Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

First, if reports are to be believed, legendary investor George Soros was found to be investing in cryptocurrency. Now, Venrock, a 3 billion USD venture capital firm owned by storied American family, the Rockefellers, have taken to crypto.

Also read: George Soros Is Rumored to Be Investing in Cryptocurrency

First Soros, Now Rockefellers’ $3 Billion Firm to Invest in Crypto

Limited liability venture capital firm, Venrock (a compound of “venture” and “Rockefeller”), is turning its sights on cryptocurrency projects and markets. Famously an investment vehicle of the Rockefeller family, the focus for Venrock since its inception nearly half a century ago is technology and science. Their investments are a laundry of list of dominant companies, from Intel and Apple, to AppNexus and StrataCom, among many, many others. Cryptocurrency seems like a logical progression.

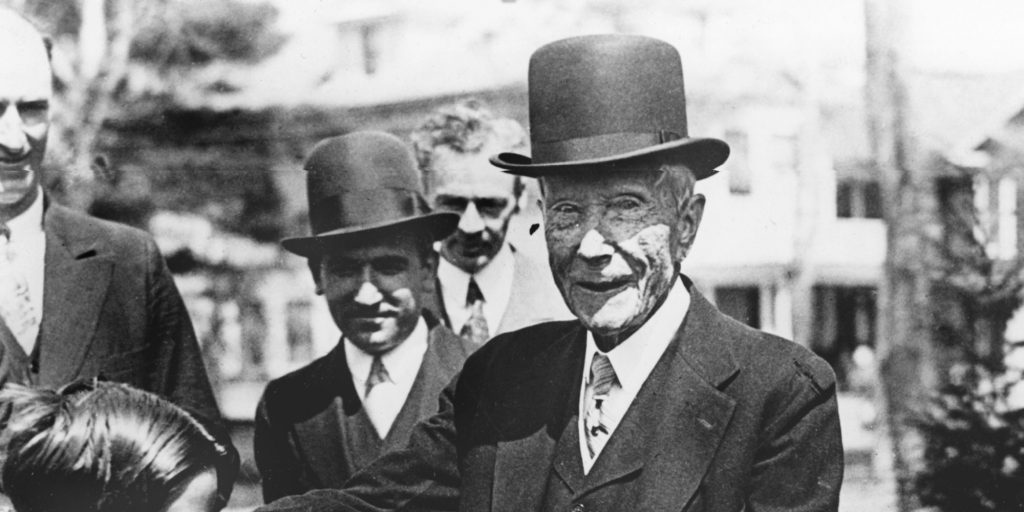

Though the firm might not move the needle so much in crypto circles, at least at first, the family carries a certain cache with Americans. They’re best known for Standard Oil, which not only grew out of the late 19th and early 20th centuries to confer on the family previously unheard of levels of wealth, but was also subject to landmark Supreme Court decisions concerning monopolies. The family’s holdings are vast, as a tour of New York City would reveal: the Rockefeller Center, Museum of Modern Art, to the former World Trade Centers. They have also served in high government posts – from Vice President of the United States to Senator, and everywhere in between. Indeed a lasting tribute to the family’s incredible wealth is the very name itself being a synonym for outrageously rich.

Venrock Teams with Coinfund

David Pakman of Venrock explained, “There are a lot of crypto traders in the market. There are a lot of cryptocurrency hedge funds. This is different. In fact, to us, it looks a little bit more like venture capital,” he told Fortune. Mr. Pakman is speaking of Venrock’s announced partnership with Coinfund, an investor group exclusively geared toward cryptocurrency startups. “We wanted to partner with this team that has been making investments,” Mr. Pakman continued, “and actually helping to architect a number of different crypto economies and crypto token-based projects.”

Coinfund is noted in the ecosystem for such projects as Coinlist, to help facilitate initial coin offerings (ICOs), and the chat application maker, Kik. “We’ll be working closely with them to help mentor, advise, and support teams in the space. We’re trying to cultivate a unique synergy between teams as we see more experienced founders and more traditional tech startups taking up blockchain,” Coinfund’s Jake Brukhman noted.

Mr. Pakman insisted Venrock is in crypto for the long term, seeing the surrounding tech as transformative. “Gatekeepers tend to charge rent or toll on users. The benefit of the advent of crypto is that we have fewer gatekeepers. Venture capital itself is effectively a gatekeeper industry and I’d actually like to see that undone. I don’t believe that a small group of people should make the decisions about which projects can raise some money and get off the ground,” he told the show, Balancing the Ledger.

Will the Rockefellers entrance into the space make a difference? Let us know in the comments section below.

Images courtesy of Shutterstock and Wikipedia.

Need to calculate your bitcoin holdings? Check our tools section.

The post First Soros, Now Rockefellers Move into Cryptocurrency appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.