Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin experienced a significant dip last week, losing over 9% in 24 hours and dropping to $26,299 on Aug. 18. Its price plunged even further during the weekend, settling at $26,198 on Aug. 20.

A massive exodus of leverage from the derivatives market primarily triggered this abrupt decline. As leverage was flushed out, the spot market quickly followed suit, exerting even more downward pressure on Bitcoin’s price.

And while Bitcoin’s price currently stands above the $26,000 level, its stability above this threshold is under question. There’s an underlying concern that if short-term holders start offloading their holdings driven by panic, the price could drop even further.

Short-term holders are entities that have held onto their Bitcoin for less than 155 days. As newcomers to the market, they are typically more reactive to price fluctuations, often making trading decisions based on short-term market dynamics rather than long-term potential.

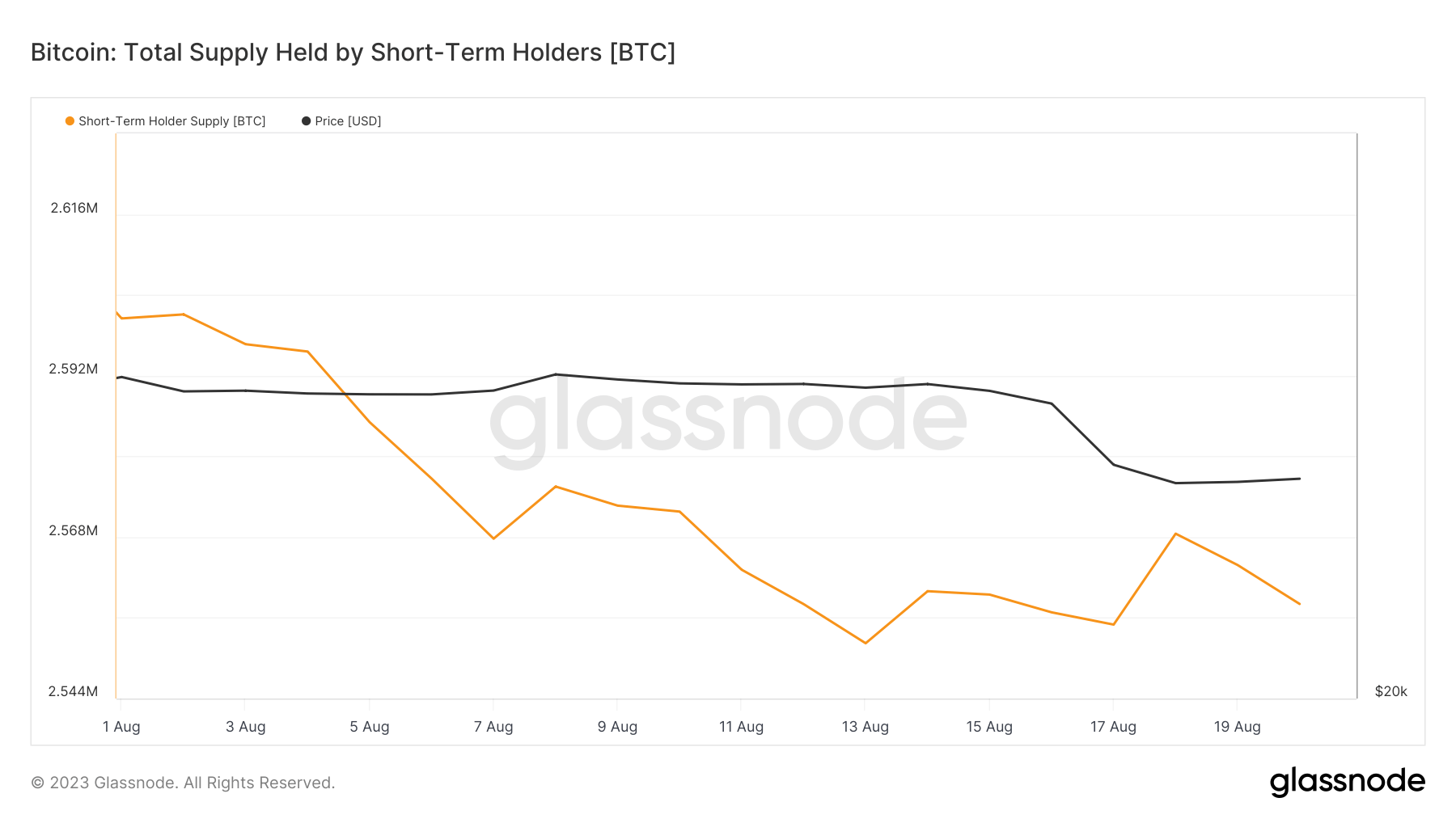

As Bitcoin’s price took a nosedive, the portion of its supply held by short-term holders remained relatively stable. However, their unrealized losses saw a significant surge.

Graph showing Bitcoin supply held by short-term holders in August 2023 (Source: Glassnode)

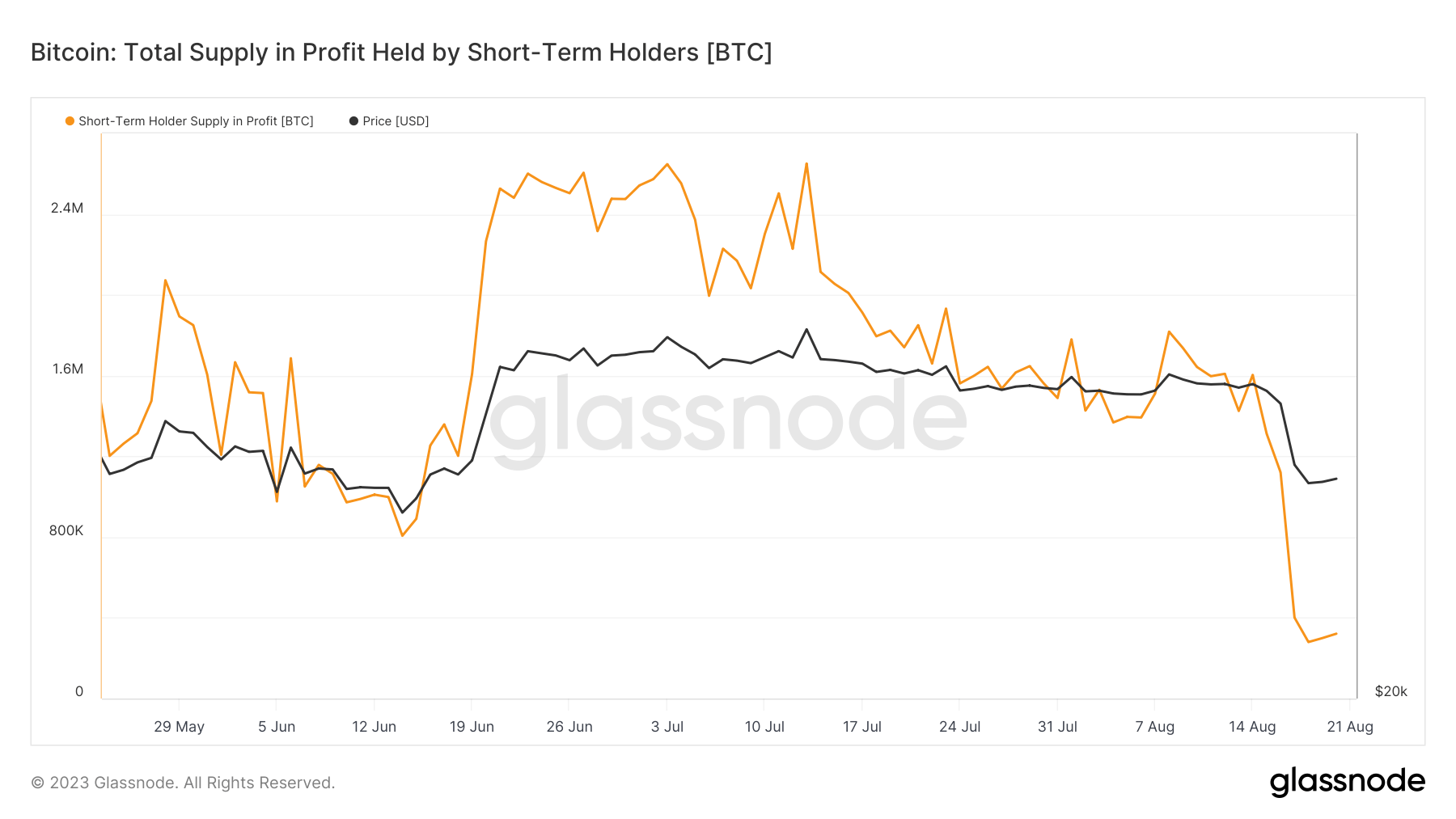

Data from Glassnode showed a near-vertical drop in the percentage of short-term holder supply in profit. On Aug. 14, this figure stood at 2.56 million BTC. A week later, on Aug. 21, it stood at 321,238 BTC. This represents a slight increase from the 8-month low recorded on Aug. 18, when the short-term holder supply in profit dropped to 279,907 BTC — an 82% drop from Aug .14.

Graph showing short-term holder supply in profit from May 21 to Aug. 21, 2023 (Source: Glassnode)

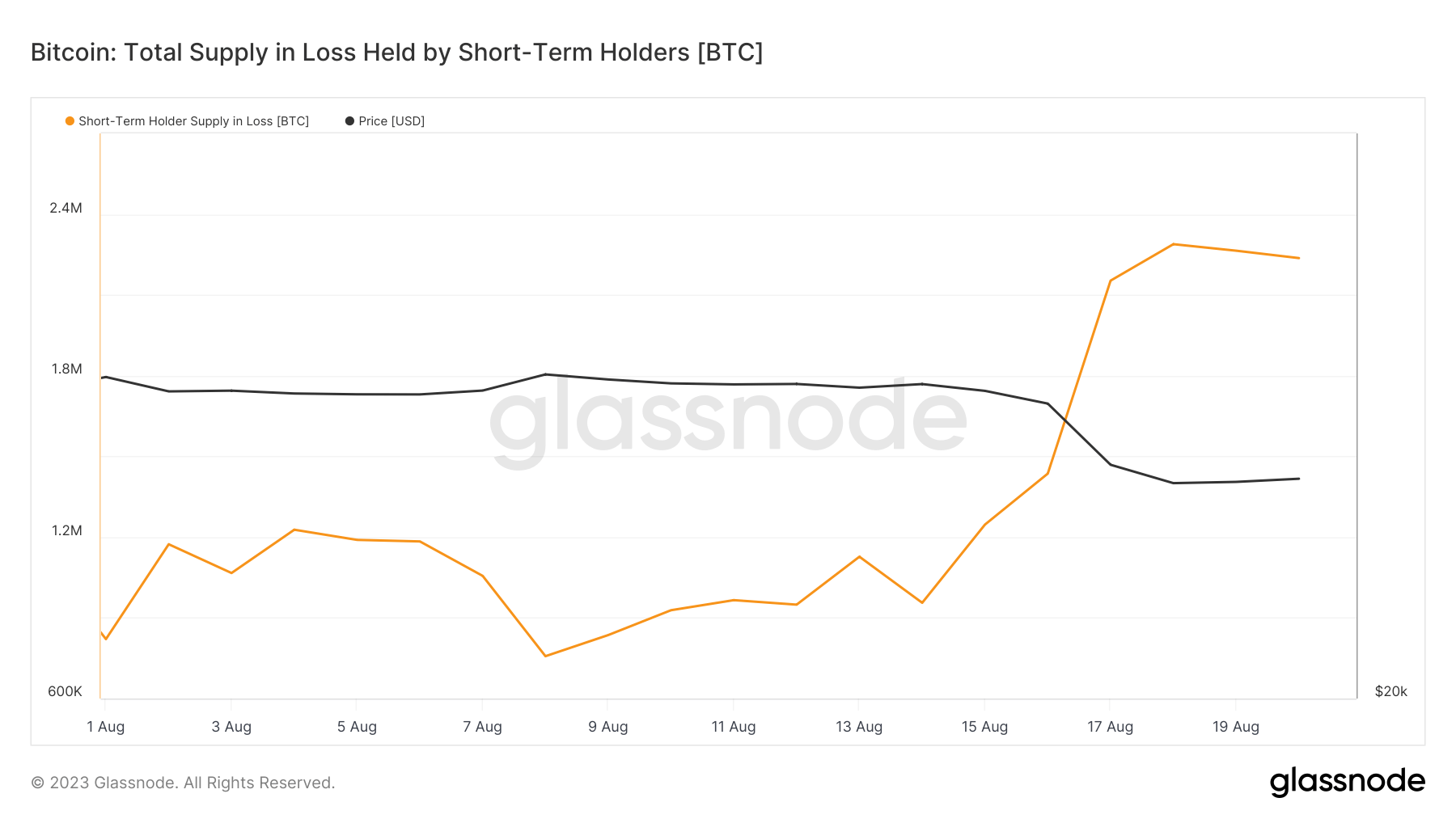

Short-term holders are currently sitting on approximately 1.28 million BTC at a loss. If Bitcoin’s price trajectory continues on this volatile course, there’s a looming risk that a sizeable portion of this BTC could flood exchanges. This could create immense selling pressure, potentially triggering further price cascades.

Graph showing short-term supply at loss in August 2023 (Source: Glassnode)

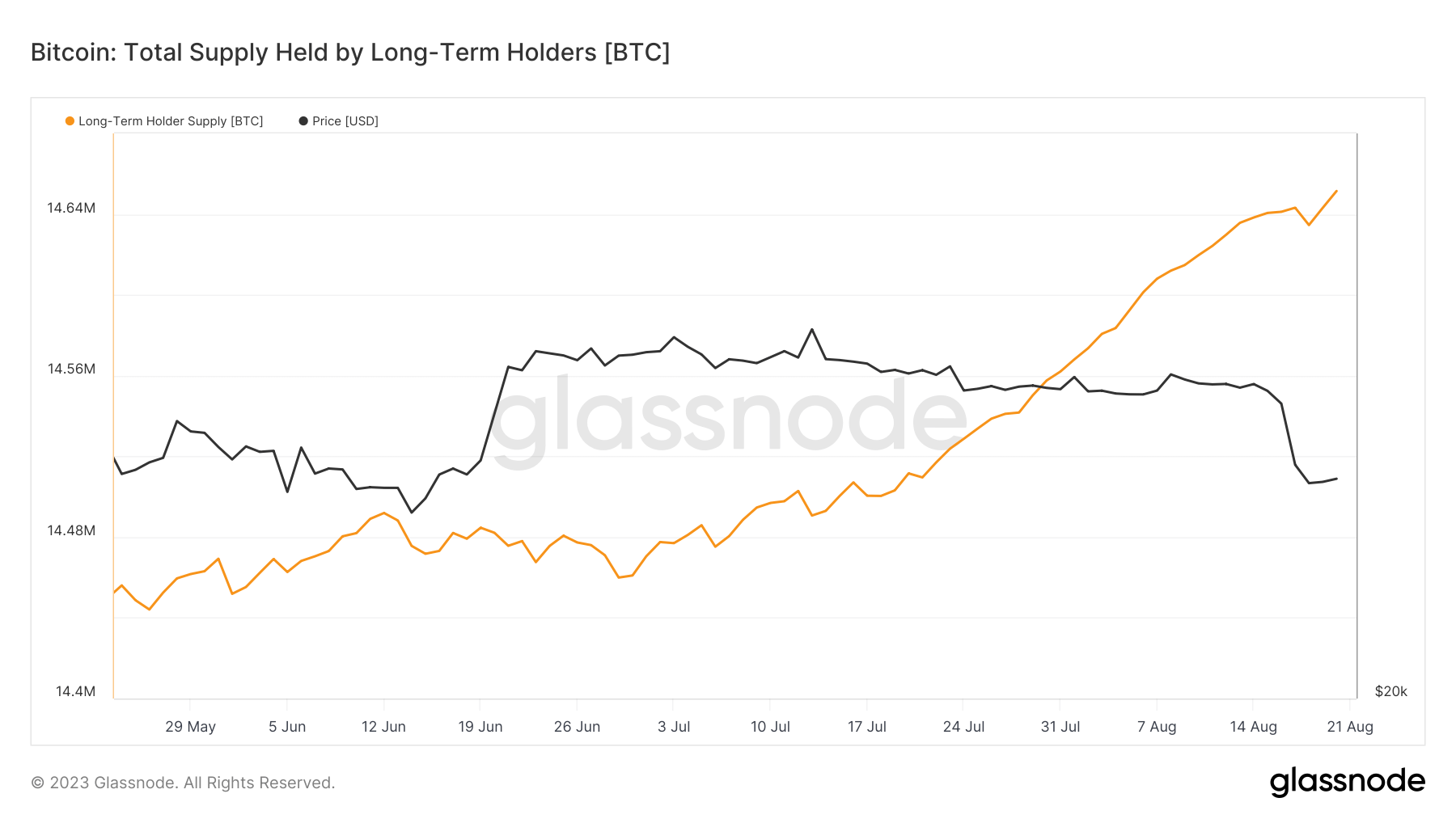

The market currently sits at a critical juncture, as the actions of short-term holders in the coming days could significantly influence Bitcoin’s price direction. Historically, long-term holders have absorbed most of the coins distributed by short-term holders, quickly re-establishing equilibrium on the market. However, long-term holders have been increasing their supply, and there’s a possibility that they could lack the liquidity necessary to stop further price drops.

Graph showing Bitcoin supply held by long-term holders from May 21 to Aug. 21, 2023 (Source: Glassnode)

The post Short-term holders are sitting on 1.3M BTC at a loss appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.