Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Earning yield on your long-term bluechip holdings while maintaining upside price exposure

In the DeFi ecosystem today there are numerous high yield opportunities with lower economic risks where users can allocate their assets. With RWA tokenization and LST/LRT growth, there are many high TVL markets where users can deploy capital with almost no impermanent loss (IL) and very little to no liquidation risks. However, the market is currently exceptionally lopsided in the distribution of asset types that are generating high yields. Stablecoins, ETH, and ETH derivatives have been the primary assets used in the currently available high yield opportunities. This means that holders of other large market cap assets such as BTC or LINK are not able to take advantage of these high yields directly with their current holdings.

In our series exploring IntoTheBlock’s Smart Yield DeFi strategies, we have highlighted Leveraged Staking, Recursive Lending, and liquidity deployment in AMMs. This article will explore supervised loans, a multi-protocol strategy that builds on top of previously highlighted strategies. Supervised loans expands upon these strategies by enabling users to borrow more productive assets, using their bluechip assets as collateral. Borrowed assets are then deployed into high yield strategies such as AMM pools.

Supervised Lending Strategy Overview

Though supervised lending is complex from a risk management standpoint, the implementation is straightforward. As this strategy focuses on bluechip assets that have few yield opportunities in DeFi, we will use a WBTC supervised lending position as an example to highlight the implementation and dynamics of this strategy.

Implementing a supervised loan follows three main steps:

Primary Strategy (S1):

- Depositing WBTC as collateral into a lending protocol. This can be either a monolithic style lending market such as Aave or modular lending market such as Silo or Morpho. This collateral could potentially earn yield but it will likely be nominal to the strategy.

- Borrow the more productive asset such as ETH or stablecoins (USDC, USDT, DAI). The borrow rates can vary depending on the assets borrowed and market conditions. The key is for the borrow rate to be lower than the yield rates in step 3.

Secondary Strategy (S2):

3. Deposit borrowed assets into a high yield secondary strategy (S2) that earns more than the borrow rates from step 2.

The aggregate yields should be high enough that they produce an ROI on the entirety of the collateral used that it outperforms alternative low-risk strategies for that asset. In the example of WBTC, it can be difficult to find DeFi strategies with attractive returns and low risk. Both lending markets and AMM pools with WBTC have below 2% APY, but by borrowing assets like ETH or stables and deploying these assets into DeFi, users can obtain APYs that reach 5% to 10%+ depending on the strategies selected.

Supervised Lending Risks

Risk management on supervised loans can quickly become complex due to the fact that a user needs to monitor both economic risks for the loan and for the S2 strategy. Below are the main economic risks to consider when evaluating a supervised loan:

Primary Strategy (S1):

Liquidation Risk — When borrowing in any DeFi protocol, there is always a risk of liquidations if the value of the collateral drops sufficiently relative to the value of the debt. If liquidation thresholds are reached before a user repays their loan or adds more collateral, a partial or full liquidation can occur, resulting in a loss. Moreover, this can occur automatically at any time of the day, making automated risk management essential as we’ll further discuss.

Recall Risk — This risk refers to how easily a user can recall the borrowed assets that they have deployed into the S2 strategy. Bridging assets to a different chain from where the loan position is or locking the deployed assets into a protocol reduce a users ability to recall these funds to repay their loan and increase their risk of liquidation.

Secondary Strategy (S2): Since the S2 strategy can be any other DeFi strategy that uses the borrowed asset, the list of risks will depend on the type of strategy and protocol a user deploys into. Below is a non-exhaustive list of some of the biggest economic risks to consider for a variety of different strategies.

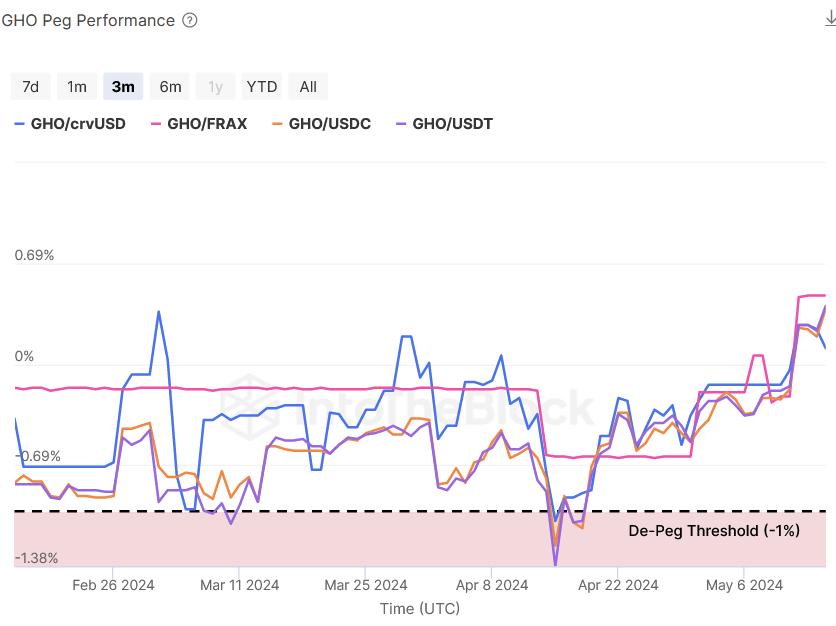

Depeg Risk — Tracks how closely an asset maintains its intended peg. Since depositing the borrowed assets into an AMM pool will expose the strategy to the other asset in the pool, it is important to monitor the price peg of that asset as peg deviations could lead to capital loss and inability to repay the S1 loan in full.

Source: ITB GHO Risk Radar

This chart shows GHO’s peg performance compared to other stablecoins that it trades against. Deviations from the peg can occur, but what is important is that it recovers its peg quickly.

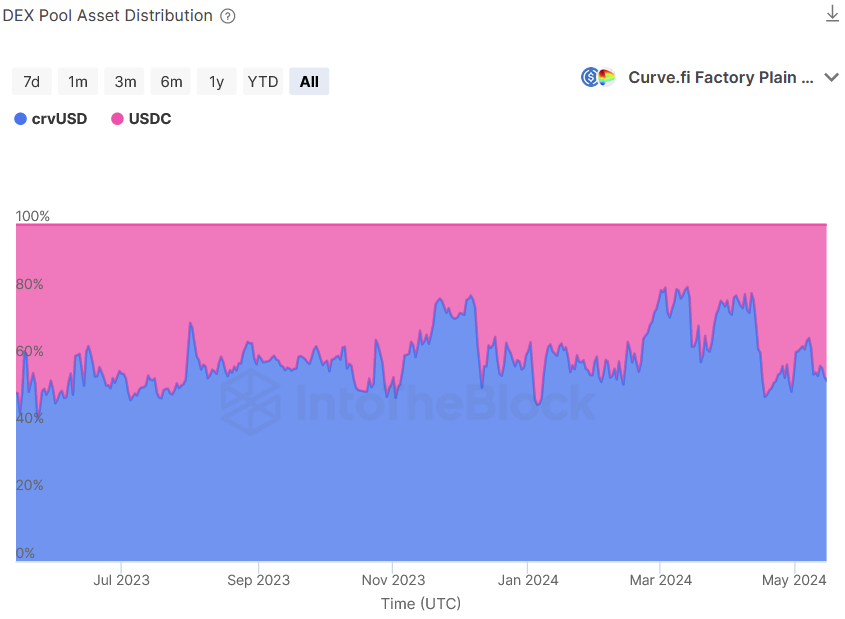

Pool Distribution Risk — If depositing into an AMM pool, the distribution of assets in the pool over time can impact the strategy when entering and exiting the pool one-sided with the borrowed assets. Imbalance pools can signal potential depegs or lead to slippage fees.

Source: ITB crvUSD Risk Radar

Balanced pools such as seen above indicate that the demand is in equilibrium between the two assets. A trend towards a high concentration of one asset in the pool can lead to liquidity exiting and high fees in the form of slippage for depositors who try to exit in one token.

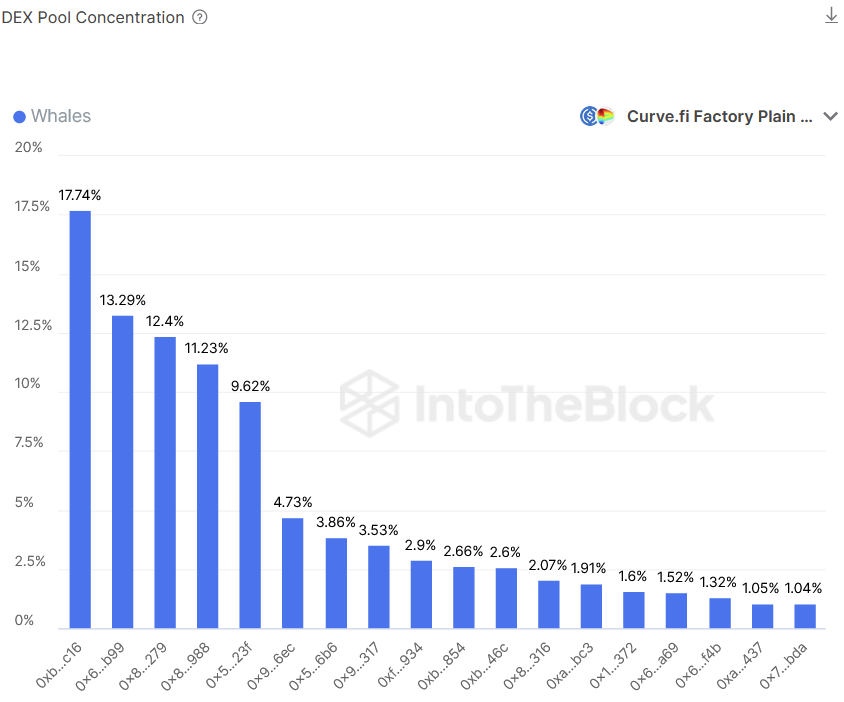

Depositor Concentration Risk — AMM pools with high concentration indicate that most of their liquidity is deposited by a small number of entities. Depositors can be at higher risk of higher slippage when exiting if any of the large depositors exit their position before them.

Source: ITB crvUSD Risk Radar

Though the pool highlighted above indicates that there are just 5 addresses that hold over 60% of the entire pool’s liquidity, the largest depositor is still below 20% of the total liquidity in the pool. A scenario such as this pool needs to be watched to see if concentration trends higher or lower. Higher concentration would indicate a scenario where a user would likely want to reduce pool exposure.

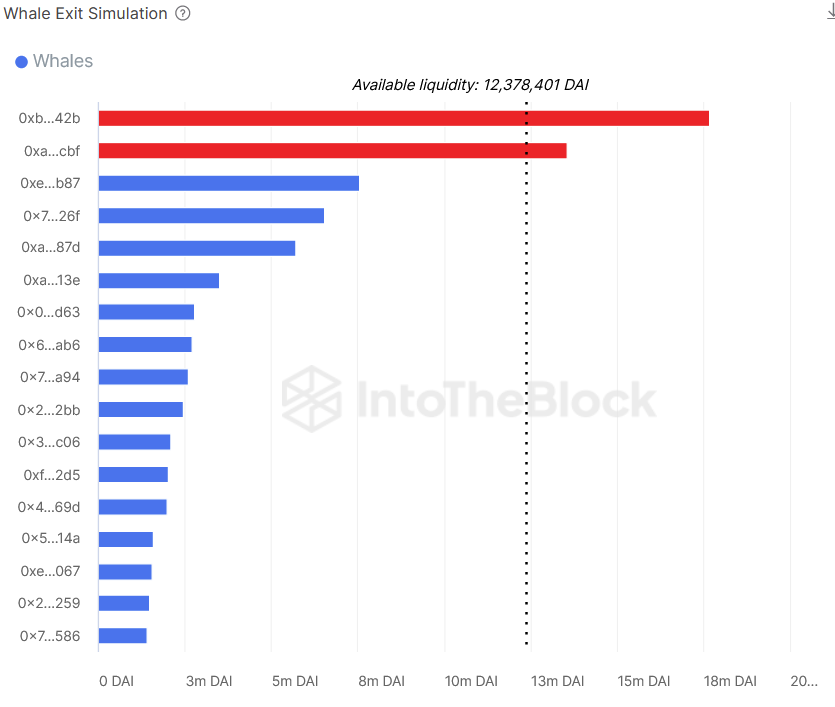

Available Liquidity Risk — If depositing into a lending market, there is a risk that all liquidity gets borrowed from the market and prevents a depositor from being able to withdraw their funds. This would prevent repayment of the S1 loan. Monitoring large depositors in these markets can help gauge the level of risk a depositor faces that their liquidity gets locked in the lending protocol.

Source: ITB Aave Risk Radar

The chart above shows an example of a risky market for available liquidity. If either of the two positions in red were to try and exit their position, all other depositors would not be able to withdraw their assets until new depositors added more liquidity.

IntoTheBlock’s Risk Management & Execution

ITB’s smart yield platform is designed to manage the risks highlighted above and more. Our platform calculates safe capacities, informing how much capital can be deployed without taking excessive risk. Then once capital is deployed, automated systems continuously monitor the economic risks and rebalance the position if necessary.

Like with any ITB strategy, supervised loans are deployed separately for each client, avoiding any co-mingling of funds. The contracts are non-upgradable and non-custodial, assuring the highest security standards.

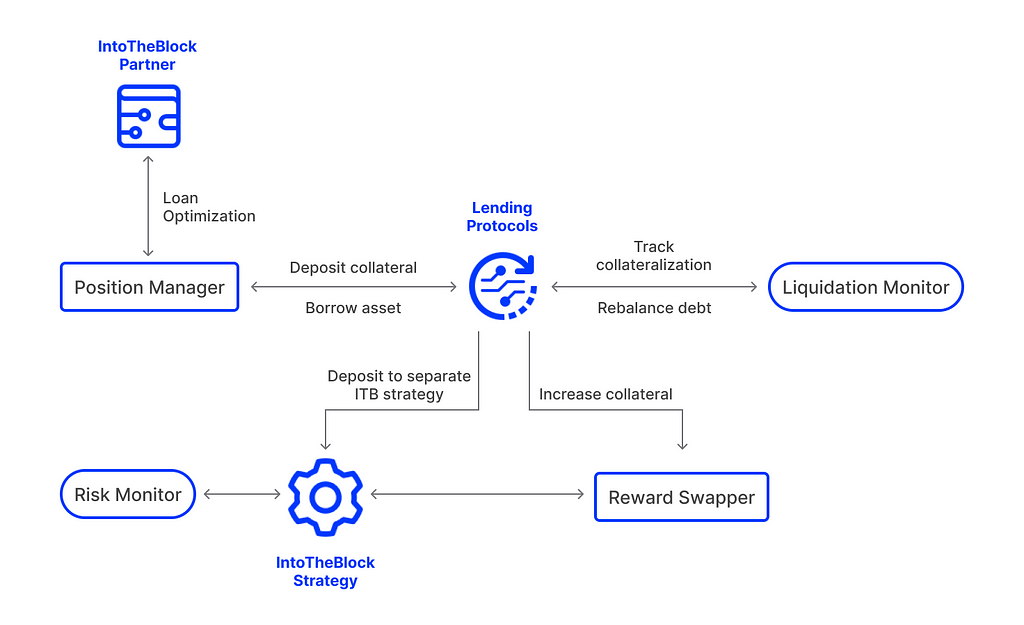

ITB’s supervised loan strategy can be visualized by the diagram below. Two smart contracts (Position Manager and Reward Swapper) interact with two risk engines (Liquidation Monitor and Risk Monitor) to protect our clients’ deployments in both the lending protocol as well as the S2 strategy.

The position manager smart contract is in charge of receiving, allocating and eventually withdrawing funds into the strategy. This contract manages the S1 strategy of depositing collateral and borrowing an asset at the optimal LTV for the given collateral-asset pair. These positions are assembled with a 10–20% buffer away from the max collateral ratio to prevent position liquidations. The reward swapper contract improves LTV by swapping rewards earned in the S2 position into the collateral asset to be deposited into the loan position.

Most importantly, the off-chain risk engines run simulations block-by-block to monitor the strategy’s exposure to economic risks. The liquidation monitor engine focuses on the health of the S1 loan position. If the loan is ever within 5% of liquidation (or another predetermined threshold), the liquidation monitor executes a transaction withdrawing capital from the secondary strategy and repays part of the debt all within the same block. This effectively mitigates liquidation risk as much as possible, and allows this type of strategy to be executed in a more capital efficient manner than if it were done manually.

Overall, supervised loans are among the riskier strategies that can be taken out in DeFi. Deploying this type of strategy without proper risk monitoring and execution can result in devastating losses. Having modeled economic risks for years, the ITB supervised loans effectively mitigates risks, minimizing potential losses from liquidations and other risk vectors, while still generating attractive yields.

About IntoTheBlock Smart Yields

IntoTheBlock Smart Yields is an institutional product safeguarding access to some of the most attractive opportunities in DeFi.

While supervised loans are one of the more complex strategies that ITB has to offer, there are over 100 strategies available within our platform, all protected through an advanced layer of risk management. Strategies are deployed across more than ten blockchains, with broad coverage of assets and protocols available.

Exploring Institutional DeFi: Supervised Loans was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.