Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Launching the spot Bitcoin ETF in the U.S. caused quite a stir in the crypto market. While most of the activity and volatility came from institutions and short-term holders, another significant market segment has begun showing quite bearish signs.

CryptoSlate analysis found extraordinarily sharp and aggressive movements and activity from long-term holders and whales. These cohorts are often seen as the backbone of the market, as their actions can signify confidence or concern regarding Bitcoin’s future. A significant movement from these holders often indicates a major shift in sentiment or strategy.

Long-term holders are entities that hold their Bitcoins for more than 155 days. Their investment strategy is usually characterized by a deep conviction in BTC’s long-term value, which results in a lower propensity to sell during short-term market fluctuations. Whales are entities that hold a large amount of Bitcoin, usually over 1,000 BTC. Monitoring whale activity is crucial when analyzing the market, as their transfers and traders can significantly impact Bitcoin’s price due to the sheer volume of their transactions.

A critical indicator of market sentiment and strategic shifts is the volume of Bitcoin transferred to exchanges. Such transfers are pivotal as they often precede selling, suggesting liquidity provision or potential price pressure. A heightened transfer volume to exchanges can indicate a readiness among holders to take profits, cut losses, or reposition their portfolios in response to market developments.

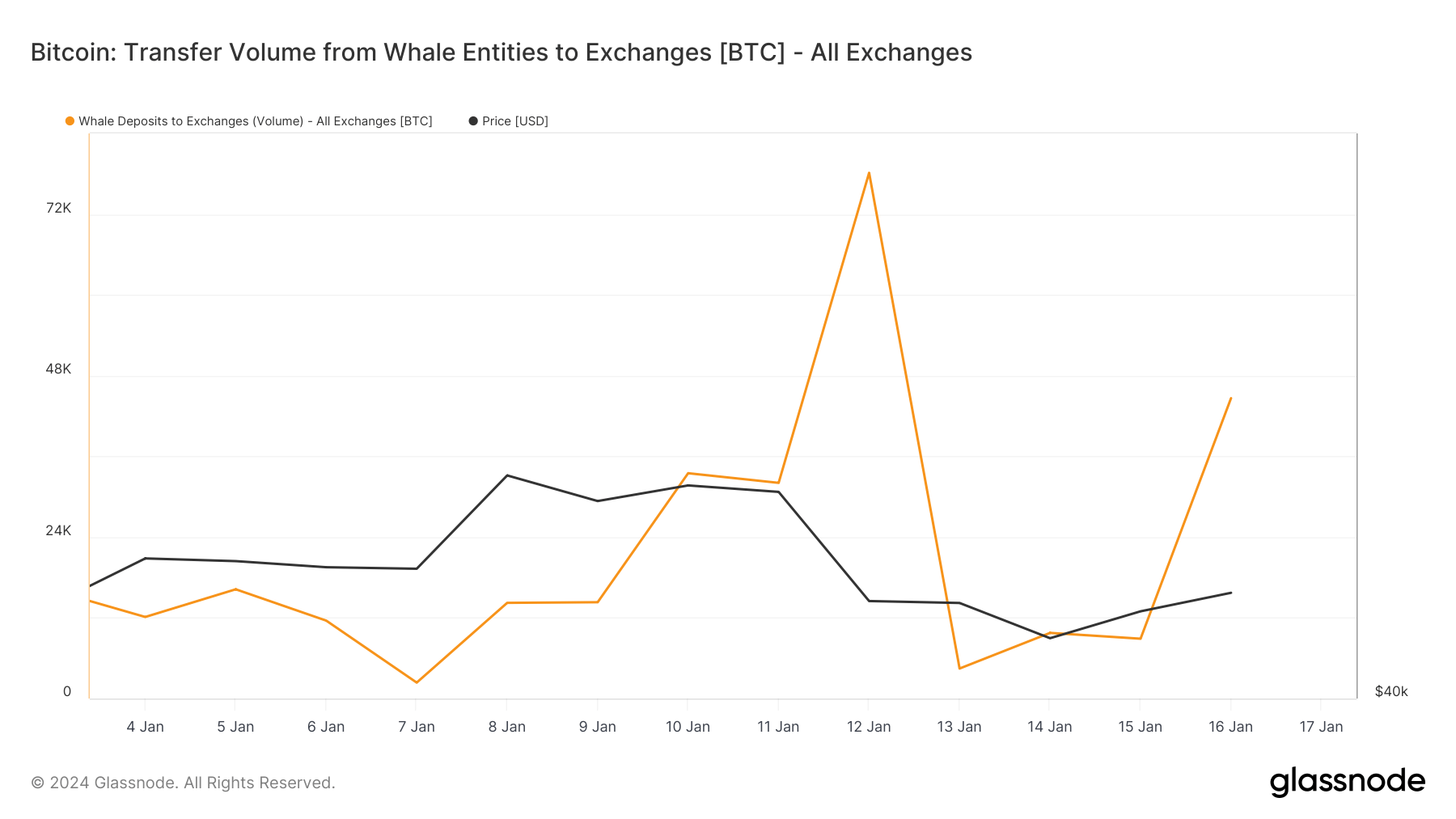

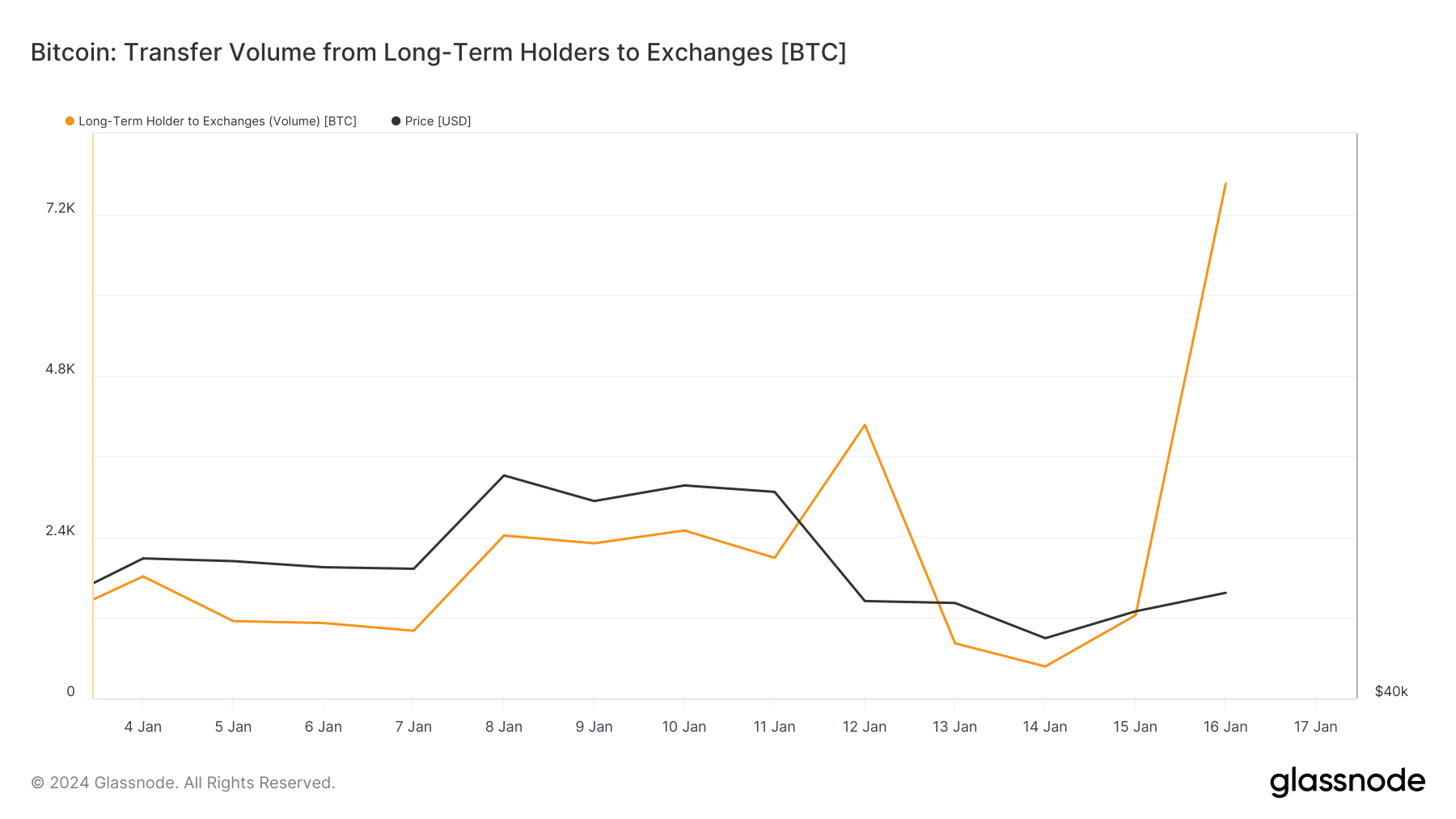

Following the launch of Bitcoin ETFs in the U.S., long-term holders and whales began adjusting and repositioning their positions. Bitcoin’s price declined, dropping from $46,608 on Jan. 10 to a low of $41,769 on Jan. 14 before slightly recovering to $43,152 on Jan. 16. This price movement coincided with substantial whale activity and shifts among long-term holders.

Whale deposits to exchanges showed a significant increase in this period. The volume escalated from 14,315 BTC on Jan. 9 to a peak of 78,140 BTC on Jan. 12 before another substantial increase to 46,463 BTC on Jan. 16. This suggests that whales were actively repositioning their holdings, possibly in anticipation of market reactions to the new ETFs.

Graph showing whale deposits to exchanges from Oct. 20, 2023, to Jan. 16, 2024 (Source: Glassnode)

Concurrently, long-term holders also altered their behavior. The daily transfer volume from these holders to exchanges increased notably, peaking at 7,652 BTC on Jan. 16.

Graph showing the daily transfer volume from long-term holders to exchanges from Jan. 4 to Jan. 16, 2024 (Source: Glassnode)

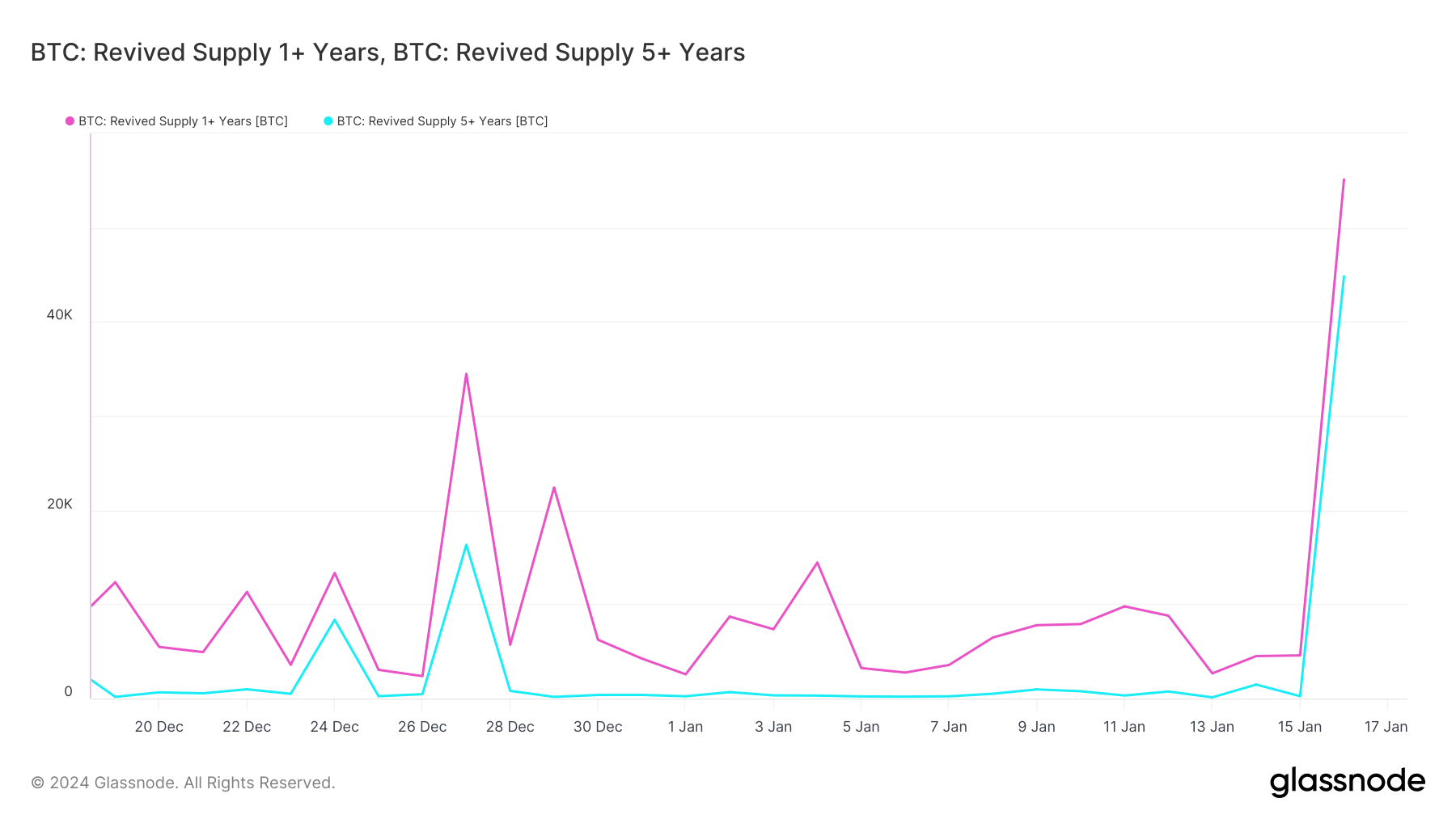

The transfer volume of coins previously dormant for over a year reached 55,108 BTC on Jan. 16, the highest since July 2023. Moreover, coins that have been dormant for over five years tallied 44,821 BTC in transfers on the same day, the highest since February 2022. This awakening of old and hodled Bitcoin indicates a significant shift among long-term holders, who generally resist selling even in volatile markets.

Graph showing the transfer volume of coins previously dormant for more than a year (pink) and more than five years (blue) from Dec. 19, 2023, to Jan. 15, 2024 (Source: Glassnode)

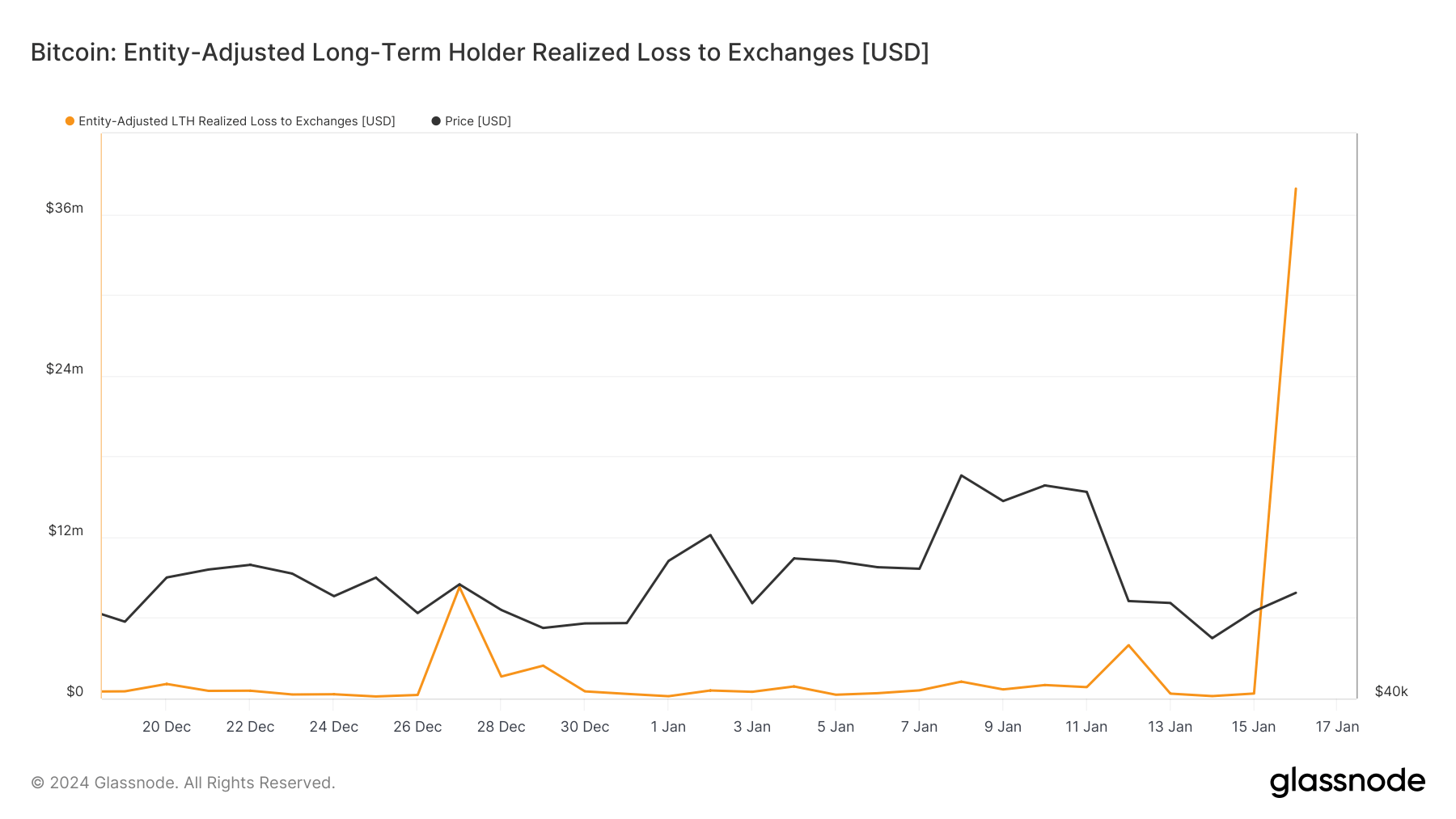

In terms of losses, the market saw a dramatic increase in realized losses, particularly among long-term holders. The entity-adjusted realized loss for this group escalated to $37.89 million on Jan. 16, a considerable increase from the previous days and suggestive of a significant strategic shift or sentiment change among these Bitcoin holders.

Graph showing the entity-adjusted realized losses for long-term holders from Dec. 19, 2023, to Jan. 16, 2024 (Source: Glassnode)

The convergence of these trends—increased whale deposits to exchanges, heightened transfer volumes from long-term holders, and the realization of significant losses—indicates a market in a state of flux. Nonetheless, it’s important to note that long-term holders still make up almost 86% of Bitcoin’s total supply, with 76.3% sitting on unrealized profits. Long-term holders also made up only 10% of total exchange transfers on Jan. 16, with just under 9% transferring their coins at a loss.

A spike in activity among long-term holders and whales is a regular occurrence in times of increased volatility. Despite being dwarfed by short-term holder activity, these movements are statistically significant and are often seen as precursors to major price upticks.

The post Old and HODLed Bitcoin is on the move with whales active appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.