Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In a noteworthy development for the Bitcoin (BTC) market, BlackRock’s Bitcoin ETF, under the ticker name IBIT, has experienced a significant shift in trading dynamics.

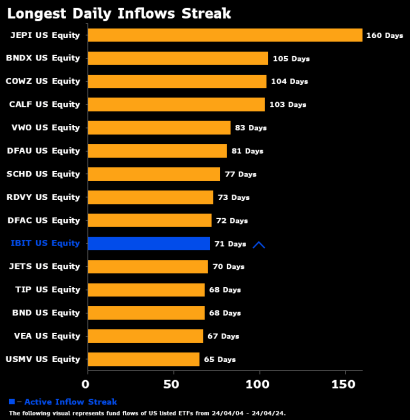

After an impressive streak of 71 consecutive days of inflows, IBIT recorded zero inflows during Wednesday’s trading session, marking the first time in nearly three months.

Turning Point For BlackRock’s Bitcoin ETF?

IBIT had emerged as a frontrunner in the race among Bitcoin ETFs, securing the top spot in inflows and trading volume. However, this recent halt in inflows signals a potential turning point for the fund, albeit falling just short of claiming the record for consecutive inflow days.

Eric Balchunas, an ETF expert at Bloomberg, highlighted the significance of IBIT’s 71-day streak of inflows, noting that it is close to a record and underscoring its formidable performance since its launch.

By comparison, Balchunas points out that even the popular gold ETF, GLD, experienced an impressive three-day streak of inflows during its initial launch phase.

Nonetheless, BlackRock’s absence of inflows on Wednesday was not exclusive; eight other Bitcoin ETF issuers also reported zero inflows.

Notably, Fidelity, a strong contender in the ETF race and the runner-up in inflows since trading began in January, and Cathy Wood’s Ark Invest were the only managers to record inflows during Wednesday’s session, with $5.6 million and $4.2 million, respectively.

On the other hand, Grayscale, one of the largest BTC holders in the world, continued to experience outflows, with a staggering $130 million outflow on Wednesday alone.

According to Farside data, Grayscale’s ETF GBTC has witnessed outflows totaling $1.2 billion in April alone. These outflows have exerted downward pressure on Bitcoin’s price, which has declined by 4.2% in the past 24 hours, currently trading at $62,990.

Declining Demand And Negative Funding Rate

In different developments within the Bitcoin market, bullish traders have shown signs of reducing their positions in the world’s largest cryptocurrency as two significant factors that propelled its growth begin to diminish.

According to Bloomberg, the Bitcoin funding rate, which represents the premium paid by traders to open new long positions in the perpetual futures market, turned negative on April 19 for the first time since October 2023.

This shifting funding rate indicates a moderation in demand for Bitcoin following the launch of several US spot Bitcoin ETFs on March 15, when the token reached record highs of $73,700.

Bitcoin funding rates reached a three-year high in March, indicating an overheated market. However, as of Tuesday, they fell below zero, suggesting a decreased desire among traders to open long positions.

Julio Moreno, the Head of Research at CryptoQuant, stated that this trend reduces traders’ willingness to enter new long positions.

Analyst Vetle Lunde from K33 Research noted that the 11-day streak of neutral-to-below-neutral funding rates is unusual. A flurry of leveraged bets has promptly followed past dips in funding rates.

Lunde suggests that the extended duration of the current perpetual discount may indicate further price consolidation in the market.

Furthermore, open interest in the Chicago-based CME Group’s Bitcoin futures market has decreased by 18% from its record high. This decline reflects a wavering interest among US institutions in cryptocurrency-related exposure and hedging.

As the cryptocurrency market seeks fresh catalysts, attention is now turning to Hong Kong, where a new set of spot Bitcoin ETFs is set to debut. The market is eagerly observing whether these ETFs can generate even a fraction of the demand their US counterparts enjoy.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.