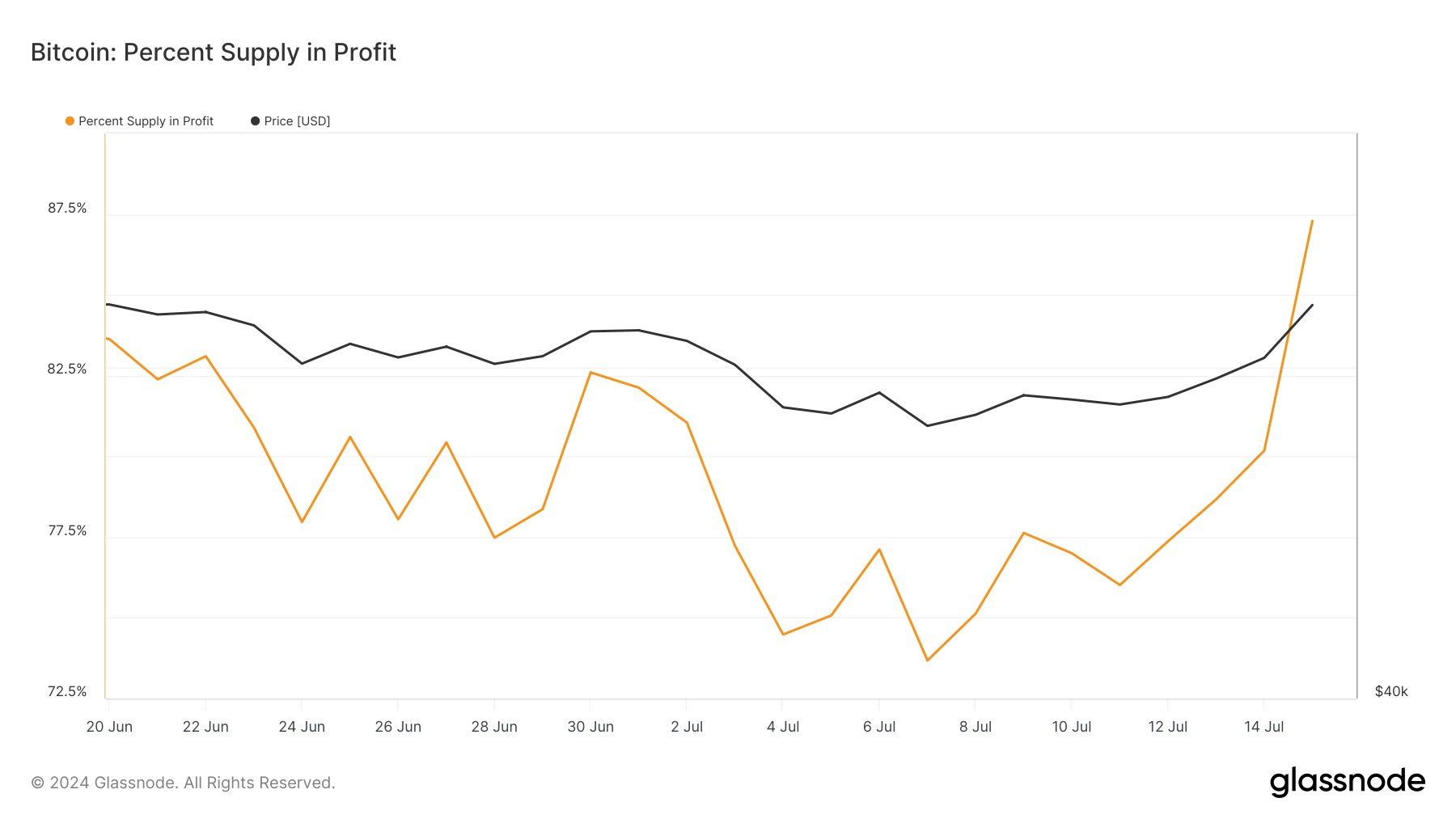

The market’s increase in profitability can be seen through the percentage of Bitcoin’s supply in profit. While the metric is simple, it provides a clear snapshot of the market’s health and shows the distribution of gains and losses.

Data from Glassnode showed the percentage of supply in profit increased from 73.67% on July 7 to over 87.29% by July 15. It represents a significant increase and confirms the extent of the positive sentiment in the market. This could potentially encourage further buying pressure as the market becomes more profitable for a large segment of short-term holders.

Graph showing the percentage of Bitcoin’s supply in profit from June 20 to July 15, 2024 (Source: Glassnode)

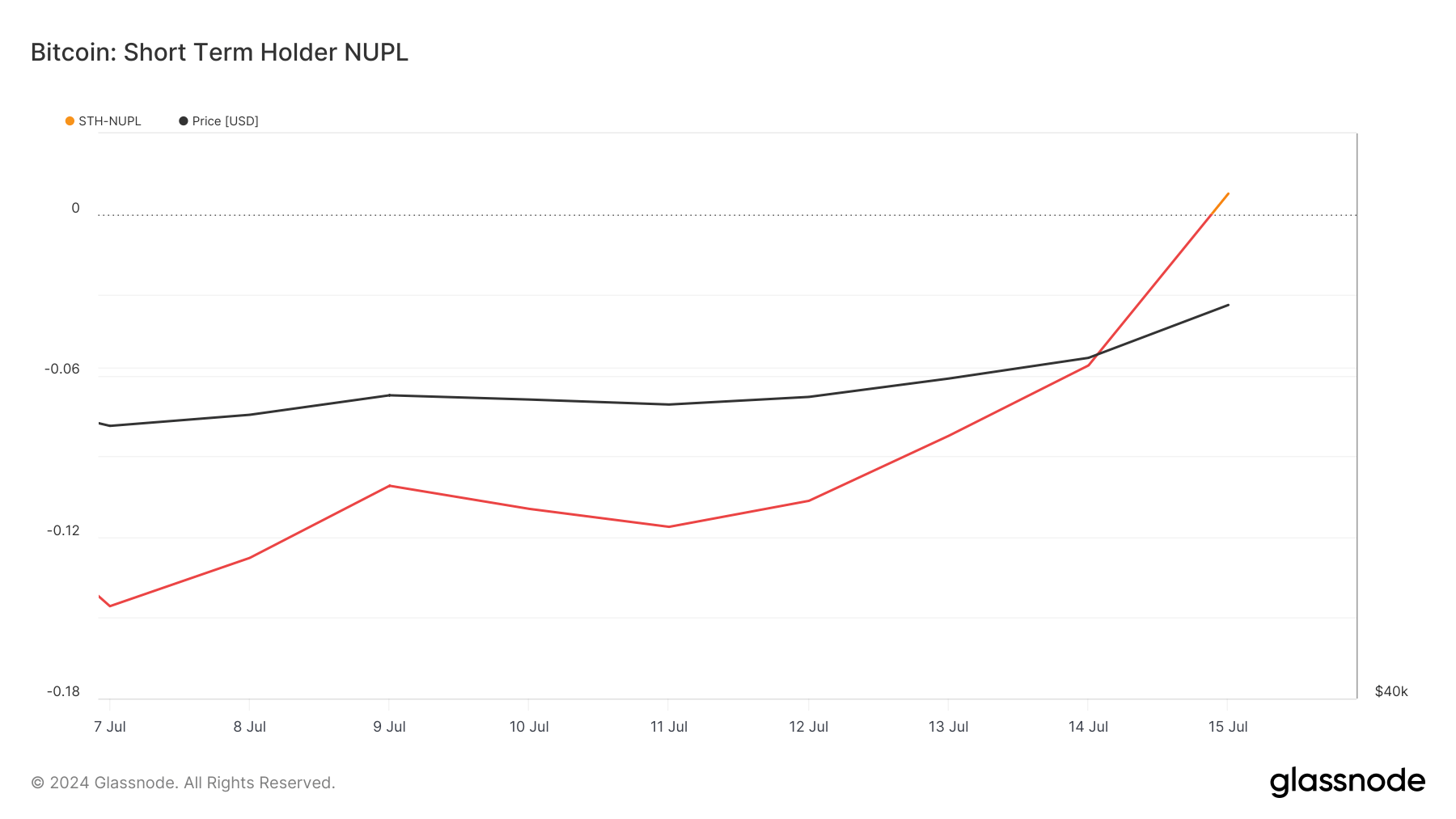

The profitability and sentiment of short-term holders (STHs) are best assessed through the net unrealized profit/loss (NUPL). NUPL measures the difference between the market value and the cost basis of held coins, offering a real-time gauge of whether the cohort is in a state of profit or loss. For STHs, who tend to be more sensitive to price fluctuations and market changes, a positive NUPL indicates a favorable environment, potentially reducing selling pressure and fostering a more stable market. Conversely, a negative NUPL might signal distress among short-term traders, increasing the likelihood of selling and market volatility.

Data from Glassnode showed that NUPL turned positive on July 15 as BTC crossed $64,000. It represents a culmination of a gradual increase we’ve seen over the past week or so, with STH NUPL increasing from -0.1456 to 0.0076. This is a critical indicator of market recovery and growing optimism among recent buyers. It suggests that the market is absorbing new demand effectively, and short-term traders are beginning to see positive returns on their investments.

Graph showing the net unrealized profit/loss (NUPL) for short-term holders from July 7 to July 15, 2024 (Source: Glassnode)

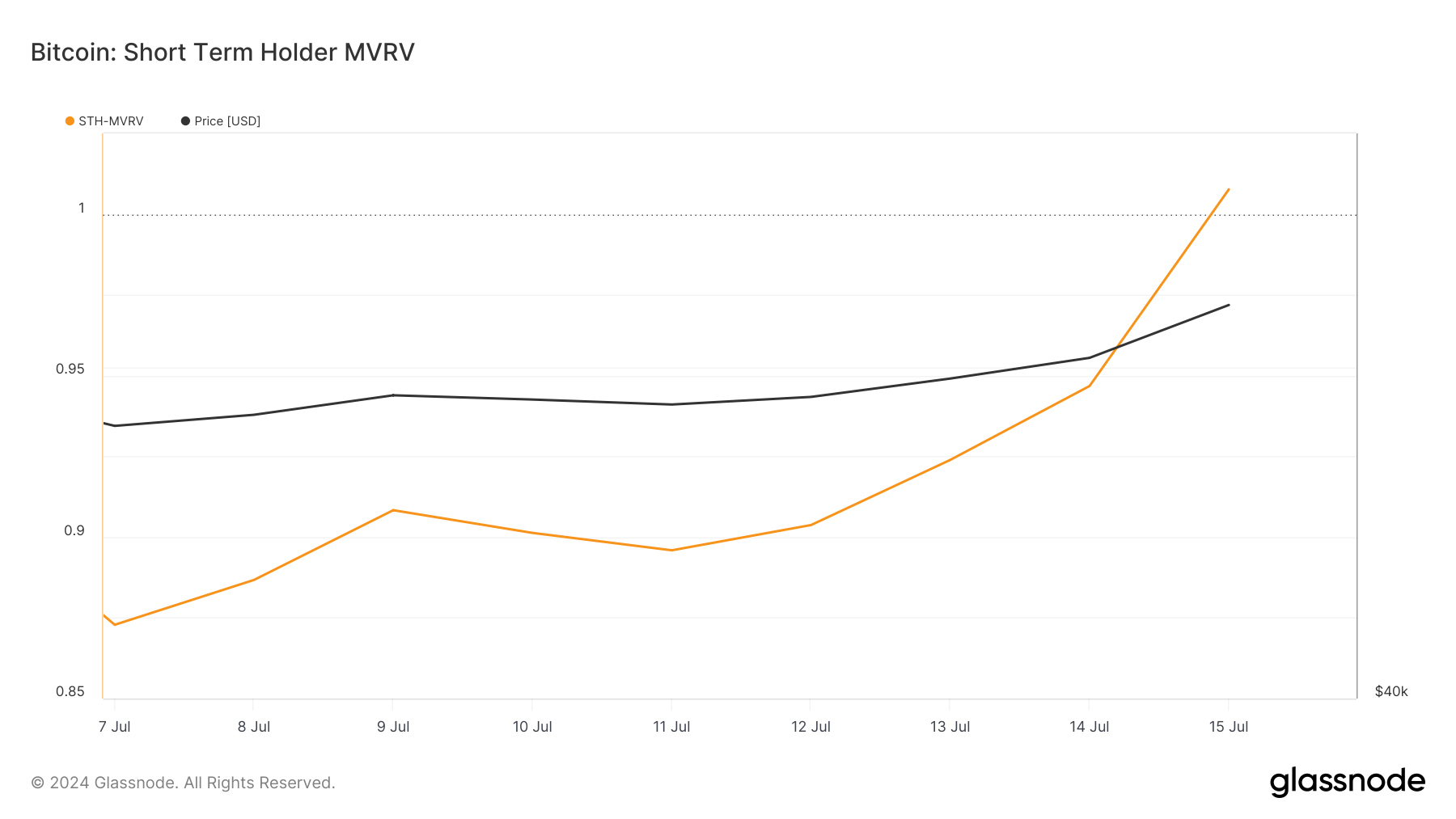

Market value to realized value (MVRV) is another critical metric for assessing STH profitability. It compares Bitcoin’s market value to its realized value, providing a ratio that reflects the current market conditions relative to the cost basis of recent investments. An MVRV ratio above 1 indicates that the market value is higher than the realized value, suggesting that investors, on average, are in profit. For STHs, a rising MVRV ratio indicates increasing profitability, which can boost confidence and reduce the selling pressure.

Like the STH SOPR, the STH MVRV increased from 0.8728 on July 7 to 1.0076 on July 15. This metric moving above 1 for the first time since June 20 indicates that short-term holders’ market value now exceeds their cost basis. This crossover point is a bullish signal, often suggesting that the market is recovering and short-term holders are gaining confidence as their holdings become profitable.

Graph showing the market value to realized value (MVRV) ratio for short-term holders from July 7 to July 15, 2024 (Source: Glassnode)

The improvement we’ve seen in both NUPL and MVRV ratios shows a significant shift in the profitability of short-term holders. The consistent rise in these price and profitability metrics creates a solid foundation for the bullish trend to continue in the coming weeks. As more STHs move into profit, the potential selling pressure they create might decrease, allowing for a more sustained price increase.

However, a sharp price correction can potentially wipe away this unrealized profit and push STHs back into the red. The reactive nature of this cohort means any negative news could flip the trend and create losses.

The post Short-term holders recover gains as 87% of Bitcoin’s supply now in profit appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.