Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

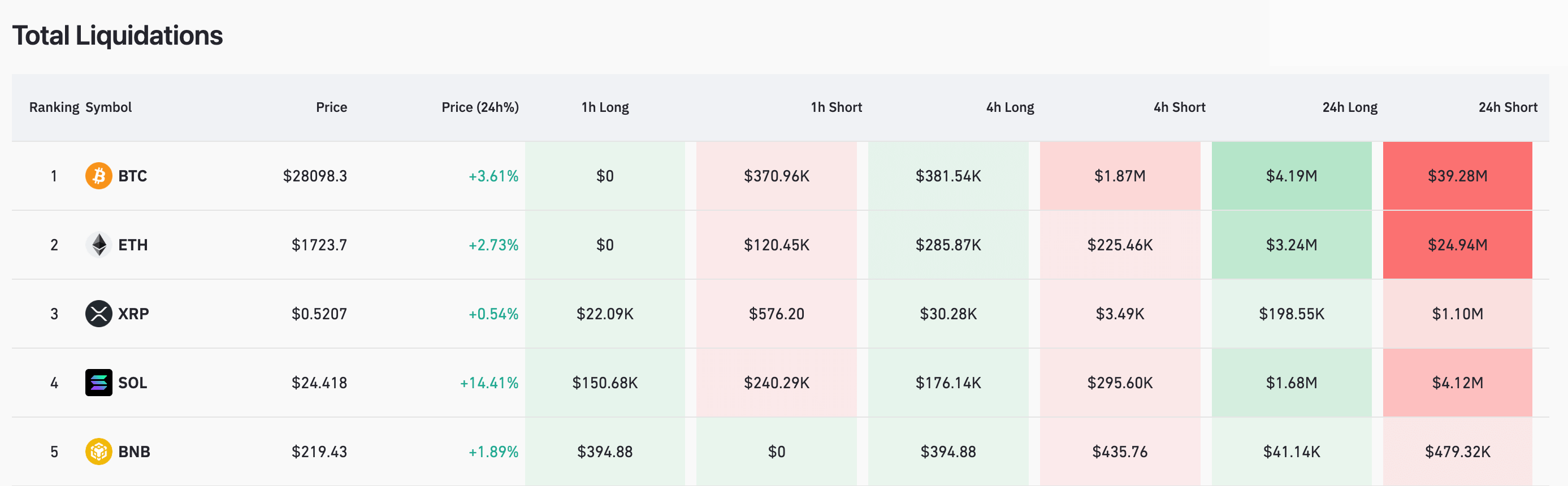

The crypto market witnessed a tumultuous 24 hours between Oct. 1 and 2, seeing a massive liquidation spike. Around 85% of these liquidations were short positions, translating to $97.73 million in shorts liquidated in just a day. This rapid movement affected 29,510 traders, bringing the total liquidation value to $114.92 million. The most significant single liquidation order was observed on Huobi with the BTC-USDT pair, valued at $8.39 million.

Major exchanges like OKX, Binance, and Huobi were at the epicenter of these liquidations. They recorded liquidation values of $36.21M, $33.20M, and $27.79M, respectively. CoinEx, mainly, experienced a notable 97.94% of its liquidations in short positions. In contrast, other exchanges oscillated between 72% and 96% in short liquidations.

| Exchanges | Liquidations | Long | Short | Rate (Overall) | Rate (Short) |

|---|---|---|---|---|---|

| All | $114.56M | $17.05M | $97.51M | 100% | 85.12% |

| OKX | $36.21M | $6.52M | $29.68M | 31.61% | 81.99% |

| Binance | $33.20M | $6.10M | $27.11M | 28.98% | 81.64% |

| Huobi | $27.79M | $1.04M | $26.75M | 24.26% | 96.26% |

| Bybit | $10.94M | $2.98M | $7.96M | 9.55% | 72.79% |

| CoinEx | $4.88M | $100.37K | $4.78M | 4.26% | 97.94% |

| Bitmex | $593.91K | $100.82K | $493.10K | 0.52% | 83.02% |

| Bitfinex | $581.34K | $146.79K | $434.56K | 0.51% | 74.75% |

| Deribit | $367.16K | $68.72K | $298.43K | 0.32% | 81.28% |

Zooming into individual cryptocurrencies, Bitcoin was at the forefront of the liquidation charts. Within a mere 4-hour window, Bitcoin saw long liquidations amounting to $381.54K and short liquidations reaching a significant $1.87M. Ethereum wasn’t far behind, with its 24-hour shorts touching a high of $4.12M.

Table showing the total crypto liquidations on Oct. 2, 2023 (Source: CoinGlass)

Liquidations refer to the compulsory closure of a trader’s position when market conditions move against their speculation, eroding the collateral they’ve posted. When trading any asset, including cryptocurrencies, traders can adopt two primary stances: ‘long’ or ‘short.’ In a long position, traders are essentially betting on an upward trajectory of an asset’s price. Conversely, a short position is taken with the expectation that the asset’s price will decline.

The mechanics of liquidation come into play when the market’s actual movement contradicts a trader’s position. For instance, if the market price rises when a trader has a short position or drops when they’re long, the position is liquidated to prevent further losses. This ensures the trader’s losses don’t exceed their initial margin or collateral. The dominance of short liquidations in the past 24 hours indicates that many traders had bet on Bitcoin’s price descending, only to be surprised by its climb to $28,000.

The surge in Bitcoin’s price can be attributed to several factors. After consolidating under $27,000 for over a month, Bitcoin broke the interim resistance, aiming for the $28,000 mark. The increased volatility and historical data suggesting bullish trends for Bitcoin in October and November have fueled optimism. The ongoing volatility is expected to remain elevated, potentially increasing the price.

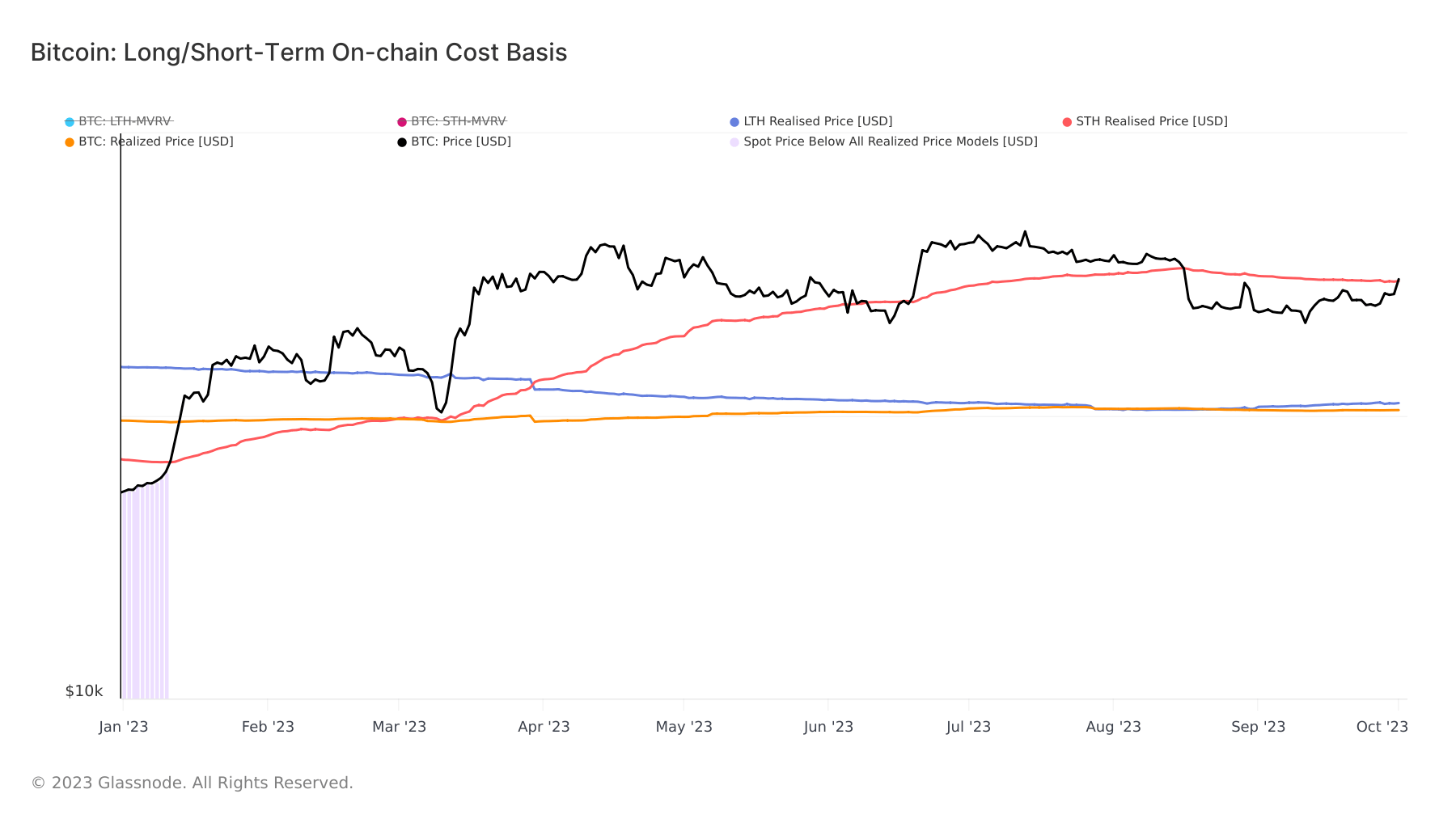

Another crucial metric in this narrative is the realized price. Bitcoin has now surpassed the realized price for short-term holders, which was pegged at $27,850 on Oct. 1. When Bitcoin’s price exceeds the short-term holder cost basis, the likelihood of these holders selling their assets to realize profits escalates.

Graph showing the on-chain cost basis for long-term holders and short-term Bitcoin holders in 2023 (Source: Glassnode)

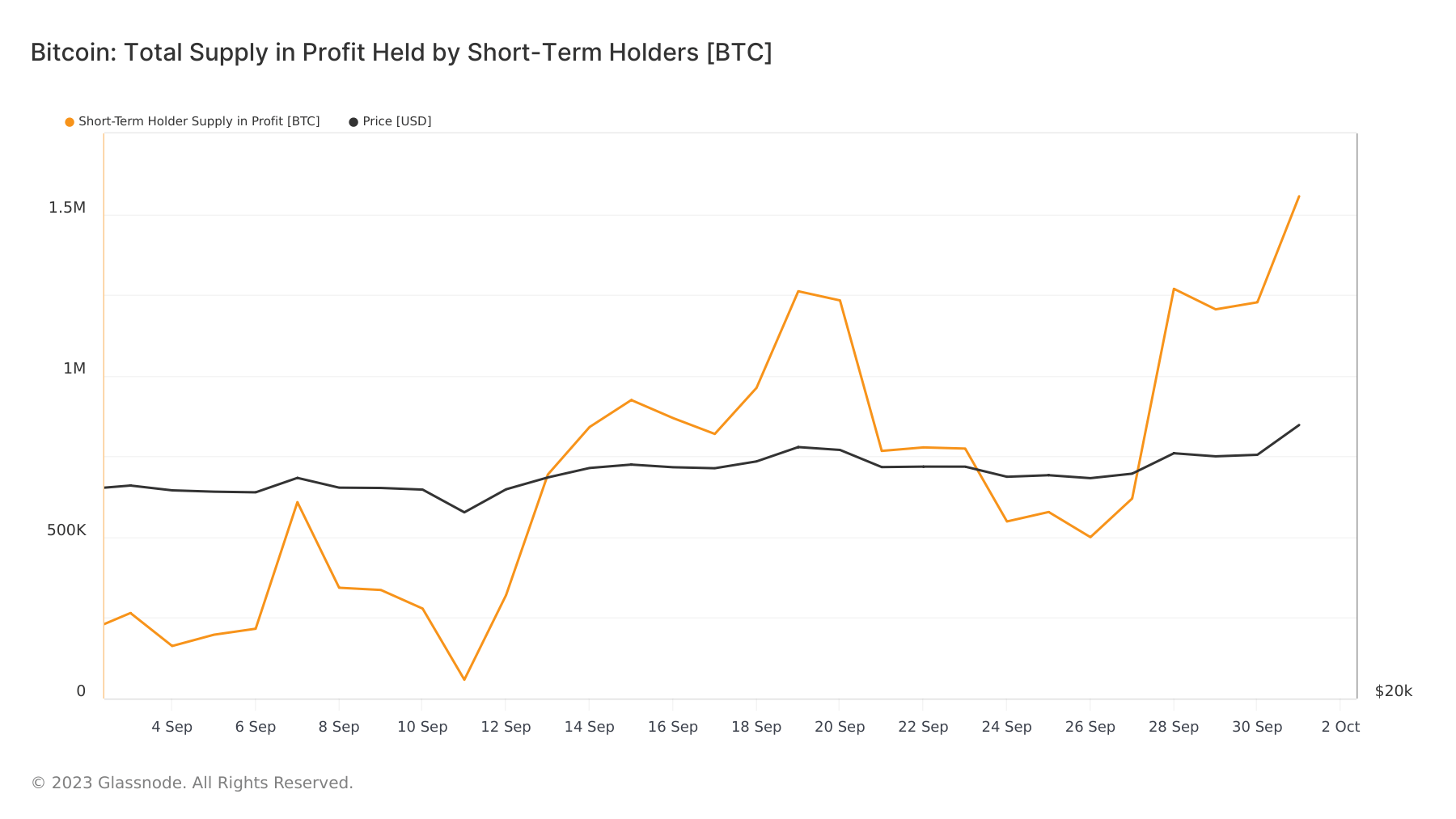

Data from Glassnode reinforces this, showing that the short-term holder supply in profit surged between Oct. 30 and Oct. 1, with approximately 331,450 BTC held by long-term holders currently in profit.

Graph showing short-term holder Bitcoin supply in profit from Sep. 2 to Oct. 2, 2023 (Source: Glassnode)

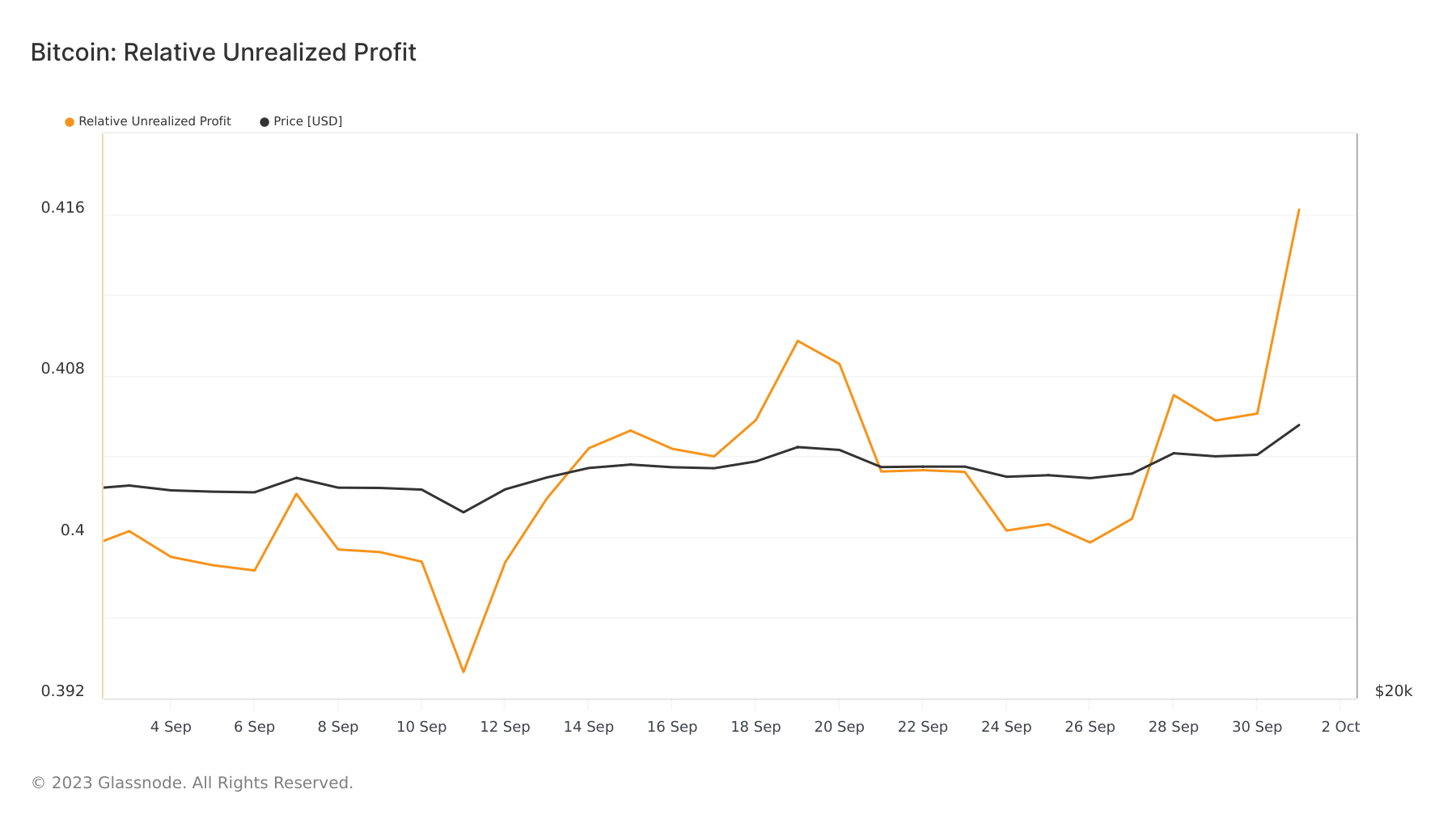

The recent liquidations and Bitcoin’s price movement suggest a bullish momentum. The market is witnessing a shift in sentiment, with traders becoming increasingly optimistic. However, it’s important to note that a rise in unrealized profits seen in the market creates a barrier to Bitcoin’s further growth. With an increasing number of market participants now sitting on unrealized gains, expectations of further volatility could push them to sell their positions, pushing prices down.

Graph showing Bitcoin’s relative unrealized profit from Sep. 2 to Oct. 2, 2023 (Source: Glassnode)

The post Bitcoin’s surge to $28k leads to $114M in liquidations in 24 hours appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.