Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Here’s, in numbers, how much transaction volume the Bitcoin network has handled in total during its entire history so far.

Bitcoin Total Cumulative Volume According To Three Different Models

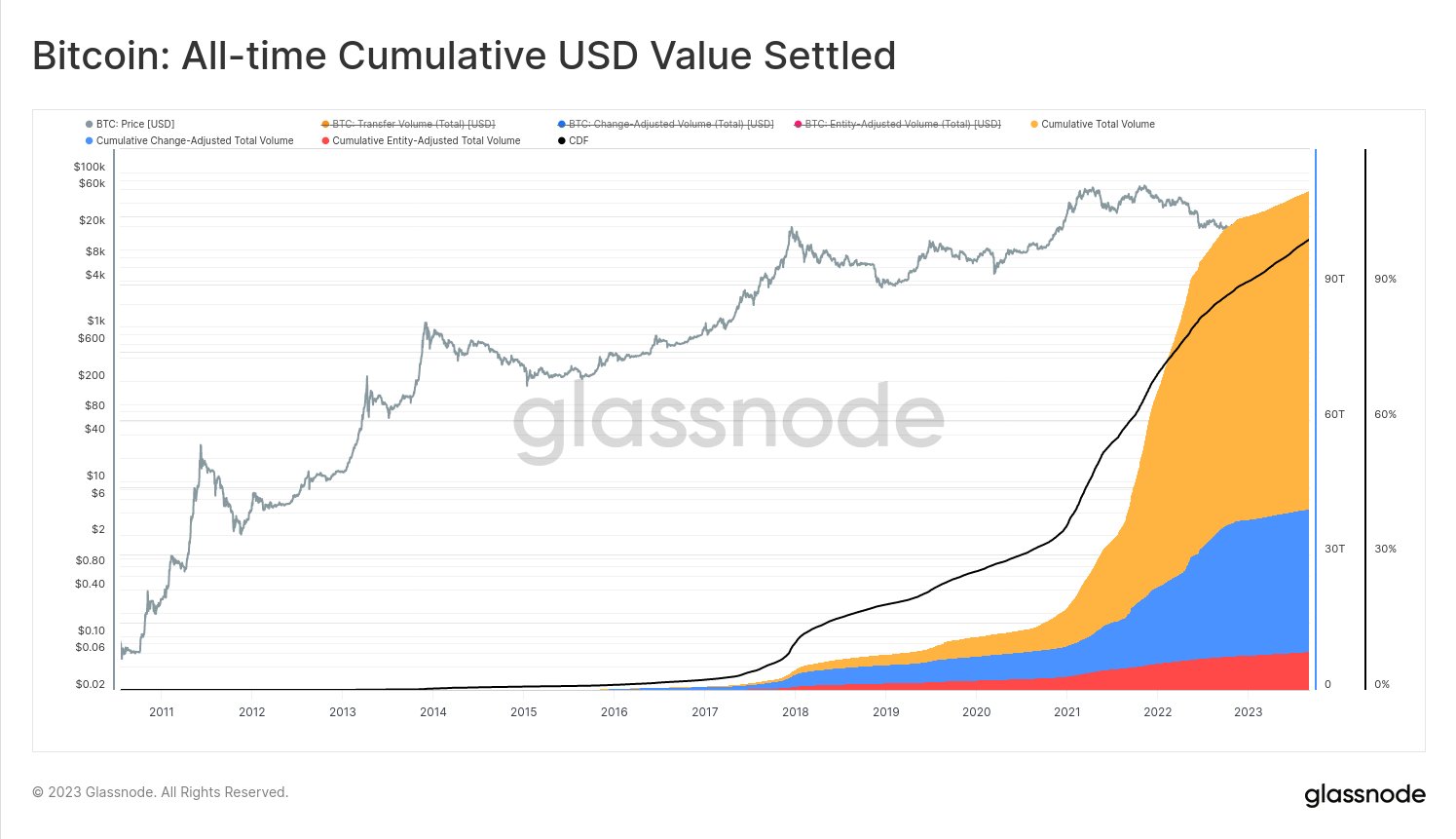

In a new post on X, the lead on-chain analyst at Glassnode, @_Checkmatey_, has shared a chart that assesses the total transaction volume that Bitcoin has processed in its lifetime using three different models.

The first model of interest here is the “cumulative total volume,” which keeps track of the raw amount of BTC transacted on the chain since the network first went online. This metric updates daily as new transaction activity occurs and the total volume increases.

However, some issues are involved with measuring just the raw volume, as not all movements happening on the blockchain are actually because of some meaningful activity.

Take the “change volume” as an example. Whenever a user makes a transaction from their wallet, the amount that initially moves across can be more than the sending amount entered by the user.

BTC transfers only occur regarding entire “unspent outputs” (essentially the leftover amounts from previous transactions). If the unspent outputs add up to more than the amount that has to be transferred to the other user, then a “change” has to be returned to the sender.

This is similar to how if you make a $98 purchase with a $100 bill, you will get back $2 in change. This return transfer of the change is not any real meaningful transaction.

The “change-adjusted total volume” metric removes such transfers from the total volume, thus providing a more accurate picture of the network. Here is a chart that shows the trend in both the raw cumulative volume data and this metric over the history of Bitcoin:

The raw volume handled on the network so far measures about $110.8 trillion, while the change-adjusted value of the metric comes to about $40.2 trillion. There is a pretty significant difference between the two.

Even the change-adjusted volume, however, may not be entirely accurate, as some transactions on the network count as real transactions but don’t involve a flow of coins that might be relevant to the broader market.

Examples of such transfers include internal exchange transfers and transactions between the addresses of the same investor. To filter out these irrelevant transfers, Glassnode uses the concept of “entities,” which are clusters of addresses the analytics firm has determined to belong to the same owner.

The third volume in the above graph (the red curve) displays the data of this “entity-adjusted” transaction volume. According to this model, Bitcoin has handled $8.6 trillion in transfer volume.

BTC Price

Bitcoin has registered only flat returns over the past week as the asset has continued to float around the $25,800 mark.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.