Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The Bears are Back in Town

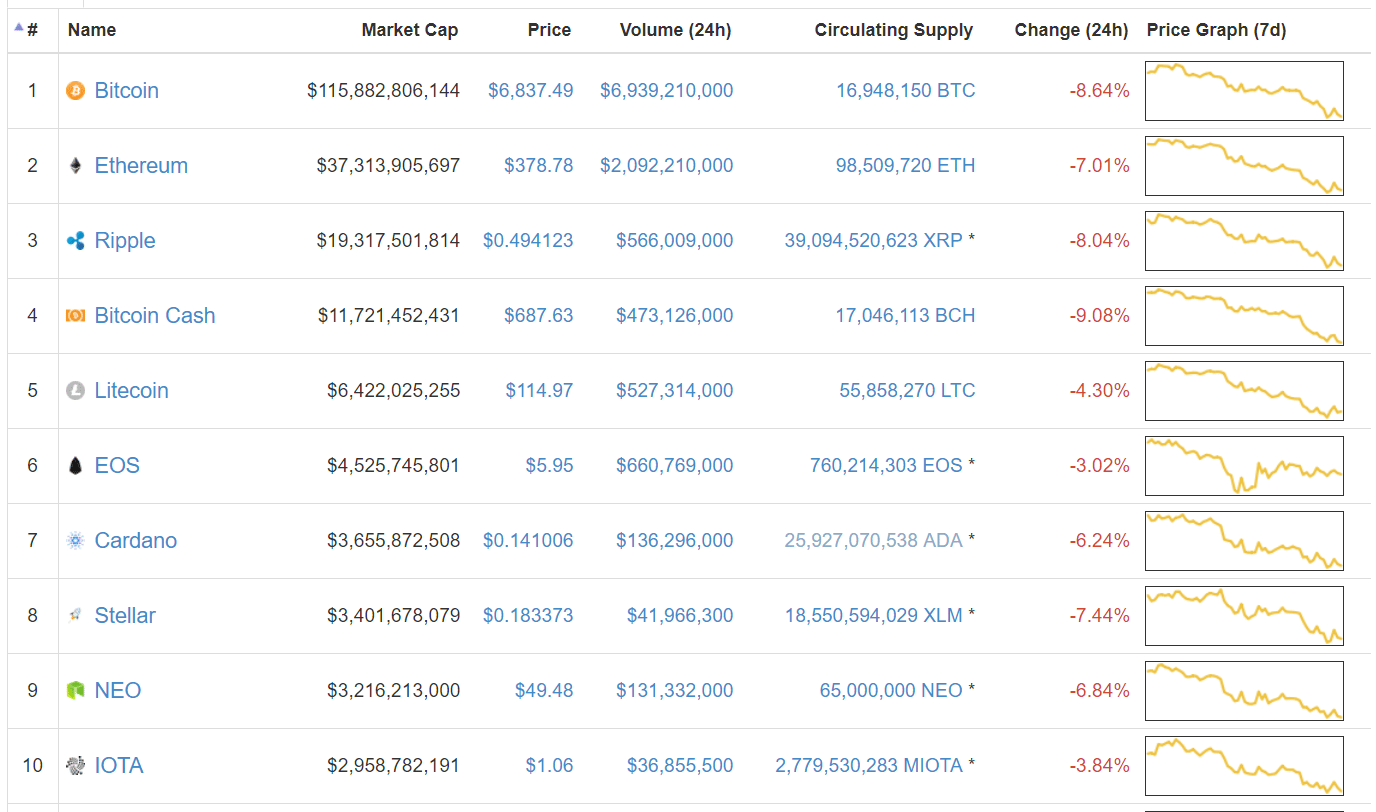

The cryptocurrency market slipped even further into recession this week. With a total market cap of $258bln, it’s down 20% from the $320bln in value it carried going into this week. This is the lowest the entire market has been since November, 24th 2017.

Yep, we’ve turned back the clock and dialed prices back to 2017 levels. Too bad this valuation was on the come-up last year–now it’s just the hangover of the market’s meteoric rise. While it’s not necessarily a good feeling to be at our lowest lows in four months, perhaps this most recent precipitous drop tells us that we’re nearing a bottom. But we’re not out of the woods yet.

Bitcoin: Nearly mirroring the market’s own movements, granddaddy Bitcoin is down 21% on the week, dropping from a humble $8,600 to an even humbler $6,720.

Ethereum: Ethereum is fairing even worse. At $377, the second most popular cryptocurrency is down 28% over the seven day period from its $528 asking price at the beginning of the week.

Ripple: Number three on our list is performing better than usual. Well, better is relative, here, as it’s still down 21% at $0.50 from $0.64, but it hasn’t recorded the largest price decrease of the bunch as it has in other bear weeks

Domestic News

2018 Will Be the Year Whales Make “All Hell Break Loose”: Bill Barhydt, CEO of crypto investment app Abra, predicts that “all hell will break loose” in the cryptocurrency world as western institutional money begins to explore crypto assets. “I talk to hedge funds, high net worth individuals, even commodity speculators. They look at the volatility in the crypto markets and they see it as a huge opportunity,” Barhydt stated. Nonetheless, the CEO remains bullish on virtual currency.

Search for Crypto Jobs Decline as Prices Fall: According to the employment search engine Indeed, in parallel with the decline of cryptocurrency prices, crypto-related job searches have decreased as well. “Over the last year interest in cryptocurrency jobs on Indeed has risen strongly. However, in recent months the prices of bitcoin and other cryptocurrencies have been volatile and (in some cases) declining,” the company said. “Job seeker interest on Indeed for bitcoin and cryptocurrency jobs has fallen, too.” Although cryptocurrency and bitcoin job searches have declined, blockchain-related searches remain steady.

OmiseGo Donates $1 million to Refugee Charity: Ethereum creator Vitalik Buterin and OmiseGo, a fintech startup, recently donated $1 million to GiveDirectly, a charity dedicated to providing no-strings-attached grants to the extremely poor. The donation is set to go towards a new campaign in Uganda which will provide more than 12,000 refugee households a grant to facilitate business growth and other opportunities.

Reporting Crypto Activities Is An Obligation, Says US Futures Self-Regulator: The U.S. National Futures Association issued a reminder that CPOs, CTAs, and IBs who either trade, advise or solicit orders in cryptocurrency or cryptocurrency derivatives need to report all cryptocurrency activity. “This is an ongoing obligation,” the SRO said. The reminder comes a couple months after the notices were addressed in December of last year.

Cybersecurity Firm HackerOne Hires Former U.S. Justice Department Prosecutor/Crypto Expert: HackerOne, known for their “bug bounty” program, is ramping up its cryptocurrency profile with a new addition to their team – Kathryn Haun. A former U.S. Justice Department prosecutor and current board member of Coinbase, Haun also had a hand in prosecuting figures linked to the drug market Silk Road, and BTC-e. At HackerOne, she plans on helping bridge the communication gaps between technologists and developers on one hand and policymakers on the other.

Ford Patent Imagines Crypto Transactions Between Vehicles: Paying your way through traffic might just become a reality. Ford Motor Company has been awarded a new patent that includes a way for cars to communicate with each other and even use token currency as a transaction aid to buy passage and preferences. “The CMMP system operates with individual token-based transactions, where the merchant vehicles and the consumers’ vehicles agree to trade units of cryptocurrency,” reads the patent.

Cybersecurity Firm Finds Covert Crypto-Mining Infecting Customers: Cybersecurity firm Darktrace has detected hidden crypto mining on the networks of around 1,000 of its clients. In one case, they found a rogue employee of a European bank had set up a “crypto-mining side business” under the floorboards after finding puzzling traffic patterns within. The firm specializes in using artificial intelligence to discover and respond to data breaches.

Twitter Joins the Crypto Ad Band-wagon: Following suit with other social media platforms like Facebook and Google, Twitter has begun banning cryptocurrency ads. “We are committed to ensuring the safety of the Twitter community,” the company says. “Under this new policy, the advertisement of Initial Coin Offerings (ICOs) and token sales will be prohibited globally.” Twitter’s new policies are designed to discourage opportunities for fraud and deception.

What’s New at CoinCentral?

What is Riot Blockchain ($RIOT)?: A look into Riot Blockchain Inc. ($RIOT), the first NASDAQ listed company that focuses exclusively on bitcoin and blockchain-based companies.

Don’t Let the Markets Fool You: Bulls Run Amok: Don’t let the downward trend of today’s markets distract you from the still red-hot investment world. In 2017 alone, venture capitalists and other investors put $1.06 billion into the industry.

Bitfract Announces Private Beta Release: Normally, rebalancing your portfolio can be a tiresome, expensive process. If your trading strategy involves keeping a balanced portfolio, you may find this tool useful.

Multinational Crypto Organization to File Lawsuit Against Tech Companies for Ad Ban: A coalition of cryptocurrency and blockchain organizations won’t be taking big tech’s recent ban on crypto-related ads sitting down. Who will judges side with?

What is AST?: AST, or the AirSwap Token, is the membership token of the AirSwap decentralized exchange. The folks at AirSwap call the present iteration of their decentralized exchange (or DEX) the AirSwap Token Trader.

How to Buy Digital Art: From Rare Pepes to Anime, blockchain and technology are expanding what we think of as art and how we share art in the modern era.

What is Gnosis (GNO)?: Check out this beginner’s guide on Gnosis, a prediction market platform built as a decentralized application (dapp) on the Ethereum network.

Europol Busts Cybercrime King Pin Responsible for Laundering €1bln with Cryptocurrency: Earlier this week, Europol, the European Union’s leading law enforcement agency, recently apprehended the ringleader of the hacking group responsible for stealing more than €1bln from over 100 financial institutions worldwide.

What is IAMA Coin?: Find out more about IAMA (or I am a coin), a collection of both physical and digital artwork by Kevin Abosch.

Controversy Turns to Closure as Litepay Shuts Down: According to a blog post released this week by the Litecoin Foundation, Litepay CEO Kenneth Asare is ceasing all operations in preparation to sell the company.

The Top Six Blockchain Art Projects: In this article, we’ll take a look at six of the most popular blockchain art projects and how the artists behind them are using blockchain technology in their works.

The Cryptocurrency Ad Ban: Gain insight into why some of tech’s largest companies have been leading a crusade against cryptocurrency-related advertising on their platforms.

Blockchain’s Fight Against Fake News: With the growing ease of communication, fake news and false stories are now spreading quicker than ever. Learn how blockchain is attempting to curve this annoying trend.

What is Pura?: While every cryptocurrency would argue they’re trying to make the world a better place, Pura reserves 10% of every block reward to do exactly that.

What is Anime Coin (ANI)?: Learn more about Anime Coin, a project offering a platform for users to issue and sign, hold, and exchange anime-related digital items on the blockchain.

Why are So Many ICOs Failing?: ICO’s aren’t dead. The fact is that there are many ICOs that emerged in 2017 and early 2018 due to the overall market hype, and many don’t have the strategy to last.

Binance Moving to Malta: The most popular cryptocurrency exchange in the world, Binance, is making their move to Malta.

International News

Belarus Legalizes All Crypto-Related Businesses: In an effort to become a global leader in blockchain innovation, the small country of Belarus enacted regulations essentially legalizing the crypto industry. Signed by President Alexander Lukashenko, Decree №8 offers tax breaks (such as no taxes for mining profits), visa waivers, and other incentives to attract blockchain firms.

The U.K.’s Financial Regulator Warns of Possible Scam: According to the report, “we believe this firm has been providing financial services or products in the UK without our authorisation. Find out why to be especially wary of dealing with this unauthorised firm and how to protect yourself from scammers.” Olsson Capital, which runs out of Bulgaria, is said to be targeting UK investors with their crypto trading services.

Two Trading Platforms in Japan Set to Close Amidst Regulations: Tokyo GateWay and Fukuoka-based Mr. Exchange are two of the most recent Japanese exchanges set to shut down as regulators tighten their grip. In the wake of a $500 mln theft of NEM in January, increased oversight in the sector has put pressure on exchanges to register with the FSA and improve their relatively poor security. Upon closing, the two exchanges are required to return all investor funds.

South Korea May Have Crypto Payments Options by 2019: Generally known for their love of tech, South Korean consumers may soon be able to spend their crypto at over 8,000 retail shops. Teaming up with digital payment provider Korea Pay, major exchange Bithumb announced it will soon offer a payments solutions service for its customers wishing to pay using their crypto wallets. From cafes to candle shops, businesses of all types and sizes are expected to join in on the virtual currency revolution.

Denmark’s Largest Bank Deems Crypto Too Risky to Trade: In the report, Danske bank states “we have a negative position towards cryptocurrencies and strongly recommend that our customers refrain from investing in the field.” Due to high volatility, a lack of transparency, and overall lack of consumer protection, the bank ruled out the option for its customers to buy crypto related financial instruments, such as exchange-traded notes. Nonetheless, customers can still use their Danske credit cards to make cryptocurrency purchases.

China’s Central Bank Thinks Crypto Threatens its National Currency: In a meeting highlighting China’s monetary gold and silver achievements, the People’s Bank of China addressed possible risks to the Chinese yuan, including “the development of digital economy”. While the vice governor of the bank Fan Yifei celebrated the banks increase on digital currency research and development, he highlighted one of their top priorities is to protect the yuan from virtual currencies through strict policies.

Canadian Lending Institution Bans Customers From Investing In Crypto: Lending institution Bank of Montreal (BMO) announced March 28th that its customers can no longer conduct credit, debit and online payments on cryptocurrency trading platforms. According to the bank, “this decision was made due to the volatile nature of cryptocurrencies, and to better protect the security of our clients and the bank.”

The post This Week in Cryptocurrency–March 30th, 2018 appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.