Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Navigating Risks of Improving Capital Efficiency with Stablecoins

In our first and second articles in the risk management series explored the economic risks of AMMs and DeFi Lending. For the third installation in our series on economic risk management, we will explore collateralized debt position (CDP) stablecoins. Minting new stablecoins with your existing assets as collateral is a straightforward method to increase your assets’ capital efficiency while also maintaining upside price exposure. CDPs have existed for several years through protocols such as Maker, but have seen a recent renaissance in the last few years with the surge of interest-bearing tokens such as sDAI and wstETH.

Since CDPs are essentially loans with the protocol as the counterparty to borrow a stablecoin that needs balanced liquidity in AMMs to maintain its peg, risk management of CDPs builds on top of the economic risks laid out in our previous two articles. In this piece, we will discuss the risks users face when depositing into CDP stablecoins, focusing on key indicators for Aave GHO and Curve crvUSD.

Depegging Risk

Possibly the most important risk indicator for a stablecoin, the peg monitor allows a user to see how well a stablecoin is able to maintain its 1:1 peg with USD. While it is common for stablecoins to have occasional small deviations that are often resolved in the open market by arbitrageurs, extended depeg scenarios can result in immediate economic losses for users who mint and then trade the stablecoin for another asset or potential losses for users that have bought the stablecoin off the market as a store of value.

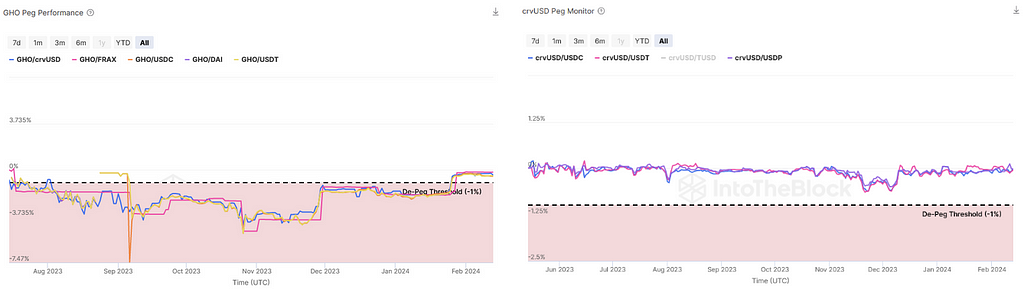

Peg Monitor for GHO (left) and crvUSD (right)

The above charts show the Peg Monitor indicators for GHO and crvUSD. Since small deviations from the USD peg do occasionally occur for a stablecoin, a more robust onchain method to track the peg is to compare how well the stablecoin maintains its peg against other stablecoins.

Due to fewer initial use cases and a different stabilization mechanism, GHO had initially struggled to maintain the peg as users minted GHO and swapped it for other assets in AMMs. However, a recent mechanism design implementation (GHO Safety Module) has helped GHO recover its peg. With respect to crvUSD, we can see that though there have been momentary depegs, the stablecoin has managed to maintain its 1:1 value relatively well since the upgrade was implemented in late January.

If a stablecoin has an extended de-pegged period, this can be a risk for users and for the protocol. From a user’s perspective, any transactions involving the de-pegged stablecoin can result in immediate economic losses. If withdrawing liquidity from a pool, there is the possibility that the user will withdraw less then they have added. For the protocol, a long-term de-pegging event can cause a loss of faith in the stablecoin and cause a ‘run on the bank’ style event where users rapidly repay their positions to withdraw their collateral. This in turn would cause a supply collapse of the stablecoin from which it may not recover.

Collateralization Ratios and Distribution

The overall collateralization ratio and diversity in collateral assets backing a CDP stablecoin can be a strong proxy to the overall health of the coin. Low collateralization ratios indicate a strong possibility of large supply fluctuations if collateral prices have a sharp drop. If prices of collateral drop far enough, there exists the risk that stablecoin will become undercollateralized which can be the death knell for a stablecoin.

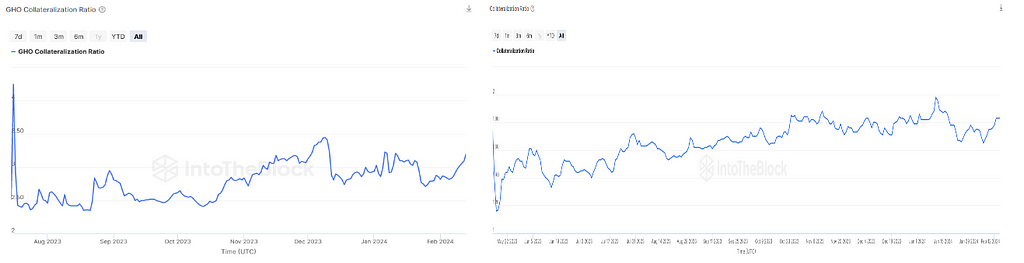

Below are the collateralization ratios of GHO and crvUSD showing upwards trends, indicating a healthier positioning of the stablecoins and reduced risk of supply contractions.

Collateralization Ratios for GHO (left) and crvUSD (right)

Equally important to the collateralization ratio is the distribution of assets backing the stablecoin. A diverse collection of assets helps to reduce the risk of cascading liquidations and supply contractions, especially if the assets used to back the stablecoin are not significantly correlated amongst each other. Another reason to monitor the collateral distribution indicator is to monitor the types of collateral being used. The expectation is that larger portions of the collateral backing a stablecoin should be assets with high market caps. CDP stablecoins with large collateral positions of tokens with smaller market caps are at higher risk of price shocks that could result in cascading liquidations.

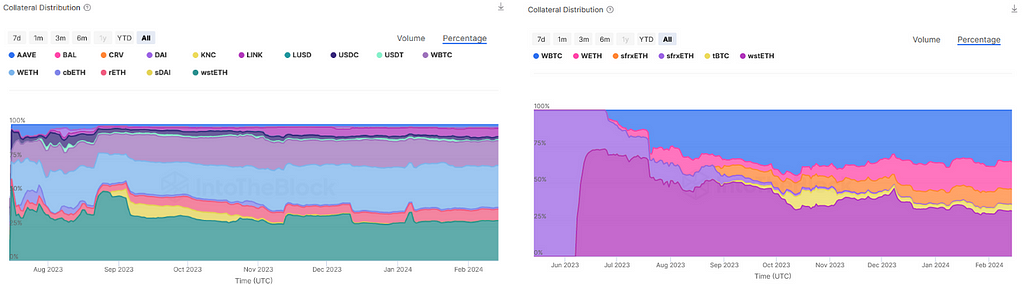

Collateral Distribution for GHO (left) and crvUSD (right)

As seen in the charts above, both GHO and crvUSD are primarily backed by BTC or staked ETH tokens. GHO is also collateralized to a smaller extent with smaller cap tokens like AAVE and LINK. Both stablecoins have a good distribution of collateral with the majority of the assets being bluechip tokens that will have smaller price fluctuations.

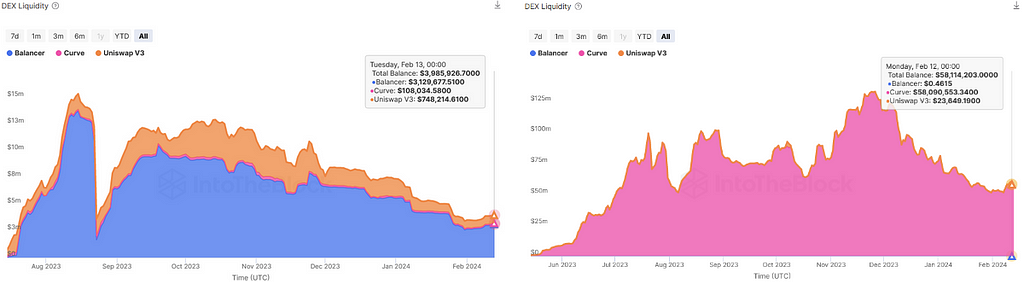

DEX Liquidity

Liquidity in AMMs is essential for a stablecoin. Deep liquidity allows arbitrageurs to swap between pools and help maintain peg stability and liquidators need liquidity to be able to acquire liquidity to exercise liquidations. Not all of the stablecoin supply is expected to be available in AMMs, but a proxy for healthy AMM liquidity is that the amount of liquidity in AMM pools would be able to cover the largest stablecoin minter for the CDP protocol.

DEX Liquidity for GHO (left) and crvUSD (right)

The DEX liquidity for GHO and crvUSD are both relatively healthy with 11.6% and 51.5% of total supply available respectively. GHO would appear to be significantly less well suited to handle liquidations compared to crvUSD, but with the specific stability mechanisms in place for GHO such as their safety module and flash minting, it appears to be in a healthy liquidity situation. However, the limited liquidity for GHO does have an impact on the use cases for the stablecoin. This limited liquidity is partly due to the current supply cap on GHO that is imposed by the Aave Protocol and will likely be lifted in the near future.

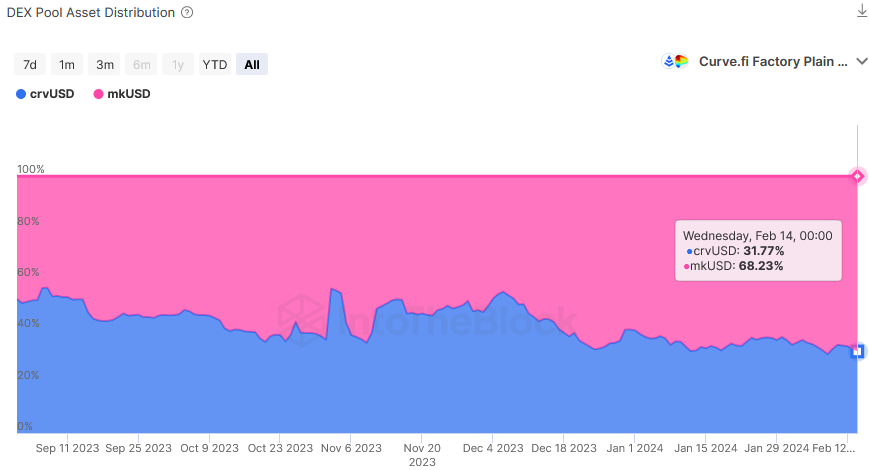

To further understand the liquidity distribution in pools within a DEX, the DEX Pool Asset Distribution indicator highlights the composition of each pool that the stablecoin is in. This is important for users who mint a stablecoin with the intention to deploy as an LP into a pool to earn incentives and fees.

crvUSD-mkUSD pool on the Curve Protocol

The crvUSD pool above that is paired with another stablecoin (mkUSD) is a good example of a slightly imbalanced pool. A user who enters this pool single-sided with crvUSD will initially receive positive slippage in their position as they help to rebalance the pool distribution. However, the current trend is an increasing proportion of the pool being mkUSD. If this were to continue, the same user who initially deployed crvUSD in the pool would incur a large negative slippage if they were to exit the pool. This could potentially mean that the user would receive less crvUSD when exiting than when they entered the pool, resulting in the user not being able to repay their loan in full.

CDP stablecoins are an efficient way for users to increase capital efficiency of their assets. It is a simple and effective method to hedge or leverage your portfolio in both bull and bear markets with less risk exposure to volatility or costs as perpetuals and other derivative products. However, risks still remain and it is essential to monitor these risks to avoid capital loss.

For both user and protocol, de-peg events are by far the most important risk to monitor for a stablecoin. Users performing DeFi transactions during a de-peg are immediately exposed to potential economic losses and sustained de-pegging events can be an existential risk for the protocol. Risks pertaining to collateralization and DEX liquidity can be leading risk indicators to potential supply and peg volatility and therefore are reliable indicators to monitor when holding or deploying a stablecoin in DeFi.

About the IntoTheBlock DeFi Risk Radar

IntoTheBlock’s newly launched DeFi Risk Radar is a sophisticated tool for institutional-grade risk management in the DeFi sector. Developed through rigorous testing and partnerships, it addresses the significant economic risks within DeFi that have contributed to nearly $60 billion in losses.

The Risk Radar today supports nine key DeFi protocols and offers tailored economic risk metrics, high data granularity, an intuitive API and CSV data download functionality. IntoTheBlock’s expertise, gained from years of working with the largest institutions in crypto, strengthened the development of this tool, aimed at enhancing risk analysis and management in the DeFi markets. Additionally, we expect to release more protocols in 2024, expanding the scope and efficacy of our risk management solution.

If you want to know more about Risk in DeFi, We recommend downloading our latest report, which explores DeFi risk in detail.

Additional general analytics on more CDP protocols can be found in our CDP Perspectives dashboard.

Exploring the Economic Risks of CDP Stablecoins was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.