Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In my last article, What is a Masternode and why should I have one, I explained what a Masternode is, how it works and, in basic terms, how to set one up.

This time around I am going to run through some simple steps and checks you can take to mitigate the risk of choosing either a poorly run project or, even worse, a project with the sole purpose of scamming you out of your hard earned cash (or BTC in this case)!

Anatomy of a Masternode scam

Before we get into the details of the checks you should perform before purchasing a node I’ll just explain briefly how a typical masternode scam works and how the perpetrators make money from this.

The basic steps are as follows:

1 — Scammers create the new blockchain & wallets and perhaps a website and whitepaper. Discord group is setup. Premine of coins to be sold for nodes and a later dump in completed. Listed on masternodes.online advertising crazy ROI figures.

2 — Unwary investors attracted by high ROI join the discord channel where nodes are sold off in a pre-auction commonly at the price of 0.5 BTC per node. This is the first cash grab.

3 — For a few weeks the scammers portray the illusion of supporting the community and developing the underlying product (if there is one).

4 — The scammers disappear into the background and start to dump their coins on the exchange. This is the second cash grab.

5 — The community realises the scammers have left and a frenzy of dumping on the exchanges starts with the price of the coin tanking.

6 — With the scam perpetrated the scammers usually move onto a new project and ‘rinse & repeat’.

There can be differences to the above scenario above but this is typical of the sequence of events that can happen.

Due diligence

Selecting the right project to invest in is something you need to take seriously and you should have a structured approach if you want to stop those filthy scammers doing a runner with your BTC.

None of the criteria I am about to run through will protect you 100% against accidentally choosing a poor project, or a well constructed scam, but it should minimise the risk of doing so.

This is doubly important when selecting a node to run because setting up a masternode can require a significant investment and as such due care and attention is needed.

Some, but not all, of these criteria can also be applied to other cryptos you are looking to invest in so feel free to undertake similar due diligence on your other investments in the cryptocurrency space.

OK, what am I looking out for?

I’m now going to run through the various checks you should go through when selecting a project. Most of these checks require some judgement on your behalf as there is no ‘magic bullet’ that will protect you fully from picking a ‘wrong un’.

After completing these checks it is very likely some boxes will be ticked but others will not. It is down to you to decide what your risk appetite is and what risks you are willing to take — I can’t do that for you. What I will do is tell you what I consider important in making decisions myself but please remember this is not investment advice! It’s just the approach I take.

One more thing before we start on these checks. You will be able to find data on most of the nodes on the market on various masternode listing websites but the one I use is called masternodes.online.

ROI, or how quickly will I see the moolah?

ROI (Return on Investment) is the percentage of return that a node is predicted to pay out in 12 months. For example an ROI of 100% will give you your initial investment back within 12 months. 1000% will pay it back ten times quicker (1.2 months) or earn you 10 times your investment within 12 months and so on. ROI does tend to drop as the blockchain ages and I will touch on this in my next article.

ROI is the carrot the scammer dangles in front of unwary investors enticing them in with visions of massive returns made in a short space of time. If there is one golden rule when selecting a masternode then it is never select a node on ROI figures alone. Doing so will increase your chances of being stung significantly. That’s not to say there aren’t some good projects out there with high ROI but your chances of finding one is like shooting in the dark if you only look at the ROI on offer.

So to repeat…. Never ever ever ever……ever invest in a node purely on ROI alone.

Utility

OK, a coin must have utility!…. Ummm what’s utility?

Utility is the purpose or function of the coin. Things to be wary of are coins that offer no more utility than being a masternode coin offering POS (proof of stake), instant transactions and privacy or a utility that is very unlikely to be achieved by a small team of developers (most dev teams on masternode projects start off quite small). For example a well known scam coin in the masternode space, Fornix, promised AI on the blockchain but with very vague promises of exploring it as a function…. Some claims go further and are just plain ludicrous. One recently launched coin has on their roadmap that they are going to be sending a rocket to Mars…. Yes incredibly this is in their whitepaper for Q1 2019!

So the utility needs to be realistic. This doesn’t need to be unique or even particularly awe-inspiring but more importantly it needs to be achievable. For example you pay for a service provided by the project with the projects coin or the coin is used as a currency in certain marketplaces or for supporting community projects or charitable aims. These are realistic aims.

If a coin has no utility beyond POS, privacy and instant transactions I avoid.

Whitepaper

A whitepaper is the mission statement for the project. It should explain why the project was created, what it’s purpose will be, the specs behind the blockchain, the roadmap and perhaps details of the team. Some whitepapers will include more but this should be the absolute minimum. It should also look professionally written and be devoid of spelling mistakes and poor grammar.

What it shouldn’t be is a guide for installing a node — yep! I have recently seen a whitepaper that was just a node install guide….

Even worse is if the project has no whitepaper. Without this you really are investing with a blindfold on. You may be able to join the projects Discord server and find out more detail but what professional project wouldn’t take the time to produce a whitepaper?

Team

In an ideal world each core team member of a project should have a full bio with full name hosted on the project website linked to a Linkedin profile detailing their background and experience. Unfortunately I’ve yet to come across a node that provides all of this information — at least any coin that isn’t already well established.

So what is an acceptable minimum? Given the bar is pretty low across all projects, and being too strict here would effectively rule out most projects, I like to see at a minimum first names and pictures of the team on their website. Of course the pictures could be anyone’s pictures but in the absence of full disclosure we have to start somewhere.

If there are no pictures and, even worse, anonymised names then I would normally avoid — at least initially. If after further digging I was able to track the project to offices or a location then I would possibly re-consider.

The question to ask yourself is why does the team wish to remain hidden? This criteria becomes less of a concern with projects that have been running a while and also have a operational product out of testing. Why? Because if the team have spent time and effort on a working product they are less likely to allow the project to collapse or be looking to ‘scam exit’.

Website

Yes. Some projects do not even bother to create a website. Not much to say on this one. No website equals avoid in my book.

If a website is available check to see whether it has any dead links. It should also host similar information to that you would expect to see in a whitepaper. It should also link to most of the key sites for the project — Discord, Facebook, Twitter, Telegram, Github (explained below) and the block explorer (this is the website that allows you to perform searches on the projects blockchain for addresses, transactions and other information such as what block the blockchain is currently on — I will cover the block explorer in more detail in my next article). The website should also have links to node install guides and the latest version of the desktop wallets.

Github

What is Github?…I hear you ask. Well Github is a website which hosts the public code repositories for projects and should have details of ongoing code releases and changes. When assessing a project check out their Github page. If there have been no updates in a few weeks this could indicate that work on developing the coin has stalled or the coin has fulfilled it’s purpose already and the devs are planning their next project…..or a week in the Bahamas….

Social Media

Does the project have an active social media prescence? Are they on Facebook, Twitter or other platforms and how often do they post? An initial flurry of activity followed by ‘dead air’ may be an indication that the project is no longer an ongoing concern. No social media presence at all would indicate a lack of nous in building a market for the project and again may need to be avoided.

Discord

Discord seems to be the main hub of activity for the communities of these coins and can be a great source of information on the project, devs and activity on the project. It’s worth monitoring the projects discord group and assessing the behaviour of the team supporting the project. Are they responsive, do requests for help get dealt with quickly, do the main devs interact with the community on a regular basis — and by regular I mean daily. This can give a good sense of the project you are potentially investing in but it should be used in addition to the checks above and not on it’s own.

Price action

OK I know this seems to be a strange subject to include but please bear with me. This is your last check before you spend your cash on the coins for your chosen node. Assuming you are happy with your due diligence findings above the final check to perform is to ensure you are not buying into a coin at the top of a pump in price. Has the price risen sharply in the last few days? If so check Discord and other sources to see if there is a reason for this such as a successful test of the product, imminent release or significant partnership. If so then this could just a natural upturn in the price of the coin and less likely to be a pump. If you can find no reason for a price increase it could be a pump or the market going through it’s normal up and down cycle. Either way you may wish to consider delaying your purchase to see if the price retraces.

Finally….

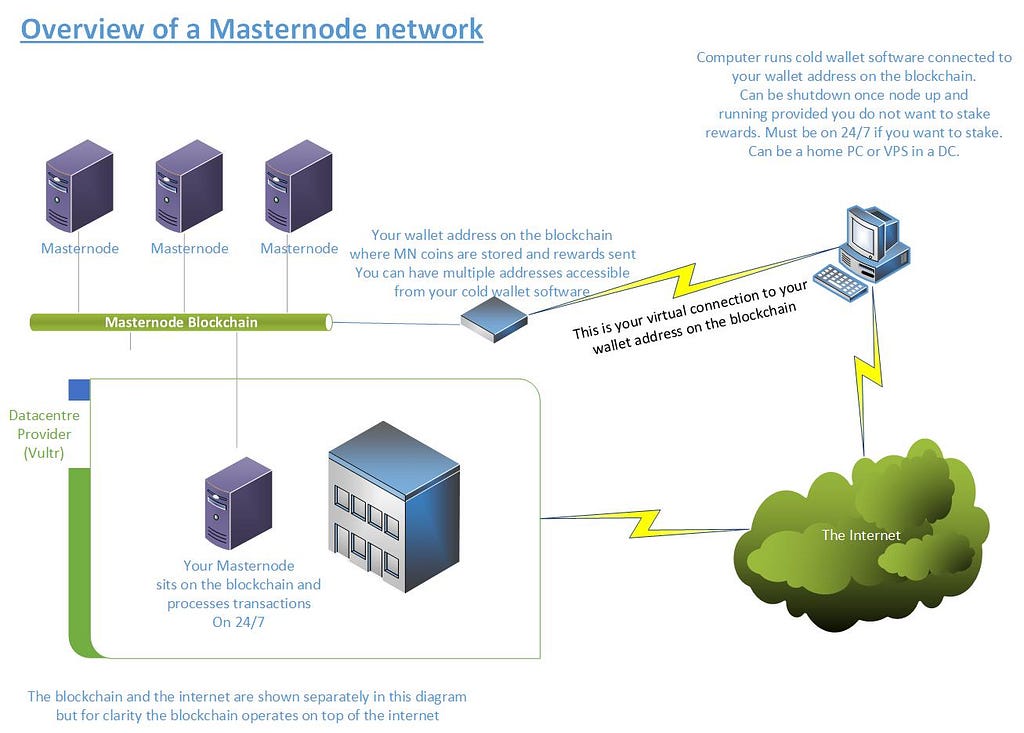

So as a final nugget I have pulled together a very high level diagram which attempts to simplify the structure of a masternode blockchain. Blockchain purists will probably be able to poke plenty of holes in this but the aim is to bring a level of understanding of how a blockchain is structured for the uninitiated amongst us.

What’s next?

Well next it’s time to fill your boots and get buying! But joking aside please consider performing the checks above next time you are deciding upon a node or as the oft repeated adage goes…. DYOR!

In my next article I’ll run through all the tips and knowledge I have picked up on my node journey thus far in the hope of helping you get a few steps ahead with your set-ups and running your nodes.

Until then….

Happy noding!

:-)

I want to run a Masternode. How do I pick a good one? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.