Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

We’re thrilled to announce the launch of the StakeWise Risk Radar. This new addition is specifically designed to provide comprehensive risk analytics for StakeWise, a leading liquid staking solution for Ethereum (ETH).

About StakeWise

StakeWise is a DeFi protocol that offers users the ability to stake their ETH and receive a liquid staked-ETH derivative in return. This derivative can be leveraged across various DeFi applications, maintaining liquidity while earning staking rewards. With a focus on security, ease of use, and maximizing yield, StakeWise serves a broad audience — from individual stakers to institutional investors — by providing a flexible and trusted staking protocol.

The Importance of Risk Analytics in DeFi

The DeFi landscape, while offering unprecedented opportunities for growth and innovation, is not without its risks. The IntoTheBlock DeFi Risk Radar is designed to address these risks by providing in-depth risk analytics. This enables investors to manage their capital in DeFi as safely as possible.

StakeWise has a strong focus on security and the integration in IntoTheBlock’s DeFi Risk Radar helps maintain StakeWise’s position as one of the safest staking protocols.

Risk management is a number one priority for our customers, and we care deeply about their needs. By integrating StakeWise in IntoTheBlock DeFi Risk Radar, we equip clients with real-time data that helps them protect their capital, and ensure they remain a step ahead of the market at all times. kirill kutakov — Co-founder StakeWise

Key Features of the StakeWise Risk Radar

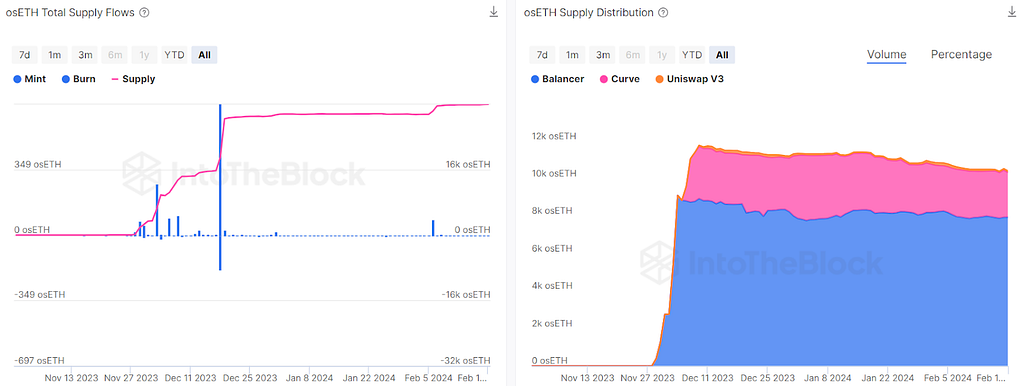

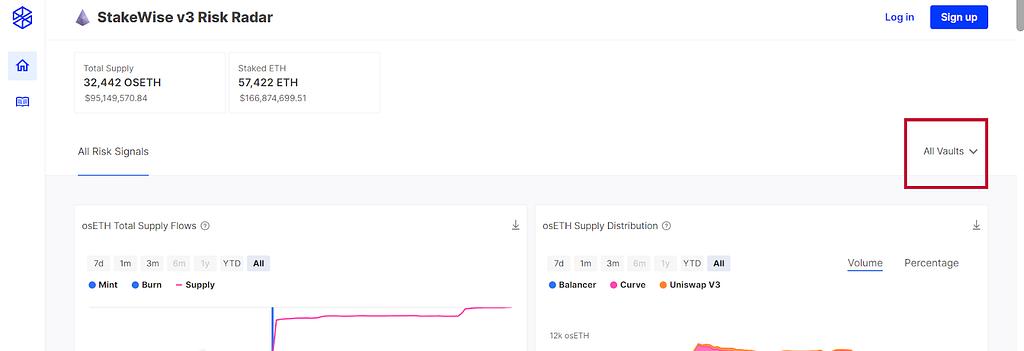

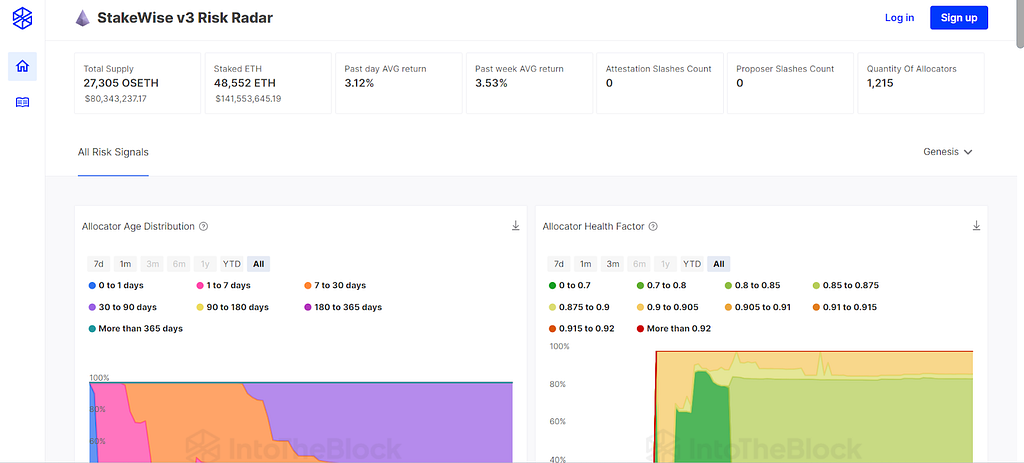

The IntoTheBlock DeFi Risk Radar for StakeWise offers more than 20 indicators to monitor and evaluate the health and stability of the StakeWise protocol and StakeWise vaults. These include osETH supply flows and distribution, allocator age and health, attestation effectiveness, staking exit queue and many more. You can explore these indicators yourself here.

If you’d like to explore individual vaults, you can select the desired vault from the top-right menu.

In the specific vault view, you can easily view all the risk metrics for that individual vault, along with performance metrics like average returns, number of slashes and number of allocators.

The StakeWise Risk Radar empowers users with the tools to conduct thorough risk assessments, ensuring a deeper understanding of the economic and operational health of the protocol and their staked ETH.

A Step Forward for DeFi Risk Management

Integrating StakeWise into the DeFi Risk Radar is a great milestone in our mission to deliver institutional-grade risk management tools to the DeFi sector and helps further the ecosystem’s safety and reliability.

We invite our users to explore the StakeWise Risk Radar and discover the comprehensive risk insights it offers. Your feedback is invaluable as we continue to refine and expand our risk management solutions.

About IntoTheBlock

IntoTheBlock is a pioneer in providing advanced analytics, DeFi services and risk management tools for the cryptocurrency industry. We leverage cutting-edge technology to deliver insights that help both retail and institutional investors navigate the complex landscape of digital assets. Our commitment to innovation ensures that our partners and users are always at the forefront of the latest developments in the industry.

Introducing the StakeWise Risk Radar on IntoTheBlock’s DeFi Risk Radar was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.