Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In depth-dive into the market share, number, long term and large holders of Ethereum’s liquid staking options

Liquid staking tokens (LSTs) enable users to receive rewards from a proof-of-stake blockchain without the need to lock their capital. This idea has grown into one of the most significant sub-sectors within the cryptocurrency space, with approximately $20 billion being staked via Ethereum LSTs as of November 2023. Due to the substantial size of the staking market, numerous participants are involved in the Ethereum liquid staking sector. Lido’s stETH remains the leading liquid staking token, but other protocols have recorded notable expansion and progress, especially after the Shapella upgrade introduced staking withdrawals in April 2023.

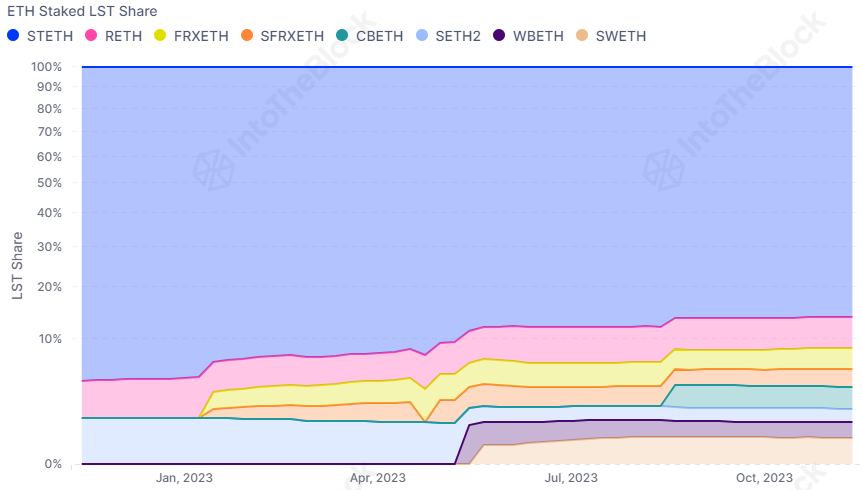

As liquid staking protocols came to market, many introduced distinct mechanisms to gain competitive advantages and set themselves apart from existing options. Lido has played a central role in the Ethereum ecosystem’s liquid staking landscape, achieving significant scale relying on institutional node operators. Prior to the Shapella upgrade, it held a dominant market share, accounting for over 90% of the liquid staking token market. With the introduction of the Shapella fork and growing investor confidence in holding liquid staking tokens, the market share of new alternatives has seen an increase, reaching its current level of 15%.

Via IntoTheBlock’s Perspectives Dashboards

Alternative liquid staking token products distinguish themselves in various ways, such as Rocket Pool, which has the second-largest market share with its rETH token. Rocket Pool is particularly well-known for its strong commitment to decentralization. The primary objective of this protocol is to foster a community of decentralized validators, ensuring that validator power doesn’t concentrate in the hands of just a few individuals or entities.

Different approaches to liquid staking token models include the dual token system, as implemented by the Frax protocol with its frxETH and sfrxETH tokens. In this dual token model, one token is heavily incentivized within the DeFi ecosystem, while individuals holding the other token receive the combined staking rewards from both tokens.

Additionally, despite Lido and its stETH token dominating the current market, there are indicators within various other tokens that suggest their robustness and potential for a long-term presence in the market.

Via IntoTheBlock’s Perspectives Dashboards

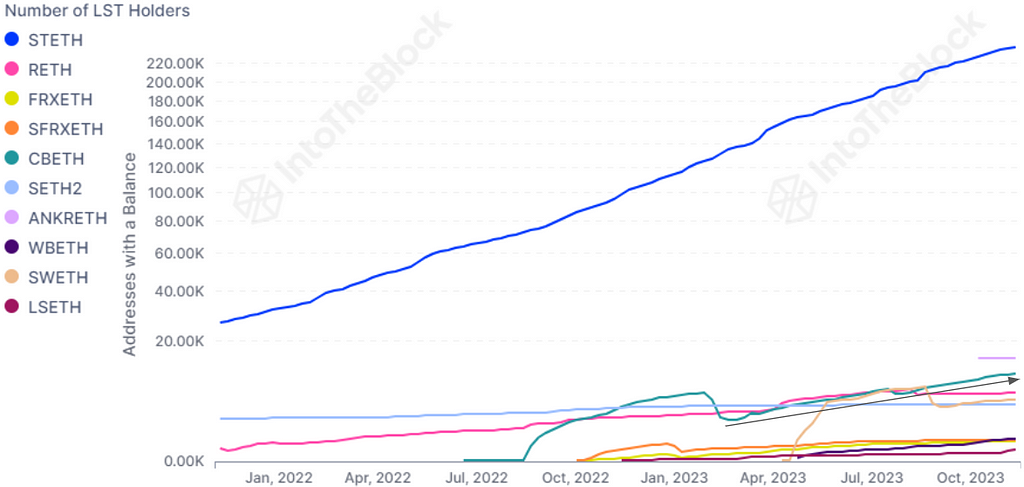

Presently, there is a staggering $18.3 billion staked through Lido’s stETH, furthermore the protocol has the most holders in the market as well, an impressive 238.6k unique addresses hold the token. Following stETH, ankrETH comes in second with 14.9k holders, which indicates a significant difference in the number of token holders between the top two positions.

In addition to stETH, another noteworthy trend is the increasing number of holders of cbETH, Coinbase’s Ethereum staking token, which was introduced just over a year ago. This token has shown consistent growth in its holder number over time. This indicates a positive and growing demand for the token, and to stake through Coinbase more broadly. While it may not have the largest number of holders, cbETH has successfully outgrown other competitors in the industry and currently holds 10.8k unique holders.

Furthermore, as cbETH has expanded, another encouraging sign of its token health is that it has the highest percentage of Hodler users among all the liquid staking tokens.

Via IntoTheBlock’s Perspectives Dashboards

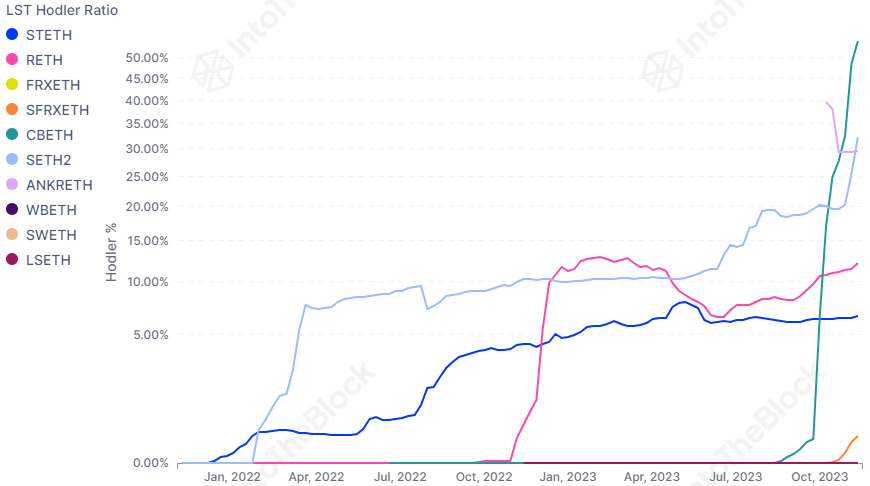

54.26% of all addresses holding cbETH have maintained their holdings for over one year, showcasing a strong commitment and long-term perspective among its holders. A substantial number of Hodler addresses represents a positive indicator, as it signifies users trust both the token and the underlying protocol. In this instance, it demonstrates a significant degree of trust in its deployer, Coinbase.

This observation might be attributed to the way Coinbase has organized the cold storage of tokens. Specifically, if tokens are held in representation of client accounts within the centralized exchange, which could explain the lack of movement among the tokens. Even if this scenario holds true, it would remain a positive indication in general. This is because, if the token’s demand were decreasing, the exchange would go through constant rearrangement as tokens would likely be getting sold or burned.

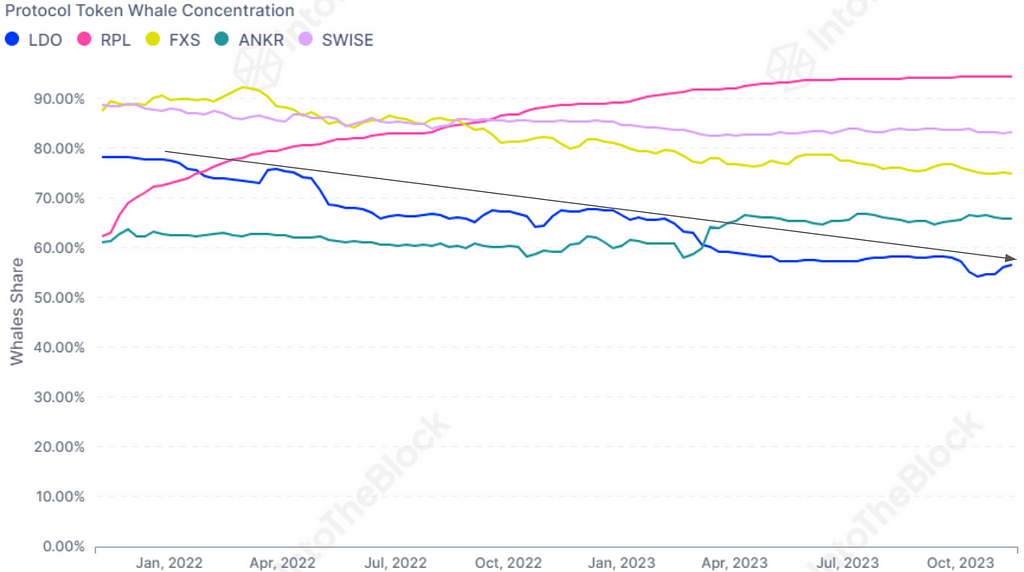

Finally, the concentration of major holders serves as a function to indicate the degree of decentralization. This helps to spot tokens in which an over concentration of holders could potentially create unfavorable conditions for the ecosystem. Large holders can introduce additional risks to other token holders, making this information valuable for assessing their potential impact on the market.

Via IntoTheBlock’s Perspectives Dashboards

While this indicator does highlight that most tokens in the Liquid Staking token ecosystem have a significant concentration among large holders, it’s worth noting the ongoing process of decentralization evident in Lido’s development. Over the past year, there has been a reduction in whale concentration within the LDO token, which serves as Lido’s governance token. This concentration has decreased by more than 10%, dropping from 67.8% to 56.4%.

This trend also serves as an indicator of the token’s maturity, a lower concentration implies a more widespread distribution among token holders, signifying greater decentralization and reduced influence of individual holders, which is generally considered a positive development. It’s common for newly launched tokens to exhibit a high concentration among large holders. Therefore, given Lido’s established adoption and scale with its stETH token, it’s logical that the concentration of major holders in its governance token is decreasing over time.

In conclusion, the liquid staking market within the Ethereum ecosystem presents a dynamic landscape characterized by various tokens, each with its unique features and user bases. While Lido’s stETH token has historically held a dominant position, recent trends suggest a growing diversity of options and an evolving competitive landscape. Notably, tokens like cbETH have gained traction with a significant number of holders, underlining their appeal and long-term potential. The percentage of Hodler users and the concentration of large holders serve as key indicators of token health and ecosystem decentralization. Furthermore, the decrease in whale concentration within governance tokens, such as Lido’s LDO, reflects the maturation of these tokens and their move toward greater decentralization.

Exploring Ethereum’s Liquid Staking Landscape was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.