Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

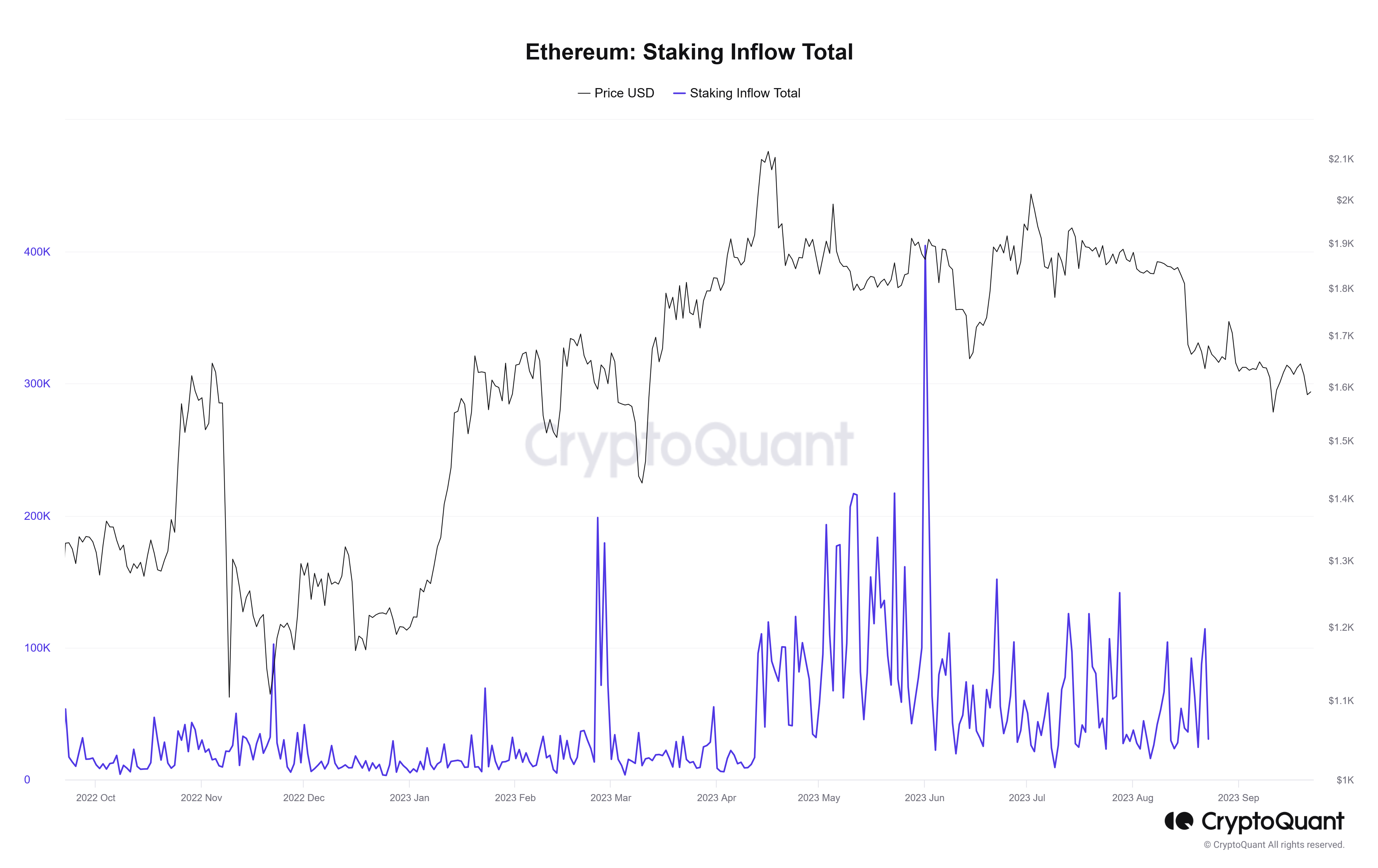

The number of Ethereum (ETH) holders choosing to stake, effectively locking their coins in the smart contracts platform, is falling. According to CryptoQuant data, as of August 23, the staking inflow total stood at 30,656, down from 404,704 registered on June 1.

Ethereum Staking Inflow Dropping, But There Are Over 813,000 Active Validators

The staking inflow total, which measures the number of unique addresses moving coins to the official Beacon Chain deposit address for staking purposes, rose steadily from around 5,952 on April 3 to 404,704 on June 1.

This spike was significantly buoyed, as data shows, with the activation of the Shapella upgrade on April 12. To illustrate, between April 12 and June 1, the staking inflow total rose from 16,736 to 404,704, a more than 25X increase.

The Shapella upgrade allowed Ethereum validators to withdraw their coins for the first time since they began locking in late December 2021. This update gave validators—tasked with validating transactions and keeping the network secure—an option to keep staking their coins or exit.

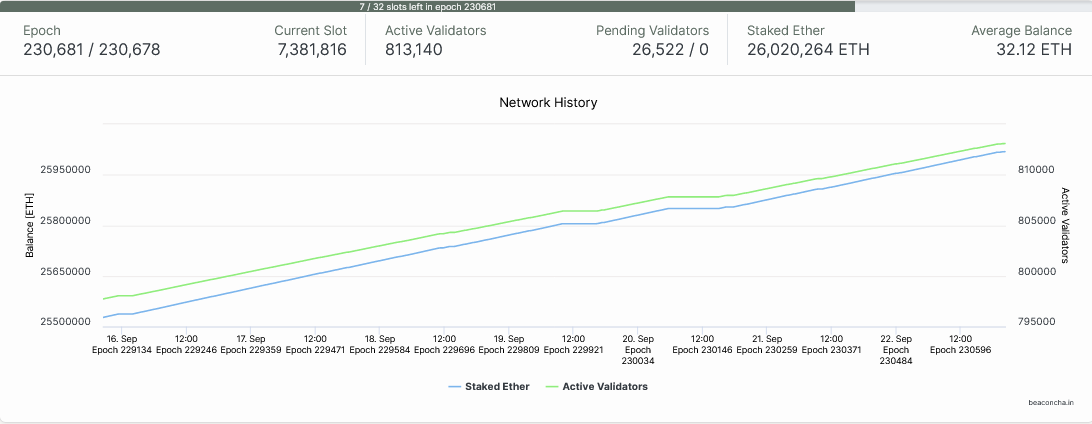

However, according to Dune Analytics, the number of validators rose from around 568,000 on April 12 to over 913,000 as of early September 2023.

In September 2022, Ethereum powered off the proof-of-work consensus protocol to validate transactions to a proof-of-stake consensus. Instead of miners, Ethereum now relies on validators. When writing, there are over 813,105 active validators who have, in total, locked over 26 million ETH.

Will This Make Ethereum Centralized?

The 92% contraction in staking count is concerning. However, it doesn’t necessarily mean the Ethereum network is now susceptible or flawed.

Specifically, while the metric tracks the number of ETH holders choosing to stake and earn rewards on Ethereum, the tracker doesn’t reveal the number of those who withdraw during this period.

A sharp increment in the number of ETH unlocked—as shown by the number of validators deactivating their nodes—or choosing not to validate transactions could cause worry. This might open the network to centralization concerns since liquidity-staking providers like Lido Finance are increasingly popular following the Shapella upgrade on April 12.

To quantify, Lido Finance, a dominant decentralized finance (DeFi) protocol with a total value locked (TVL) of over $13.9 billion when writing on September 22, channels hundreds of thousands, if not millions of ETH, from holders, allowing them to earn staking rewards.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.