Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Crypto News Magnet

Crypto News Magnet

- With Bitcoin now reaching below $7,000, many analysts believe the Bitcoin bubble has popped.

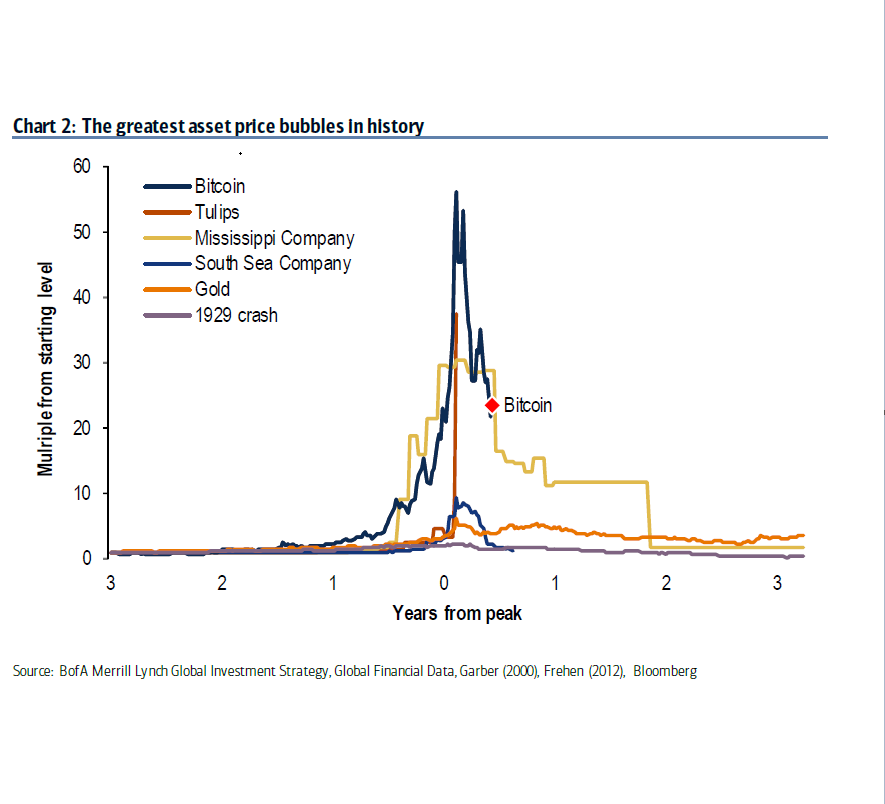

- A team of Bank of America Merrill Lynch (BAML) researchers is arguing that bitcoin is one of the “greatest asset price bubbles in history.”

- Global regulation and an Ad-ban by major digital platforms such as Google, Facebook, Twitter and Snap Inc has slowed crypto’s momentum as search for Bitcoin and cryptocurrencies have plummeted.

BITCOIN IS THE BIGGEST BUBBLE EVER Bloomberg

Bloomberg

Many believe Bitcoin could suffer the same fate as the Tech bubble, only at a faster rate. As blockchain adoption continues, cryptocurrencies and especially ICOs will require regulatory measures, which Japan appears to be leading.

The current mood from those in the cryptocurrency sphere is dismal, as Bitcoin has had a price correction of in the area of 60% in 2018.

The cryptocurrency has fallen more than 65 percent since peaking in December at $19,511.

Cryptocurrencies are still for good or ill, tethered to the price of Bitcoin, as an index of crypto’s adoption in mainstream society. However, Bitcoin is far from perfect and more of a symbol than a valid form of payment. Bitcoin is also the grandmother of smart contract platforms of the likes of Ethereum, NEO and others could become.

Telegram raised in the area of $1.7 Billion in its ICO recently, but also exposed more frauds.

As Bank of America has pointed out, Bitcoin as a bubble beats out the likes of the Mississippi Company and South Sea Company in the 18th century, gold, the U.S. stock market in 1929 and the Dutch tulip bubble in 1637. Bitcoin is therefore in uncharted territory. Is the cryptocurrency market really popping forever? With better regulation, there’s a fair chance the bear market reverses once again.

Coinbase itself is working with the SEC about turning into a regulated brokerage. The San Francisco-based cryptocurrency exchange is reportedly in talks with the US Securities and Exchange Commission (SEC) about becoming a regulated brokerage firm and trading platform, according to the Wall Street Journal.

However let’s make no mistake, a regulated and mature cryptocurrency market would attract more mainstream traders, and that movement is inevitable.

The San Francisco-based cryptocurrency exchange is reportedly in talks with the US Securities and Exchange Commission (SEC) about becoming a regulated brokerage firm and trading platform.

The epicenter of the cryptocurrency markets future appears to be in Asia, where adoption and high-risk investment in crypto is more common and where regulation is likely to first occur in places such as Japan and South Korea.

While Bitcoin as a digital crypto asset remains murky and even highly controversial as a highly liquid form of “digital gold” that isn’t tied to any physical asset of value, altcoins have several value propositions that could once integrated with online ecosystems provide an exchange of value as the name “cryptocurrency” suggests. In a bear market, it’s always doom and gloom for Bitcoin, however the future is dynamic and the Bitcoin run of December 2017 taught us that Millennials and opportunistic investors have a huge capacity to opt-in to new developments in the space.

While Telegram may try to raise as much as $2.55 billion in its ICO, the Bitcoin sell-off appears to be continuing in early 2018, but if the pendulum reverses we could see the cryptocurrency market rising with vengeance.

Bitcoin is the Biggest Bubble Ever, and it’s Popping. was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.