Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The recent buzz surrounding the potential approval of a Spot Ethereum ETF has not only propelled Ethereum’s price but also sparked significant interest in Solana as a strong follow-up candidate for ETF consideration. Amid this optimism, Daniel Yan, co-founder of Matrixport, has proposed a strategic pivot for investors, suggesting a focus on Solana (SOL) in relation to Ethereum.

Is Solana The Next In Line?

In a post on X, Yan dissected the immediate market reactions to major ETF approvals and provided a strategic analysis for potential future moves. His insights draw from the historical market behavior observed following the spot Bitcoin (BTC) ETF approval.

After the spot Bitcoin ETF’s acceptance on January 10, BTC experienced a significant drawdown of -15% in the weeks following the event. This pattern of initial surge followed by a sharp pullback may provide a cautionary framework for investors eyeing Ethereum’s potential ETF approval.

Yan proposes that while the intuitive reaction might be to invest directly in Ethereum, given its nearly 20% increase in value over the last 24 hours, a more nuanced approach could be beneficial. He advocates for a “BUY SOL/ETH” trading strategy. This recommendation is based on three key observations:

- Next Candidate for an ETF: Yan believes that Solana could very well be the next cryptocurrency to be considered for an ETF if Ethereum’s ETF gains approval. This anticipation could lead to increased investor interest and a potential price surge in SOL.

- Relative Market Movements: Post the approval of Bitcoin’s ETF, the ETH/BTC pair saw an approximate 12% increase within a week. This was likely due to expectations that Ethereum might follow suit. A similar speculative momentum could be expected for Solana, which could enhance its value against Ethereum.

- Uncongested Trade: The current market focus is predominantly on Ethereum, making it a potentially crowded trade. In contrast, Solana presents a less saturated option, offering the potential for higher relative gains based on ETF speculation dynamics.

The broader context of Yan’s strategy includes the latest regulatory developments where the US SEC has encouraged issuers to update their 19b-4 filings, a move that has been interpreted as a significant step towards the possible approval of spot Ethereum’s ETFs. This has boosted confidence among experts, raising the estimated likelihood of approval from 25% to 75%, according to senior Bloomberg analysts.

The optimism around Ethereum’s ETF prospects has not only enhanced Ethereum’s market position but has also positively affected other major cryptocurrencies, including Solana, which saw robust gains in response to the overall market sentiment.

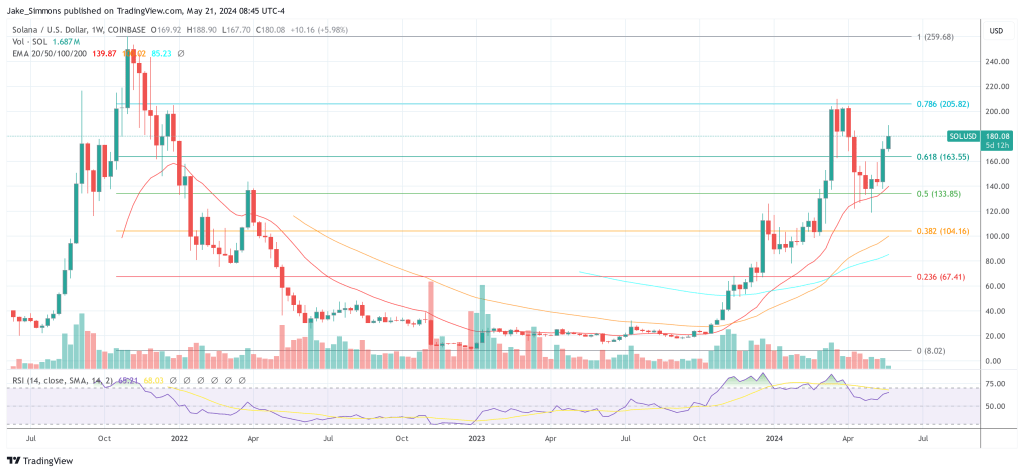

At press time, SOL traded at $180.08.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.