Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Coinbase vs Binance

If you’re new to the cryptocurrency space, it’s possible that the only exchanges that you’ve heard of are Coinbase and Binance. Coinbase is the go-to platform for beginner investors while Binance has quickly become the largest cryptocurrency exchange even recently surpassing Deutsche Bank in profitability.

Both exchanges are suited for different purposes, and you should view them as complementary rather than competitors. In this Coinbase vs Binance review, we’ll provide all the information you need to figure out which exchange is better for you (if not both).

We’re going to cover:

- Funding Methods

- Interface

- Trading Fees

- Available Cryptocurrencies

- Transfer Limits

- Company Trust

- Fund Security

- Customer Support

Coinbase vs Binance: Key Information

ExchangeSite Type

Easy Buy/Sell Methods

Cryptocurrency Exchange

Beginner Friendly![]()

![]()

Mobile App![]()

![]()

Buy/Deposit Methods

Debit Card, Bank Transfer, Cryptocurrency

Cryptocurrency

Sell/Withdrawal Methods

Bank Transfer, Cryptocurrency

Cryptocurrency

Available Cryptocurrencies

Bitcoin, Ethereum, Litecoin, Bitcoin Cash

Bitcoin, Ethereum, Litecoin, Bitcoin Cash + >100 more coins

Company Launch

2012

2017

Location

San Francisco, CA, USA

Malta

Community Trust

Great

Great

Security

Great

Great

Customer Support

Good

Good

Verification Required

Yes

No

Fees

Medium

Very Low

Site

Visit Coinbase

Visit Binance

jQuery(document).ready(function($) {

$("#table-8472").stacktable({ myClass:"stacktable small-only" });

});

Funding Methods

Coinbase has significantly more options to fund your account than Binance does.

On Coinbase, you can deposit money and/or buy cryptocurrency via ACH transfer, debit card, or wire transfer. You can also deposit supported cryptocurrencies – currently Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

Binance is purely a cryptocurrency exchange, so you’re only able to fund your account with cryptocurrency. For this reason, many traders will first buy either Bitcoin or Ethereum on a platform like Coinbase or another fiat exchange and transfer it to Binance to get other coins.

Interface

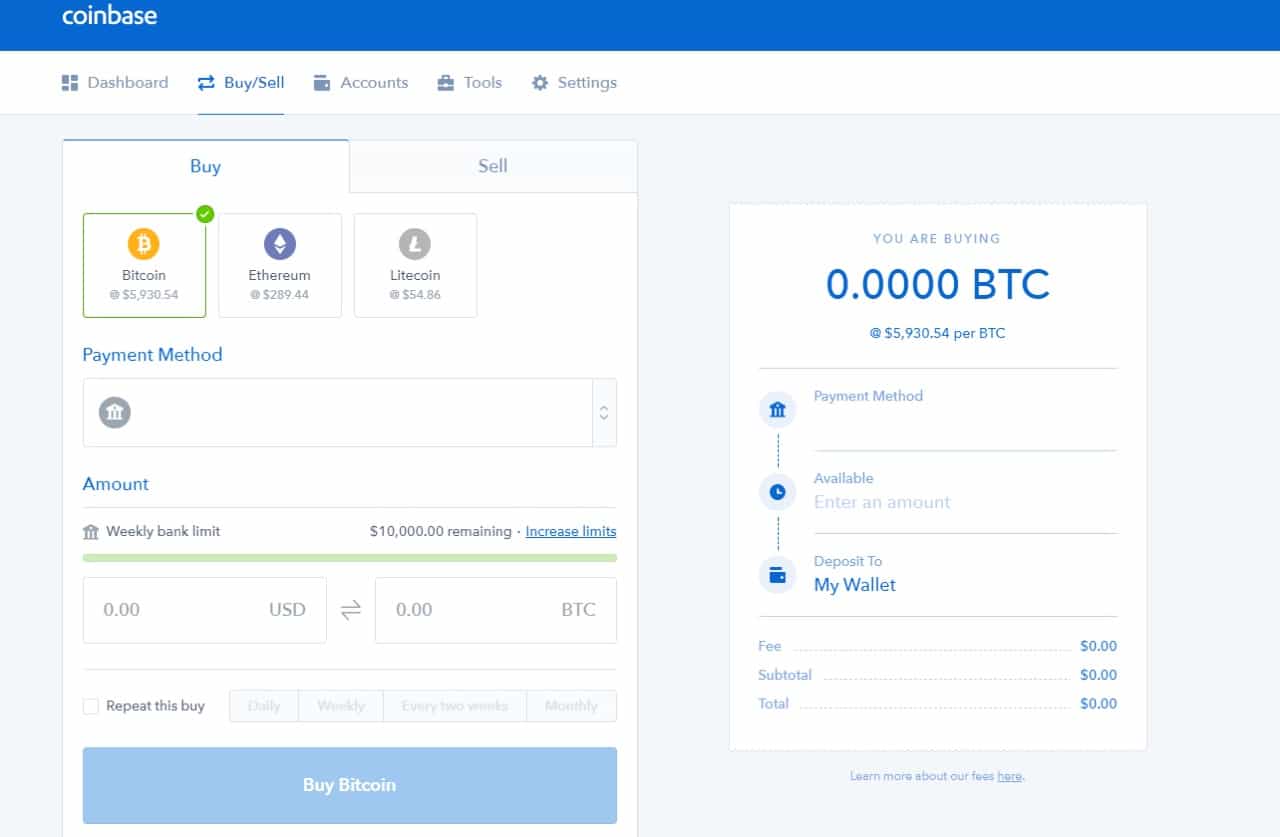

The Coinbase team designed their interface with the novice investor in mind. Unlike more complicated trading platforms, you don’t have options for margin trading or even market/limit orders. You just have simple buy and sell options.

This is great if you’re just starting out or using Coinbase as a stepping stone to another platform. However, if you’re the type interested in including technical analysis (TA) in your trades, you may want to look elsewhere.

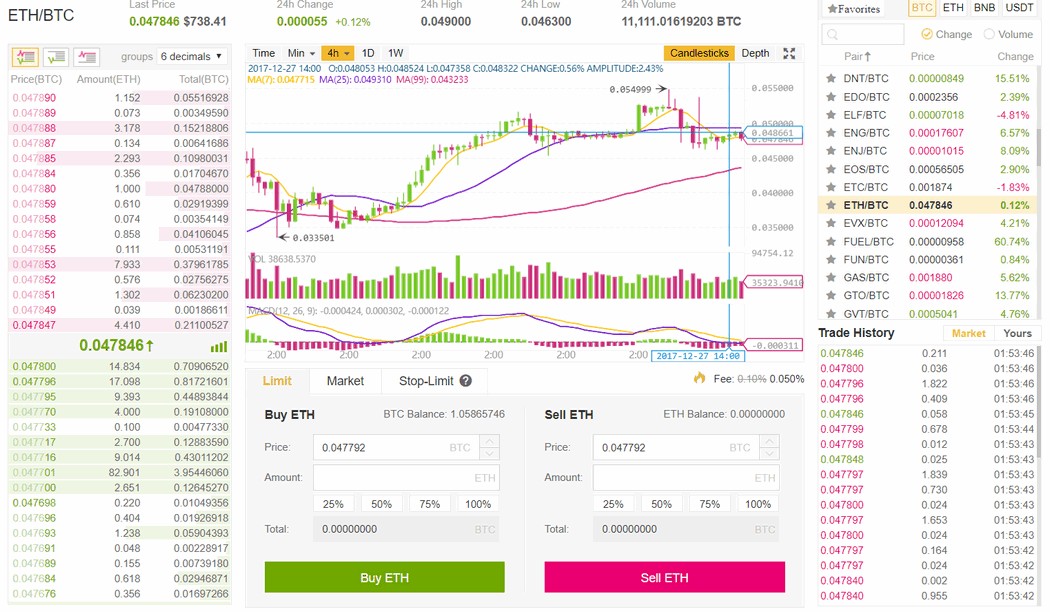

On the other hand, Binance is better suited for more experienced traders. The exchange does include both a “Basic” and “Advanced” platform, though, so you shouldn’t be intimated to try it out if you’re new.

The Basic view gives you all the standard options of a trading platform (order books, charts, trade history) while the Advanced view gives you some more analysis tools.

As mentioned earlier, a solid strategy is to quickly buy a coin on Coinbase for the purpose of transferring it to Binance to do more extensive trading.

Trading Fees

Binance blows Coinbase out of the water when it comes to trading fees. Coinbase fees vary based on the buying method but typically range between 1.49% and 3.99%. Investments under $200 could bring you even higher fees as well.

Binance has some of the lowest fees out of all the exchanges at 0.1% per trade. Additionally, this fee is cut in half when you pay using the Binance coin, BNB.

Available Cryptocurrencies

Binance has a much larger coin selection than Coinbase.

Currently, Coinbase just supports Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. The team has announced, though, that they plan to add ERC20 tokens to the platform soon.

Binance includes the same coins as Coinbase in addition to over 100 more. The list of other coins includes, but isn’t limited to:

The coins on Binance are in trading pairs with either Bitcoin, Ethereum, Binance, and/or Tether.

Transfer Limits

On Coinbase, your buying history, account age, and verification level determine the maximum amount you can transfer into and out of your account in one week. With a verified U.S. account, you shouldn’t have any trouble getting a weekly limit of $5,000 for bank account purchases and $50 for card purchases. For the most part, the withdrawal limit is much higher than the deposit limits.

Coinbase deposits using a bank account generally take 4-5 business days, and card deposits are instant. Withdrawals can take anywhere from 2 to 4 business days.

Binance is more lenient with their limits. There’s no limit to the amount you can deposit, and your withdrawal limit is based on your verification tier:

- Non-verified: 2 BTC daily limit

- Verified: 50 BTC daily limit

The verification process includes sending in some personal information and proving photo identification.

Company Trust

Both Coinbase and Binance receive an immense amount of trust and respect from the cryptocurrency community.

Coinbase is a US-based company that has adhered to all proper regulations since its founding. The platform has over 10 million users and has exchanged over $50 billion worth of digital currency. They also have the backing of investors like Andreessen Horowitz and the New York Stock Exchange.

Binance CEO Zhao Changpeng is known for his transparency no matter which situation Binance is in. Whether it’s hack attempts, platform outages, or rumor allegations, Changpeng keeps users informed over email and Twitter. That’s just one of the reasons why the exchange currently boasts the largest trading volume of any other cryptocurrency exchange.

#Binance has verified all listed ERC20 tokens are not affected by the Batch or Proxy Overflow Bugs. Thank you @Quantstamp for your assistance in keeping Binance the most secure exchange by efficiently auditing all ERC20 tokens listed.

Read more on Medium: https://t.co/ikfuwYWtI8

— Binance (@binance) April 30, 2018

Fund Security

Your funds are safe on both Coinbase and Binance.

The U.S. dollar funds you store on Coinbase are covered by FDIC insurance up to $250,000. Additionally, the exchange stores 98% of users’ digital assets in offline storage with the remaining 2% being insured. Even in the event of a data breach, that insurance is enough to recoup all lost funds.

Even though security information is not readily available on their website, Binance has proven time and again that it’s a top priority. Recently, some Binance users fell victim to a phishing/API attack. The Binance team suspended withdrawals immediately upon noticing suspicious activity which stopped the hackers in their tracks. After thwarting the bad parties, they reversed the appropriate trades and returned users’ funds.

That being said, it’s still recommended to keep your funds off an exchange and in a wallet to gain an extra layer of security.

Customer Support

The customer support on both platforms has been historically slow compared to traditional companies due to the rapid growth of the cryptocurrency industry. This seems to be changing, though.

Coinbase recently added a customer service phone number. Although email responses can still take over a week, getting through on the phone line is quick and easy.

Binance also has a backlog of support tickets, but the team is communicative on both Reddit and Twitter in helping users fix the issues that they have.

Coinbase vs Binance Conclusion

Both Coinbase and Binance are reputable exchanges that excel in different areas. And, they easily complement one another.

Coinbase is perfect if you’re a beginner or want a quick way to purchase coins to transfer to other exchanges. This comes with a higher price tag, though.

Binance is ideal to purchase a wide array of coins for minimal fees. Its more complex interface also gives you more information for you to make TA-based trades.

(See CoinCentral’s Full List of Crypto Exchange Reviews)

More Coinbase Comparisons

The post Coinbase vs Binance Exchange Comparison appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.