Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin on-chain data shows the so-called “accumulation addresses” have been buying large amounts of the cryptocurrency this month.

Bitcoin Accumulation Addresses Have Seen Large Inflows Recently

As analyst Ali pointed out in a new post on X, Bitcoin accumulation addresses have been observing inflows recently. The “accumulation addresses” here refer to the wallets of the cryptocurrency’s perennial HODLers.

Certain conditions must be satisfied for an address to be included in this cohort. Perhaps the most characteristic is that the wallet must not record outgoing transfers.

This means that accumulation addresses are those who have only bought tokens (that is, received only incoming transfers) and never participated in any selling.

Addresses are also only considered to be part of this group once they have received at least two inflow transactions and hold greater than 10 BTC in their balance.

Exchange and miner-associated wallets are excluded from this class of investors, as the supply held by these entities represents the sell-side of the market (as investors deposit to exchanges for selling, while miners themselves are a constant source of selling pressure in the market).

The supply held by the accumulation addresses is considered to be locked tightly in the hands of these HODLers, so the available supply effectively goes down when these investors buy more.

Wallets that last received an inflow more than seven years ago are also excluded from this group since addresses so inactive are generally considered lost due to being forgotten or having their keys misplaced. Such wallets would naturally not count as “HODLers,” at least not voluntary ones.

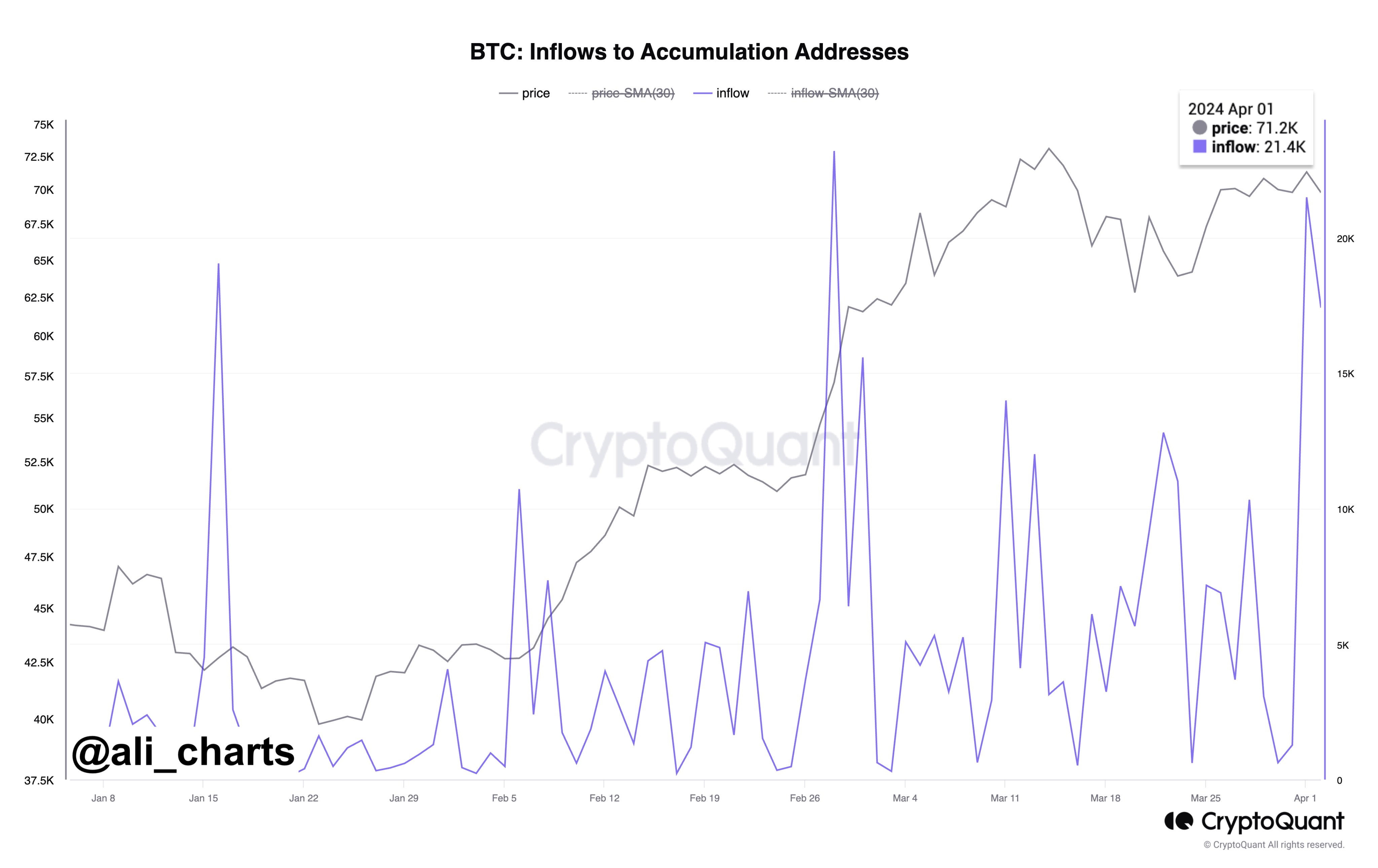

Now, here is the CryptoQuant chart shared by Ali that shows the trend in the Bitcoin inflows going towards these accumulation addresses since the start of the year:

As the above graph shows, the Bitcoin inflows to accumulation addresses have been high this month, suggesting that these investors have been continuously buying recently.

On the first date of the month, the metric even hit a value of 21,400 BTC. At the current exchange rate of the cryptocurrency, this stack is worth more than $1.4 billion.

This is a significant amount and is not too far from the 25,300 BTC all-time high (ATH) that the indicator achieved just a month and a half ago.

Naturally, this latest buying from these investors would be a positive sign for the cryptocurrency. As if responding to it, BTC appears to have found its footing again, as it has made some recovery over the past day.

BTC Price

Following the jump of over 3% today, Bitcoin has recovered above the $68,100 level.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.