Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Curve Stablecoin (crvUSD) represents a new approach to the concept of collateralized debt positions (CDPs) in DeFi. Designed to create a more stable and manageable system for leveraging crypto holdings, the platform introduces a fresh concept: soft liquidations. Through this unique mechanism, crvUSD significantly decreases the risk associated with conventional liquidations, offering a more gradual, flexible, and less damaging liquidating process in case of adverse market conditions.

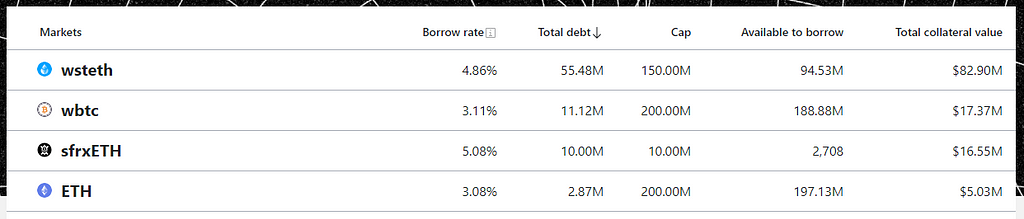

Taking a look at the interface of their app, it can be seen the currently available markets and its live parameters. The supported assets at the moment are wstETH, wBTC, sfrxETH and ETH, although new assets could be onboarded in the future. As can be seen in the image below, more than $100M in total have been deposited into the protocol (accounting for $110M of TVL), which originated a total of more than $75M in loans, most of them being taken with wstETH as collateral:

The current state of the CRVusd markets from the Curve App.

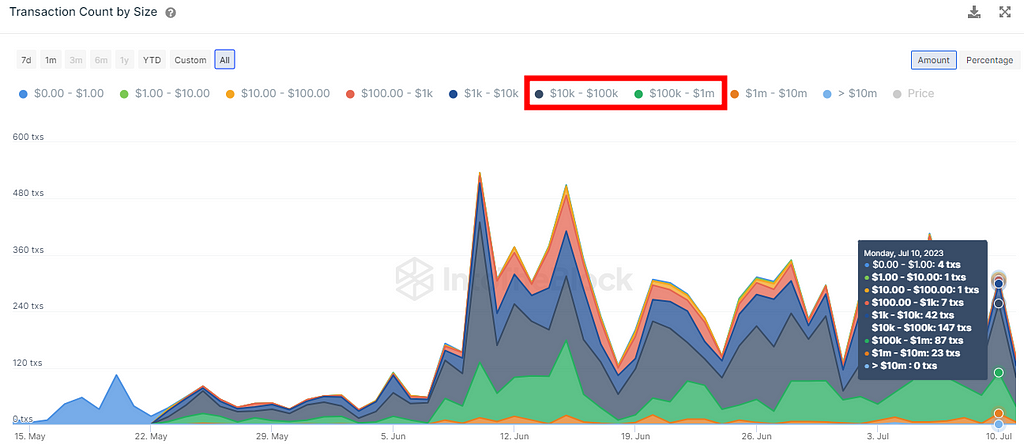

To further understand how users are using crvUSD at the moment, the IntoTheBlock’s crvUSD indicators show a historical snapshot of the transactions involved in crvUSD divided by buckets of dollar amounts:

‘Transaction Count by Size’ chart from IntoTheBlock crvUSD indicators.

An average of 200 to 250 transactions interact daily with crvUSD, which is remarkable for a novel and complex protocol just deployed on Ethereum. The segmentation of the transactions by the transferred USD equivalent shows how the protocol has been predominantly used with positions that range between two buckets: the one that goes from $10K to $100K and the one that goes from $100K to $1M. Interestingly there are daily an average of 20 or more transactions that range from $1M to $10M. This portrays the confidence that large whales have over crvUSD at the moment.

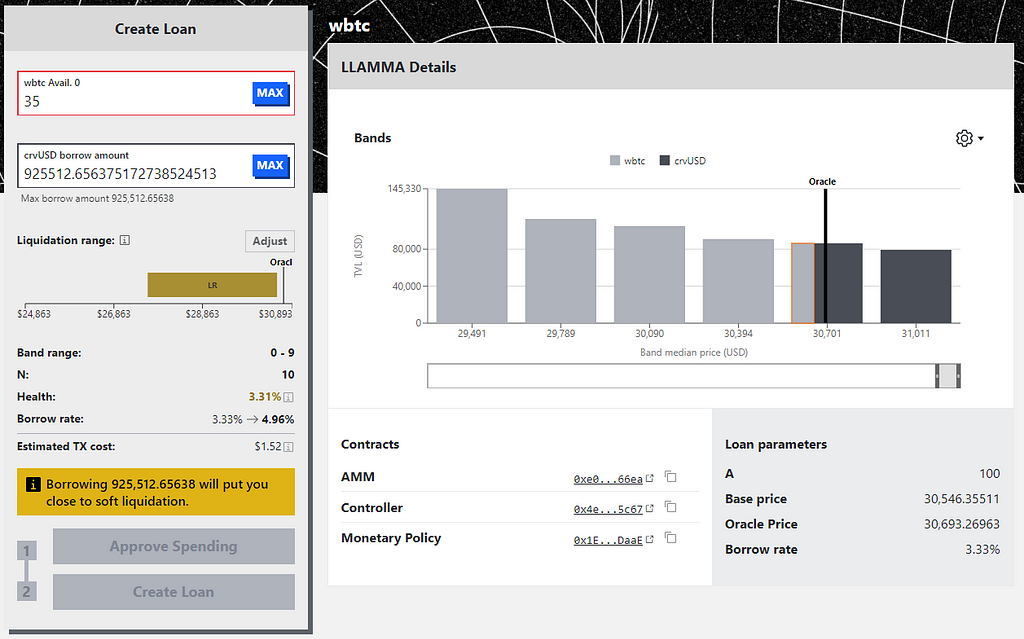

A factor that might affect demand for the protocol and have a positive impact in its further growth could be borrowing rates. The current borrow rates have been fluctuating but at the moment they remain slightly more competitive than borrowing stablecoins in other lending or CDP protocols. Curiously, these rates were as low as 0.5% one month ago, adjusting dynamically to the leverage appetite of the market. Speaking of leverage, the protocol allows very high loan-to-value ratios; according to the advanced view interface a debt position collateralized by 35 wBTC (a bit more than $1M), allows to borrow crvUSD up to around 86% LTV, allowing a leverage of around a 7x to 9x in case that the crvUSD would be swapped out for wBTC and looped by depositing again. Although this would put the position at a high risk of liquidation and is far from safe, these proves that the leverage limits are higher than other protocols, where the maximum leverage accessed tends to be closer to a maximum of 3x to 5x:

Advanced view of the crvUSD loan interface.

The LL’AMM’A and its bands

At the heart of the crvUSD system is the Lending Liquidating AMM Algorithm (LLAMMA): an Automated Market Maker (AMM) specifically designed for the crvUSD ecosystem, replacing liquidations with special-purpose rebalancing AMM. LLAMMA enables soft liquidations, arbitrage opportunities, and collateral rebalancing. It breaks down the collateral into separate bands, each representing a different price segment. But how these bands work?

The use of the term ‘bands’ to describe the portions of collateral tied to specific price ranges is particularly noteworthy. Bands can be understood similarly to how liquidity is provisioned in a concentrated liquidity market maker protocol such as Uniswap v3. Each band represents a portion of the collateral that gets liquidated at a particular price point. Users can choose the number of bands their collateral is divided into. A greater number of bands means that the liquidation will be more gradual but will start earlier as the price falls. While fewer bands mean that the liquidation process starts later but is more abrupt.

Back to the LLAMMA, in reality there are several LLAMMAs, since each of the collateral assets supported has a different one. In the image above can be seen the wBTC LLAMMA in the bar chart displayed, and how it trades against crvUSD along several bands. This must not be confused with the different crvUSD pools offered through the classic Curve interface, which can be seen in the next image:

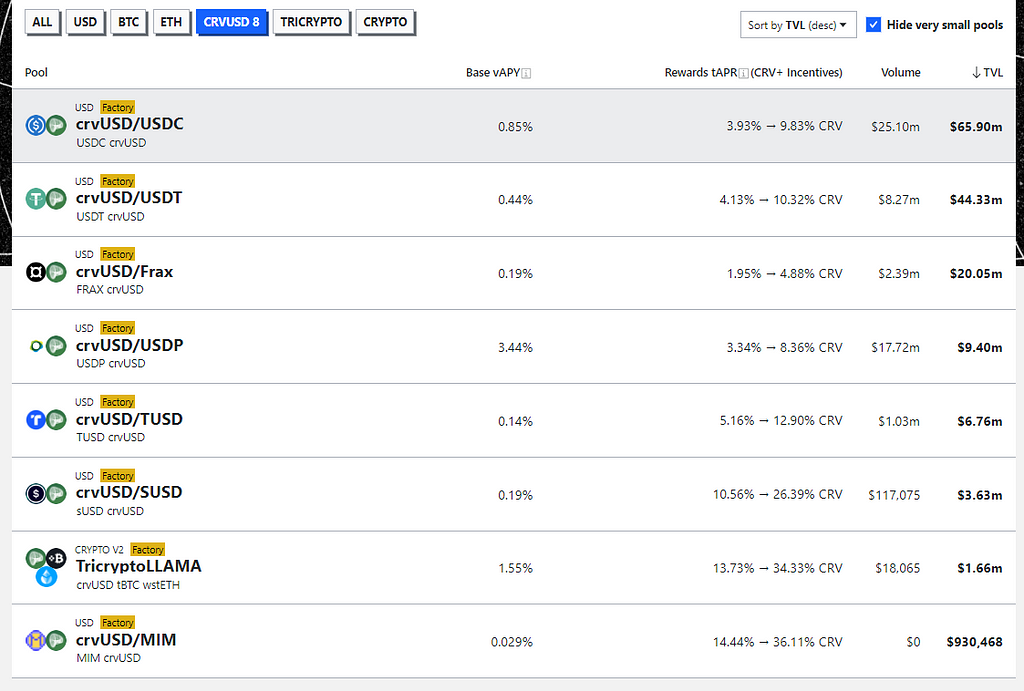

The currently available CRVusd pools from the Curve App.

These are the pools that allow the exchange of crvUSD against other stables. These currently have compelling yield opportunities, with rates above the current standard for stablecoin strategies, which tends to be currently at 4–5%.

Soft Liquidations

Hard liquidation in a typical lending protocol involves the sudden seizure and sale of collateral when its price falls below a certain threshold. This can be an overly costly measure, particularly during periods of market volatility. By contrast, the LLAMMA’s soft liquidation is a gradual process that adjusts collateral in proportion to its market price. As such, it reduces the risks and losses associated with sharp collateral price drops, providing a more flexible and less punishing method of dealing with debt collateral. The price feed that dictates these liquidations is an aggregation of multiple price oracles such as Uniswap v3 TWAP, Chainlink, and Curve’s Tricrypto.

During a soft liquidation process, the system splits the collateral into multiple ‘bands,’ each representing a particular price range. If the collateral’s price falls within the range of a band, the collateral is partially liquidated and exchanged into crvUSD. However, if the price recovers, the collateral can be ‘de-liquidated’, reconverted from crvUSD back into the collateral.

These constrains under soft-liquidation can be summarized as:

- If the price enters into one of the bands and soft-liquidation starts: the user can not add more collateral or withdraw it, but can repay the debt or self-liquidate it.

- If the prices moves in favor of the user, out the band: the user is free to withdraw, add more collateral, repay or self-liquidate.

This novel system presents numerous opportunities and risks. On the upside, it significantly lowers the losses associated with liquidation. According to the available data, soft liquidation losses typically hover around 1–2% — significantly lower than the hard liquidation penalties of around 5% to 15% prevalent in other lending and CDP protocols, also known as liquidation bonuses. Additionally, the variable borrow rate can create incentives for different user actions: If the rate falls (typically when collateral prices are down), there’s an incentive for users to borrow and sell. Conversely, when the rate increases, it incentivizes users to buy crvUSD and repay their loans.

On the downside, the risk of hard liquidation still looms, particularly if the collateral’s price drops sharply over a short time interval. In such cases, positions can get hard-liquidated with no option of de-liquidation. There are also risks associated with volatile borrow rates and crvUSD price swings. Additionally, the more the collateral’s price swings within the bands, the higher the losses during soft liquidations.

‘The Price Peg’

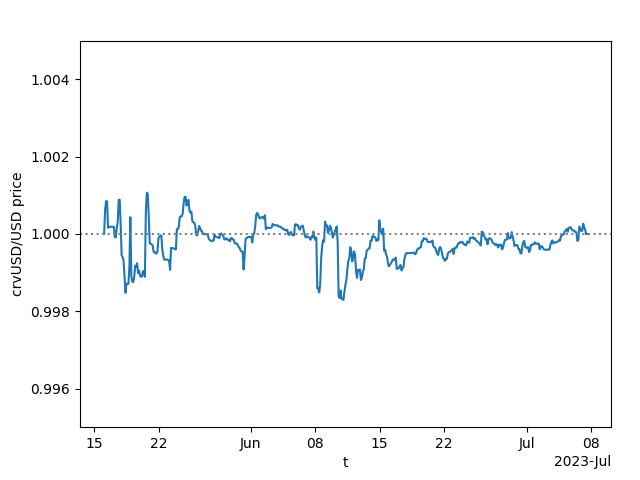

An important aspect of crvUSD is its price-keeping mechanism. It is maintained via two smart-contracts, the ‘Peg Keeper’ (or Controller) which uses a mint and burn mechanism interacting with the crvUSD pools shown before, and the Dynamic borrow rate (or Monetary Policy). The Peg Keeper contract can mint new crvUSD without collateral and deposit it into crvUSD pools when the crvUSD price is above $1. Conversely, when the crvUSD price is less than $1, the Peg Keeper contract can withdraw the minted crvUSD from the Curve crvUSD pools and burn it. While the Monetary Policy implements an exponential borrow rate rise when the Peg Keeper has run out of balance and crvUSD remains below $1.00. As can be seen in the chart below, the price peg of CRVusd has remained considerably stable, not decreasing below $0.098 so far and keeping a very low volatility during the last 30 days, which signals that the system is working as intended:

crvUSDprice against the dollar. Source: Curve’s Twitter account.

Overall, crvUSD presents a fascinating development in the DeFi landscape. The introduction of soft liquidation and collateral banding creates new opportunities and challenges for users. The protocol underscores the growing sophistication and maturity of DeFi, which is continually evolving to provide better, more flexible and efficient financial solutions than the ones usually found in traditional finance.

Despite its many innovative features and attractive benefits, the crvUSD system carries its share of complexities and challenges. Users must understand the inner workings of soft liquidation, band selection, and collateral management. The management of loans in CurveUSD is also somewhat restrictive as collateral cannot be added during soft liquidation to mitigate losses. Furthermore, users must deal with fluctuations in the borrow rate and the risk of hard liquidation. But on the other hand, crvUSD is currently providing competitive borrowing rates for large capacities, extensive leverage (if needed), and interesting yield opportunities over holding crvUSD on top of that. At IntoTheBlock we will keep an eye on how the protocol matures and grows, covering it in further articles and probably adding some crvUSD analytics for our Risk Radar soon.

crvUSD: Liquidating Them Softly was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.