Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Emerging Dynamics in

Bitcoin’s ETF Landscape

Exploring the Bitcoin ETF potential approval timeline the 50% discount and 300% rally of GBTC and the implied volatility of the assets

The cryptocurrency sector has been surrounded with speculation about the potential approval of a spot Bitcoin ETF. This presents the opportunity for straightforward access to the asset and the chance to gain exposure through conventional financial channels. The escalating interest from both traditional finance and crypto ecosystems has captured the attention of major players in traditional finance, who are now seeking to seize this opportunity. The approval process for applications has been both lengthy and tedious. Numerous companies originating from the crypto sector, such as Grayscale, have been pioneers in this area, but their applications are still awaiting approval.

The final deadline for other products applying is quickly approaching, and the speculation and interest surrounding this topic are rapidly increasing.

IntoTheBlock’s Bitcoin ETF Perspective Dashboard

The SEC has the authority to postpone their decision on applications up to three times before making a final determination to either approve or reject them. Ark Invest is set to be the first to reach its final deadline on January 10th, 2024. The simultaneous listing of 9 Ethereum futures ETFs on Monday, October 2, hints at the possibility that the SEC might consider a similar approach in evaluating the approval of a Bitcoin spot ETF. Instead of approving each application by their individual deadlines, the SEC might choose to issue a wider range of approvals at the same time, to prevent showing preference towards any particular entity.

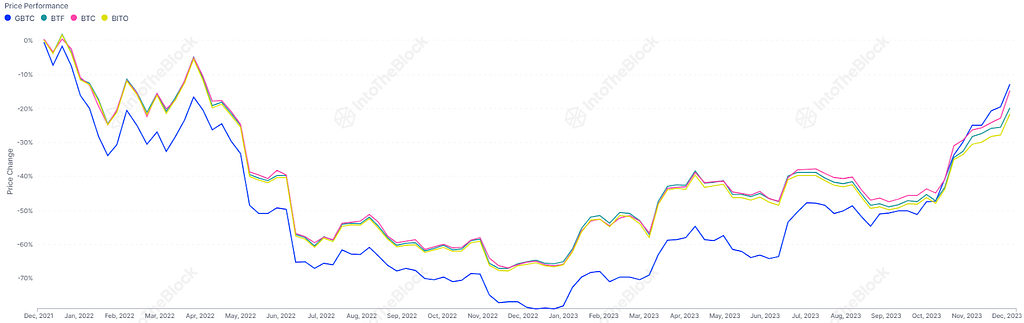

In early 2022, the bear market resulted in GBTC trading at a discount relative to the value of its Bitcoin holdings. After the downfall of Genesis, a branch of Digital Currency Group, which is also the owner of Grayscale, the discount on GBTC intensified towards the end of 2022, hitting a record high of nearly 50%.

IntoTheBlock’s Bitcoin ETF Perspective Dashboard

Nevertheless, in the summer of 2023, BlackRock’s application for a Bitcoin ETF, coupled with its impressive track record of 575 approvals out of 576 ETF applications and nearly $10 trillion in assets under management, revived the optimism for an eventual ETF approval, leading to a reduction in GBTC’s discount. Shortly after, Grayscale achieved a significant win in its lawsuit against the SEC for denying its transition into an ETF. This victory further confirmed the shifting dynamics in the field.

As a result of these developments, the Grayscale (GBTC) product has acted as a barometer reflecting the market’s assessment of the probability of an ETF approval. This was evident in the 320% price surge of GBTC throughout 2023, outpacing Bitcoin’s 165% increase during the same period. These rising price changes and the discrepancies between GBTC and BTC have become particularly noticeable in the correlation between the assets and their different levels of volatility.

IntoTheBlock’s Bitcoin ETF Perspective Dashboard

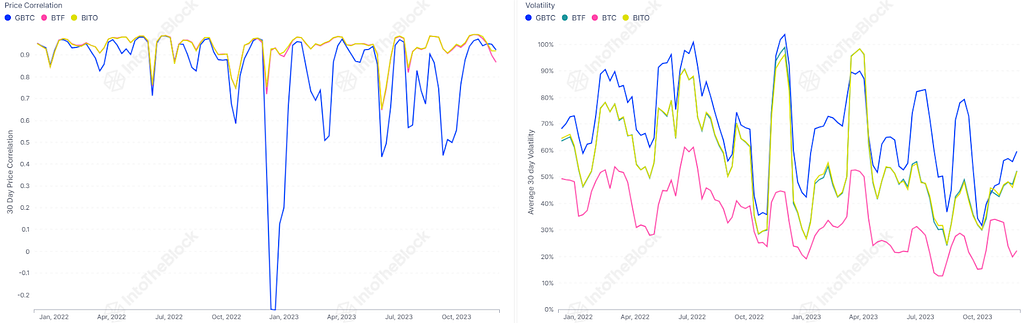

At the point of greatest price divergence between GBTC and Bitcoin, the correlation between the two assets was at -0.27. Such a low correlation indicates that during this specific period, GBTC was trading almost inversely to Bitcoin’s price movements. In the last two years, GBTC’s volatility has reached a peak of 103%, significantly surpassing Bitcoin’s highest peak volatility, which stood at 61%.

Additionally, it’s noteworthy to analyze the trend concerning the approved Bitcoin futures ETFs, BTF and BITO. Over the past two years, the 30-day volatility for these two ETFs has consistently been higher than that of BTC, the actual asset they are intended to track. The heightened volatility experienced by these futures ETFs can be attributed to their underlying structure, where the contracts for the asset are rolled over on a monthly basis. Typically, when a new futures contract is issued, it often carries a premium, but as the expiration date nears, this premium begins to diminish. In the process of rebalancing from one month’s contract to the next, futures ETFs typically buy Bitcoin at a premium, resulting in worse performance and higher volatility.

This dynamic is one of the reasons why a potential upcoming spot ETF would be a more advantageous product. Since the funds in a spot ETF can be redeemed, the closer alignment with the underlying BTC assets would likely result in a more accurate tracking, thereby reducing the higher volatility associated with futures ETFs.

While the concept of a Bitcoin spot ETF has been a topic of conversation for many years, grasping its deep significance is crucial. In contrast to the Bitcoin futures ETF, which was approved in late 2021 and involves derivative contracts, a spot ETF would involve the direct purchase of actual Bitcoin. A spot ETF would pave the way for participants in the traditional market to directly invest in Bitcoin. Despite the uncertain future of a Bitcoin spot ETF’s approval, recent events indicate a shifting landscape and a growing convergence between the traditional financial system and the cryptocurrency market. These developments highlight the evolving dynamics and increasing recognition of cryptocurrencies as a significant asset class.

Emerging Dynamics in

Bitcoin’s ETF Landscape was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.