Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In 2014, watchdog Transparency International reported that the biggest firms in the world fail to disclose their financial details concerning business operations overseas. Covering 124 companies, the report found that firms in the U.K. were among the most transparent businesses while Chinese firms and big U.S. tech companies were short on that aspect.

To cite an example, Facebook earlier faced public scrutiny and was slammed by lawmakers for failing to intervene in Russia’s influence — through massive advertisement placement purchases from the U.S. tech giant — in the 2016 U.S. elections.

Despite mounting pressure to reveal the number of ads Russia bought from them, the social media company refused to reveal the figures in public and only unveiled it in Congress. Facebook reasoned out that doing so would result to a breach of federal laws, but the company failed to cite the specific law they were pertaining to.

Startups work towards transparency through blockchain

In situations like these where transparency is demanded for the benefit of the public, Adam Ludwin, co-founder and chief executive officer of Chain, offered that blockchain plays a significant role.

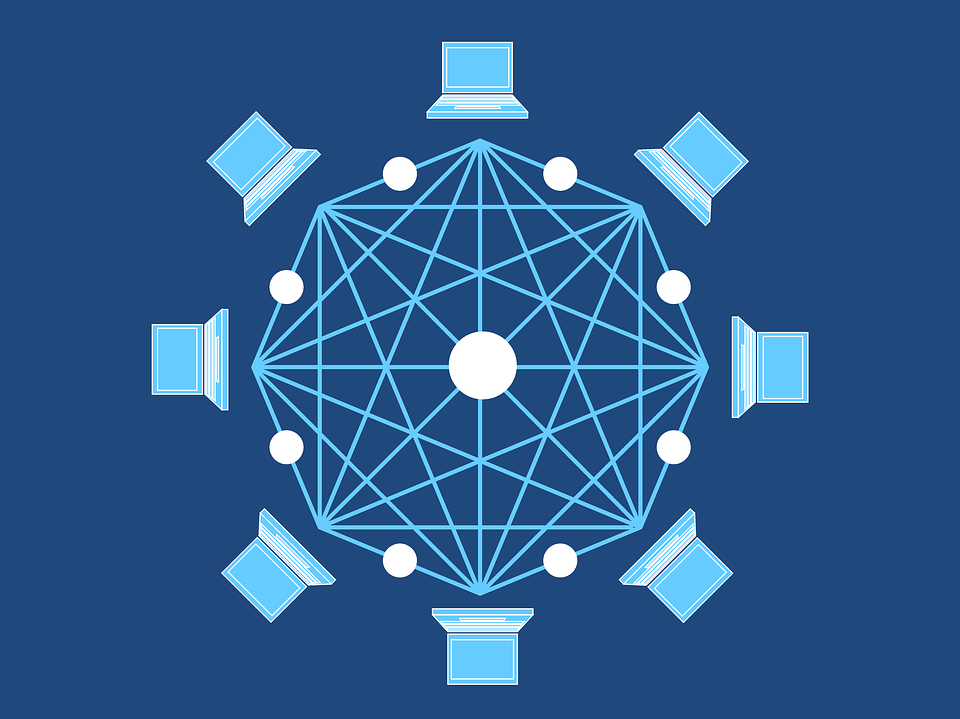

Blockchain is a public ledger that is designed to store information which cannot be altered without recording the changes made. It was popularized as a tool for crypto transactions but has since been used in several business pursuits to promote transparency.

“At the same time, the value that they see and gain from the technology is being able to cryptographically prove to third parties that they’re not manipulating data; no one in their company has manipulated any data — intentionally or accidentally; no hackers have changed any state,” Ludwin said in an interview with the Business Insider.

This is exactly the reason why a number of firms have emerged in the hopes of developing the technology to its maximum potential in several applications that are geared toward promoting transparency.

One of these is Nevada-based Filament, a blockchain startup that is making a change in the shipping industry. The firm has made a microchip that allows shipping containers to communicate and to complete transactions through a software called Blocklet. With this Blocklet microchip, shipping containers do not have to go through several regulatory approvals to get to its final destination. Not only does Blocklet make the process easier and faster, but it also shows the transactions made between retailers and consumers in full.

Meanwhile, an early stage firm has adopted blockchain to show how donations are impacting a homelessness charity. London-based social tech startup Alice uses blockchain to put donations on hold until the previously mapped out charity projects at St. Mungos are achieved. Founders of Alice said they hope its technology “will encourage more giving and support greater transparency in the third sector.”

More firms seek to join the fray

Undeniably, blockchain continues to disrupt several industries. But the financial sector, from which the technology was introduced, is now ever changed. Blockchain made it possible to improve transactions, in terms of transparency, through virtual currencies. As such, it also gave birth to the hundreds of cryptocurrencies now in the market.

But despite the presence of several dozens of new crypto coins in the market, only a small few, particularly those that aim to improve the transparency environment further, are meant to survive. Supporting this trend are digital currencies whose values are measured through commodity prices. Some believe that this system offers not just transparency when making transactions but also ease and less volatility.

One of its likes is Qu Ltd.’s Silverback initial coin offering that is redeemable for silver. This way, the value of these coins are not pegged by the erratic movement of cryptocurrencies. Instead, its value is based on current prices of silver.

The silver metal for the token will be acquired by Mansfield-Martin Exploration Mining, Inc. (OTCMKTS: MCPI) which agreed to supply up to 5 million oz. to support the new cryptocurrency. MCPI will receive the option to be paid in Silverback tokens or dollar.

Another example is the United Kingdom’s Royal Mint’s launch this year of its Royal Mint Gold. Basically, the idea is that one crypto coin represents 1 gram of gold. The firm said that the system offers transparency in a way that investors can monitor its RMG inventory and trade with real-time pricing.

Undeniably, the technology is providing businesses, especially the financial sector today the opportunity to provide transparency in ways never done before during trading and other transactions. Without a doubt, it will be a matter of only a few years before the technology permeates into our everyday lives.

Is blockchain the key to a transparent business? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.