Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Breaking down the innovative structure behind osETH and it’s associated risks

Since the Shapella fork on Ethereum mainnet that allowed users to withdraw their staked ETH, the ecosystem of staking token derivatives has exploded. Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) protocols now hold billions of dollars in TVL and are one of the fastest-growing sectors in the Ethereum ecosystem. This means that economic risks pertaining to LSTs and LRTs such as slash risks, de-pegging events and liquidations can cause substantial economic impact to users and the broader DeFi space.

Stakewise Risk Overview

Stakewise v3 launched in November of 2023 introducing the osETH LST, a unique collateral debt position (CDP) style LST. Stakewise implements a vault design similar to other CDPs such as Maker where vault owners can deposit ETH into a vault and mint up to 90% of their position in the liquid osETH token. This permits users to acquire osETH in 3 main ways; run a vault and become a validator, deposit into a vault and mint osETH, and simple conversion ETH into osETH. For retail and institutional investors alike, the primary way that users will access osETH is through the latter two options.

ITB’s 19 new metrics for Stakewise are well suited to provide insights into the economic risks relevant for each method of acquiring osETH as well as overall protocol risks that can help a user make informed decisions to match their risk profile. The remainder of this article will highlight some of the key indicators in the Risk Radar.

Peg Risks

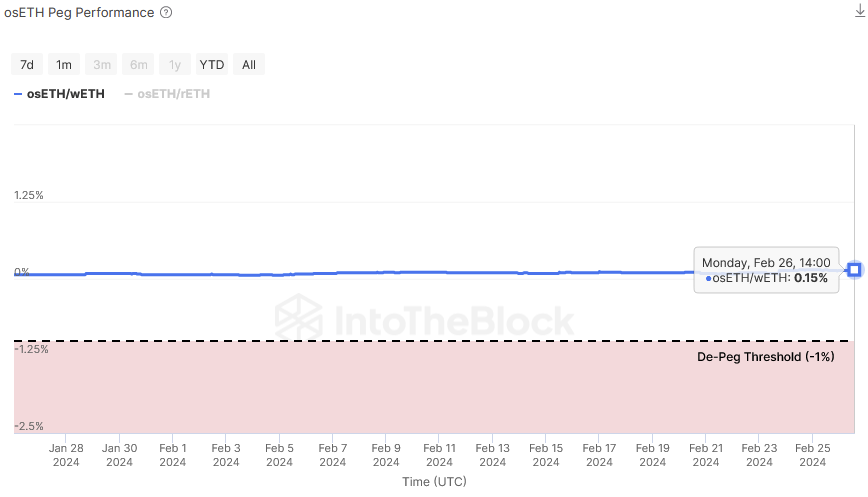

A critical indicator to measure a derivative asset such as liquid staking tokens is their ability to maintain their expected value relative to the underlying asset that they track. The osETH Peg Performance indicator does this by tracking osETH’s value (and accrued yield) to the ETH. A de-pegging event in this case would be when the value of osETH strays away from its expected value given the price of ETH and the interest it has accrued over time.

osETH Peg Performance. Source: ITB Stakewise Risk Radar

The above chart shows that it has been tracking its intended value tightly at its current price. A strong ability to keep peg is crucial for LSTs to gain adoption as users need to be confident that they will be able to hold their value.

A second indicator that tracks osETH’s peg is the osETH Redemption Size to Repeg. This indicator helps users understand the notional value needed to bring the LST back to its expected value. In the mechanics for Stakewise, users can burn osETH in the vaults when below peg or mint new osETH when above the peg.

osETH Redemption Size to Repeg. Source: ITB Stakewise Risk Radar

In the chart above, we can confirm that osETH is currently trading above parity to ETH. This is shown by the negative amount of osETH needed to return to peg. This indicates that users could mint 48 new osETH and trade it on the open market to capture a premium on the price.

Vault risks

Unlike simple ETH to osETH conversion, minting from a vault has higher risks as well as rewards. Minting from a vault gives the user the staking rewards earned specifically in that vault. Efficient validators can earn higher rewards on their staked ETH compared to the general rewards received by osETH holders. However, while creating an allocator position in a vault can yield higher returns, allocators in the vaults take on the slash risks in the protocol and any penalties incurred by the validator are localized to the vault. To help potential allocators make the right vault decision based on their risk profile. ITB’s Risk Radar includes metrics to evaluate the effectiveness and risks associated with each vault.

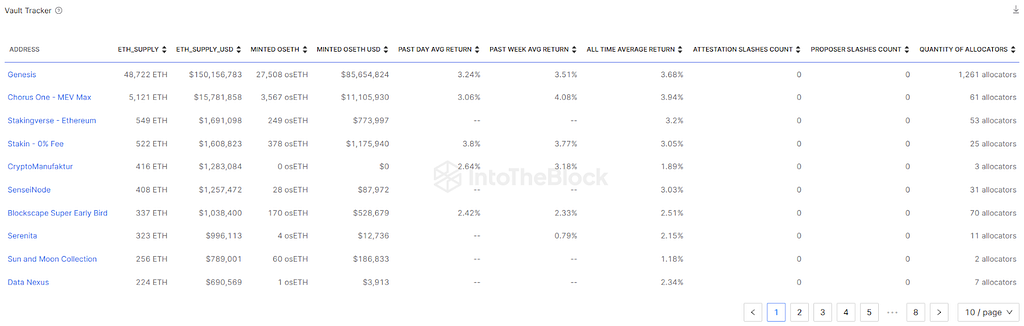

The Vault Tracker chart gives a global overview of all the open vaults on Stakewise. On top of ETH supply and minted osETH in each vault, this highlights the average historical returns and total slash penalties that the validator hosting the vault has incurred. This provides a user with quick insights into the vaults performance before allocating capital

Vault Tracker. Source: ITB Stakewise Risk Radar

The chart snapshot above shows that there are two vaults that stand out. The Genesis and Chorus one vaults hold the majority of the supplied ETH to the protocol and neither vault has been slashed, indicating that the validators are performing their staking tasks correctly. The Genesis vault has consistent returns and is one of vaults with higher returns. However, individuals who are looking for higher potential returns might opt for the Chorus One vault which operates a more aggressive MEV strategy to achieve higher returns since its inception but with potentially more volatility on the day-to-day returns.

Staking Risks

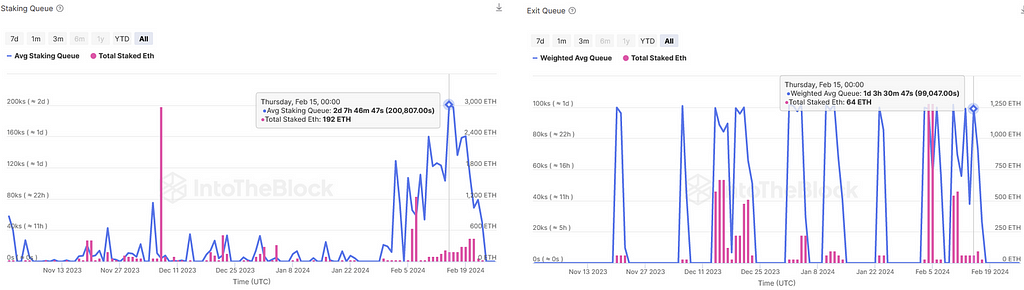

Entry and exit queues for staking ETH on the Beacon chain can become congested and create cascading economic risks for unaware users. For example, when the exit queue becomes congested, impatient LST holders might resort to swapping on AMMs instead of waiting potentially days to get their ETH back. This can create strong downward price pressure on an LST, resulting in the token de-pegging which can cause a spiral effect with more users wanting to quickly exit their positions, exacerbating the situation. The opposite can occur if the staking queue becomes too large.

While queue wait length is partially determined at the blockchain level. There are also queue mechanisms placed at the protocol level to help protocols manage flows and prevent supply shocks. On Stakewise’s Risk Radar, Exit Queue and Staking Queue indicators can help users determine the queue lengths specifically for the protocol. This helps a user identify liquidity flow trends to manage risk when deploying assets into AMMs as well as identify potential de-pegging events.

Staking Queue (L) and Exit Queue (R) Indicators. Source: ITB Stakewise Risk Radar

The protocol level staking and exit queues for Stakewise show currently no queue for staking or exiting osETH. It can be seen from the charts above that in the beginning of February of this year, staking queues reached as high as two days to enter osETH positions. This was in large part due to users wanting osETH to deposit into the Eigenlayer protocol.

Monitoring staking and exit queues historical patterns can help users determine what impacts upcoming events might have on the ability to enter and exit positions (such as Eigenlayer cap raise). This information can prepare users for these events and help them mitigate any risks they might create for the user’s investment strategy.

Validator Risks

For LSTs, exposure to validators is unavoidable. Unlike solo-stakers that use their own assets and assume all the risk exposure on those assets, users who stake ETH with LST protocols delegate their assets to professional validators who manage the technical aspect of proposing and attesting blocks on the Ethereum blockchain. This means that LST holders need to have some level of trust that the validators will perform their tasks correctly in order to avoid slash penalties that will impact the LST holder. While some level of trust is needed in this process, verification of validators effectiveness can help hedge some of the required trust from LST holders. For this reason, ITB’s Risk Radar includes several indicators that monitor validator performance.

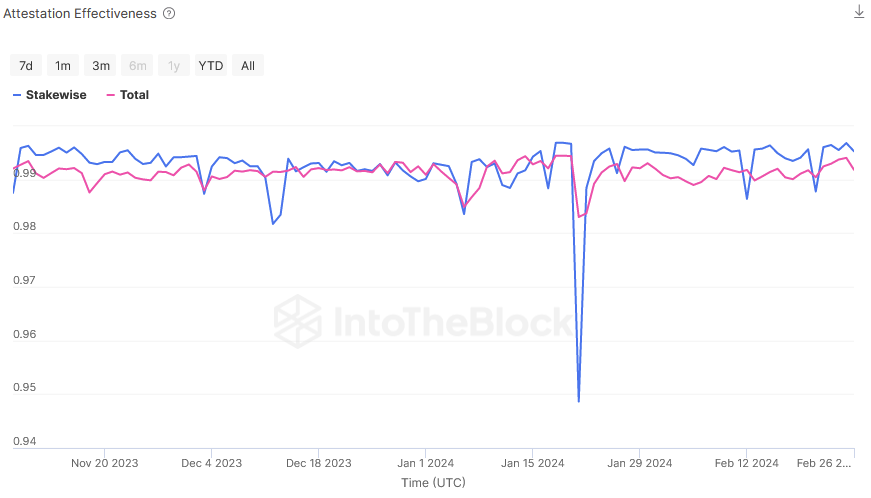

Attestation Effectiveness is a key metric for tracking the overall performance and efficiency of a node’s ability to perform its tasks validating the network. While some attestations can be slow to occur, a general heuristic for an effective validator is having an attestation rate above 97%.

Attestation Effectiveness. Source: ITB Stakewise Risk Radar

Looking at the chart above, we can see that validators on Stakewise are maintaining an efficiency rate consistently above 98%. This indicates that the validators operating in Stakewise are consistently performing quickly and accurately.

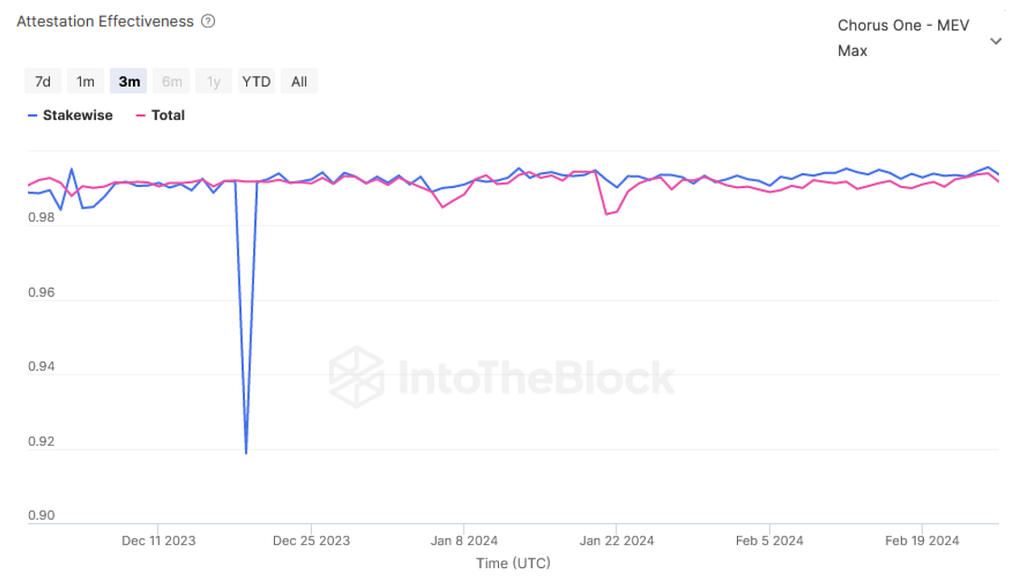

The Attestation Effectiveness indicator can also be used to look at a specific vault’s validator set. In the chart below, we see that the Chorus One validator set had a brief drop in performance in mid-December of last year, but quickly recovered and is now performing better than the average.

Attestation Effectiveness for Chorus One MEV Max Vault. Source: ITB Stakewise Risk Radar

For users that are planning to deploy into a vault to mint osETH, this metric can be a useful indicator into the trends of performance of validators in the vault. Looking at the chart over time can help a user identify if the validators have been consistent in their performance. If a vault is showing a negative trend in recent performance, this can suggest that the validators are struggling to perform their tasks and could indicate an increased risk of a slashing event in the vault in the future.

Stakewise Risk Radar Review

osETH is an innovative approach to LSTs and provides flexibility for users on risk to return profile they want to adopt for their LST strategy. While LSTs are often seen as a lower risk asset to hold, this does not mean that risks don’t exist. ITB’s Risk Radar can help provide clear insights into the current and potential future risks that a user could face and allows them to design their portfolio in a way to manage the potential economic risk.

Stakewise’s osETH is the first LST Risk Radar Dashboard created by ITB but is not the last. Check our Risk Radar dashboard regularly to discover the upcoming LST and LRT dashboards that we launch.

The indicators used in this dashboard are based on the metrics used in our quant strategies to manage and mitigate risk for capital deployments into DeFi from large institutions and treasuries in the ecosystem. Our aim is to provide a comprehensive overview of economic risks in DeFi and we encourage any protocol or user to reach out to us for future collaboration or feedback on our existing dashboards.

Do you want more insights about risk in DeFi? Download our recent DeFi Risk Report here.

Diving into the Design & Economic Risks of Stakewise v3 was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.