Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Data from Santiment shows the recent local top in Bitcoin came after bullish calls from social media users spiked to high levels.

Bitcoin Moves Against Crowd: Decline Comes After Traders Get Hyped

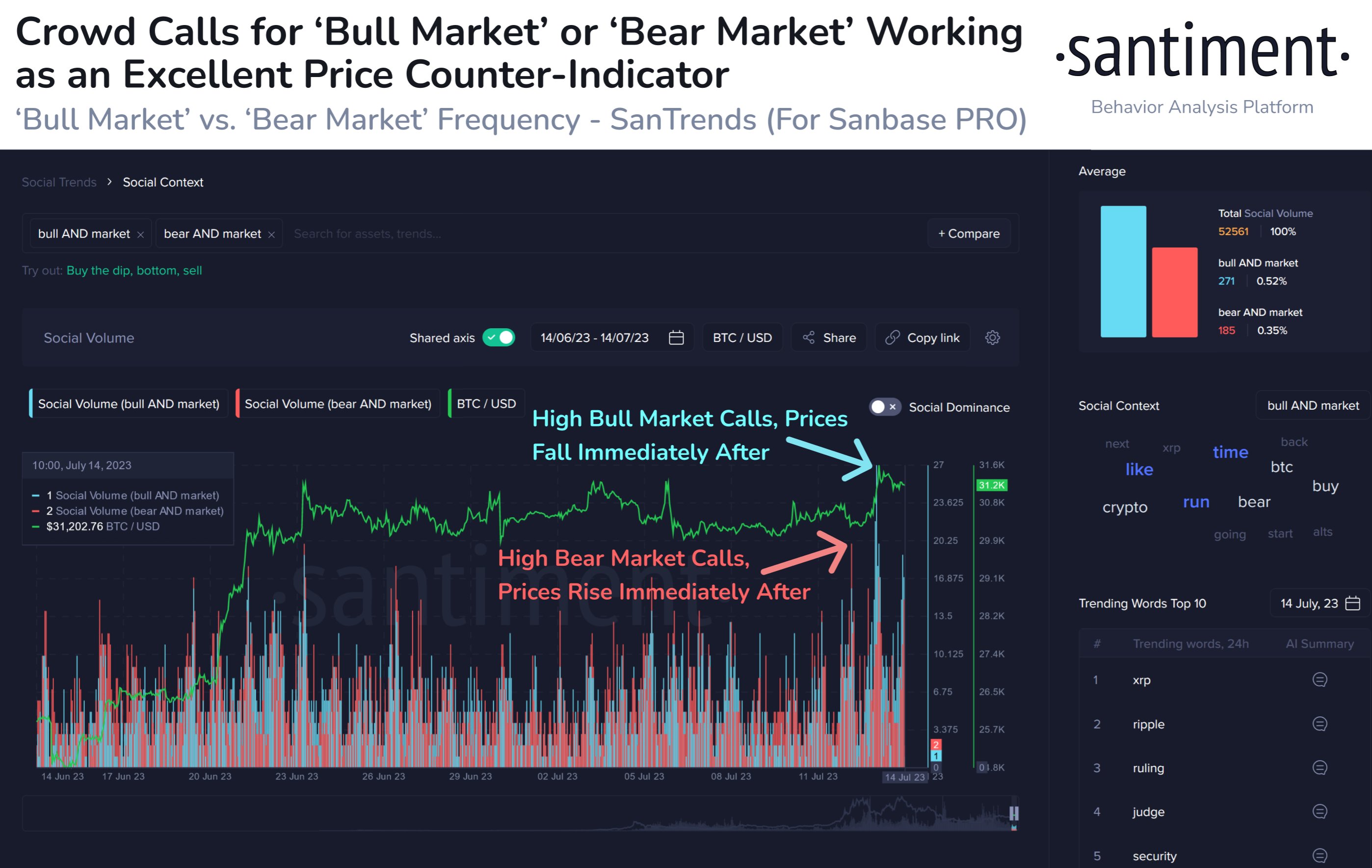

According to the on-chain analytics firm Santiment, crowd calls for a “bear market” and “bull market” can work as indicators for where the BTC price may be headed next.

The relevant metric here is the “social volume,” which measures the total number of text documents (that is, posts, threads, and other forms of text messages) on the major social media platforms that are making mentions of a given term or topic.

This indicator only counts the unique number of text documents, meaning that it doesn’t care about how many mentions a specific post may contain the term in question, only that it mentions the topic at least once.

If the social volume is applied to the term “Bitcoin,” for example, the indicator will provide us with hints about the degree of discussion that the cryptocurrency is receiving on social media platforms right now.

The metric can also be used to pinpoint sentiment in the market if appropriate terms are used. In the context of the current discussion, Santiment has filtered the social volume of “cryptocurrency” to find the mentions of the terms “bull market” and “bear market.”

Here is a chart that shows how much talk the topics of a bull market and bear market are receiving from cryptocurrency traders on social media:

As displayed in the above graph, the total number of cryptocurrency-related social media posts containing both “bear” and “market” observed a spike last week as Bitcoin plunged to $30,200.

Interestingly, while investors were making a high number of these bear market calls, the BTC price actually bottomed out and built up towards an upwards move.

Historically, the Bitcoin market has tended to move in a direction opposite to what the majority of investors are expecting. So the more the crowd leans towards a specific direction, the more likely such an opposite move becomes to take place. As such, the recent high bear market calls seem to have had a similar effect on the price.

A few days back, when BTC had surged towards the high $31,000 level, the social volume for the “bull market” had also observed a large spike. This would suggest that traders had started getting hyped about the possibility of the bull market being back on.

Though, as it had happened when investors had become too bearish, their turning too bullish also lead to the price moving in the opposite way. This time, of course, the price registered a decline.

This established market trend gives credence to the popular investing saying that “Buy when there is blood on the streets.” In the context of cryptocurrency, this advice translates to buying when there are calls of a “bear market.”

BTC Price

At the time of writing, Bitcoin is trading around $30,200, down 1% in the last week.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.