Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Adam Cochran, a crypto analyst, is urging Coinbase, the largest cryptocurrency exchange in the United States by trading volume, to prioritize the creation of an insurance fund for its users rather than focusing on diversifying its Ethereum client infrastructure.

Coinbase Should, Most Importantly, Have An Insurance Fund

In a post on X, Cochran thinks the exchange’s current approach to Ethereum client diversity is “inadequate.” Instead, the analyst recommends that Coinbase focus on mitigating the risks associated with Ethereum’s potential “supermajority” failure.

Ethereum is a leading smart contracts platform, allowing users to transact and developers to deploy smart contracts powering apps, some with billions in total value locked (TVL). However, Ethereum’s leading node operators at the backend rely on Geth, a validator client.

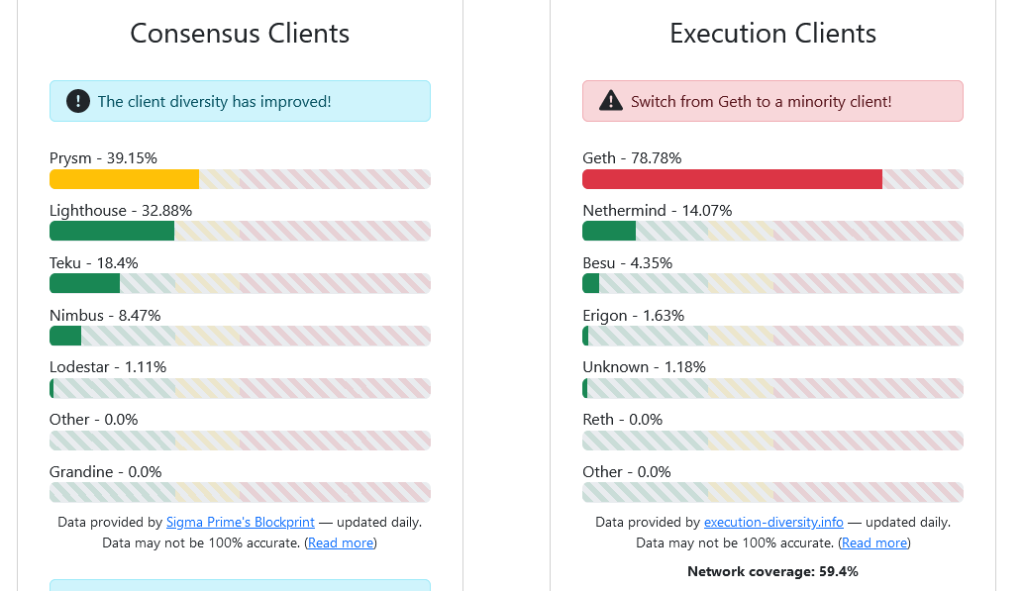

Data shows that the client is used by over 75% of all node operators. Through the open-source software, Ethereum remains up-to-date, and users can access funds and more. Besides Geth, there are options, including Besu and Nethermind.

The analyst pointed out that a “supermajority” failure, in which most Ethereum nodes simultaneously fail, could lead to significant disruptions and losses for Coinbase users. The “supermajority” failure, as the analyst points out, is if Geth fails, a possibility that would halt the operation of the network, even leading to a split. Cochran prioritizes creating an insurance fund or allowing users to use alternative Ethereum clients to address this risk.

The insurance fund will allow Coinbase to compensate users in this event. Binance, the world’s largest crypto exchange by trading volume, already has an insurance fund to compensate users in case of a hack. Besides the fund, Cochran thinks giving users options to opt-in on alternative clients gives them more autonomy, empowering them to take over their security.

Nethermind Knocked Out By A Bug, 8% Of Ethereum Node Operators Impacted

This preview comes a day after Coinbase said it was looking to diversify its Ethereum clients, expanding its base away from Geth.

In a post on X, the exchange said it has been constantly evaluating clients since 2020. It plans to update the community on its next action step by the end of February.

On January 21, Nethermind, an Ethereum client used by roughly 8% of all node operators, was temporarily knocked out due to a bug. Since the reliability of some Ethereum node operators using Nethermind dropped, the network penalized them.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.