Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin prices and cryptocurrency spot markets, in general, have been recovering after the downturn that took place from mid-December 2017 up until three weeks ago. At the time, when BTC derivatives products were introduced to the public, futures contracts got off to a slow start. Now bitcoin-based futures markets from the Chicago Board Options Exchange (Cboe) and the Chicago Mercantile Exchange (CME) have seen a significant uptick in product sales for the trading sessions during the month of April and May.

Also read: Bitcoin Markets Steady for Another Gox Dump, 16,000 Coins Moved by Trustee

Bitcoin Futures Products from CME and Cboe Start Seeing Significant Trade Volume

In March, news.Bitcoin.com reported on bitcoin-based derivatives products from CME and Cboe starting to pick up in volume. CME contracts at the time had around 1,000 contracts per day and zero sold for the month of May as it stood. However, that month Cboe saw a great influx of volume as March expiries closed above 10,000 contracts and May products were starting to sell steadily. Fast forward to this week as cryptocurrency spot markets start seeing some signs of recovery, bitcoin futures products are selling like hotcakes.

Last Wednesday’s Futures Volumes Were Nearly Three Times the Average Daily Volume

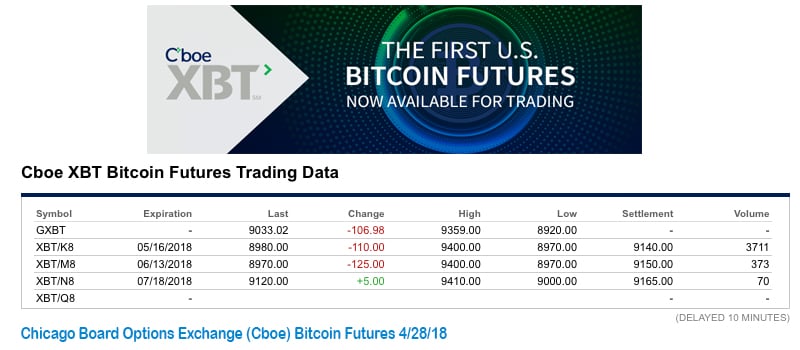

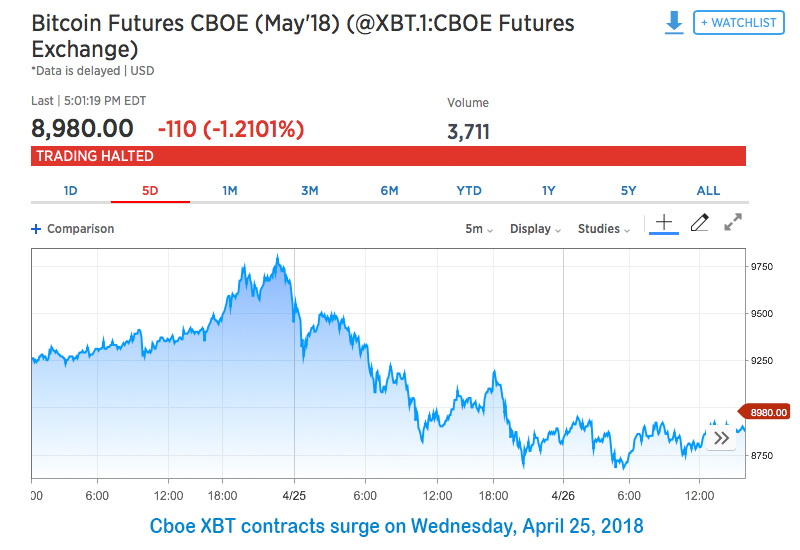

This past Wednesday Cboe’s bitcoin futures (XBT) spiked in volume as more than 18,000 contracts were traded for May. Furthermore, public data shows June and July Cboe XBT products have starting selling as well but there are zero sold for the month of August.

The next three months of predictions show price stability as contracts hover around the $8,900-9,100 region per XBT. Right now daily May volumes are around 3,700 contracts and 24-hour statistics have been between 3,000-6,000 products a day. Last week’s 18,000+ record beat Cboe’s first milestone of 15,000+ contracts when the futures markets first launched but slowed down considerably since then.

“[The] average daily volume (ADV) runs about 6,600 in XBT Bitcoin Futures. Yesterday’s volume was nearly three times ADV,” Kevin Davitt Cboe Options Institute senior instructor explained this Thursday.

Yesterday was the highest daily volume for bitcoin futures since their introduction here at CBOE nearly five months ago. The lead month May futures traded 18,210 contracts, and across the term structure, a total of 19,000 bitcoin futures traded here yesterday. The previous high-volume session was January 17 with just less than 15,500 contracts traded.

Last Week’s Volumes Were Different to January’s Bitcoin Futures Volumes

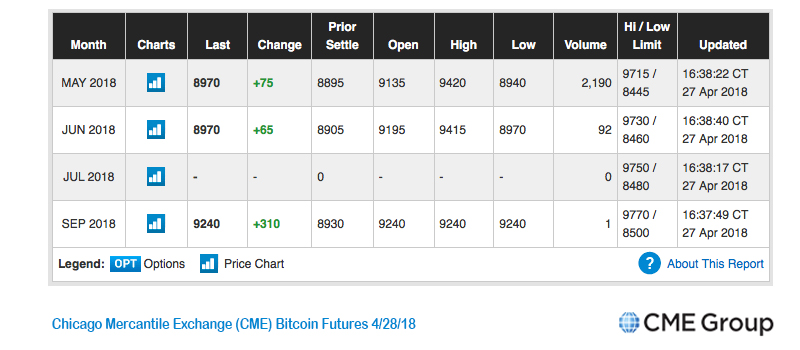

The same day CME Group saw a similar uptick in bitcoin futures volumes for its April 2018 contracts. Wednesday saw 11,000+ contracts on CME’s bitcoin markets according to public data. Cboe’s Davitt says that January’s volume coincided with the first set of contracts but this past Wednesday’s volumes did not, the Cboe senior instructor explained. Nor did it have a 15-20 percent range in futures he would otherwise have expected, he added.

What do you think about Cboe and CME’s bitcoin futures markets seeing considerable contract volume this past week? Let us know in the comments below.

Images via Pixabay, CME Group, Cboe, and CNBC charts.

Looking for a Bitcoin Cash Block Explorer? Check out Bitcoin.com’s BCH Block Explorer today to find transactions, blocks, and other important blockchain data.

The post Bitcoin Futures Markets See a Big Uptick in Trade Volume appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.