Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bridges play a key role in the DeFi ecosystem, enabling the transfer of assets across various blockchains. In this article, we’re analyzing different bridge protocols and their performance based on our latest Bridges Perspective.

Synapse shows growth, Axelar remains leader

The launch of Synapse’s Request for Quote (RFQ) Bridge mid-January 2024 has generated substantial buzz and volume for the protocol. This caused a price surge in its native SYN token, moving it above Stargate for second place in Market Cap.

This price action in its token has been coupled with increased volumes across its bridge with four days between February 2, 2024 and February 5 where its bridge had $50M+ transaction volume.

Despite Synapse’s success, it is not enough to dethrone Axelar. With a market cap of over $500M, the network’s token $AXL sits at roughly 4x the market cap of Synapse.

The best-performing assets have the lowest percentage of hodlers

One key metric we track for tokens is the percentage of long-term holders, or “hodlers”. We define this as any address that has held their assets for more than 1 year. Often, a high percentage of hodlers correlates with positive price movements. In the bridges ecosystem, the situation is quite different. $AXL and $SYN have been the best-performing assets in the past 3 months, but have the lowest percentage of hodlers. In contrast, DVF and HOP both have a hodler share of more than 80%, and are also among the least profitable tokens in the same period.

ZKSync: The Quiet Giant

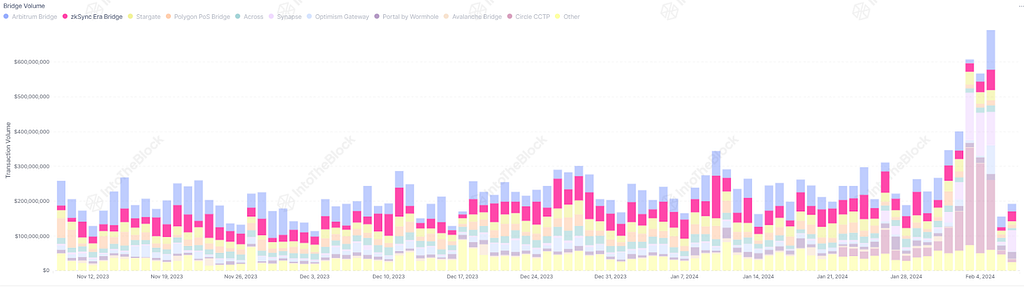

While ZK rollup mania has quieted down in recent months, The ZKSync bridge that moves assets between Ethereum mainnet and ZKSync Era chain has been busy. With regular weekly volumes between the two chains of over $200M over the past year, liquidity has been flowing into ZKSync with large inflows from Ethereum at the beginning of 2024.

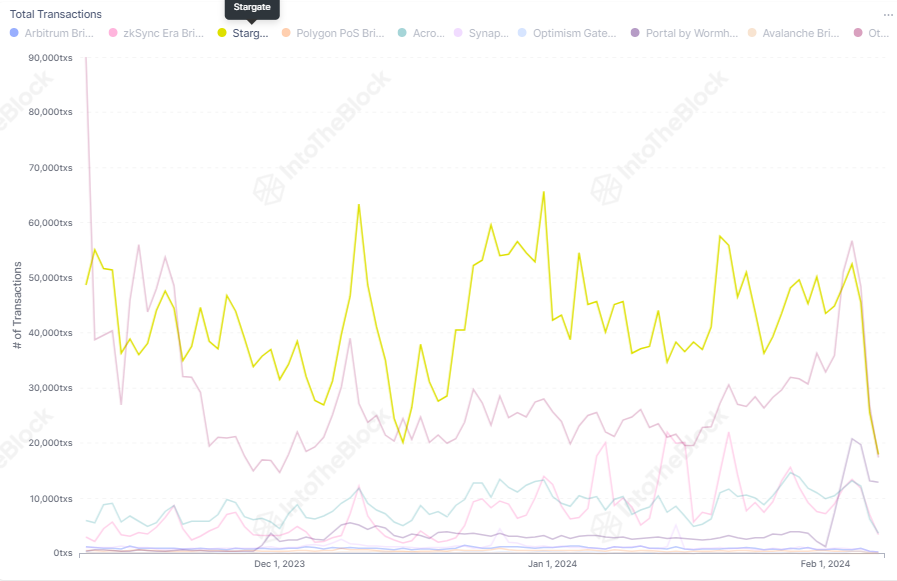

Stargate: The People’s Bridge

The undeniable leader in total transactions, Stargate is a favorite bridge for smaller transfers between chains. Even with average transaction sizes well below many other chains, it makes up for this with the quantity of transactions it handles daily. With consistently 200k+ transactions processed daily across all the chains it operates on, it manages to maintain its market share by appealing to users bridging smaller amounts.

Avalanche of Deposits

The beginning of February 2024 has been kind to the Avalanche ecosystem with over $300M of inflows in the first days of the month. Several narratives are starting to gain strength in the Avalanche ecosystem with the potential of restaking imminent and several high-profile video games launching in the coming months.

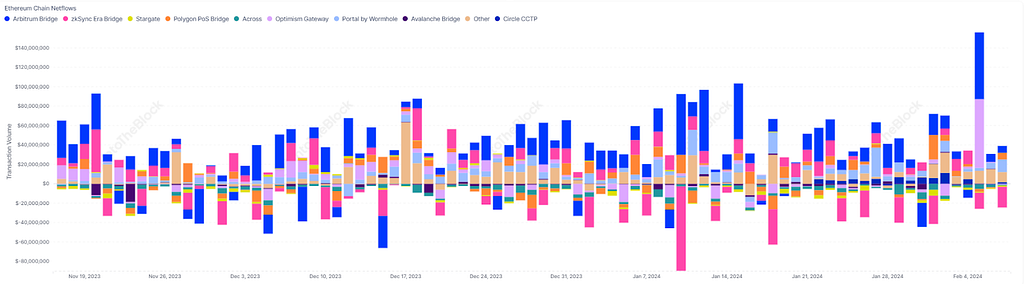

Capital Returning to Ethereum Mainnet

The beginning of 2024 has seen large inflows coming back from the various Layer 2 blockchains into Ethereum mainnet. One reason that could be behind this is the much-anticipated launch of Eigenlayer and its restaking of ETH to earn additional yield. The largest net inflows to Ethereum in the last 3 months (February 5, 2024) was the same day that Eigenlayer reopened for depositors to restake additional ETH.

Explore Our Latest Perspective

Our latest Perspective dashboard is dedicated to delivering a comprehensive analysis of DeFi interoperability and the dynamics of bridges. It helps you explore pricing across different blockchain networks, examine the flow of assets through bridges, and analyze the distribution and movement of liquidity in these networks.

You can explore this Perspective in detail here: https://app.intotheblock.com/perspectives/bridges

An on-chain exploration of bridges was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.