Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

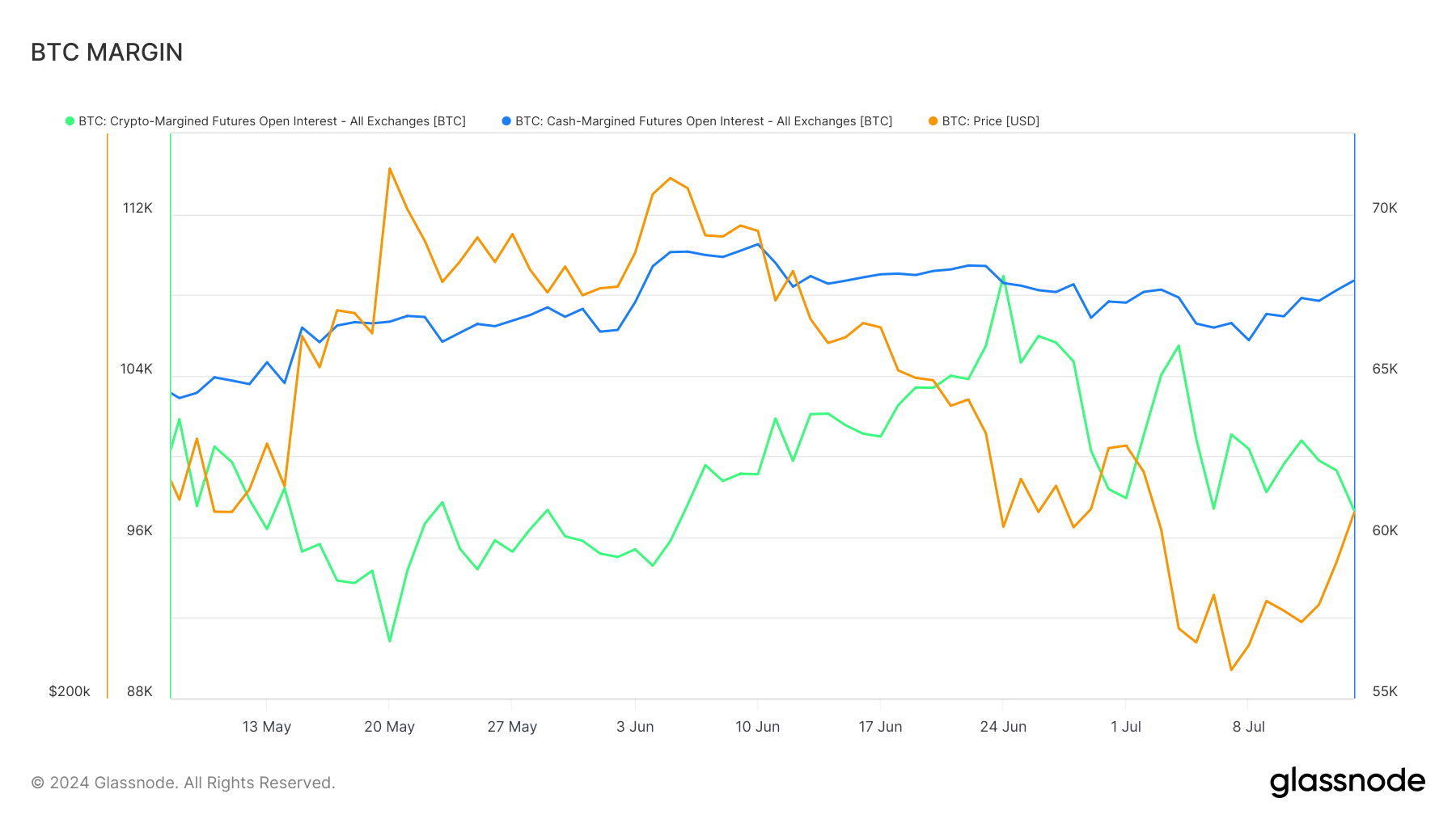

Bitcoin’s recent price action has seen a notable divergence in futures market activity. Data from Glassnode reveals a marked increase in cash-margined futures open interest across all exchanges, while crypto-margined futures open interest has declined.

This trend coincides with Bitcoin’s price surging past $62,000 following bullish momentum on former President Trump’s assassination attempt at the weekend.

The blue line, representing cash-margined futures, demonstrates a steady upward trajectory, suggesting increased interest in these instruments. Conversely, the green line, indicating crypto-margined futures, shows a decline over the same period. The orange line tracking Bitcoin’s price correlates with the uptick in cash-margined futures.

This shift implies a growing preference for cash-margined futures, particularly on platforms like the Chicago Mercantile Exchange (CME), as traders seek to hedge positions or gain exposure without holding the underlying asset—the divergence between cash and crypto-margined futures highlights differing market sentiments and risk management strategies among participants.

This trend emphasizes the evolving landscape of Bitcoin derivatives trading, where institutional engagement through cash-settled products appears to be gaining traction.

The post Shift to cash-margined futures intensifies as Bitcoin surpasses $62,000 appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.