Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In June, the surge in stablecoin volume flowing into exchanges has been a clear indicator of the market’s changing dynamics. This is particularly evident when analyzing exchange buying power, a metric that measures the 30-day change in stablecoin buying power on exchanges.

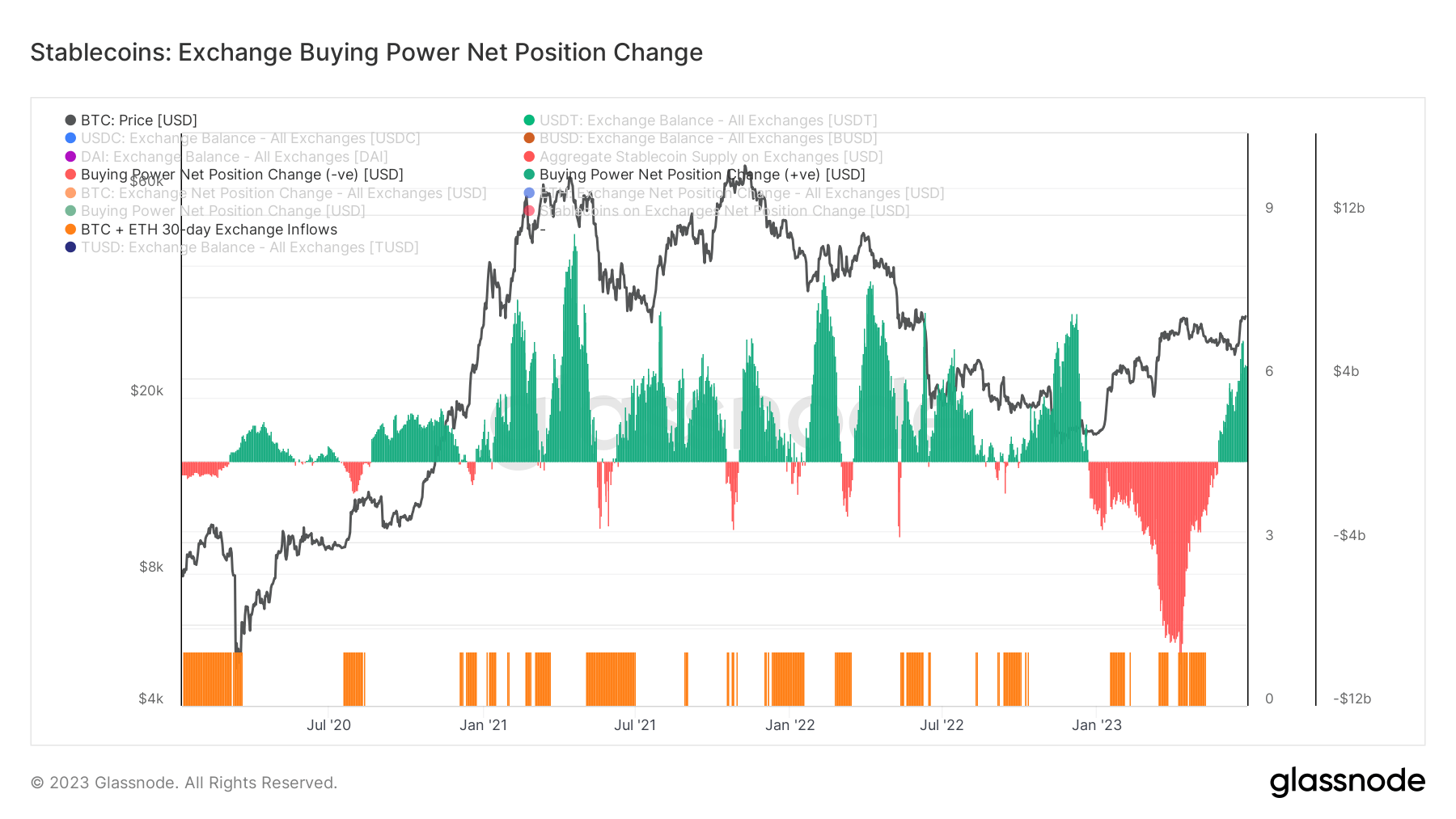

Graph showing the net position change in stablecoin exchange buying power from 2020 to 2023 (Source: Glassnode)

The exchange buying power metric is calculated by tracking the 30-day change in the supply of various stablecoins (USDT, USDC, BUSD, DAI ) on exchanges and subtracting the USD-denominated 30-day change in BTC and ETH exchange flows.

Glassnode’s methodology assumes that BTC and ETH inflows to exchanges represent selling pressure, while stablecoin inflows represent buying pressure. Positive values and uptrends indicate an increasing volume of stablecoins flowing into exchanges relative to BTC and ETH over the last 30 days. This suggests there is more stablecoin-denominated buying power available on exchanges.

On the other hand, negative values and downtrends indicate a declining USD volume of stablecoins, suggesting there is less stablecoin-denominated buying power. According to Glassnode, this usually correlates with declining or stagnant prices.

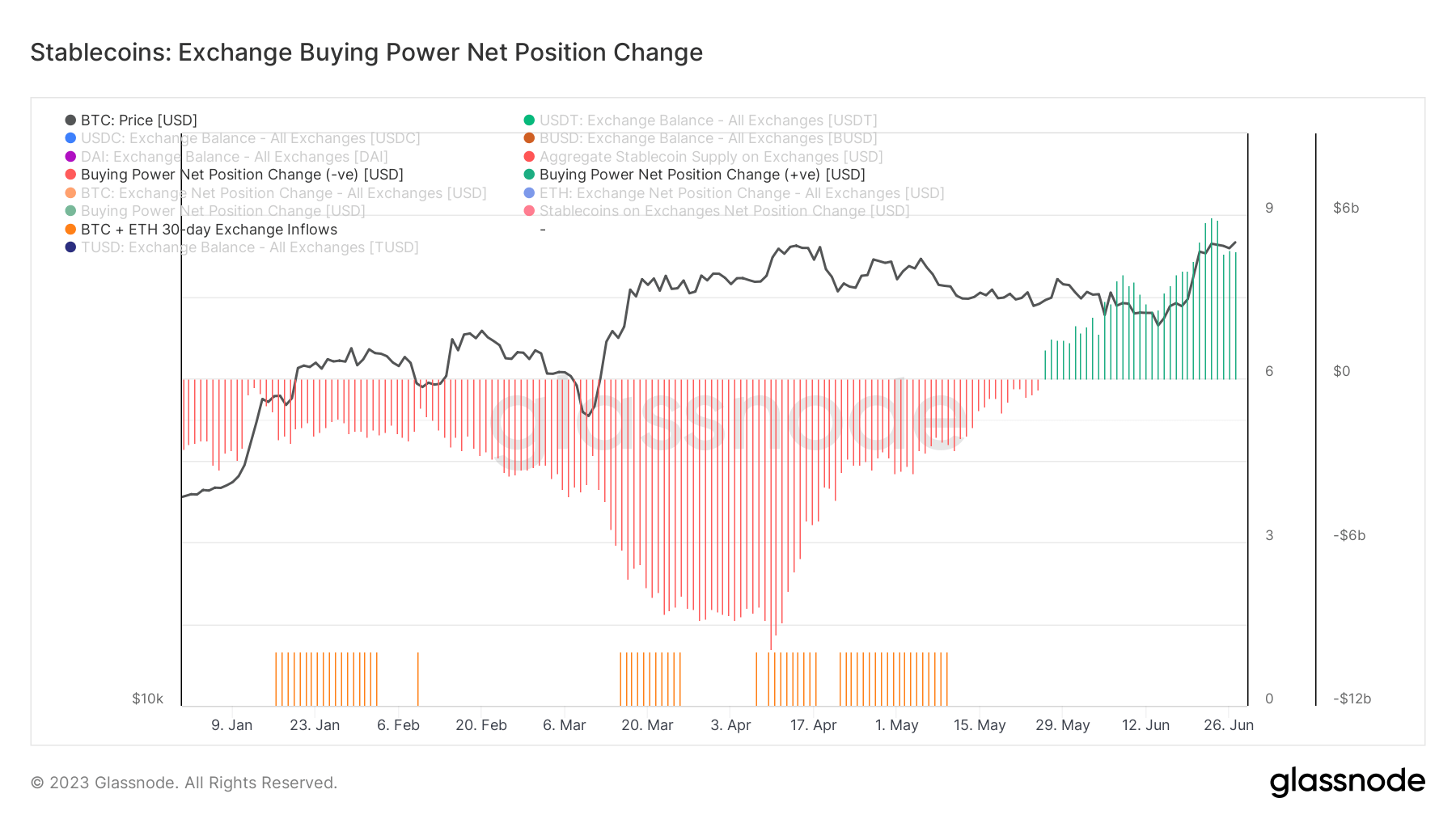

Most of 2023 witnessed a notable decline and downtrend of exchange buying power. However, this trend experienced a reversal towards the end of May, with an influx of stablecoins to exchanges relative to BTC and ETH drastically increasing buying power. Since May 26, exchange buying power has grown steadily and has returned to the levels recorded in mid-December 2022.

According to Glassnode, there was a $4.6 billion increase in exchange buying power on June 27.

Graph showing the net position change in stablecoin exchange buying power YTD (Source: Glassnode)

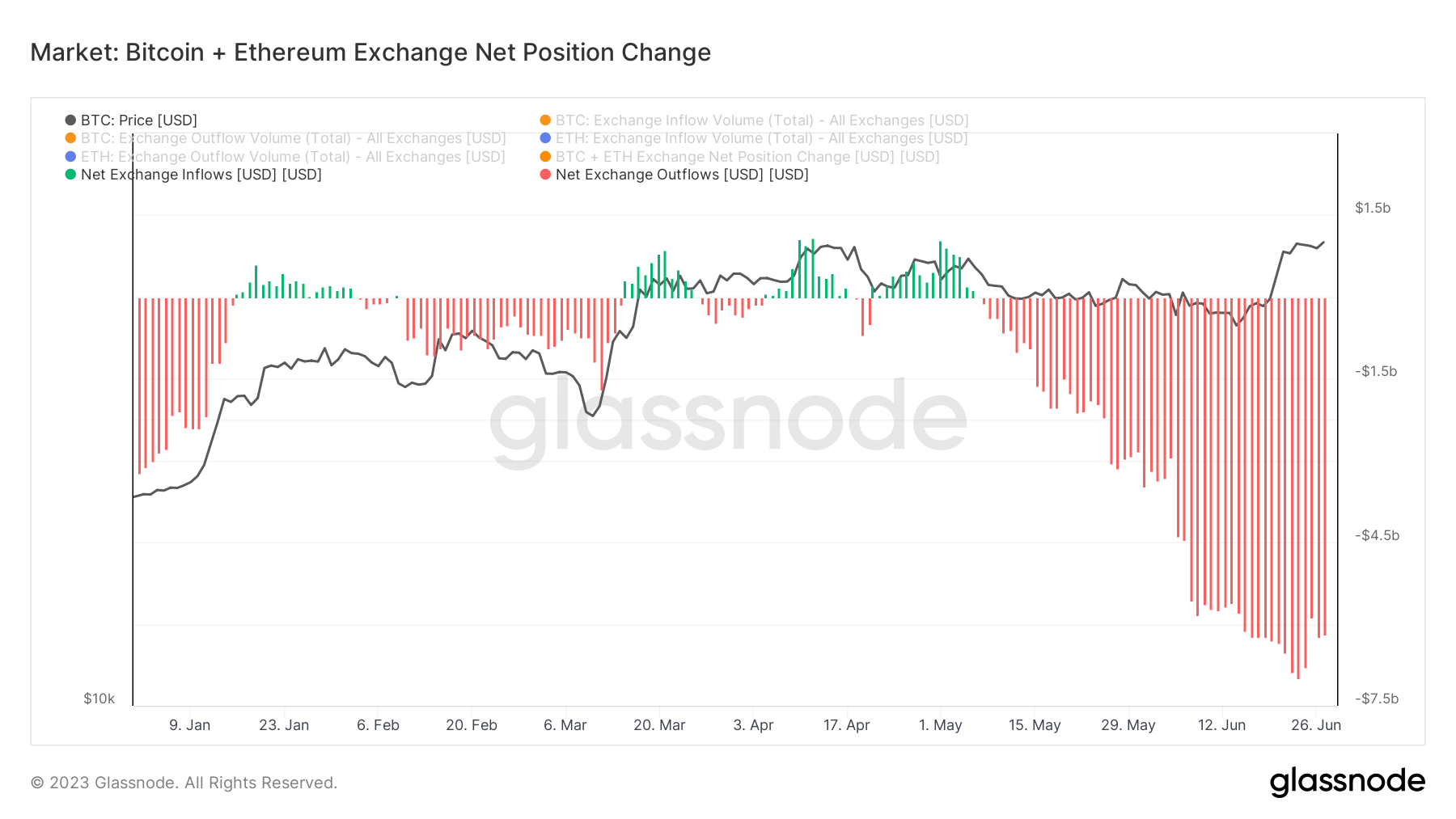

These findings align with the recent trend of exchange outflows. Data from Glassnode has revealed a significant uptrend in Bitcoin and Ethereum outflows from exchanges that began in May. On June 27, approximately $6.2 billion worth of BTC and ETH exited exchanges. While the inflow of stablecoins hasn’t been particularly significant over the past month, the BTC and ETH outflows rate has led to a notable increase in exchange buying power.

Graph showing the net position change of Bitcoin and Ethereum balances on exchanges YTD (Source: Glassnode)

This surge in stablecoin buying power could have significant implications for the market. If this trend continues, it could fuel a new wave of buying activity in the crypto market, increasing price volatility.

The post Stablecoin buying power on exchanges increases as BTC and ETH see outflows appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.