Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Governance in distributed, open source networks is a frequent point of discussion in the cryptosphere. These networks allow developers to create and test intricate governance models in a rapid, iterative manner. As projects experiment with governance tokens, it’s useful to measure the value a token might capture for its governance functionality; how much is a user willing to pay to vote?

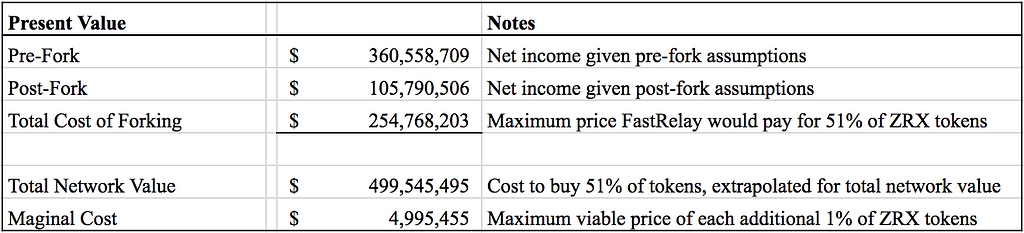

The TLDR; The maximum price a network participant (maybe a relayer) will pay for 51% of governance tokens is bound by the cost associated with a network fork. Cost is equal to the difference between the net present value of the pre-fork and post-fork business. This serves as a starting point for determining fair value of the network. The attached framework provides additional detail.

Background

Off-chain Governance

In off-chain governance, network participants communicate outside of the network. Mechanisms like CarbonVote can be used to give token holders informal voting rights. The votes can act as a signal to the community to download a code change, but the vote does not automatically trigger a change. If a minority disagrees, it can choose to not download the code update. This will result in two separate networks. In this way, off-chain voting serves as a coordination tool.

On-chain Governance

With on-chain governance, a code change is implemented automatically after a vote is complete. Similar to off-chain governance, the minority can choose another path by installing a hard fork that cancels out the change. In each scenario, the minority has the power to revolt against the majority vote by copying the network and creating a new development path.

The key difference between the two systems is in the way that participants opt in. On-chain allows a code change to happen as a result of majority vote, whereas off-chain requires participants to download a code change. Being open source networks, each scenario presents an opportunity for the minority to create a network that suits them.

Governance tokens allow holders to vote for changes in the network in which they belong. Typically, the amount of tokens one holds is proportional to the number of votes they have. In a system that can be copied, what is the value of a governance token? If Facebook’s code could be copied, shareholders may not care quite as much about their voting rights. Of course, code is not the only thing that matters in a company, network, or platform.

Forking is nontrivial and should be avoided if possible, but if there is a disagreement, or a compelling reason to upgrade, a group of users may elect to develop a variant and fork the original network.

Fundamentally, the network value of a governance token is bound by the net cost of forking or creating a new copy of the network.

Example: 0x

0x, a protocol for decentralized exchange, is one of the most well-respected ERC-20 projects and has shipped a great product. The 0x protocol has given rise to decentralized exchanges such as RadarRelay and Paradex, known as relayers.

0x recently announced that its native token, ZRX, will drive protocol governance and allow stakeholders to securely vote on protocol upgrades. The transition to community governance will happen in phases. Governance being the primary function of holding ZRX, it seems appropriate to explore a fair value price for ZRX.

In an attempt to value the 0x governance token, we will assume the perspective of a relayer, a user facing application that facilitates exchange on the 0x protocol. Because relayers are currently operating successful businesses on 0x, they appear to be the largest stakeholders in the future of 0x. Here we will consider a fictional relayer called “FastRelay”.

How much should FastRelay pay for ZRX tokens?

FastRelay is a decentralized exchange built on top of the 0x protocol. As a company that is building on the protocol, it has an interest in defining a specific direction for protocol development. This interest can be represented in voting power. Voting power is represented in ZRX.

FastRelay is considering whether to purchase ZRX tokens in order to ensure the direction of 0x. FastRelay needs to consider two key extremes to determine the maximum price it is willing to pay for ZRX:

1. Status quo: FastRelay is operating a successful business and wants to keep it that way. To ensure business-as-usual, FastRelay could dictate the direction of 0x by purchasing 51% of all ZRX.

2. Revolution: FastRelay owns no ZRX and hopes that 0x progresses smoothly. In the event FastRelay disagrees with the majority of 0x voters, it may decide to copy 0x, and host the FastRelay platform on the new 0x network. There would be ongoing development costs associated with maintaining a copy and potential revenue loss.

By looking at the difference in net income between each scenario, FastRelay is able to determine the maximum price it is willing to pay to ensure status quo by purchasing 51% of ZRX.

We can attempt to calculate a net present value of FastRelay’s business for each scenario. Please see the attached framework for clarity.

Assumptions

All assumptions are intended to be illustrative.

Scenario 1 (No Fork)

1. Gross Revenue: $10,000,000 — This assumes FastRelay has an average daily volume of $20 million with a .15% fee. Note — currently 0x has a total daily volume closer to $500,000.

2. Annual Growth Rate: Assuming widespread adoption, we estimate FastRelay revenue will grow at 80% a year.

3. Engineering: FastRelay has 10 engineers with an average salary of $200,000.

4. Operational Expenses: $1 million — Office, supplies, travel, etc.

5. Marketing: $1 million — Important to spread the word!

6. Expense Growth: 30% annually

7. Discount Rate: 40% — Venture capital rate is typically between 30%-70%.

8. Terminal Growth Rate: 5%

Estimating cash flow over five years, we obtain a net present value of $360.6 million.

Scenario 2 (Post-Fork)

1. Gross Revenue: $7,000,000 — Assume a 30% decrease in revenue due to reputation damage, and possibly lower volume (no shared liquidity pool).

2. Annual Growth Rate: 45% — Slower growth rate due to absence of liquidity pool and reputation damage.

3. Engineering: 20 engineers — FastRelay hires an additional 10 resources to maintain the new 0x network.

4. Operational Expenses: $1 million — Office, supplies, travel, etc.

5. Marketing: $1.5 million — Increased marketing to account for any reputation damage.

6. Expense Growth: 30% annually

7. Discount Rate: 40% — Venture capital rate is typically between 30%-70%.

8. Terminal Growth Rate: 5%

Due to increased costs and a 10% decrease in revenue, FastRelay (post-fork) has a net present value of $105.8 million.

FastRelay (Pre-Fork) NPV = $360.6 million

Fast Relay (Post-Fork) NPV = $105.8 million

See attached framework for clarity

See attached framework for clarity

Logically, FastRelay would not be willing to pay more than $254.8 million for 51% of ZRX because anything more would mean that forking is cheaper. Given that 51% is worth $254.8 million, ZRX has a total fair market value of $499.5 million.

However, FastRelay may not want to control voting with 51% of ZRX. Instead, the company determines 30% is sufficient to influence the direction of the network. Using the above framework, FastRelay finds the maximum price it would pay for 1% of ZRX — $5 million. For 30% of ZRX, FastRelay would be willing to pay up to $150 million.

Considerations

- It may difficult to buy 51% of ZRX.

- Marginal utility may decrease for each additional 1% of ZRX.

- Groups of relayers may choose to fork together.

- Pooled liquidity may be significantly more or less valuable than estimated.

- Cost will be different for each participant of the network.

Conclusion

In attempting to estimate the value of ZRX, we made a number of assumptions around trade volume, growth rate, and costs associated with forking a network. The goal of this post is to progress the conversation around the value of governance tokens rather than assert a true valuation for ZRX.

The cost to fork a network dictates the associated value of its governance token. Networks that implement governance tokens should aim to increase cost associated with a fork while remaining open source. I look forward to continued work around governance models and subsequent valuation methods.

Thanks to Derek Hsue and Dan Zuller for their feedback. If you have any comments, reach out to me on Twitter!

A Framework for Valuing Governance Tokens: 0x was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.