Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The current popular designs and incentive mechanisms in crypto protocol governance have a narrow scope of focus and lack transparency. Complex design can lead to voter apathy and low turnout, resulting in small groups deciding the direction of the protocol. Fortunately, easy implementations exist to improve the governance framework.

Introduction

It is best to begin by saying that good governance is hard. It is hard to create a system that can govern both short and long term benefits. It is hard to develop good incentive schemes. It is hard to improve voter turnout, even when incentive schemes are implemented.

On top of this, DeFi is already a complex ecosystem to navigate, which means that by the time users have understood a protocol’s mechanics, acquired the token, and staked them correctly, their mental bandwidth to learn and vote in governance is already diminished. The lack of voter enthusiasm is compounded by the often convoluted governance proposal system within protocols.

To counter this, protocols have added certain design mechanisms such as veTokens and delegates to reduce the voting power being left on the sidelines. However, these mechanisms have drawbacks that end up centralizing voting power and often reduces voting to maximize a single objective.

Drawbacks of veTokens

One of the most popular governance mechanisms currently in place is the veToken design. In summary, users can lock their tokens for a set period of time and receive a proportional amount of voting power based on the length of the time lock. veTokens can then often be used to vote in gauges and receive rewards (bribes) to direct token emissions to specific liquidity pools.

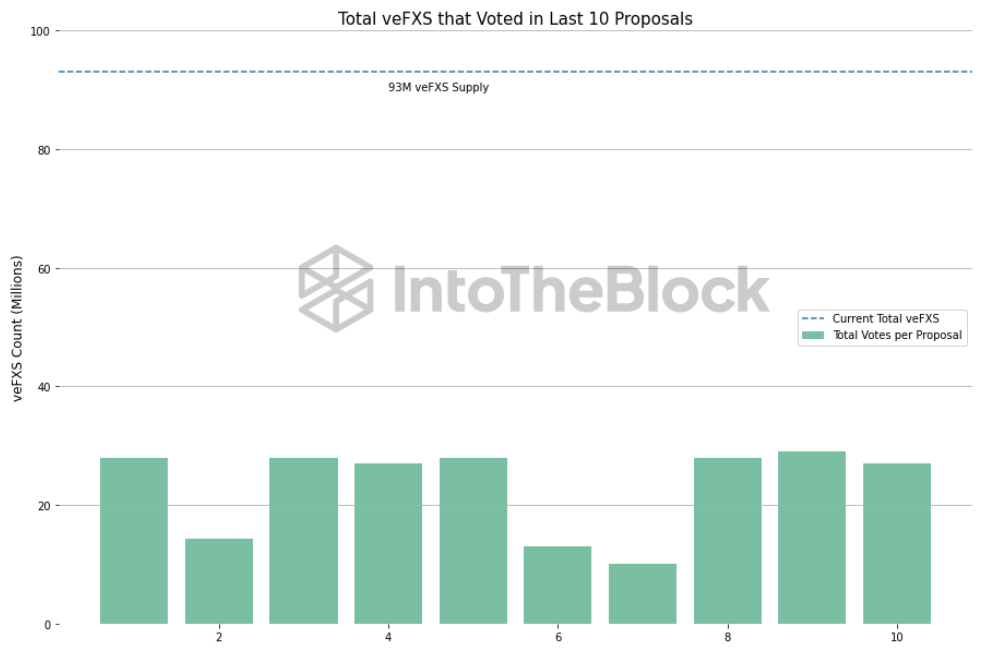

While voting on directing incentives is the main focus of veTokens, they are also used for non-token emissions specific governance votes as well. Nevertheless, since the main focus of the veTokens is for emissions management that the holders get incentives to vote on, most of the other governance proposals are overlooked. An example of this can be seen looking at recent Frax votes where less than a third of all potential voting power is deployed on many of the proposal votes in the last months.

Source: Frax Snapshot, IntoTheBlock

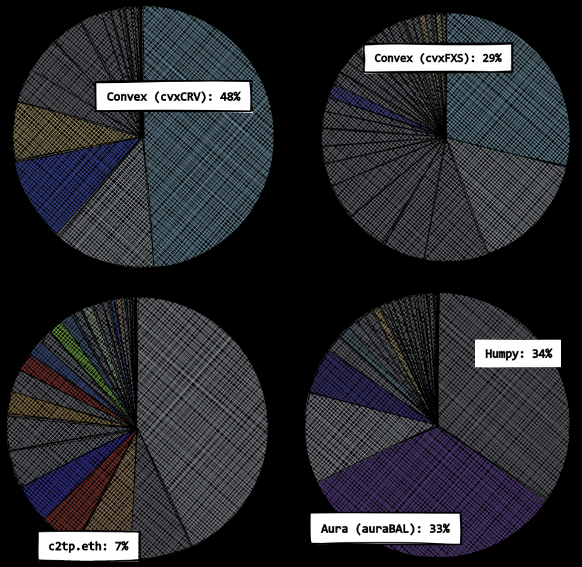

Since the veToken’s main design focus was to maximize token holder value accrual, it was not a big leap to have yield aggregating protocols enter a second layer on top of existing veToken protocols. Projects like Aura and Convex further turbocharge the veToken’s focus on emissions voting by adding additional incentives for users to lock the underlying protocol’s tokens (Balancer and Curve respectively) into their own platform. While this boosts the short-term gains for the users, it also centralizes the voting power for the underlying protocol with the yield aggregating protocol. Many of the veToken wars have been now won by a small group of entities who can effectively shadow-govern the underlying protocols.

Clockwise starting from top left: Curve, Frax, Balancer, Convex. Source: DeFi Wars

The charts above show the voting power distribution of Curve, Frax, Balancer, and Convex with the largest single entity highlighted. The Voting power of these protocols is highly concentrated. In all protocols except Convex, Just a handful of entities are needed to achieve a 50% majority

Delegate Design needs improvements

Delegates are a second popular governance design that is commonly used by protocols to increase underutilized voting power. This is done by allowing token holders to delegate their voting power to people or entities that are more active in day to day operations of a protocol. Delegations can help users still be active in governance by letting them choose a delegate that aligns with their beliefs of what the direction of the protocol should be.

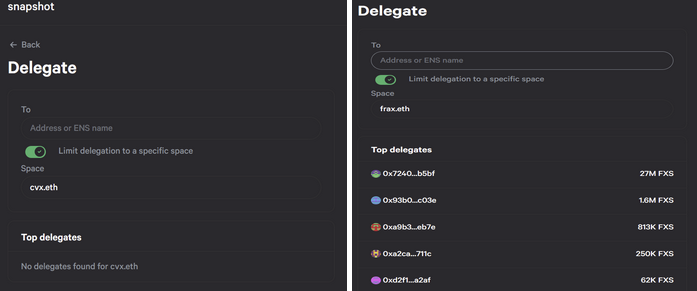

However, delegating is not always straightforward. As an example, when using the popular governance portal snapshot, users can delegate their voting power to addresses. Yet, information on the delegates or the potential addresses to delegate to are not available.

Examples of incomplete delegate information: (L) Convex Snapshot (R) Frax Snapshot

The examples above highlight the lack of information that is available on delegates. Even for Frax delegates, when you click on the addresses to open their bio, often there is little or no information indicating their voting intentions. This can lead users to defaulting into the easiest choice. For the example of Frax, it is to choose one of the existing top delegates (further centralizing voting power). In the Convex example, users will likely choose the default choice offered on the Convex website, which is to delegate your voting power to the protocol’s team.

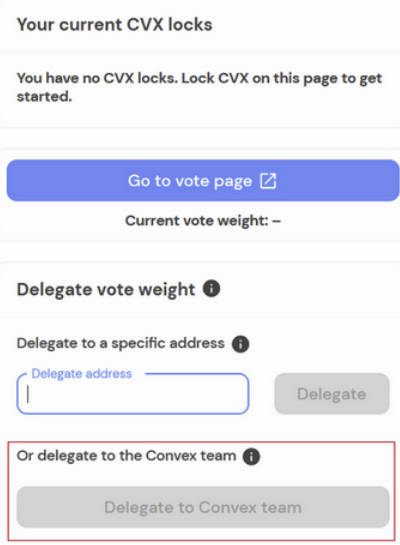

Delegate vote weight options interface on Convex

Delegating to the easiest option isn’t a bad choice. The Convex team and the top delegators on Frax are incentivized to promote the long-term viability of the protocol and therefore vote on proposals accordingly. However, there can be more than one vision of what the best way to promote the long-term viability of a protocol. This can be seen in the debate around the eventual decision for MakerDAO to adopt the Endgame proposal. Without easily accessible delegate information, the default easiest option is often chosen, leading to centralized voting power and making protocol governance a single-issue platform.

Compounded effects of veTokenomics and Delegates

To highlight the influence veTokenomics and delegation design can have in a vote, we will look at a recently rejected grant proposal that IntoTheBlock (ITB) submitted to Frax governance.

A brief summary of the proposal was to develop a risk indicator dashboard for Fraxlend. A grant was requested to develop this dashboard and put to a vote within the Frax snapshot. This generated an identical vote on the Convex snapshot to request input from convex voters. While the proposal was winning in the Frax governance (albeit with very low voter turnout), the proposal was losing the vote on Convex (also low voter turnout). Convex uses the outcome of their vote to then vote in proportional weights on Frax governance. This means a total of 7.9M vlCVX ( ~16% of total vlCVX) was able to implement a vote against the proposal of 29% of all voting power on a proposal on Frax.

To be clear, this voting process worked exactly as it is supposed to. This is how veTokenomics is designed and the voters in Convex voted in the manner which they believe is best for Convex. It does however bring to light some important issues.

The first is that no matter the size of the vote power on Convex, the full weight of the veFXS tokens that they hold will be implemented in proportion to the weights of the vote on Convex. This means that even a very small turnout on a Convex vote (say 5% of vlCVX), could be the lynchpin to a governance proposal on Frax if 100% of the Convex vote was in favor or against.

The second issue that is perhaps special to Frax is that the veFXS token governs all Frax products. This means that proposals for Fraxlend and Frax pools are voted on by all veFXS holders. If veFXS holders are only interested in one aspect of the whole Frax ecosystem, they can vote against expenditures on other products in the ecosystem.

Potential Improvements

On the bright side, protocol governance is still in its infancy, which means there is still room for improvements that can be quickly implemented. Furthermore, DeFi has always embraced experimentation and experiments within the governance framework is no exception.

Simple Steps

An improvement that can be easily implemented across any DeFi protocol that uses governance is increased accessibility to delegate information so that token holders can make more informed delegations. Key points such as delegate’s name, address, mission statement, voting history, and vote motivations can provide enough information to make it easier for a token holder to choose an alternative delegate option instead of the default. Within the Ethereum ecosystem, Aave and MakerDAO provide good examples of how this can be implemented.

Get out the vote! (by incentivizing)

Since it is often that even delegates don’t vote on 100% of proposals in a protocol, a more experimental improvement to encourage voter turnout can be through incentivizing voting. While this could be more controversial and would involve initial votes to authorize spending, this design could encourage delegates and non-delegates alike to become engaged in the protocol’s governance. Aave is currently experimenting with incentivizing delegates to become more active in governance. An expansion of this experiment could lead to more active delegates and a more robust governance environment.

There is still a large portion of token holders that don’t delegate nor vote. A method to bring them into governance would be to incentivize users to vote. An extension to this to promote individuals voting rather than just delegating to get the incentives would be to implement some sort of quadratic incentive scheme (or more sybil resistant scheme) or to have a cap on incentives allocated to any one entity. This would incentivize all delegates to vote and would provide additional incentives for token holders who decide to put in the additional effort to make a vote themselves. This scheme would inherently punish unengaged delegates who don’t vote as token holders would undelegate from them to vote themselves or redelegate to an active delegate.

Conclusion

DeFi governance is still in its early stages, but there are many different experiments on possible improvements yet to be explored. While the current system leaves much to be desired, there appears to be a clear path forward to improving and maintaining diversified and decentralized governance forums. Improving voter turnout is crucial to creating a vibrant governance ecosystem. Protocols are trying to improve this, but there are still low hanging fruit in terms of improvements that could greatly improve the voting and delegation systems.

The Hidden Hands and Pitfalls in Governance was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.