Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

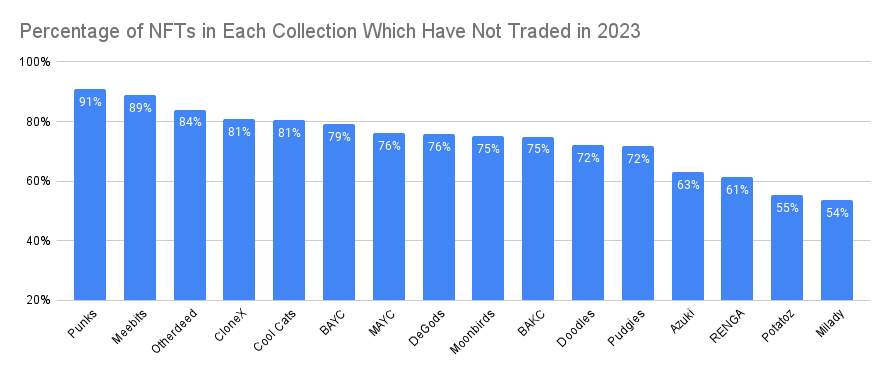

Despite the sharp contraction in the non-fungible token (NFT) market, CryptoPunks, Otherdeed, and Meebits owners are holding on to their assets. Data shared on August 23 shows that over 75% of major collections have not been traded, with an astounding 91% of all CryptoPunks not changing hands over the past eight months.

Meanwhile, 89% and 84% of Meebits and Otherdeed NFTs have not changed hands despite the cool-off in crypto asset prices and floor prices of leading collections.

CryptoPunks, Otherdeed Holders Not Selling In 2023

After crypto prices peaked in late 2021, the floor prices of top collections rose to record highs from late 2021 to early 2022. At one point, for instance, CryptoPunk #8857 sold for 2,000 ETH, which was worth $6.63 million as of September 2021.

Meanwhile, CryptoPunk #5822 was sold for 8,000 ETH or $23 million in February 2022. During this time, Beeple’s Everydays: The First 5000 Days was sold for $69.3 million and remained the most expensive NFT. The founder of BitAccess, Vignesh Sundaresan bought the art.

While the price of blue chip NFTs remains relatively high even at spot rates, associated trading volumes continue to be suppressed. The drop in Bitcoin and Ethereum prices from record highs negatively impacted trading volumes and activity.

However, despite the over 90% drop in volumes, owners of CryptoPunks, a blue chip NFT collection, are not letting go of their limited assets in 2023.

NFT Activity Suppressed

Data from Dune, a blockchain analysis platform, shows that the number of unique Ethereum NFT transfers peaked in July 2022 at over 1.3 million before crashing to around 180,000 in late July 2023.

At the same time, the number of unique weekly transfers of major collections, including Punks and BAYC, pales compared to those registered in early 2022. These transfers, on-chain data reveals, are down by over 90%.

The rapid drop in transfers is in tandem with general trader interest. Data indicates a significant decrease in trading activity in recent months. On July 31, 115 buyers and 88 sellers were compared to August 8, 2022, with 98,345 buyers and 112,037 sellers. However, holders of blue chip NFTs seem to be holding onto their assets.

It is not immediately clear what could be the motivator. However, what’s evident is that Punks, BAYC, or MAYC holders can access NFT-backed loans on platforms such as Blur and Binance.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.