Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Trading cryptocurrencies can, at times, feel fraught with risks. The looming threat of losing all of your investment dollars aside, exchange security is often a topic of concern.

And with good reason. Last year alone, we saw a handful of exchanges, such as Bithumb and Youbit, get hit hard by hackers. Centralized exchanges, while convenient, come with security vulnerabilities that leave coins ripe for the picking if a savvy hacker comes along looking for an easy harvest.

No investor should unwillingly relinquish the fruits of his/her labor to malicious actors. Luckily, there are safer alternatives to trading out there to protect your crypto cornucopia from harm, and they go by the name of decentralized exchanges.

DEXs allow you to exchange values from person to person, meaning that you never have to submit your private keys to a third party upon deposit. With decentralized exchanges, you’re essentially exchanging IOUs with other traders until you wish to withdraw your funds, but with a DEX, you’re always in full control of your private keys and thus your coins.

So we’ve compiled a list of the more popular DEXs out there so you can take your pick of the litter. Note: this list is based on rankings per 24/hr trading volume, not based on any objective superiority in design or platform.

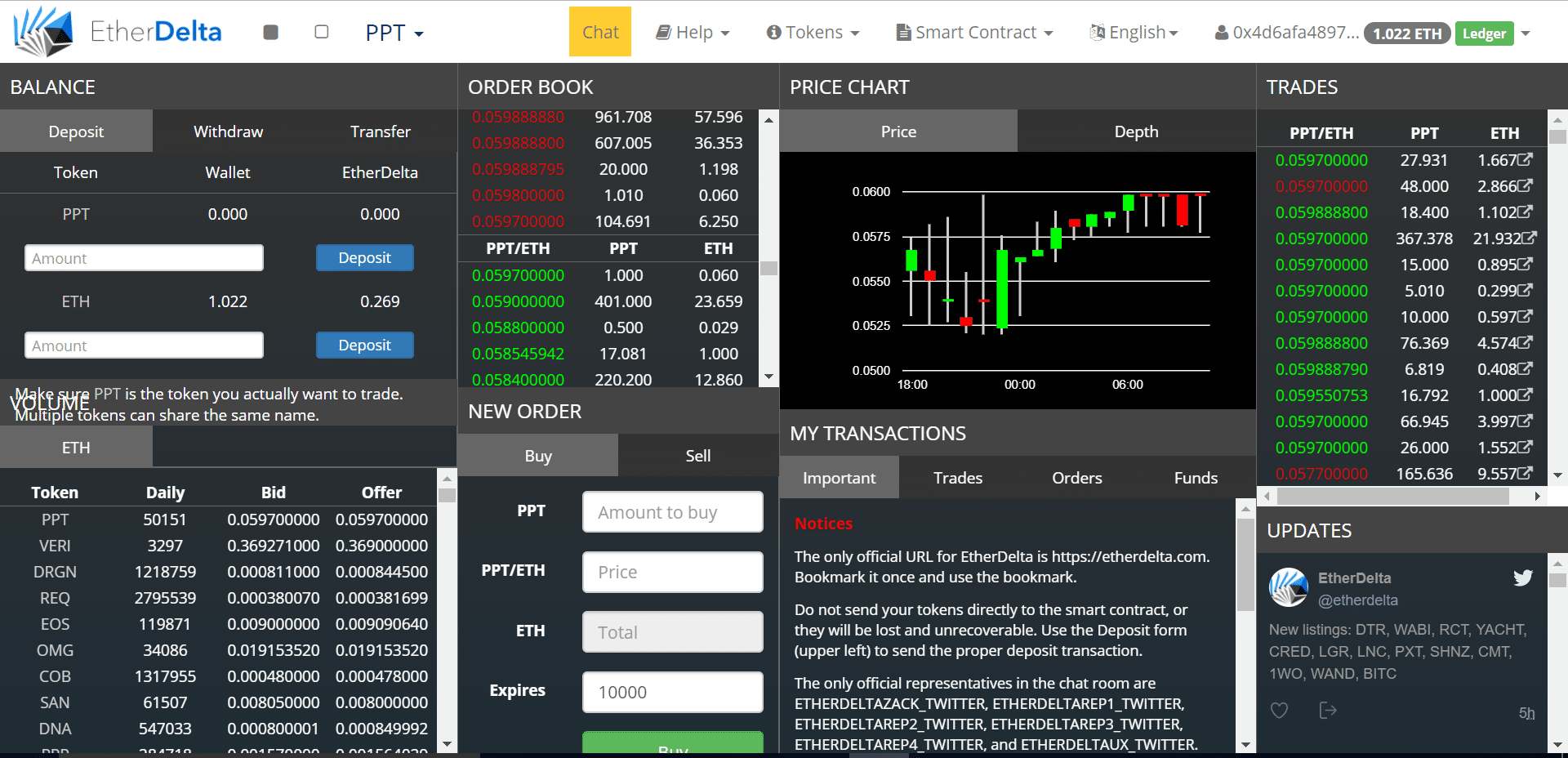

EtherDelta

Leading the pack at a $8.5mln in 24/hr volume is EtherDelta, a DEX that specializes in ERC20 tokens. It runs on the Ethereum blockchain, and if you’re looking to trade your ETH for an ERC20, it’ll have any and all tokens you’re looking for.

Deposits and withdrawals into the exchange are managed by smart contracts powered by Ethereum, and all transactions on the exchange (deposits, trades, and withdrawals) require gas to be processed through the network.

EtherDelta also integrates with Meta Mask and the Ledger Nano S, allowing you to send funding directly from these wallets into the exchange’s smart contract. You can also create a wallet on the exchange’s website–just make sure to write down the private key, because without it, your funds will be stuck in this wallet for none to access.

Out of the three account managing options, creating a new wallet and private key is definitely the least secure. Ether Delta’s DNS was hacked back in December of 2017, and the hacker phished funds through a fake website that allowed him to key log private keys. The good news is, if you used a Nano Ledger S or Meta Mask while visiting the fake site, you would’ve been fine–only wallets where the private key was manually entered on the phony site fell prey to the attack.

Besides this security breach, Ether Delta’s Achilles heel is also its greatest strength: the Ethereum network. The exchange’s smart contracts keep funds especially secured, locking them until they are signed by a user’s private keys, but this also means that the exchange can perform poorly if the Ethereum network is congested. So if too many people are dropping obscene cash on Crypto Kitties, you might tear your hair out when your trades take hours or don’t go through at all.

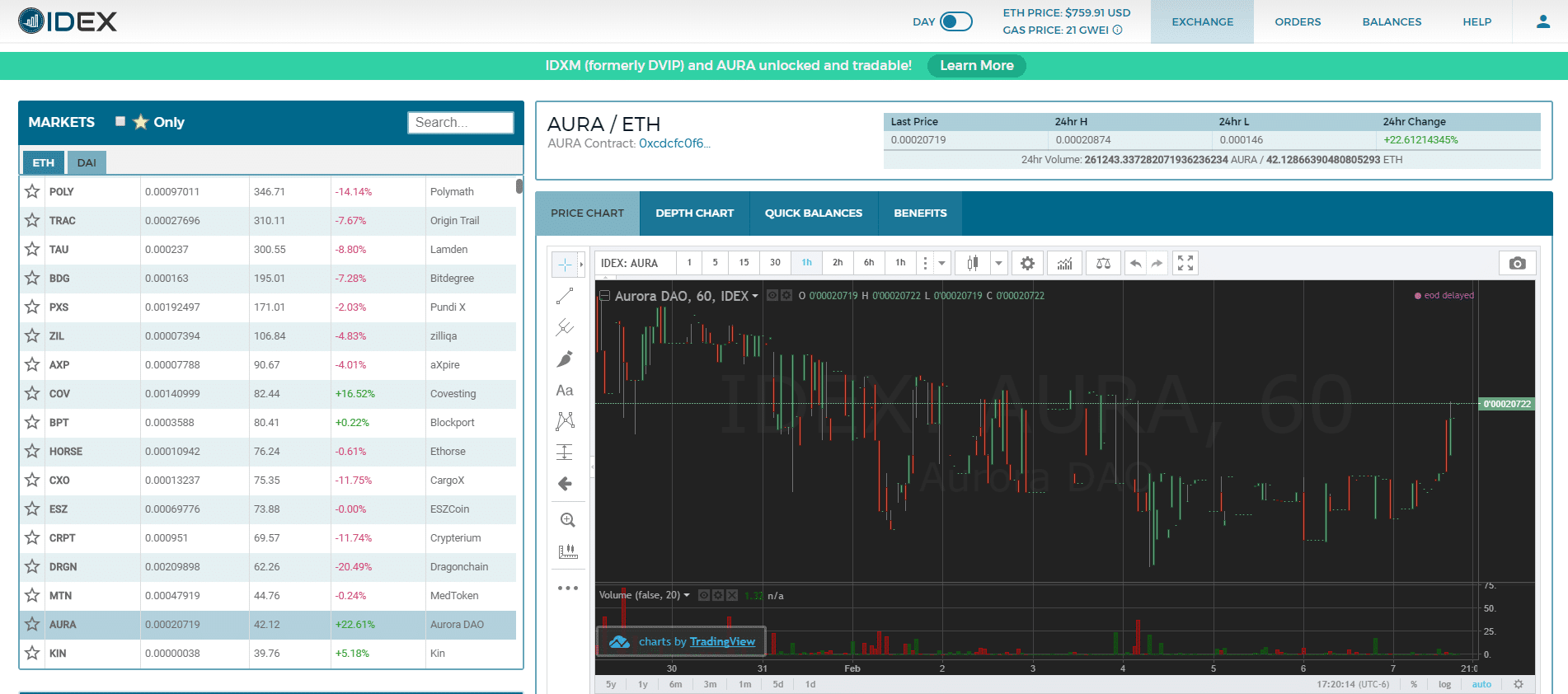

IDEX

Coming in behind EtherDelta at $4.7mln in 24/hr volume is IDEX, another Ethereum-powered exchange. Like its competitor, it offers pretty much every ERC20 token imaginable, funds are managed via smart contracts, and each transaction requires gas.

Unlike EtherDelta, however, IDEX acts as an arbiter for every trade, meaning that the IDEX smart contracts validate transactions before submitting them to the Ethereum network. This serves a couple of functions. First, it allows IDEX to quality control orders, making sure that every trade is valid before executing it and keeping a queue of transactions to streamline processing. Second, IDEX can update account balances off-chain after they submit a transaction, allowing for the convenience of a centralized exchange without sacrificing security.

Generally, IDEX seems to process orders more quickly and efficiently than EtherDelta. It lags less than EtherDelta, but it’s still beholden to the Ethereum Network like its counterpart. Moreover, it has other downsides, including a $40 withdrawal minimum and a minimum of $150 for maker orders and $50 for taker trades.

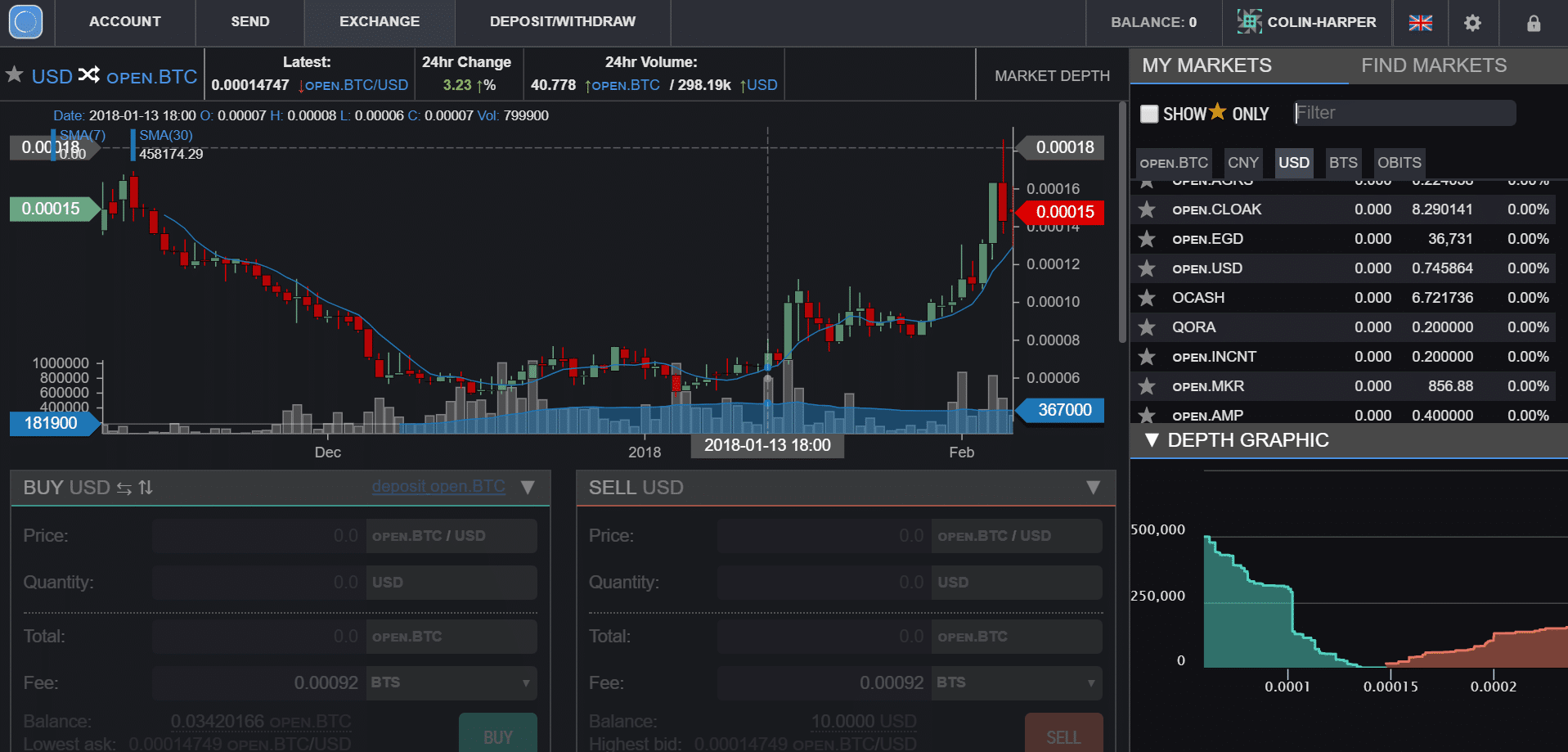

OpenLedger DEX

In third at $1.5mln in 24/hr volume is the OpenLedger DEX. This decentralized exchange is our first break from the more popular Ethereum options, as it is built on the Bitshares platform.

As a result, if you wanted to use OpenLedger and you already had a Bitshares account, you’d be all set. Alternatively, you can also set up an OpenLedger account or make an OpenLedger wallet. The latter is a browser wallet, meaning that you’ll only be able to access it from the specific computer you opened the account on. With the account options, however, you’ll be able to access the DEX from any computer.

A beautiful feature of the accounts: your username serves as your wallet ID. Cool, right? This means that you won’t have to keep track of a long-ass string of numerics to access your account.

Once you’ve set up an accounts or wallet, you’ll be free to use it for trading on the OpenLedger DEX for a variety of coins. Unlike IDEX or EtherDelta, your choices are not limited to ETH and ERC20 tokens. You can trade for Bitcoin, altcoins, and even USD/EUR pairs in the form of BITUSD/BITEUR (Bitshare’s fiat-pegged assets). Considering it’s built on Bitshare’s platform, Bitshare’s coin (BTS) is the DEX’s native coin.

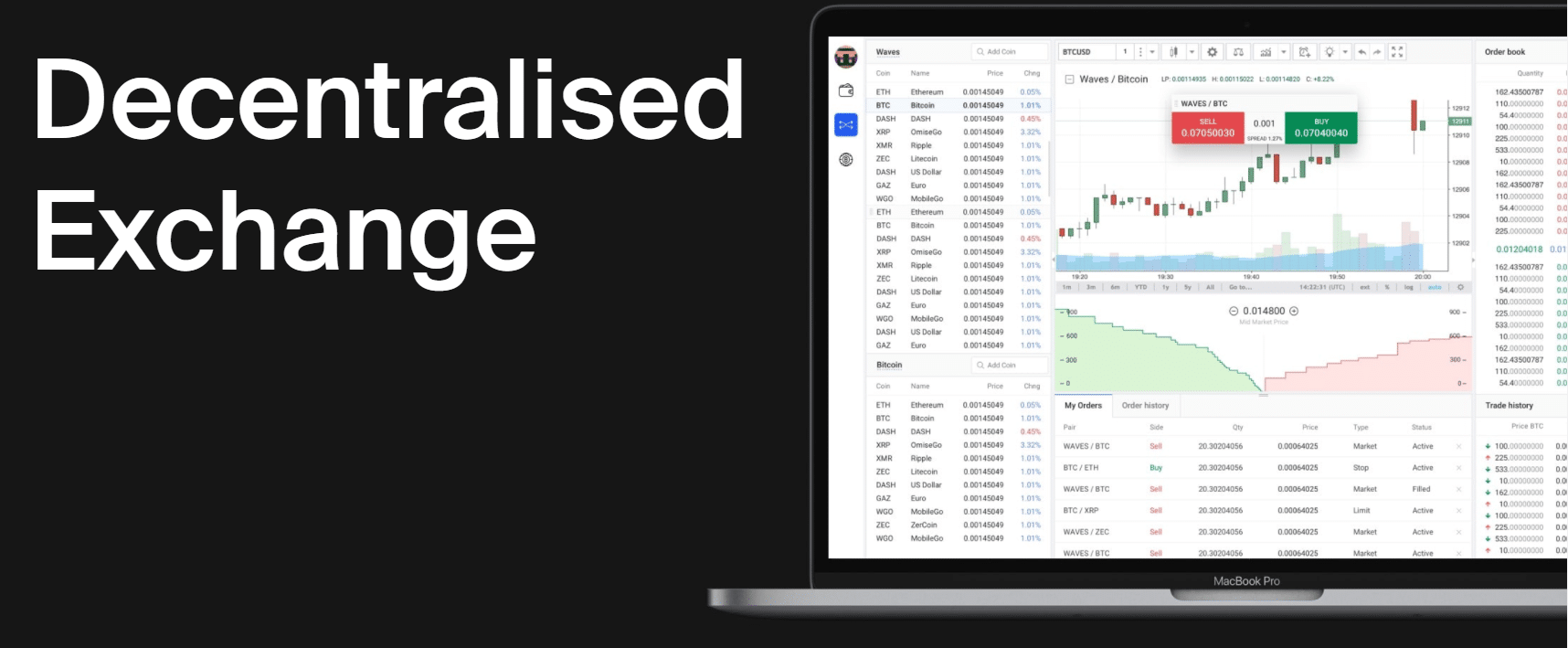

Waves DEX

Coming in last with a 24/hr volume of $1mln we have Waves. Like OpenLedger, Waves’ DEX offers more than just ERC20 tokens and ETH pairs. It allows you to trade in USD, EUR, BTC, and WAVES, the Waves platform’s native coin.

If you hadn’t guessed already, we’ll go ahead and spoil it for you: yes, Waves’ DEX is *shockingly* build on Waves’ platform. So you’d need to download Waves’ wallet before you can access the exchange. The reason is, the wallet integrates with the exchange, allowing you to trade directly from the wallet without having to deposit onto the exchange itself.

Waves set itself apart from other DEXs with its order-matching system. Thanks to its novel design, all order matching is handled on a centralized server. This allows users the ordering speed of a centralized exchange with the safety of a decentralized one, as all trades are executed on-chain wallet-to-wallet.

Rising Stars

Before we conclude this article, it’s worth mentioning a few rising stars in the field that are looking to disrupt the current DEX model:

- Altcoin.io: This DEX will use atomic swaps to facilitate exchange trader-to-trader, offering what could be the most decentralized option available when it goes live. Users need only deposit funds into altcoin.io’s wallet to begin swapping peer-to-peer. For comparison, it’s like a decentralized Shapeshift–which is actually not a DEX, though it is often labeled as such. Altcoin.io recently released a beta version of their product for test net coins only, and the team hopes to have a fully operational version launched in Q1 of 2018.

- 0x: The 0x decentralized exchanging platform is a complete 180 from the typical DEX experience. With 0x, all orders (and their order book)are managed by an off-chain network layer, while all trades are executed on-chain. Moreover, anyone can run an exchange node to add liquidity to the network, a similar system to the anchors that make up Stellar’s infrastructure. Lastly, 0x allows developers to build applications on its platform, so it’s similar to Waves or Ethereum in that respect.

- Loopring: So this isn’t a DEX per se, but rather, a decentralized exchanging protocol. With Loopring, users have access to orders on any market–decentralized or centralized–that has integrated with Loopring. This not only gives users access to theoretically bottomless liquidity, but its ring-matching order system strings orders together, allowing for an order ring wherein each trade is responsible for satisfying another in the sequence.

Final Thoughts

There are a handful of other DEXs that we didn’t cover in this article, such as Stellar’s DEX, Bisq, and CryptoBridge. These simply had lower volumes than the others we covered, as we chose not to cover any DEX under $1mln worth of 24/hr volume.

Each DEX comes with its own pros and cons. Ethereum-based DEXs like EtherDelta and IDEX, for example, integrate with the Ledger Nano S hardware wallet, and this allows for the most secure trading available. That said, they’re also the least user-friendly of the bunch, as they can falter from network bloat and congestion.

OpenLedger and Waves, on the other hand, offer more flexible trading pairs. They may have fewer coins/tokens, but you’re not limited to ETH only trading pairs. As a trade-off, you don’t have hardware wallet compatibility, and the wallets that you use for trading can be subject to hacking attempts and brute-force password-guessing attacks.

Whatever flavor trader you are, there’s a DEX out there for you to get a taste of. So try ‘em out, find what you like, and get to trading your decentralized currency on a decentralized platform.

You can find a complete list of decentralized exchanges on inDEX, a project that tracks decentralized exchanges and lists their relevant information.

The post The Competition for the Best Decentralized Exchange in 2023 appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.