Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In a surprising twist that sent shockwaves through the Bitcoin community, seasoned trader Peter Brandt recently shifted his focus from his well-established technical analysis to delve into the fundamental aspects of the cryptocurrency market.

In a thought-provoking post on X, Brandt challenged the widely held belief that the Bitcoin halving event has a significant impact on the coin’s price. Contrary to the expectations of many BTC holders, Brandt argued that the reduction in supply resulting from the halving might be accompanied by a lot of hype but, in reality, would have minimal repercussions on the coin’s value.

On Supply Reductions And The Gnat’s Behind

Brandt’s unorthodox stance prompted a wave of skepticism and curiosity among his followers. Nevertheless, he provided a rationale for his viewpoint, emphasizing that the reduction in supply, while generating substantial excitement, ultimately acts as a mitigating factor in preventing a substantial surge in Bitcoin prices.

The Bitcoin halving hype is a whole lot of excitement over nothing

Sure, halving hype might temporarily impact price

But the reduction of supply as % of daily volume is the size of a gnat’s ass pic.twitter.com/9JWRr12dkt— Peter Brandt (@PeterLBrandt) December 21, 2023

Following his comment regarding shorting Ethereum (ETH) and his research of Bitcoin (BTC), Brandt has now shared some views: “Interesting to note that ETH has lost 36% in value vs BTC in 2023,” Brandt noted on Wednesday.

The following day, he talked about the opinion of some analysts who claim that Bitcoin is way overbought. Despite this, Brandt said that the 30-day relative strength index (RSI) is presently in the ideal range where previous bull markets have seen a notable acceleration in their upward momentum.

In the middle of the excitement, Brandt’s contrarian viewpoint questions the dominant narrative and emphasizes the importance of maintaining a balanced viewpoint. His analysis suggests reconsidering the importance attached to cryptocurrency market halves incidents.

Even if some may disagree with Brandt’s conclusion, pointing to Bitcoin’s previous post-halving performance as proof, it’s important to recognize the distinct market dynamics at work.

Prior to the halving events in 2012 and 2016, the value of Bitcoin experienced significant increases, peaking at $133 and over $4,000, respectively. The fact that the top coin’s all-time high nearly hit $70,000 raised hopes that the approaching 2024 halving will raise the value of BTC to previously unheard-of levels.

Against this context, Bitcoin has shown resilient in 2022, rising in value by an impressive 159.22% in spite of difficult market conditions.

Bitcoin Future: Analyzing NVT Signal, Dominance

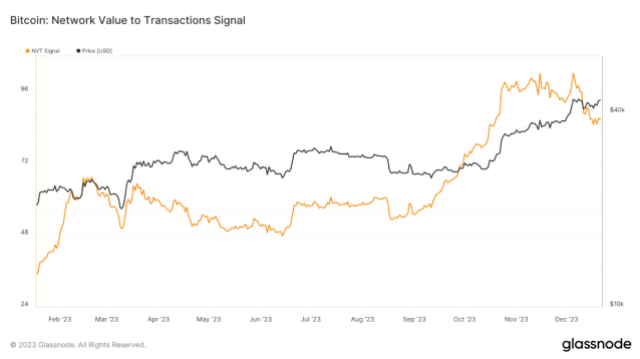

Bitcoinist conducted an analysis of Glassnode’s Network Value to Transaction (NVT) Signal as part of its investigation into on-chain intelligence in order to determine the possibility for future growth.

The NVT signal that is now in place makes use of a 90-day moving average of Bitcoin volume and transactions to pinpoint probable market gains and losses. This helps to illuminate the fundamental durability of the coin in the face of changing market conditions.

$BTC.D Still very undecisive. Seems to be some profit taking on $BTC prior to the ETF and some front running of the rotation to $ALTS after a BTC ETF approval.

I do think BTC Dominance wil trend down shortly after the ETF approval. pic.twitter.com/0CLuT3wNXx

— Daan Crypto Trades (@DaanCrypto) December 22, 2023

Meanwhile, renowned cryptocurrency expert Daan Crypto trades his attention on Bitcoin Dominance in anticipation of changes in the industry.

According to his estimate, Bitcoin currently enjoys a 53% market cap dominance, with significant thresholds for future alterations. The “BTC ETF Approval Target,” he said, is 57%. He predicts a decline in dominance following approval.

Featured image from Shutterstock

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.