Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Santiment has explained that a couple of altcoins have significant FUD behind them, which could end up providing “rocket fuel” to their prices.

These Altcoins Are Being Shorted By Traders On Binance Currently

According to data from the on-chain analytics firm Santiment, Bitcoin Cash (BCH) and Loopring (LRC) are among the altcoins currently being bet against on the futures market.

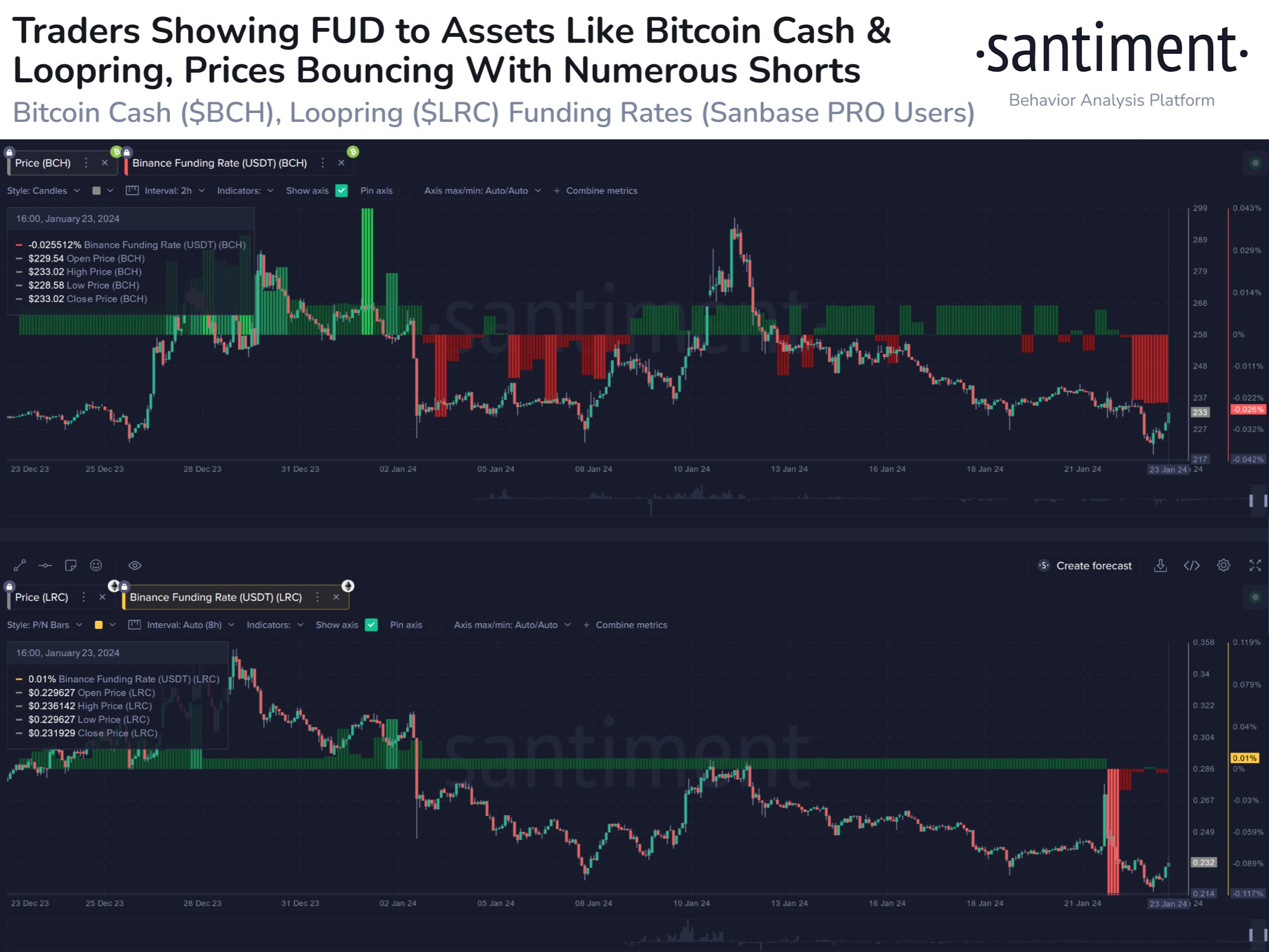

Below is the chart shared by the analytics firm that shows the trend in the “funding rate” for these two assets on cryptocurrency exchange Binance over the past month:

The funding rate here refers to the periodic fee that futures contract holders on Binance are paying each other right now. From the chart, it’s apparent that the indicator has been negative for both of these altcoins recently.

Such values of the metric suggest the shorts are dominant on the platform, as they are the ones willing to pay a fee to hold onto their positions. This naturally means that there is FUD among traders around these alts at the moment.

This kind of bearish mentality, however, can actually play to the benefit of their prices. Both of these altcoins have already shown signs of a turnaround in the past day, and as noted by Santiment, if this market recovery goes through, the shorts will find liquidation, potentially ending up acting as rocket fuel.

Bitcoin Cash, in particular, has a significant amount of FUD on Binance currently, and with the asset starting to climb up, it’s possible a mass liquidation event called a “squeeze” could take place.

Squeezes are often volatile events where the price moves sharply in a direction, and as the shorts might be more probable to fall prey to a squeeze currently (based on the funding rate and the price action starting to brew up), BCH could end up enjoying a sharp move up.

Speaking of altcoins, the on-chain analytics firm Glassnode has discussed how the different sections of the sector have performed against Bitcoin recently in its latest weekly report.

Glassnode has broken down the entire sector into four “indexes.” These are DeFi Index, GameFi Index, Scaling Index, and Staking Index. As is visible in the above chart, all the different altcoin indexes have seen some rise since the Bitcoin spot ETF approval earlier in the month.

This suggests that as BTC has sold off on this news, the risk appetite for alts across the sector has gone up among the market participants.

BCH Price

Following Bitcoin Cash’s turnaround in the past day, the asset has recovered back towards the $238 level.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.