Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

*courtesy of Andre Francois

*courtesy of Andre Francois

Gist: the velocity data of bitcoin currently supports the thesis that BTC may have found a market bottom. However, technical analysis charts and the gap between Market Cap and USD network transaction volume possibly suggest that a more reliable bottom could be found lower.

Bitcoin (BTC) Bottom Fishing?

Over the past few weeks, many well written articles have touched the topic of whether bitcoin (BTC) is bottoming out, and if so, then how that might be setting the stage for BTC to finish 2018 above the $20k level. Initially, these prognostications seem spot on with BTC rallying ~30% from the “bottom” called levels. We will not speculate on where BTC will finish 2018, but we will offer a framework and visualization that may help validate whether BTC has reached a bottom or not.

NVT Ratio = Network Velocity

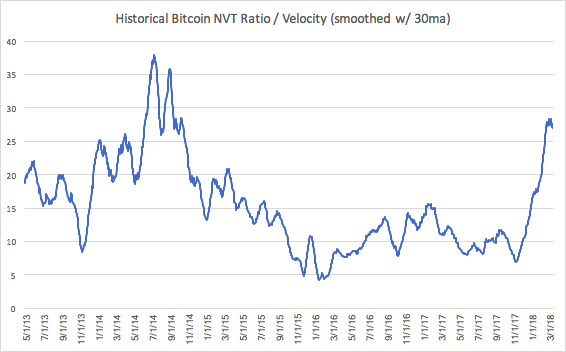

In my previous article, I explained that the NVT ratio is mathematically identical to network velocity, using the MV=PQ equation; and velocity has a negative correlation with bitcoin’s Market Cap i.e. if velocity increases then BTC Market Cap decreases. This is intuitive since bitcoin’s historically high NVT/Velocity years have coincided with bear markets (2014–2015, 2018). Similarly, the bull market years, i.e. low velocity years, (2013, 2016–2017) for bitcoin show NVT within the “normal” range between 10 and 30 (range is smoothed with 30 day moving average).

Current NVT/Velocity

The NVT/Velocity chart may validate the notion that BTC has bottomed. For example, the chart below shows the incline of NVT/Velocity plateauing around the 28 level and has since begun to decrease (positive for BTC price).

However, in theory, NVT/Velocity could still go higher (bad for BTC price) since the ratio has not left the “normal” range yet, and nor has it reached its historical peak of ~38. This notion becomes more interesting as we look at the next section.

Technical Analysis + NVT/Velocity

If we take a longer term perspective (one day chart) and look at the chart below, we see an interesting dynamic unfolding. From a technical analysis perspective, if BTC has not bottomed at its current level and the downtrend resumes, then a possible next support level for BTC is around $5000, which coincides with the 0.236 fibonacci retracement level (last red line). Additionally, a longer term support level for BTC maybe found within the band between $3000 and $4000, indicated by the two blue lines.

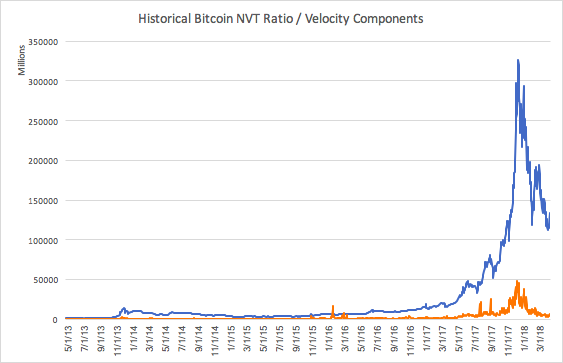

The NVT/Velocity charts, historically speaking (which see my post on Heuristics for why this logic is flawed), may indicate that BTC is bottoming out. However, one point of hesitation should be the continued gap between Market Cap (blue line) and USD volume transacted on the blockchain network (orange line).

It is possible and likely that Market Cap is a leading indicator, meaning that once Market Cap (BTC’s price) begins rising, then so does the amount of USD transactions on the network. Regardless, the aforementioned gap must close and probably return closer to the historical average of ~15 (smoothed NVT/Velocity).

The Bad Scenario: using the long term average of 15, we discount the current Market Cap of BTC (as of 4/22/2018) and arrive at Market Cap of ~$61.4B. Currently, there are ~17M Bitcoins outstanding, thus 1 BTC would equate to ~$3,500 ($59.4B/17M). This conclusion is interesting given the technical analysis charts discussed above.

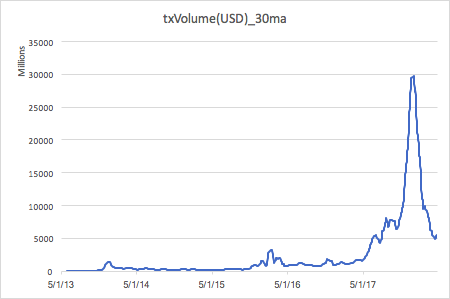

The Good Scenario: the chart below shows current pause in the USD transaction volume decline. If BTC has in fact found a bottom at its current level, then we would expect the USD network transaction volume to close the gap, which would increase from ~$5.2B to ~$10B, holding all figures static as of 4/22/2018. Meaning, we would expect Market Cap to not fall any further and probably begin to increase.

Conclusion

The NVT/Velocity charts may support the notion that BTC has found a bottom; especially if you consider Market Cap as being a leading indicator for network transaction volume. However, the technical analysis charts and gap between Market Cap and USD network transaction volume possibly suggest that a more reliable bottom could be found around the $3500 level.

Disclaimer: Information provided is for educational purposes only and does not constitute investment, financial, or legal advice.

Quantifying Bitcoin’s Potential Market Bottom was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.