Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On-chain data shows a Bitcoin whale has suddenly moved around 16,003 BTC on the chain after staying dormant for more than five years.

A Large Amount Of Dormant Bitcoin Has Just Moved On The Network

As CryptoQuant community manager Maartunn pointed out in a post on X, the Bitcoin blockchain has recently processed a transaction involving some very old coins.

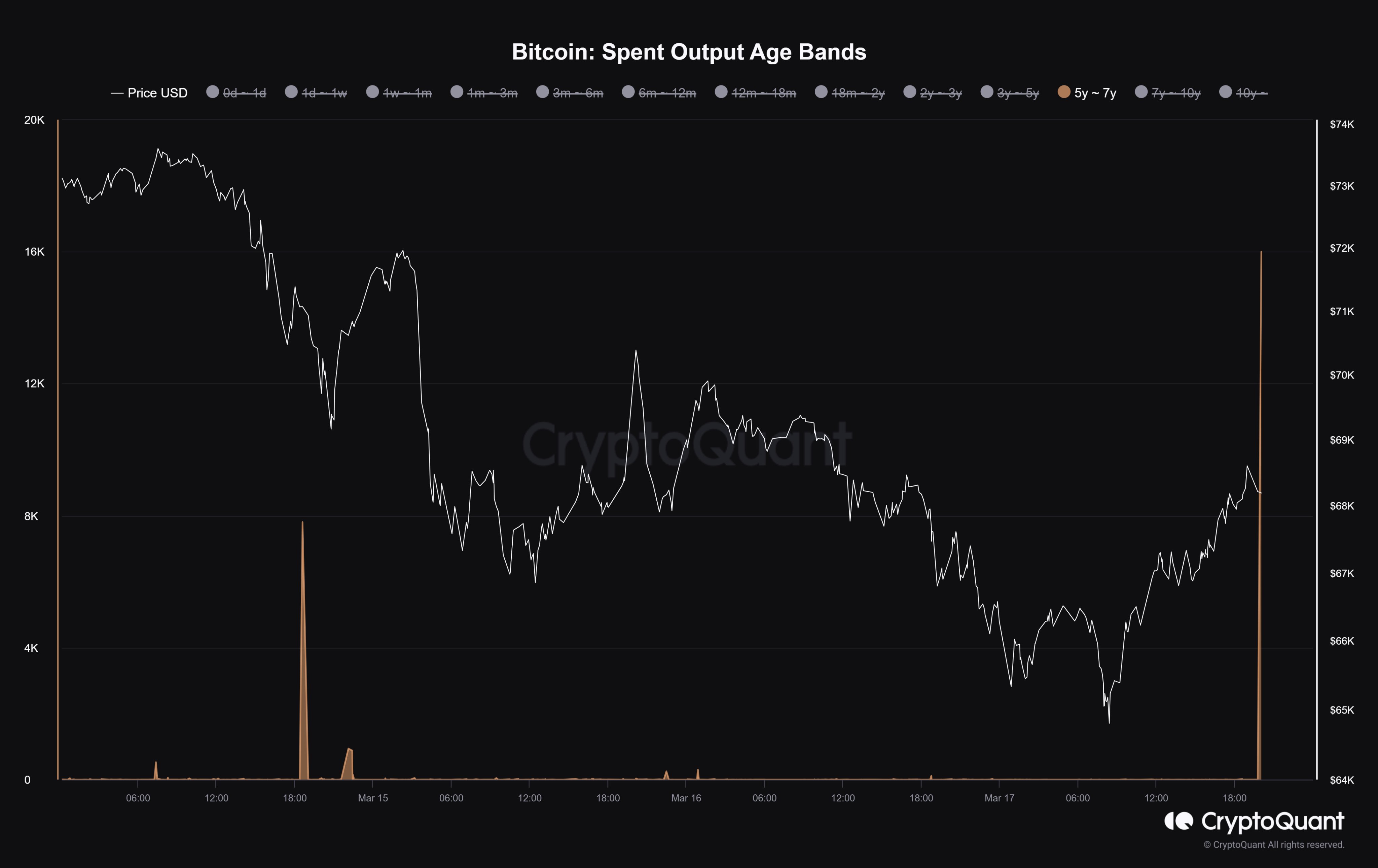

The indicator of interest here is the “Spent Output Age Bands” (SOAB), which keeps track of the total amount of Bitcoin the different age bands in the market are now transferring on the network.

The age bands here refer to groups of coins divided based on holding time. The 1 day to 1 week age band, for example, includes all tokens that have been dormant for at least a day and at most a week.

In the context of the current discussion, the 5-year to 7-year age band is relevant. Below is the chart showing the SOAB data for this particular cohort.

It would appear that 16,003 BTC belonging to this age range have just been moved on the network. This stack would be worth around $1.08 billion at the current exchange rate.

Given the massive scale of the transfer, it’s likely that a whale entity is involved here. As for why this investor has decided to break their long silence, it can be complicated.

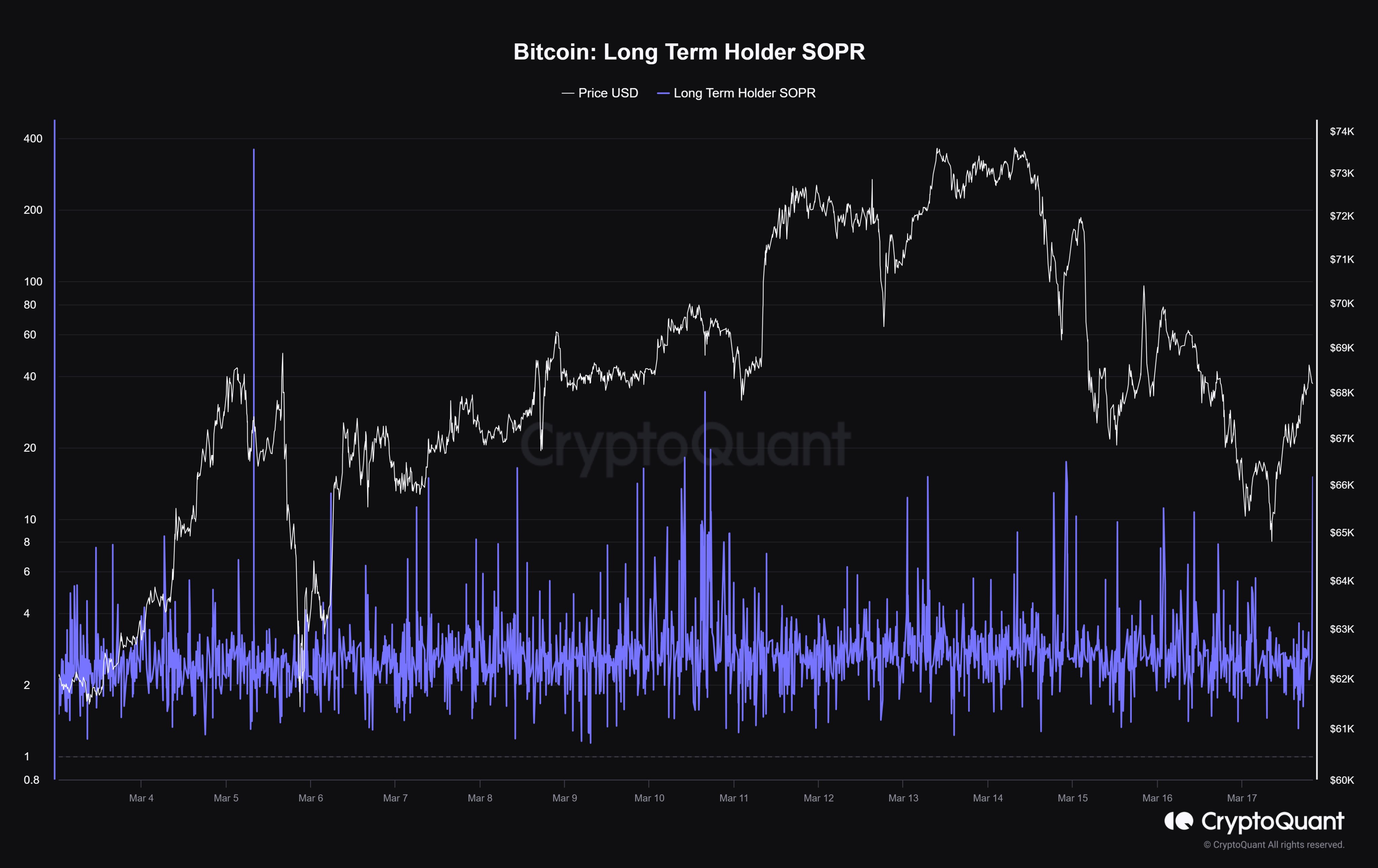

Maartunn has done some additional sleuthing to find out more about the transfer. It would seem that the profit-to-loss ratio of this transfer was 15, which is quite the amount.

As the chart shows, there have been other recent transfers of dormant coins holding a comparable profit ratio, which means that this latest transaction isn’t exactly unique. However, the scale of the movie certainly makes it stand out more.

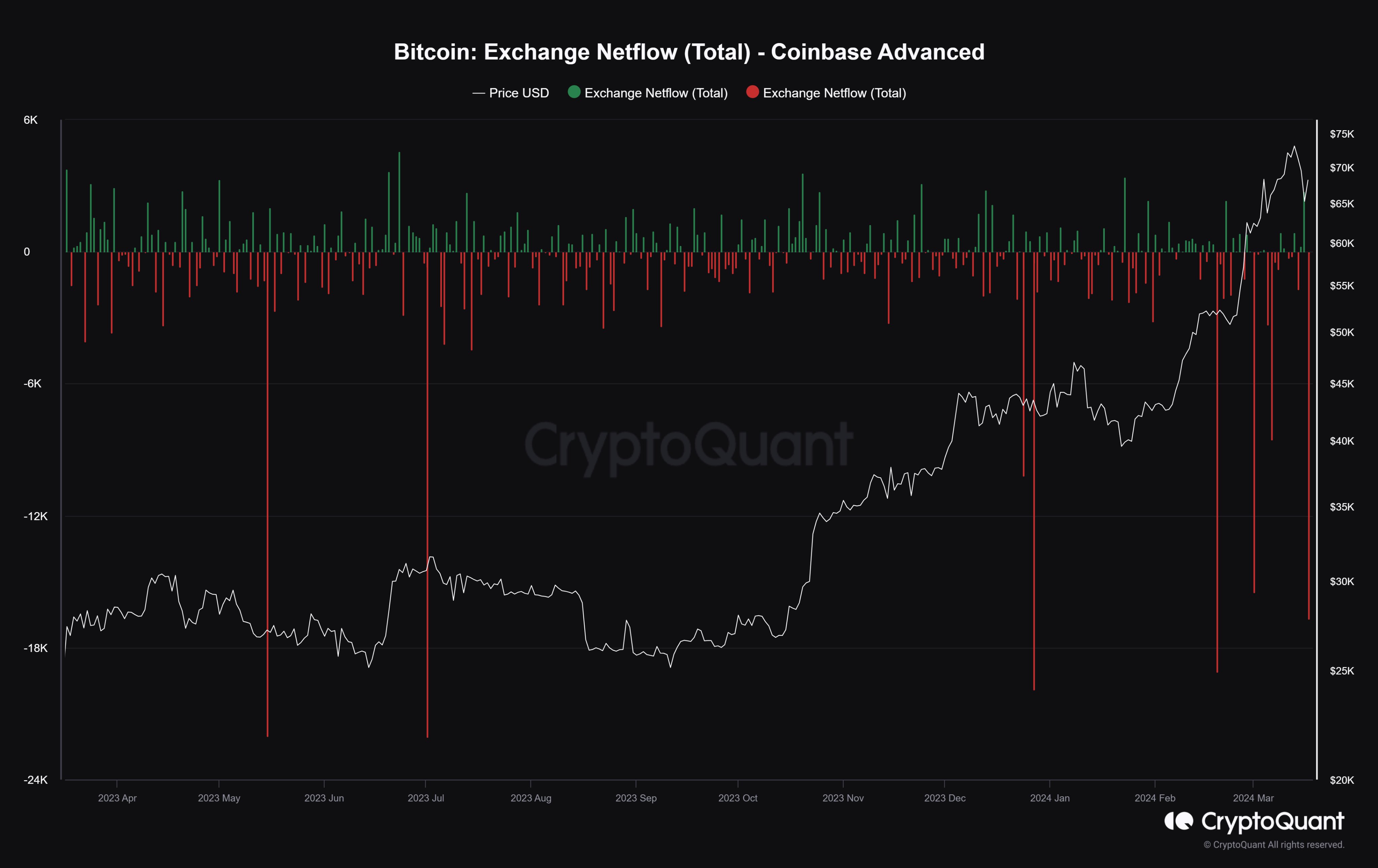

The analyst has found that the transaction is related to a Coinbase move. Below is the Bitcoin netflow data for the exchange, which provides hints about the direction of this transfer.

CryptoQuant’s netflow metric would suggest that the transaction was an outflow, as the indicator’s value had turned negative. However, Maartunn isn’t sure whether it’s an outflow, saying, “I need more time to conclude whether this is a real outflow – eventually ETF related – or it’s just an internal flow.”

If it is indeed an outflow, it could be a bullish sign for Bitcoin, as it suggests a large entity is potentially participating in some fresh buying and then taking the coins off into possible self-custody.

BTC Price

Bitcoin has gone through some notable drawdown over the past week as its price is now trading around $67,000.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.