Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

One of the main goals of blockchain technology and cryptocurrencies has been to bank the unbanked. This entails creating alternative financial mechanisms that allow everyone to have access to the financial safety and potential financial opportunities that accompany being able to safely store money and lend/borrow from others. Projects such as ETHLend tackle the latter, and provide decentralized peer-to-peer lending platforms in which anyone can act as a lender or borrower.

Overall, the ETHLend project is ran by a very capable team with a history of consistently meeting their goals, and is poised to become a leader in the decentralized lending industry with over 6,000 ETH in volume already. They have had a functioning dApp since Q2, before they even conducted their ICO, and continue to improve its user experience and add new features to their lending platform. Beyond basic peer-to-peer lending, they aim to add advanced features such as on-demand lending, crowd lending, and decentralized credit scoring in the near future. These new features, combined with the improvements to their platform’s user interface and experience, make ETHLend the premier platform for decentralized peer-to-peer lending.

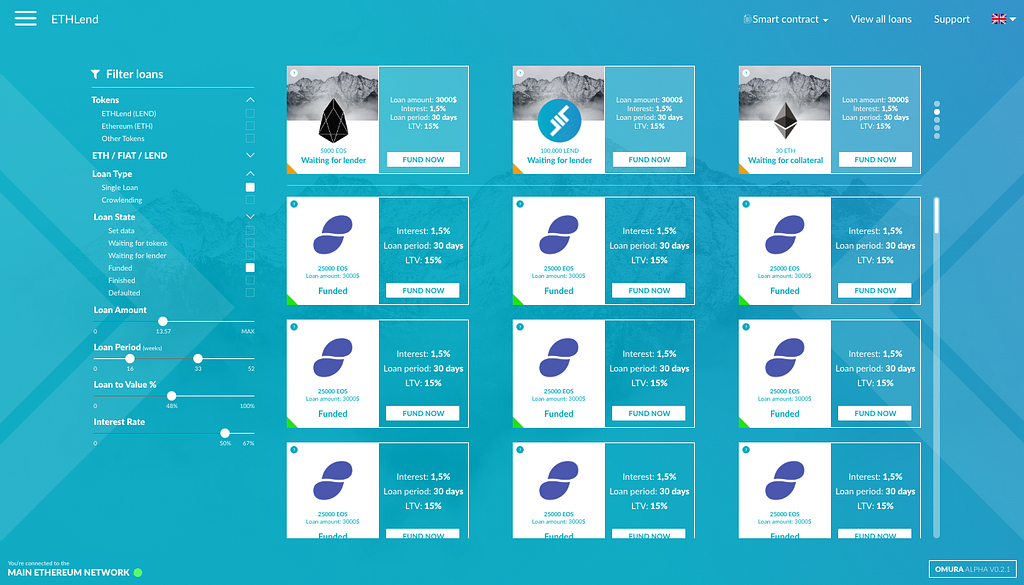

Teaser for the upcoming ETHLend UI/UX overhaul

Teaser for the upcoming ETHLend UI/UX overhaul

In this review I will cover the main aspects of the project that set it apart from existing peer-to-peer lending solutions, and go into more details pertaining to the upcoming feature additions to their platform.

The ETHLend platform is optimized to be accessible to everyone across the world, providing ease-of-use for both the banked and unbanked. Using the ETHLend platform does not require anything but an Ethereum address, which anyone can obtain for free. This means that those in areas without banks, or those who are otherwise unable to get a bank account, can still use the platform so long as they have internet access. With the rise of mobile wallets, this means that people do not even need to have a computer; even a phone would be enough. Additionally, all loans are conducted using Ether, so everyone is able to easily use the same currency as everyone else throughout the platform, removing the friction of currency conversion.

Fairness

The ETHLend platform, since it is on the Ethereum network, is a decentralized platform. This means that no one can specifically target certain lenders or borrowers — once the smart contracts that run the application are deployed, everyone is treated equally. There is no risk for bias against certain groups of people with such a trustless mechanism. Another benefit of the blockchain platform is that all loan operations are transparent, so all movements of money can be tracked on a block explorer. This permanent, immutable history provides another level of guarantee that the platform is running fairly and that no manipulation has occurred. The decentralized nature of the platform also means that no centralized entity controls the conditions of loans. This means that all rates are decided by the market equilibrium, so rates are fair, and the same for everyone.

Safe & Informed

Despite the open and decentralized nature of the platform, there are several mechanisms in place that keep the platform safe for lenders. The most simple one is that borrowers will have the option to provide collateral for loans in the form of Ether. However, in order to keep the platform accessible, collateral will not be required. The platform will also have a scoring mechanism that gauges the trustworthiness of borrowers. By issuing Credit Tokens after successful repayment of unsecured loans, borrowers will be able to build up their credit rating, which will eventually serve as a decentralized credit rating to be used throughout the dApp ecosystem. These mechanisms ensure that lenders are able to fund loan requests without uncertainty on their side of the deal.

Token Use

The LEND tokens are used as utility tokens on the platform and are used in two main ways. The first is that they provide a discount on the platform. In addition to Ether, loans may also be conducted using LEND tokens — this provides the zero-fee loans if LEND is the medium, and a 50% fee reduction if LEND is the collateral. Additionally, active lenders and borrowers are given airdrops of the token as an incentive to continue using it. Although it may not seem like a groundbreaking use of a token, fee-reducing utility tokens like LEND or Binance’s BNB have historically performed very well and offer a clear, simple use-case for new users.

User Experience

I tested out their platform and I can confirm that it is a very simple application to use, perfect for anyone tech-savvy enough to download and use Metamask. The application provides just the right amount of information to users — enough to be informed about their financial decisions on the platform, but not so much that users are flooded with superfluous information. The process of requesting and funding a loan simply boils down to configuring the terms of the loan and sending tokens, which can be done in seconds. Currently, all loans are conducted using Ethereum-based tokens, so collateral and loan payments are handled by sending tokens through the Ethereum network to an address specified by the ETHLend application. For a better look, check out these videos made by the ETHLend team on the lending and borrowing processes:

The ETHLend team has been hitting its roadmap milestones consistently, and has tons of features planned for development throughout 2018 and 2019. For Q1, the team implemented on-demand lending, crowd lending, and the decentralized credit scoring mechanism that I described earlier on. On-demand lending allows lenders to provide an open opportunity to borrow money with terms specified by the lender, which means that lenders can offer money without having to offer it to a specific borrower at the time of submission. Crowd lending can work alongside on-demand lending, and allows lenders to pool together money to finance large requests or distribute their risk. This increases the platform’s liquidity while decreasing the risk that any individual lender faces. For more information on these updates, you can read their development blog article.

To keep updated on their progress, follow their blog or join their Telegram group!

Disclaimer: The author has a professional relationship with the company mentioned in this article.

Make sure you give this post 50 claps and follow me if you enjoyed this post and want to see more!

You can also follow me on Twitter!

Devin Soni (@devin_soni) | Twitter

Democratizing Lending with ETHLend was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.