Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The demand for on-demand work has grown tremendously in recent years as organizations shift from full-time 9-to-5 workers to a more dynamic workforce that includes freelancers and contractors. However, the payroll and administration frameworks employed by these organizations have not been updated to reflect this changing workforce. Organizations spend billions of dollars every year on antiquated middleman payroll services that are unnecessary for the one-off type of work that on-demand workers provide. Additionally, other general payment concerns such as currency conversion and late payments add further hassle to the process. Projects such as Grain aim to reduce the amount of friction in this process through the use of blockchain technology.

Grain’s decentralized platform for work agreements aims to fix the inefficiency present in the market for on-demand, flexible labor, by integrating its back-end infrastructure with the platforms of its transaction partners — freelancing websites, temporary staffing companies, and HR software providers. Grain’s infrastructure allows employees and employers to agree upon a contract specified by a smart contract. This contract details the involved parties, what work is to be done, the amount of compensation, and the method of reaching consensus about the work’s completion. Once the work is completed, both parties acknowledge that the work has been submitted and carried out as specified, and the smart contract pays the worker. Payments are initially conducted using GRAIN tokens, so payments are instantly received by the worker at a very low network transaction fee. Tokens are then converted into the user’s local fiat currency by default.

Key Features

Beyond the basic smart contract execution flow, there are several key features that add to the platform’s legitimacy and make Grain’s platform much more than a simple token-based payroll back-end system. These ensure that both the employer and worker are treated fairly, and allow all involved parties to benefit from the success of the Grain platform.

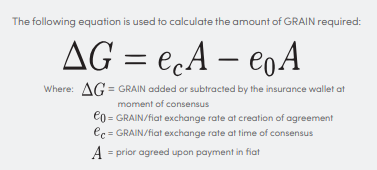

Liquidity Insurance: Volatility in cryptocurrency prices is one of the issues preventing mainstream use of tokens as actual currencies. If a price is quoted at a certain amount in fiat currency, the quantity of the cryptocurrency that is equal to that fiat amount may vary greatly over a long period of time. Grain addresses this issue by using an insurance wallet to ensure liquidity. Employers who choose to use the “Escrow” option for payment prepay the full amount of the contract at the time of its creation. When the contract is settled, either excess GRAIN is deposited into the insurance wallet in the case of token appreciation, or GRAIN is taken from the insurance wallet to make up the difference in the case of token depreciation. Either way, the employer and employee pay and receive the intended fiat amounts. Employers may also choose the “Currency” option and only pay after the work has been delivered.

The formula used for liquidity insurance

The formula used for liquidity insurance

This means that after the work has been completed, the employer has the right to buy GRAIN tokens at the original exchange rate instead of the exchange rate at the time of the contract’s end. To choose this option, the employer must pay a premium dependent on the size and duration of the agreement. This premium is transferred to insurance wallet used in the aforementioned “Escrow” option.

GRAIN Harvest: The volatility-handling mechanisms above may result in the insurance wallet having a surplus of GRAIN tokens if the token price appreciates. In order to share the success of the platform with its users, excess GRAIN collected by the wallet will be redistributed to workers and employers as a form of profit-sharing. Additionally, separate from wallet surplus, the platform also provides direct compensation for workers into the user’s Harvest fund. By default, one percent of the contract payment will be deposited into the fund, paid by the employer. This may be interpreted as something similar to a full-time employee’s pension plan, allowing employees to accumulate savings through use of the Grain platform.

Regulatory Compliance: In order to flexibly comply with regulation across the world’s nations, Grain contracts will have placeholders in which contract users can add specific regulatory requirements. For example, these requirements may include specific education or work certifications, tax payments, or identity checks. This ensures that work agreements made with Grain can accommodate local requirements and are seen as legitimate contracts.

The use of blockchain technology and smart contracts is a clear match for the needs of modern accounting and payroll services. These allow Grain’s transaction partners to trustlessly compensate on-demand workers in a way that is convenient for both sides of the work agreement. The Grain team is made up of very capable people with extensive backgrounds in technology and human resources, with several ex-Microsoft employees. The team has already began integrating the Grain protocol with the platform of a transaction partner, Flexentral, and aims to release the first public beta of the Grain API set during this quarter.

If this project seems interesting to you, the Grain token sale begins on April 16th.

To learn more or get more involved, consider joining their Telegram channel or following their blog.

Disclaimer: The author has a professional relationship with the company mentioned in the article. This is not meant to be investment advice, and is strictly informational.

Make sure you give this post 50 claps and follow me if you enjoyed this post and want to see more!

You can also follow me on Twitter!

Devin Soni (@devin_soni) | Twitter

Decentralizing Work Agreements with Grain was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.