Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Earlier this year, the market saw an unprecedented uptake of Ordinals and its associated Inscriptions. Ordinals serve as a unique numbering scheme for satoshis, allowing users to track and transfer individual sats. Inscriptions are a form of NFTs on Bitcoin’s network, enabling users to etch their messages on the Bitcoin blockchain. The introduction of the Ordinals theory marked a significant milestone, heralding Bitcoin’s foray into the NFT space.

When the popularity of Ordinals and Inscriptions surged, some market observers speculated that it was a fad. However, recent on-chain data suggests otherwise. The demand for Ordinals remains robust, and the Inscriptions phenomenon might not be waning for a while.

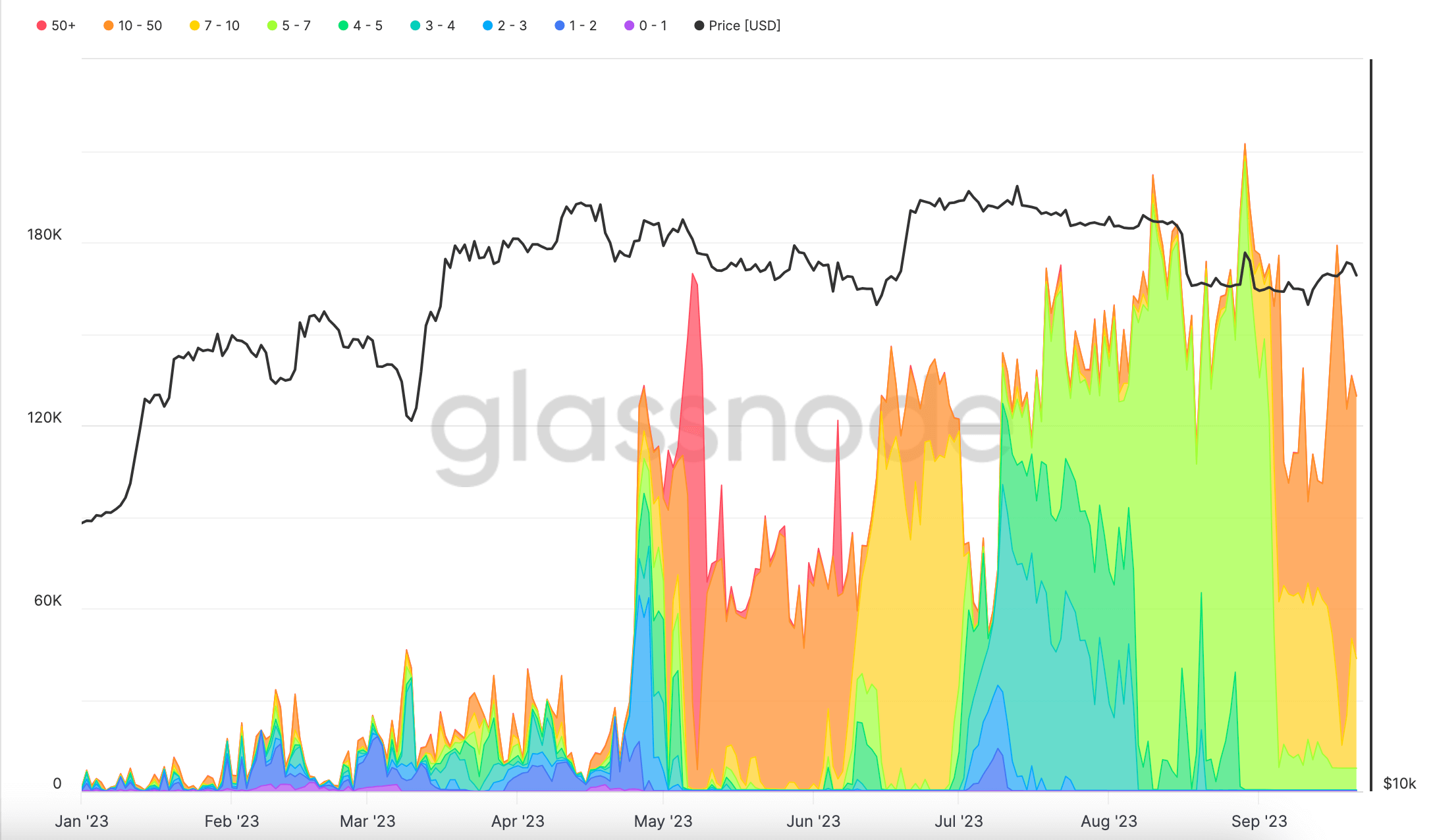

The Bitcoin mempool, a holding area for unconfirmed transactions, is a critical metric to gauge this demand. An overflowing mempool indicates a high volume of pending transactions, often leading to increased transaction fees and congestion in the Bitcoin network. The mempool hasn’t cleared since April this year, indicating sustained activity and demand.

Graph showing the number of transactions waiting in the Bitcoin mempool by a relative fee in 2023 (Source: Glassnode)

This mempool congestion correlates with a surge in the count of new Inscriptions.

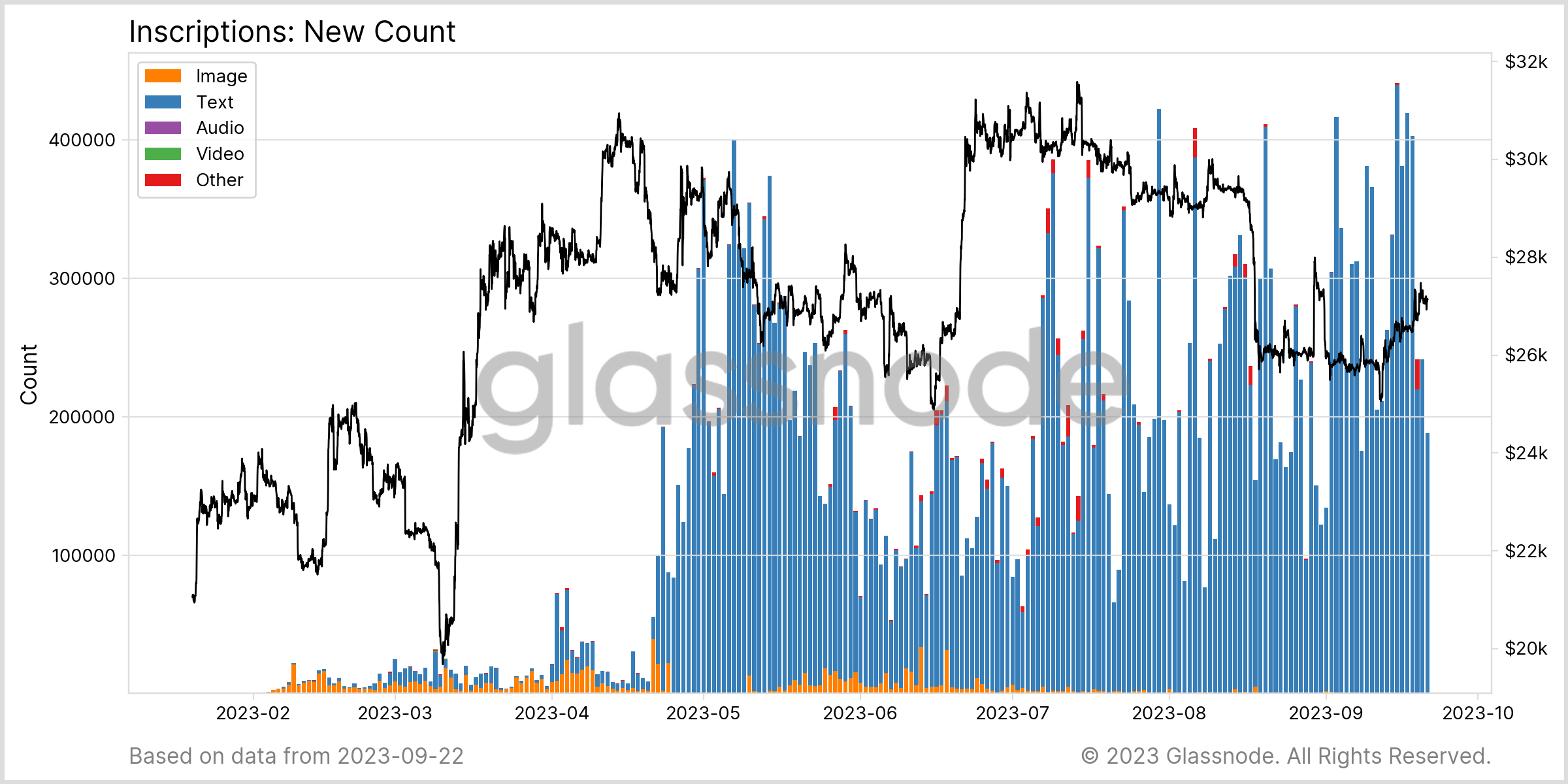

According to data from Glassnode, there was a notable increase in the daily creation of new Inscriptions towards the end of April. By mid-May, 400,000 new Inscriptions were created in just one day. While a dip in June suggested a potential waning interest, the numbers bounced back. September ended with an all-time high of 450,000 new Inscriptions in a single day.

While the early days saw the dominance of image-based Inscriptions, text-based ones have now taken the lead.

Chart showing the number of new Inscriptions created daily in 2023 (Source: Glassnode)

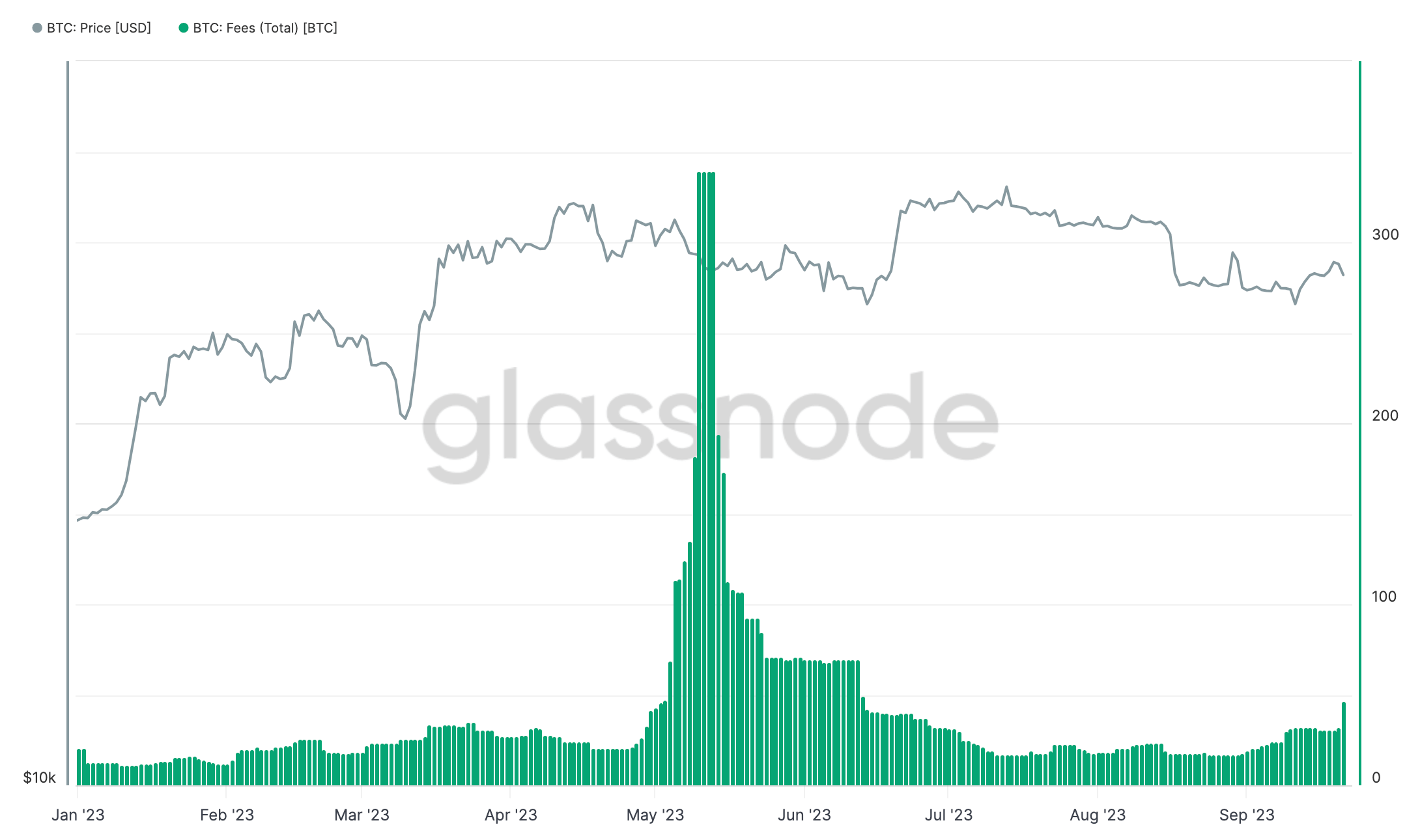

Bitcoin transaction fees spiked in May due to the surge in Inscriptions and the congested mempool. However, despite the continued demand for Ordinals, the fees have since stabilized. This stabilization suggests that the market has adjusted to the Inscriptions phenomenon, and the Bitcoin network has found equilibrium.

Graph showing the total amount of fees paid on the Bitcoin network in 2023 (Source: Glassnode)

The consistent demand for Inscriptions suggests they may have found a niche and a dedicated user base. Their impact on the Bitcoin network, especially transaction fees, and blockspace, cannot be ignored. While the initial surge might have caused some disruptions, the network’s ability to adapt and stabilize showcases its resilience.

The post Sustained Bitcoin mempool congestion shows unwavering demand for Ordinals Inscriptions appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.