Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

So the doomsayers were right all along. Crypto was nothing but a bubble and it finally burst.

Good.

Maybe you’re surprised to hear that coming from me, someone who’s dedicated more than a few words to the power of crypto to change the world. Did I suddenly have a chance of heart? Did I jump on the Paul Krugman bandwagon and finally realize that Bitcoin is evil? Did I join the naysayers who laugh with glee every time the price drops and arrogantly shout that Bitcoin is going to zero?

Nope.

I say good because the circus has finally left town. The cameras have packed up and gone home. The reporters are losing interest. The story is finished.

And now the crypto community can get back to doing the hard work of building the future in peace and quiet.

I’ve always said the bubble would burst and in the long run it wouldn’t matter in the least. In retrospect I think Bitcoin getting to $20,000 so fast was the worst thing to ever happen to the community. For years, Bitcoin was nothing but Internet geek money and something to laugh at, but when Bitcoin’s price rocketed higher and higher, it suddenly became something else entirely:

A threat.

Bitcoin’s furious rise scared the hell out of banks and governments everywhere. Banks saw their business models crumbling as programmable money took the world by storm and governments feared they might lose their iron-fisted control of the money supply. Authoritarian regimes raced to crush it. Regulators came out in force. The press unleashed a torrent of articles filled with fear, uncertainty and doubt.

But now as Bitcoin’s price recedes the frenzy of ignorance and fear will die with it and the community can get back to work.

It’s hard to do your work under the eye of Sauron.

When centralized powers feel like they’re under attack they lash out in fear and rage. They respond with a hundred times the firepower. There’s no way to win that fight head on. In a stand up fight, firepower always wins.

But now Bitcoin doesn’t have to win. It can go back to flying under the radar, laughed at and mocked, nothing but a toy for nerds, its critics confident it’s going straight to zero.

The powers that be can rest easy. Just like the Neanderthals who once beat back a horde of invading Homo Sapiens in the Levant, they can cheer and feel safe again. They can sleep soundly in their caves, knowing the threat has passed. They can keep using their stone and wood tools and not worry about those strange iron tools the foreign invaders had with them.

Bitcoin has a huge opportunity. It lost the first battle but it survived. Now it can retreat and regroup.

Most importantly it can evolve.

There’s an old Chinese proverb:

韬光养晦.

Hide your light, nourish in darkness.

And Now for the Real Crash

Whether you know it or not, cryptos got a big, big break. Be grateful for the crash. Now the eye of Sauron will turn to new imaginary boogeymen.

It’s already started.

The real economy is teetering on the brink.

The DJI’s chart is starting to look exactly like Bitcoin’s right before it crashed hard.

Quick, which is Bitcoin and which is the DJI?

Quick, which is Bitcoin and which is the DJI?

The DJI faces whipsaw plunges and rises, the sign of a market in trouble.

A looming trade war threatens to throw the world into chaos. The tech companies that powered the modern economic miracle face a furious backlash with some people in power looking to break them. They imagine we can turn back the clock and return to a quieter, simpler age where everyone bought their books and batteries in small, local shops.

It won’t work. The cozy little neighborhood bookstore is gone forever because they’re already selling on Amazon and eBay and reaching a thousand times more customers. Even they don’t want to go back to waiting on foot traffic in the neighborhood while they desperately try to make rent.

You can’t fight the future.

During the Edo period of feudal Japan, the Shogun managed to keep guns off the island for a hundred years.

But eventually gun beats sword.

And things move much faster now. Evolution quickens with each revolution. The hunter gatherer period lasted for almost two million years, but the agricultural revolution lasted for only twelve thousand before the scientific revolution exploded onto the scene five hundred years ago and remade the very fabric of society once again.

Change is speeding up, not slowing down.

Any attempt to stop it is just stacking sandbags against a tsunami.

Return of the Sapiens

There’s a second part to the Neanderthal story, told beautifully in the epic history of humanity, Sapiens by Yuval Noah Harari.

After the Neanderthals beat back the invaders they seemed to have all the advantages. They were bigger and stronger, with larger brains. But something was wrong. They couldn’t change. Like all the other animals slithering, racing and flying through the savannas and skies their genetics dictated their entire range of behaviors.

They created stone and wooden tools but for millions of years those tools remained virtually the same. They didn’t get more complex. The Neanderthals didn’t combine them into new shapes or meld them with other more durable materials to create hybrids. In this way they were just like the apes. Apes form rigidly hierarchical societies around a dominant alpha male but their limited genetics meant they would never stage a democratic revolution and replace those alphas with a council of elders or the rule of law.

For awhile it was much the same for the Neanderthals’ distant cousins, the Sapiens. They seemed to repeat the same rigid patterns of behavior generation after generation, moving along a smoothly parallel track of evolution, hunting and gathering, happy in their simplicity.

But then something changed.

We don’t know exactly what but it was probably a random genetic mutation. Their code changed. And suddenly they were speaking differently, thinking differently, seeing differently.

They evolved.

And then one day the Sapiens returned.

They’d gained a sense of time. They could talk about the past and future. They could form advanced stratagems and communicate at a distance.

The Neanderthals didn’t stand a chance.

“If violence broke out between the two species, Neanderthals were not much better off than wild horses. Fifty Neanderthals cooperating in traditional and static patterns were no match for 500 versatile and innovative Sapiens. And even if the Sapiens lost the first round, they could quickly invent new stratagems that would enable them to win the next time.” 2001 A Space Odyssey

2001 A Space Odyssey

The new super Sapiens quickly overran them and in no time the Neanderthals were extinct.

The same fate awaits the institutions of today. They’re big and powerful and violent but they move in static patterns. They can’t or won’t evolve.

The strength of crypto is its immense versatility and with just a few genetic mutations crypto will change the face of money and power forever.

Evolution is the key.

But how? Evolve into what?

Let’s take a look at five essential changes that will make decentralized cryptos unstoppable.

The Five Keys to Crypto Evolution

The scaling problem in crypto is well known and engineers are already hard at work. We already know how to scale distributed, centralized systems. We’ve been working on that problem for decades, starting with data centers and moving to cloud infrastructures, but decentralized systems are still incredibly new and the subject of PhD level research.

If you think scaling boils down to big blocks alone then you haven’t looked deeply enough.

Traditional cloud systems scale linearly. If you add more servers, you add more capacity. A properly designed cloud system can continue to grow almost indefinitely as you plug systems into the fabric. Netflix continues to add capacity even as more and more people stream movies on a nightly basis.

It’s surprising to many newcomers in crypto that no matter how many servers you add you don’t get more capacity, you just get more security. That’s a problem but it’s already changing, as new architectures evolve. We want scalability and security.

Projects like Radix are looking to smash the scaling issue once and for all. Ethereum is already well down the rabbit hole of sharding, which can and should add tremendous capacity to the biggest decentralized app network on the planet. Even if neither of these approaches work, something will eventually. It’s only a matter of time.

When it comes to Bitcoin, scaling is already picking up speed. The Lightning Network is up and running in beta and growing by the day. I expect it to go full live by the summer time and it will permanently put to bed many of the problems of Bitcoin’s strangled capacity.

Some folks don’t think that Lightning Network will solve all the network’s challenges. That doesn’t matter much either. Again, even if the critics prove right and the LN doesn’t prove to be the end all be all, remember that we’re still in the early days of decentralized consensus technology. More and more ideas will continue to flow into the collective problem solving consciousness and somewhere out there is a kid with a whiteboard and a dream to solve it once and for all.

Scaling problems your days are numbered.

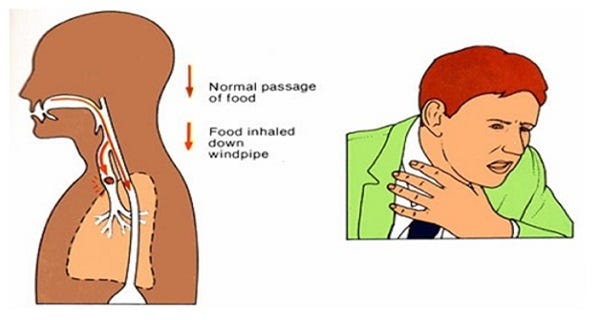

2) Eliminate Central Choke Points Choke points strangle innovation.

Choke points strangle innovation.

There are two major centralized choke points in crypto today:

- Exchanges

- Mining

Crypto architects need to work to destroy both of these paradigms as fast as possible.

ASIC mining is certainly more efficient than GPU mining but the critics are right that it still burns an absurd amount of energy. Even cryptos that focus on keeping mining totally decentralized still end up eating into the limited world energy capacity.

But that’s not the biggest problem with mining. Despite its environmentally destructive footprint there are thousands of worse energy drains in the world like cars and farming. Crypto can and will reduce the electric pull of their networks. And they better get to it soon because the worst part about big mining farms is they’re an easy and obvious target for central powers.

Up until now we haven’t seen many attempts to take out miners but as the ecosystem grows you can count on it. We’ve already seen attempts to register miners as well as the banning of large scale farms. Expect those attacks to step up in the future as central powers grow more paranoid and face more pressure from an economic downturn.

Exchanges are the second choke point. They’re a target for overly zealous and reactionary regulators and hackers. As the main bridge between the old financial system and the new they’ve grown in power but they’re incredibly vulnerable to legal and technological attacks.

We need decentralized exchanges now. But even decentralized exchanges are started by people and often need web infrastructure to run which makes them vulnerable as we saw with the Ether Delta hack. Even if you can’t hack the blockchain the exchanges are still dependent on fragile web technology that advanced persistent threats have hammered on for a decade, hoarding vulnerabilities that they never report. Web technology is a patchwork of secure and insecure frameworks and it’s nothing but a house of cards.

We have to move beyond web technology for good.

The answer is atomic swaps. We need a universal coin swap protocol.

After that trading coins becomes as simple as monitoring aggregated price streams and sending a transaction from your wallet. That will put an end to giant targets and centralized repositories of poorly secured personally identifying information that is easily hacked and lost.

Crypto is programmable money. We need to program every aspect of it to design away the Confused Deputy problem for good. Every action in today’s financial world from trading, to escrow, to inheritance of assets should happen right in the program itself without the need for “trusted” third parties.

3) Distribution

The biggest problem for crypto is one I’ve written about extensively in Why Everyone Missed the Most Mind-Blowing Feature of Cryptocurrency and Gamifying the Delivery of Money. Today’s cryptos missed a golden opportunity. They figured out how to print money without a central authority but they used the same old distribution method that we have today, top down.

The fastest and most liquid way to bootstrap a new economic ecosystem is to change the way we distribute money. Just like we get coins in video games for doing all kinds of actions we could be distributing coins at the moment of creation for chatting and posting stories and all the other things we love on social media.

For some reason every so often someone seems to think I’m talking about communism or air drops when I talk about gamified money.

Air drops don’t incentivize anyone to use the money or participate in the system. I have an airdrop of BAT and I haven’t given any to websites at all. The system is broken because there are no incentives for me to keep that money moving to websites for their content. I am not buying money to give away. But if I “won” money for doing every day things, that’s a different story.

As for communism, I hate it with a passion. It’s never worked and it never will. The only way it’s ever “worked” is by murdering tens of millions of people and even then it fails. It fails because it doesn’t account for the duality of man. We’re both selfish and selfless. Any system that addresses only one side of the coin is permanently broken.

Communism is redistributing money that people already have to other people and the insistence that everyone lives at the same economic strata. Gamifying the delivery of money is distributing the money at the point of creation to people instead of to banks and in no way does it imply a perfectly equal distribution or that people can’t start businesses, trade and do everything else to make more money.

We’re talking about programmable money delivered directly to people for beneficial actions on the network. That’s not a model that exists in history. It has no parallel. It’s never been tried anywhere, ever. It’s a revolutionary model that fits no previous idea.

Why do we want this?

Because if we can swiftly distribute money to a vast ecosystem of economic players we can bypass the fiat choke point for good. If we don’t need to keep going through the old system and converting the money to the new one everything changes.

Think about it.

Once people can live off crypto with no reason to touch the dirty paper of the old world we’ve got a totally new way of doing business that becomes quickly unstoppable.

Why?

Because dependencies create choke points.

Right now crypto is totally dependent on the current monetary system. If you still have to earn enough in fiat to buy a car, or you have to convert your crypto to fiat to buy that car you have a choke point.

But if you can earn enough through playing the economic game of life made literal with programmable coins then you can survive and thrive off crypto alone, which means all those choke points are rendered totally irrelevant.

If we don’t have to convert fiat to crypto we don’t have to play by the old rules at all. It will be a parallel economic operating system for the whole planet.

And that’s how money and people get truly free forever.

4) Killer App

So far we’ve only talked about infrastructure. Nobody buys infrastructure but today we have lots of projects out there hawking the equivalent of DNS and TCP/IP to the public. Get your domain registration here! How about a little packet switching for the misses?

Nobody cares about infrastructure. They care about the apps that run on top of that infrastructure. We need killer apps.

So what is the killer app?

I’ve given the world a number of ideas and lots of projects are out there working to make it a reality as we speak.

More and more I suspect it’s simply a new way to communicate.

Humans are special because we communicate and tell stories. We create imagined realities that we can all believe in so we can work towards a higher cause together. It’s no surprise that email, the browser and encrypted messaging are the killer platforms of the net. All of them are about creating and distributing information and communication. All of them are about stories.

Crypto needs its Netscape moment now.

Programmable money isn’t enough. We need the interface to that money.

As soon as regular folks have an amazingly beautiful application that’s functionally identical to the centralized apps they’re used to, while also delivering incredible new features they didn’t know they needed, it’s game over.

Regular folks don’t care about privacy and security until it’s ripped away from them by force in war or depression. Instead the killer crypto app will just have to gift them privacy and security without them even knowing it’s build right in.

5) Transcend the Net

Finally, once we’ve done all that, there’s on last step and this one may surprise you. Transcend the net.

Mesh networks are the future.

The Internet is increasingly dominated my uncaring central bandwidth providers that spent hundreds of millions of dollars to throttle competitor traffic so they can cram a shitty Netflix alternative they own down your throat. Authoritarian governments have warped the protocols of the web to turn it into a surveillance state. Democratic powers are not far behind and may even be more advanced by giving us the illusion of freedom while they slurp up every single thing we ever say or do on the web. We used to think that we were the customers of social media companies like Facebook but now we know we’re the product and the advertisers are the customers.

It will only get worse as AI supercharges surveillance.

Tomorrow’s communication platforms not only need robust end to end encryption with no possibility of backdoors, they need the power to leapfrog the net and leave it behind for good. That first step is to turn the Internet into nothing but a dumb packet shuttling layer that is blind to the encrypted apps that run on top of it. After that it’s time to transcend the net and move to meshes, pure peer to peer relay nets. They’ll keep us one step ahead of Big Brother’s dark eye.

The Battle for Tomorrow

Make no mistake, crypto is a battle for the future.

We’re at a crossroads in the history of the world.

The Arab Spring became the Arab Winter. Spies agencies everywhere proved that the government ignored the will of the people and build the Total Information Awareness program anyway. The Chinese are tightening the noose around their citizens every day with new and evil digital creations like the Social Credit Score.

They told us they were going to build it. Guess we should have believed them.

They told us they were going to build it. Guess we should have believed them.

Digital technology has the power to lock in open forever or it could turn into an invisible prison we can never escape.

As always there’s no fate but what we make for ourselves.

I once believed that the Internet would save us all, spreading openness and freedom like a wildfire, an unstoppable force for good. In many ways it is: Wikipedia is a continual miracle, as is telecommuting, and the ability to get anything and everything delivered right to our door in a few hours or a few days.

But bad guys get to use open platforms too and slowly but surely they’ve twisted it to their own dark designs.

In retrospect it’s no surprise. Central powers can’t resist expanding their power indefinitely.

It’s like the story from the Crying Game about the frog that agrees to carry a scorpion across the river, after the scorpion swears up and down it will never sting him. Half way across the water, the frog suddenly screams out in pain as the scorpion strikes.

“Why did you do that, Mr. Scorpion?” said the frog. “For now we both will drown.”

“I can’t help it,” hissed the Scorpion. “It’s in my nature.”

We can’t count on central powers to give back their unprecedented power to peer into everyone’s bedrooms and bathrooms, to stalk our friends and family and systematically study our web of relationships.

We have to decide for ourselves whether our digital footprints will become a weapon of control or a sword to cut the Gordian knot forever.

Nobody is coming to save us.

It’s up to us to take back tomorrow.

And that means if you’re reading this, you are the revolution.

###########################################

If you love my work please visit my Patreon page because that’s where I share special insights with all my fans. Top Patrons get EXCLUSIVE ACCESS to the legendary Coin Sheets Discord where you’ll find:

- Market calls from me and other pro technical analysis masters.

- Access to the Coin’bassaders only private chat.

- Behind the scenes look at how I and other pros interpret the market.

- You also get exclusive access to a monthly virtual meet up with me, where I’ll share everything I’m working on and give you a behind the scenes look at my process.

- I’ll follow each talk with a Q&A session. Ask me anything and I just might answer.

############################################

You can also stop by DecStack, the Virtual Co-Working Spot for CryptoCurrency and Decentralized App Projects, where you can rub elbows with multiple projects. It’s totally free forever. Just come on in and socialize, work together, share code and ideas. Make your ideas better through feedback. Find new friends. Meet your new family.

############################################

A bit about me: I’m an author, engineer and serial entrepreneur. During the last two decades, I’ve covered a broad range of tech from Linux to virtualization and containers.

You can check out my latest novel, an epic Chinese sci-fi civil war saga where China throws off the chains of communism and becomes the world’s first direct democracy, running a highly advanced, artificially intelligent decentralized app platform with no leaders.

You can get a FREE copy of my first novel, The Scorpion Game, when you join my Readers Group. Readers have called it “the first serious competition to Neuromancer” and “Detective noir meets Johnny Mnemonic.”

############################################

Lastly, you can join my private Facebook group, the Nanopunk Posthuman Assassins, where we discuss all things tech, sci-fi, fantasy and more.

############################################

The Five Keys to Crypto Evolution was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.