Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The floor price of several blue-chip non-fungible tokens (NFTs) rapidly declined during the past day despite an overall growing volume for the sector.

Falling floor price

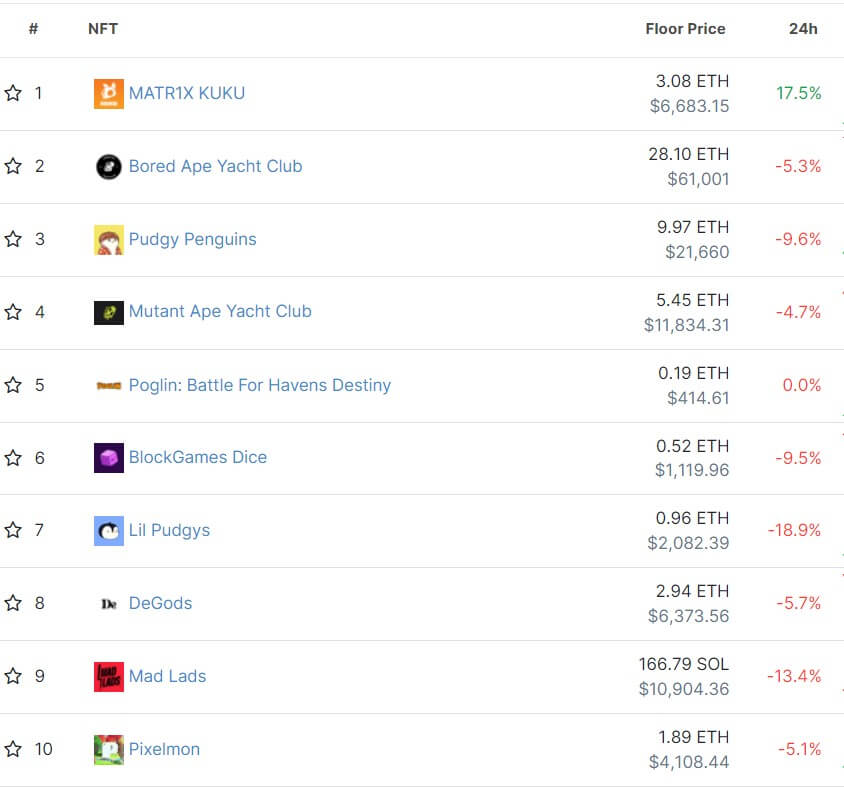

Data from Coingecko shows that the top 10 NFT collections, like CryptoPunks, Bored Ape Yacht Club, and Mutant Ape Yacht Club, recorded declines of around 5% during the last 24 hours, aligning closely with Bitcoin. Other top collections, like Pudgy Penguins, Mad Lads, and DeGods, saw significant losses of up to 13.4%.

Top 10 NFTs and Floor Price (Source: Coingceko)

This continues a trend observed most of the year despite the overall improved crypto market condition. For context, blue-chip NFT collections like Bored Apes and Crypto Punks have seen more than an 80% decrease in their floor price compared to their peak levels.

It’s important to understand that an NFT’s floor price might not consistently reflect its actual market value, as factors such as rarity traits and others often contribute to price fluctuations.

Additionally, noteworthy declines in the overall cryptocurrency market, evident in the past 24 hours, can substantially influence the floor prices of these NFT collections.

Trading volume rise

Meanwhile, these NFTs have seen an upswing in their trading volume during the same period.

According to CryptoSlam’s data, the NFT space recorded sales exceeding $58 million through 268,252 transactions during the last 24 hours. Remarkably, NFT transactions on the Bitcoin blockchain surpassed those on Ethereum and Solana without evidence of wash trading.

This continues a trend observed during the last 30 days, where the sector recorded an impressive 86.86% increase in trading volume to $1.1 billion. This growth was accompanied by 8,376,759 total transactions, marking a 26.37% rise during the same period.

NFT Trading Volume For November. (source: DappRadar)

A recent DappRadar report noted that the increasing volume recorded in the sector indicates a shift in investor behavior, with heightened activity in buying and selling NFTs. The blockchain analysis firm further noted that the average transaction value rose 114%, climbing from $126 to $270 over the past month.

“NFTs seem to be moving in tandem with the broader crypto market, reflecting similar patterns of investment and interest. This symbiotic relationship between NFTs and the wider fungible crypto market continues to shape the trajectory of the NFT industry,” DappRadar wrote.

The post NFT trading volumes surge as blue-chip collection prices hit roadblock following BTC dip appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.