Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The Chamber of Digital Commerce has issued a stark warning about proposed legislation that it claims threatens the very foundation of the cryptocurrency industry in the United States. According to the Chamber, the Digital Asset Anti-Money Laundering Act, spearheaded by Senators Elizabeth Warren (D-MA) and Sherrod Brown (D-OH), along with other co-sponsors, represents an unprecedented attack on digital assets and blockchain technology.

Through a pronounced call to action on X (formerly Twitter), the Chamber expressed its grave concerns: “Digital assets have been under attack from politicians for years, but never like this. Senators Senator Warren and Senator Sherrod Brown are trying to kill the entire industry, and their efforts are moving forward. This is the greatest threat our industry has ever faced, and we need your help NOW. Sign the petition TODAY!”

Digital assets have been under attack from politicians for years, but never like this. Senators @SenWarren and @SenSherrodBrown are trying to kill the entire industry, and their efforts are moving forward. pic.twitter.com/n7jJEAIjKI

— Chamber of Digital Commerce (@DigitalChamber) February 20, 2024

The US Crypto Industry Would Be Crippled

This legislative initiative, supported by a cohort of 19 US senators, aims to address money laundering and the financing of terrorism through stringent controls on the crypto sector. However, the Chamber of Digital Commerce views this as a veiled attempt to stymie innovation and economic growth within a burgeoning industry.

A letter addressed to Senator Sherrod Brown by Perianne Boring, the Founder and CEO of the Chamber, on February 20, 2024, encapsulates the industry’s apprehensions: “I am writing today following several attempts to secure an opportunity for an in-person discussion on an urgent topic impacting the US blockchain community representing over 50 million American voters, including 2 million Ohioans.”

Boring’s letter paints a dire picture of the bill’s potential consequences, suggesting that it could “erase hundreds of billions of dollars in value for US start-ups and decimate the savings of countless Americans invested in this asset class legally.”

She further criticizes the bill for its impractical compliance demands, likening them to an unfeasible scenario for an ink manufacturer: “Imagine an ink manufacturer tasked with tracking every individual who ever handles a single dollar bill printed with their ink, across the entire globe.”

The Chamber’s contention is not just with the economic implications but also with the strategic missteps it believes the legislation represents. Boring emphasizes the broader geopolitical ramifications, stating, “This bill will ensure we cede any remaining leadership position in the digital economy to China, Russia, North Korea, and Iran, who are eagerly waiting to take advantage of the perceived willingness to abdicate such responsibility.”

The Chamber’s letter also highlights a disconnect between the bill’s perceived intentions and its potential impact, accusing some committee members of being misled about its scope and consequences. “It is deeply troubling that members of the Committee have been intentionally misled with incorrect data concerning the impact and purpose of S.2669,” Boring asserts in her letter.

This legislative battle unfolds against a backdrop of rapid technological advancement and an evolving digital economy. With the United States at a crossroads, the outcome of this debate could significantly influence the country’s position as a leader in the global digital marketplace. The Chamber of Digital Commerce’s campaign, supported by a call for public action through a petition, represents a pivotal moment in the ongoing dialogue between regulation and innovation.

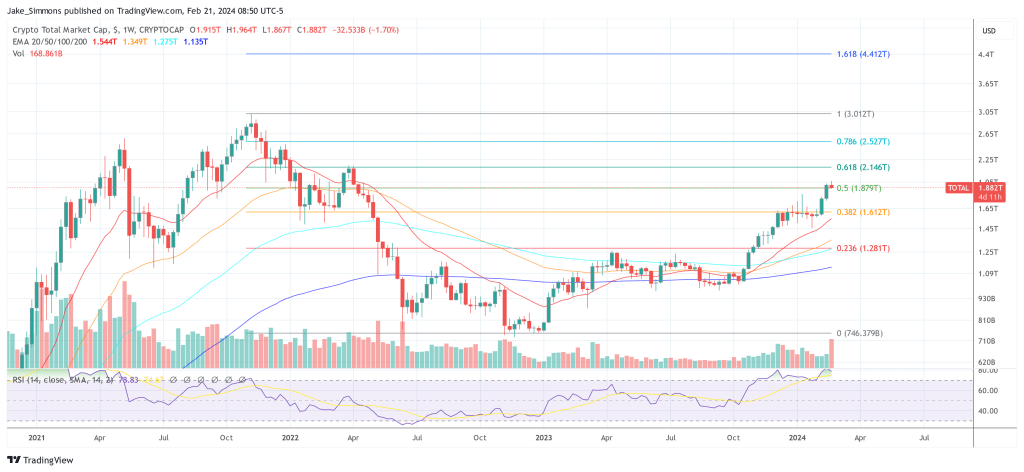

At press time, the total crypto market cap stood at $1.882 trillion, currently retesting the 0.5 Fibonacci retracement level ($1.879 trillion).

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.