Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Chris Keshian, Managing Partner and CEO of Apex Token Fund

Coin Central’s Steven Buchko recently had the opportunity to talk to Chris Keshian, Managing Partner and CEO of Apex Token Fund, about his new tokenized “fund of funds.” With this unique type of asset, Keshian and his team want to inject liquidity into the crypto hedge fund market while making them more accessible to smaller investors.

If you’re interested in learning more, check out the Apex Token Fund official website.

The Interview

SB: Before we get into Apex, how did you first get involved with cryptocurrency?

CK: I got involved about five years ago – there was just the Bitcoin community at that time. And, I built one of the first fiat gateways onto Ethereum back in 2014. I’ve worked in various areas throughout the space, consulting for larger companies on blockchain applications and actively trading crypto assets throughout that whole time.

I launched Neural Capital, a long-short hedge fund based in San Francisco about a year and a half ago, and I’ve been growing that steadily ever since. More recently, I launched Apex Token Fund, which is the first tokenized crypto fund of funds.

SB: Would you mind elaborating on that – how does Apex work?

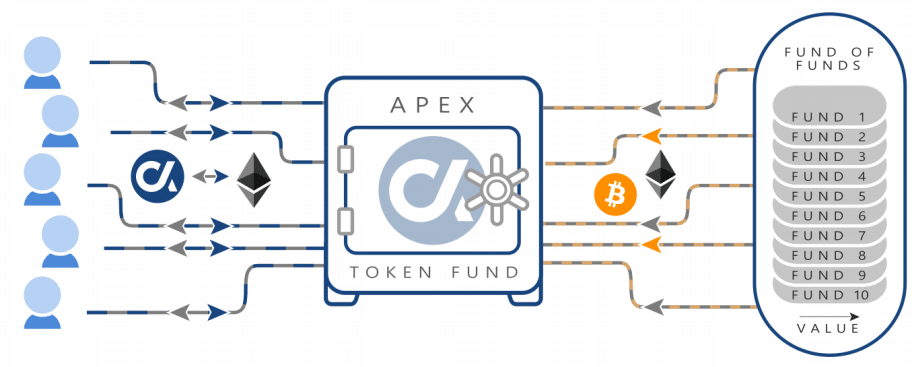

CK: A fund of funds, in the traditional sense, is a master fund that’s invested across different underlying portfolio funds rather than the asset itself. In our instance, the Apex Token Master Fund is invested across ten of the top performing crypto asset hedge funds.

For the tokenized component, rather than raising capital through investors joining the Master Fund, we’re selling off Apex Tokens which represent fractional shares of it. Apex tokens are an indirect representation of ownership in the Master Fund and that Master Fund is then invested across ten of the top performing crypto hedge funds.

There are some unique advantages to this structure. One, Apex Tokens are freely tradable, meaning that you could trade your shares in the fund when it launches. There’s no lockup period. This is different from traditional funds where there’s usually a year-long lockup period, at least, on capital that’s invested.

The other benefit is we can democratize access to these hedge funds. For the most part, hedge funds have a high minimum requirement, at least a million dollars, which precludes most of the average investors from participating in these funds. For us, you can have multiple shares in the hedge fund and include a bunch of smaller investors.

SB: How do you choose which funds are included in the Master Fund?

CK: We look at performance, founder-market fit, their involvement in the space, and their strategy for investing in crypto assets – all of those features. Because we run a fund in the space, we know what to look for and how to vet funds.

We also helped launch Protocol Ventures, the first fund of funds in the space. It’s not tokenized, but we’re advisors to them. So, we’ve already done this successfully with one fund of funds and have vetted all these hedge funds individually.

SB: We’re currently in a fairly bad bear market. How do you hedge in times like this when the market turns south?

CK: All of our hedge funds individually have their own strategies for hedging against that. It differs depending on the strategy, but it makes for a compelling case to use Apex in this instance.

Any investor who wants exposure to this asset class is not going to be actively trading, and they aren’t taking short positions in the space. They probably don’t have the technical expertise or the capacity to do that.

The alternative to just buying and holding crypto yourself is to invest in something like Apex where you’re just holding one token, but that token gives you exposure to actively traded funds. Each of these individual funds is shorting, doing arbitrage strategies, or similar things that still make money in a bear market. It’s this exposure that makes a compelling case to use Apex when we’re in a bear market.

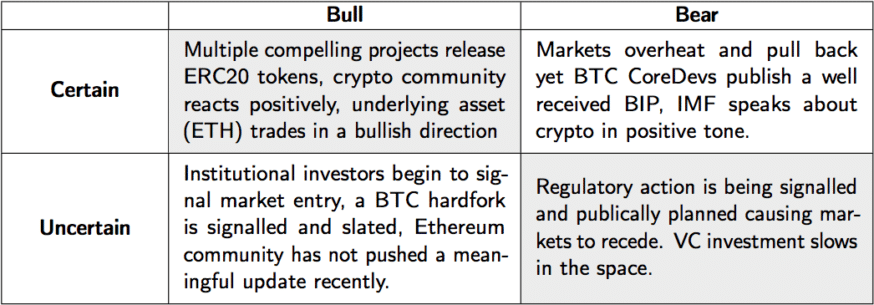

SB: I saw in the Apex white paper that you have the four quadrants strategy for certain and uncertain as well as bull and bear markets. What are the advantages of separating the strategy into those four types of market conditions?

CK: That’s what we’ve observed by watching the space over the last five years – those four market conditions. They pretty much cover any potential conditions in the space.

We have exposure to strategies that perform well regardless of which of those market conditions we’re in. However, some are going to perform better than others. For us, it’s a comprehensive review of how the market may behave in the next two to three years – the lifecycle of the fund.

SB: Tokenizing the fund has its advantages, like you said, in adding liquidity and democratizing investing. But, what are the downsides, if any, to that?

CK: There aren’t really any downsides. We’ll release the quarterly updates on the token values. The token is always fully collateralized by investments in underlying portfolio funds, so the token always has true value.

In between those quarterly reports, the token could trade up or down depending on how people are viewing the space and their outlook on the crypto market. But, that doesn’t matter ultimately because the token is redeemable when we wind down the fund for the commensurate value of the underlying investments. So, the payout at the end to the token holders will always be the same, but the token trading in between those quarterly statements could go up or down.

I don’t necessarily think that’s a bad thing; it’s just a different aspect.

SB: The SEC is coming out with more information each day on how they’re classifying tokens, but they haven’t made much action yet. Is that something that will affect Apex?

CK: It will affect the underlying portfolio funds. There’s not a lot to comment on that in terms of this structure.

We decided to work with DLA Piper Global Law Firm, one of the top five global legal firms. And, we’re offering this in a manner that’s fully compliant globally with securities laws on a jurisdiction by jurisdiction basis. As far as the SEC becoming involved in the space, I don’t think it will directly affect this project substantially.

SB: What’s on the roadmap for Apex in 2018?

CK: We’ve finished our public and private presales. Our next sale is going to be on May 1st. That’s the final public sale. Anyone can visit our website to find out more information about that too.

SB: And the fund starts investing after that sale?

CK: The funds are deployed after that and the tokens will be tradable starting June 1st.

SB: Is there anything else that you’d like our readers to know?

CK: If there are any further questions readers may have, we encourage them to join and ask in our Telegram channel. I appreciate you taking time to speak with me.

Thank You

Thank you, Chris, for taking time out of your busy schedule to speak with us. It’s always great to learn about projects that make cryptocurrency more accessible to the average investor. We look forward to tracking your fund once it’s launched.

If you’re interested in participating in the final Apex Token Fund sale, you can sign up here.

The post Apex Token Fund’s Chris Keshian is Bringing Crypto Hedge Funds to the Average Investor appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.