Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

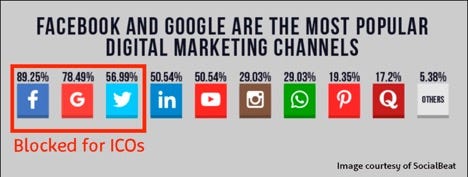

Marketers in the blockchain space (all 12 of us) have been getting hammered over the first quarter of this year with more and more bad news over the first quarter of this year as more and more traditional marketing channels become unavailable in the blockchain space. Most likely, this is because 92% of recent ICO projects were said to be scams, failed or have just gone dead, but were able to easily advertise on various platforms like Facebook and Twitter.

However, this raises the question if a blanket ban on all cryptocurrency-related advertising is the right approach? And more importantly, how do real, legitimate blockchain projects continue to market themselves now that Facebook, Twitter, Reddit and AdWords are putting the kibosh on blockchain companies?

Twitter, Facebook and Google are some of sites blocking crypto adsBig Companies Still Don’t Get Crypto

Twitter, Facebook and Google are some of sites blocking crypto adsBig Companies Still Don’t Get Crypto

One of the biggest problems facing the existing media giants is that they likely don’t understand cryptocurrency. Indeed, the cryptocurrency market is growing and evolving so quickly that it can be difficult to keep up-to-date with its latest trends and updates.

Further, the mainstream media has started to take notice of the ICO craze and sensationalize the recent Ponzi scheme-like and exit-scam events. John Oliver of Last Week Tonight recently did an entire segment about cryptocurrency.

Let’s look at it from the perspective of the advertising platforms for a moment. Up until recently, any ICO could easily pay for advertisements touting 1000% returns to potential investors, raise a bunch of capital and then just disappear.

Naturally, victims of the scheme will want to blame whoever or whatever got them involved in it. A natural first step is to blame the site that hosted the advertisement in the first place.

Boxing champion Floyd Mayweather endorsing an ICO

Boxing champion Floyd Mayweather endorsing an ICO

While it is still unclear if allowing advertising for what later turns out to be a scam makes a company legally liable, these large companies with a bottomless list of clients seem to to simply be choosing to err on the side of caution by avoiding crypto entirely. For them, the headache isn’t worth whatever profit they would’ve earned from the potential ads.

Freedom of Speech and Advertising

There’s an interesting conundrum facing those that want to market their products. Let’s say for a moment that a company that sells guns legally wants to advertise on a major platform like Facebook to US customers. Selling guns to Americans in America is not illegal. Controversial to some, but again, not illegal.

However, Facebook may decide to enact a corporate policy preventing the advertisement of guns on their platform. This could be for a number of reasons, including the fact that Facebook has many users that are young, as well as users that may be strongly anti-gun ownership. Therefore, Facebook may choose not to show this type of advertising simply as a business decision, and not as a censorship one.

Here’s where things get complicated.

As the advertising world becomes increasingly centralized, there are a smaller number of gatekeepers (i.e. Facebook, Google, and Twitter) that can decide what is acceptable or not. As a result, a number of things that are fully legal and popular could find themselves running out of advertising media.

While some may find advertising to be annoying or obtrusive, it is still an essential part of our global economy today. If these few gatekeepers decide to completely lockout or “wholesale ban” entire industries, then it quickly becomes very similar to censorship.

Is the Wholesale Banning of Cryptocurrency Ads the Right Move?

While I suspect that the banning of cryptocurrency ads was one that was made primarily as a preventative measure, it’s probably not the right way to handle it.

All online advertising today still needs to undergo a review process. That’s why you don’t see advertising for things that are illegal, or are largely considered inappropriate by society. The gatekeepers do this so that things that are illegal or widely objectionable do not appear on the platform and upset their users.

However, as we enter further into the cryptocurrency revolution, advertising to the public at large, and not just cryptocurrency enthusiasts on crypto-focused websites, is becoming increasingly essential. This is because the aim of cryptocurrency at large is to achieve mass adoption.

Widespread crypto adoption will be much more difficult if cryptocurrency projects and companies are restricted from communicating with the general public through advertising.

Advertising allows marketers to educate the public about products, services, ideas, markets and industries that they might not have otherwise been exposed to. Thus, a crypto-wide ban will set back the whole cryptocurrency and blockchain industry by a hefty measure.

What can Crypto Projects do to Market Themselves Today?

The entire cryptocurrency space is undergoing an important transition currently. Rapid adoption is already occurring with many thousands of people joining and buying cryptocurrency each day. Even if all advertising is banned on popular platforms, it cannot and will not prevent the spread of cryptocurrency and its rising popularity.

Some ads are still able to get through Facebook’s filters. I saw a few ads, sure to be banned, using the word “bl0ckchain” to get around the filters on Facebook.

During our recent digital campaign promoting the Celsius Network crowdsale, we used images to quickly convey that our ad was about crypto and then wrote related copy without using words like “crypto, blockchain, ICO, tokens, etc.” Or in other words, we avoided all the words that easily get flagged by Facebook’s algorithm, but managed to convey the same sentiment. We used the same tactics on Twitter but the CTRs were much lower on the microblogging site.

In addition to the Facebook and Twitter ban, AdWords is also following suit in a few months’ time. With this new measure, the big 3 digital ad platforms are quickly disappearing freeing up the digital marketing budget. So where should you reallocate your marketing budget?

- YouTube

For the time being, you can still freely speak about cryptocurrency all you want on YouTube. You could spend your freed-up digital ad money to produce quality video content and pay to promote it across the web.

There are tons of people out there who will do a review of your company or are willing to conduct an interview with your company’s personnel. During our recently concluded crowdsale, we reached out to many crypto reviwers on YouTube and we saw really good ROI from these channels. They helped to bring the “hype” to our brand which then lead to quite a few unsolicited and unpaid-for videos (including the one below with Ian Balina).

2. Display Ads

I’ve spent the least amount of time in my career spending money on display ads, because other than remarketing, display ads have terrible ROI. It’s no different in the crypto world. But when you have less places to spend, you need to spend some of it here.

We bought display ads on quite a few of the big crypto websites, we saw CTRs over .25% but the ads were still expensive on a CPC basis. Advertising and design in crypto still generally suck, so doing something quality will help with brand awareness for all those eyeballs that see but don’t click.

These ads had CTRs of .27% on CoinMarketCap.

3. WOM

Today, a large number of people that discover cryptocurrency do so not through advertising or marketing, but through word-of-mouth and testimonials by people they trust. Recent studies suggest that the majority of Americans are already familiar with bitcoin at least on a conceptual level. This is also true in a number of other countries.

Word-of-Mouth is the best possible referral program and great for driving true organic growth. First, build a real brand people can identify with. Then, create swag around that brand like T-shirts, stickers, etc. and give them out liberally in order to get people excited about your platform.

That’s what we did at Celsius. We sent out Celsius “swag bags” to lots and lots of Celsius fans to get them to spread the word. We think of the people in our Telegram channel like the season ticket holders of a sports team. These people are your evangelists and your biggest fans, so treat them right and hopefully they’ll spread the word about your company.

4. New Content Platforms

Medium (for now), is still a great place to do content marketing. Further, a number of new social media platforms have appeared that support cryptocurrency openly (and even use it themselves) and tend to be more focused on freedom of speech as a core principle, instead of a passive ideal.

Some examples of this include Steemit, Minds.com and Gab.ai to name a few. The sites have so far expressed no interest in banning cryptocurrency communications, and would more likely than not support such marketing endeavors.

Summing it All Up

These kinds of anti-cryptocurrency measures are most likely temporary, and intended to give the major platforms some time to come to grips with how the cryptocurrency market operates today.

A number of countries are also developing and stabilizing their laws and regulations towards not only social media, but to cryptocurrency as well. This could potentially make it easier for the big companies to spot bad advertising clients and avoid them. It would also help real companies follow the clearly-stated rules in order to show their legitimacy.

For the time being, marketers have to be agile and quick to respond to changing market conditions and advertising channels on a daily business. Unfortunately, from an ROI perspective, the best performing channels look to be the first ones to go. At least, in the near term, the job for those marketing ICOs will only get harder.

Note: Learn more about becoming Hacker Noon’s weekly sponsor :-) Blockchain companies welcome.

How to Market an ICO without Facebook, Twitter and Google was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.