Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Source: Unsplash

Source: UnsplashMy academic adventure at Oxford

A decade ago I started my PhD at Oxford University to study cartelisation and market power in energy markets. I applied empirical methods from microeconomics to political economy and analysed pricing mechanisms and contracting relationships between producers and consumers in North America, Europe and East Asia. I collected data both from academic and commercial sources and worked with economists, political scientists, energy experts and policy makers. Expert interviews led me to various countries including to Russia, Turkey, Japan and Singapore.

My doctoral research was a big privilege — working on a subject of your own choice for three years is a rare thing — but even before handing in my thesis, I had decided to try something different.

Post-PhD life as a portfolio manager

I joined Edesia Asset Management — at the time one of the largest hedge funds with a focus on commodities — during the summer of 2011 and worked at the Geneva office for the first year and subsequently in the London office. As a portfolio manager I traded mostly commodity derivatives as well as some currencies and equities too. After leaving in March of 2016, I worked for another firm doing the same job until early 2017.

My old desk at the Mayfair office in London. (Note the little green rock right under the screens — it’s copper ore I brought back from a Chilean mine )

My old desk at the Mayfair office in London. (Note the little green rock right under the screens — it’s copper ore I brought back from a Chilean mine )

Processing, analysing and understanding vast amounts of data was key. I worked with fundamental, microeconomic, macroeconomic, currency, interest rate and event-based data sets. Other types of data included central bank announcements, mean-reversion properties of price data and time series, option volatilities and many more. The goal was to figure out the most important trading signals to go long or short futures, options, currencies and stocks.

Another challenge was to combine this flood of data with context and insights that weren’t available in commercial data sets, but still could have a huge impact on market action and prices. I visited Chilean copper mines in the Atacama Desert to better understand the different elements of the production process. On other occasions I met with banks and merchants in Hong Kong that explained how certain clauses in trade regulations could be used together with large-scale commodity imports and exports for arbitrage purposes. Risks could build up in parts of the economy due to these arbitrage-driven flows — and it would have been impossible to make sense of this by just analysing data sets in London.

Extracting trading signals from the option volatility surface

Extracting trading signals from the option volatility surface

Hence, contextual knowledge and creative thinking, especially about second- and third-order effects, often added value. However, 99% of my work involved sitting in front of those four screens shown above and analysing things like option volatility surfaces to extract trading signals for both option and futures trading (see chart on the left).

In 2014, I started to wonder what impact technology would have not only on highly-paid finance jobs but the future of work in general. Oxford friend and now Covee Network senior advisor Carl Benedikt Frey started to make big headlines with his study on workforce automation and the future of employment. And why on earth do we have to sit the world’s most expensive office space to do what we do when talent is accessible everywhere today?

From hedge funds to blockchain technology

More than two years passed before I took the plunge in early 2017. Building something from scratch always seemed appealing and I had some prior experience in that. I was one of the three co-founders of the Harvard German Conference in 2007/08, which is now the largest student-led conference in North America. In 2007, we had no conference “history”, no funding and hardly any supporters initially but managed to convince the German Foreign Minister to fly over to our university and speak at our inaugural student conference. We had a full two-day programme with over 800 attendees.

Starting Covee in early 2017 actually felt very similar. Convincing potential co-founders and employees to leave well-paid and stable jobs for an idea is tough. Raising money from VC funds and angel investors is no simple and easy process either.

Blockchains redefine human cooperation and decentralise hierarchical, centralised organisations

Blockchains redefine human cooperation and decentralise hierarchical, centralised organisations

While our CTO & co-founder Jochen Krause saw the potential of cryptocurrencies and Blockchain as early as 2009, I only started to take a serious interest in this as the potential of Ethereum and smart contracts became clearer. Smart contracts are applications that run on blockchains and can coordinate and scale human cooperation globally — without a central operator or third party.

It has already been an incredible journey to learn about incorporating a company, assembling a team, raising venture capital and navigate all the administrative, legal and regulatory issues. However, understanding Blockchains, smart contracts and cryptographic tokens and their potential requires another level of comprehension.

To fully appreciate the foundational nature of the innovation and its potential impact an understanding of the following areas is very useful:

- Computer science, especially the mathematics of cryptography and the specification of communication protocols

- Game theory and mechanism design

- Network theory & analysis

- Electrical engineering, especially digital circuit design, which is important to understand and model smart contracts

- Macroeconomics, especially monetary theory & policy, which are important when designing a token economy

At Covee, we have assembled a team with expertise in all of those areas to build the Blockchain-based protocol for the future of knowledge work. Moreover, in the coming weeks we will make some particularly exciting announcements on world-leading experts joining our advisory board to further strengthen our competence.

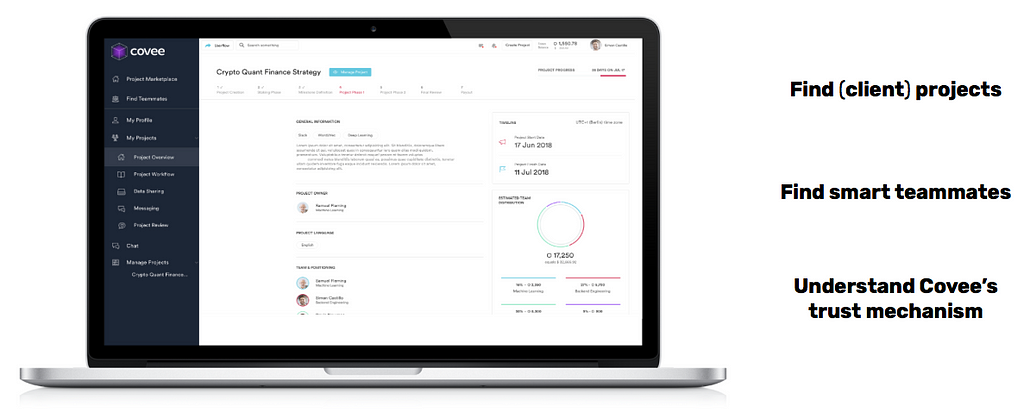

Covee Network’s alpha product will be available for testing soon

Covee Network’s alpha product will be available for testing soon

Our protocol, which is embedded in smart contracts, is already fully coded and currently being run on the Ropsten testnet. However, Covee has not only developed a protocol, but we believe a great user interface and user experience is also needed to boost widespread adoption. Therefore, a very important aspect of our work is traditional software development. If you are interesting in trying our alpha product, please watch out for announcements on Medium. Or better yet: visit our website and sign up for our newsletter.

Covee Network — where we are

Team — eight full-time staff (and hiring!)Advisors — expect exciting announcements!Smart contracts — already on Ropsten testnetAlpha product — available for testing in Q2 2018White paper: pre-publication phase, available upon request

Blockchain technology is bringing together the smartest and driven people from technology, economics, engineering, finance and many other fields. The reason is simple. It is by far the most interesting and exciting area to work in. It is time to become part of the journey.

Join us on www.covee.network, on Telegram and on Twitter.

Why I left my finance job to build a blockchain venture was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.