Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

An interesting trend is shaping up in the DeFi space.

Created Using Midjourney

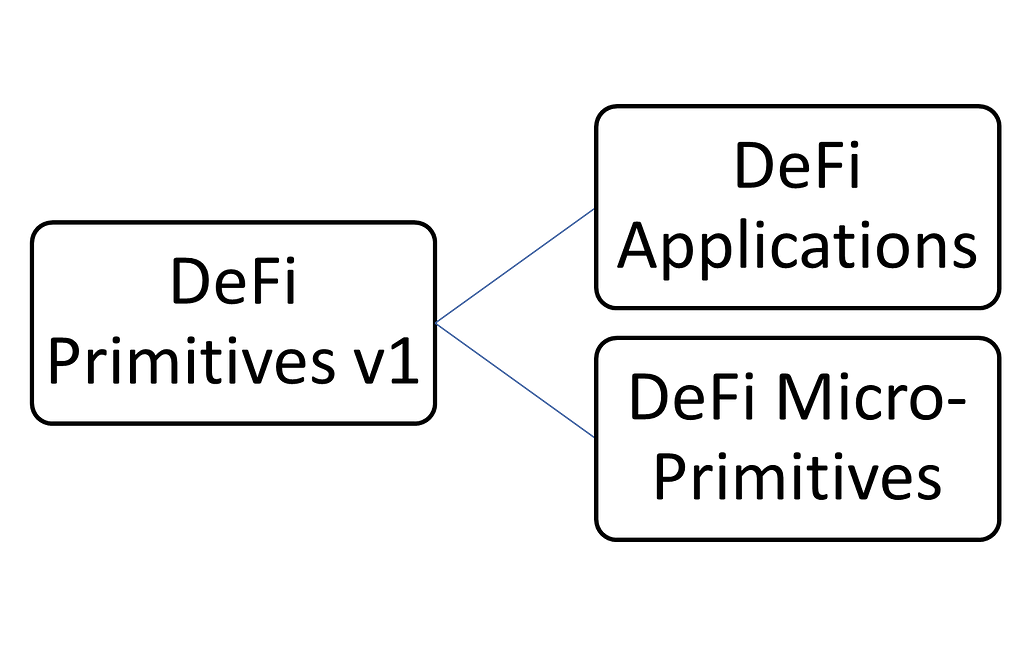

In a recent article in CoinDesk , I touched upon one of the most fascinating trends in the DeFi space which, for the lack of a better term, I chose to call it DeFi micro-primitives. Today, I would like to expand on this idea and the potential implications for the space.

In recent months, we have witnessed several attempts within the DeFi ecosystem that signal an important architecture trend of decomposing existing protocols into smaller, more granular and extensible functionalities. Take examples like UniSwap v2 with its Hooks feature, Eigen Layer with restaking primitives as well as some headlines about the new versions of protocols like Euler. All these examples, signal an unspoken trend to partition protocols into smaller primitives that can be used to build new forms of functionalities.

The fascinating thing about DeFi micro-primitives is that is a systematic phenomenon across the entire space and, yet, but hasn’t been triggered by a common event or coined as an official trend. Its like if all these DeFi protocols sort of agree that going smaller was definitely the way to go. This could result quite puzzling if you think the DeFi space spent the last couple of years building what we defined as core financial primitives in areas such as lending or market making. Shouldn’t the normal step be to build new applications and higher level functionalities on top of those primitives?

While, conceptually, the idea of building higher order functionality on top of core DeFi primitives makes sense, it seems that the current generation of DeFi protocols is too big, complex and monolithic to build complete financial applications. Many protocols, this is particularly visible in the lending space, combine the core financial primitive with application level functionality in the same protocol. For instance, protocols like Aave or Compound, mixed the lending functionality with the parameter tuning of each market at the same architecture level. Similarly, AMMs like UniSwap constrained users to a single way to express trading preferences. Are those really DeFi primitives or complete financial applications?

Expanding that line of thinking take us through the path that DeFi needs to get smaller to get bigger. Functionalities like Uniswap Hooks or smaller lending primitives are required to build a new generation of financial applications.

Micro-Services: An Analogy from the Distributed Programming

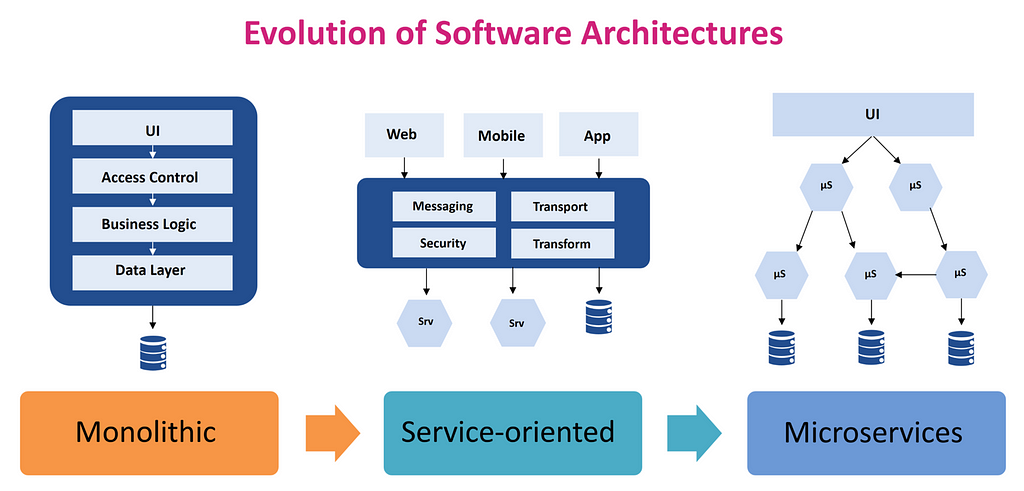

For the last few decades, the distributed programming space evolved from the so-called service-oriented-architectures to REST-based APIs. This trend created entire new sets of platforms such as API gateways or enterprise service bus(ESB). However, many organizations discovered that they were building monolithic applications that were quite difficult to extend. As a result, the industry transitioned to a new architecture pattern known as micro-services which consists on smaller, atomic, programmable functionalities that could be combined to build more complex applications. Every major tech company has jumped on the microservices trend and new companies have been created to build platforms in this area.

Iamge Credit: https://maveric-systems.com/blog/microservices-i-microservices-vs-soa/

Even though the DeFi micro-primitives trend is still very nascent, the analogies with micro-services is a very interesting one.

The Challenges: Security and Complexity

The idea of building simpler, more granular architectures via DeFi micro-primitives is quite compelling but it comes with very critical challenges. Among those, security and complexity jump off the page. Partitioning a DeFi protocol into smaller units drastically increases the surface attack and vulnerabilities. From that perspective, the risk vectors of DeFi protocols are only going to get bigger. At the same token, it is possible that the vulnerabilities might be more isolated to specific micro-primitives.

Complexity would be the second factor to consider when thinking about DeFi micro-primitives. DeFi protocols following this trend are definitely going to be an order of magnitude more complex than its predecessors. At the same token, duilding applications that combine different DeFi micro-primitives is going to become more complex.

Likely or not, the DeFi micro-primitives trend is real and is likely to play a pivotal role in the next phase of DeFi. In the next part of this article, we will try to outline some more technical principles about micro-primitives.

The Emergence of DeFi Micro-Primitives: How DeFi is Going Smaller to Get Bigger, Part I was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.