Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

A few weeks ago, a friend of mine decided to donate Bitcoin to a good cause. His Good Samaritanship ended up garnering international television coverage.

And with that, his misery began.

First his iphone started acting funny. An array of confusing notifications followed by an inability to access the phone altogether. Hackers had apparently “ported” his device.

Then the emails: Requests from his numerous Gmail accounts to change passwords. New login IP notifications. Double authentication confirmations for his Coinbase and Bittrex accounts.

In a race against the clock, he quickly changed all his passwords, and moved as much of his crypto as he could. He didn’t sleep for 36 hours.

Right when he figured he had thwarted the attack, he received an email — from one of his own email addresses:

“We’re in your Google Drive, and can see your spreadsheet with your crypto holdings. Send us 50 BTC or we take it all.”

Welcome to getting press in the world of crypto.

Flipside Crypto is pleased to announce it has closed a $3.4M venture round for its data-driven cryptocurrency investment vehicles.

True Ventures led the round, with participation from The Chernin Group, Resolute Ventures, Boston Seed, Converge and Founder Collective.

Adam D’Augelli — partner at True and crypto enthusiast, specialist and savant — is joining Flipside Crypto’s Board of Directors.

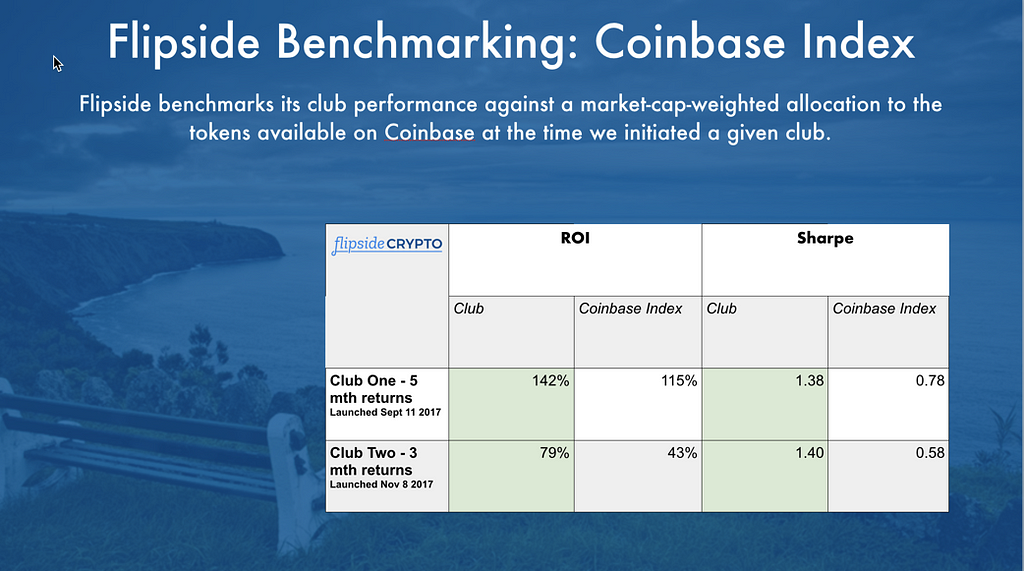

Plus, some additional news: after 5 months of investing, Flipside Crypto’s Club One substantially outperformed the Coinbase Index — a market-cap-weighted allocation of Bitcoin (BTC), Ethereum(ETH, Litecoin (LTC) and Bitcoin Cash (BCH) — delivering 141% return vs. 115% for Coinbase holdings.

Flipside Crypto’s ROI and Sharpe vs. Coinbase Index

Flipside Crypto’s ROI and Sharpe vs. Coinbase Index

All of this is news. And news means potential press. And press coverage means exposure and growth for your business.

In the world of crypto — in these early innings — it also means increased risk. Risk of losing your anonymity. Risk of theft.

It’s a Cornelian Dilemma: Press for invaluable exposure…or no press for increased protection.

My simple take: fear-of-hacking shouldn’t keep you from building your business.

Yes, do everything you can to protect your assets. Don’t cut corners. Don’t be sloppy.

And then it’s all systems go. Time to get the word out.

Flipside Crypto Closes $3.4 Million in Venture Funding From True Ventures, The Chernin Group and Resolute

Flipside Crypto’s Investment Clubs substantially outperform the Coinbase Index, which includes Bitcoin and Ethereum

Boston, MA — March 28, 2018 — Flipside Crypto is pleased to announce it has closed a $3.4 million venture capital round for its data-driven cryptocurrency investment vehicles. True Ventures led the financing round, with participation from The Chernin Group, Resolute Ventures, Boston Seed Capital, Converge and Founder Collective. True Ventures Partner Adam D’Augelli will join Flipside Crypto’s Board of Directors.

Flipside Crypto will use the funding to continue to develop and refine its algorithms, which analyze speculation, developer behavior and token utility for cryptocurrencies. In addition, the funding will be utilized to further develop Flipside Crypto’s suite of cryptocurrency management services, including cryptocurrency acquisition, digital walleting and custody services.

“This financing round will build on the tremendous outcomes from our first 6 investment vehicles,” said Dave Balter, CEO of Flipside Crypto. “We’ve proven our algorithms can deliver substantial ROI, while simplifying the process of acquiring a basket of cryptocurrencies for Club Members.”

The round of financing follows the launch of Flipside Crypto’s first six investment vehicles. Launched in 2017, the vehicles utilize Flipside’s algorithms to analyze the liquid cryptocurrency market and identify a diversified basket of 14–16 cryptocurrencies, including Bitcoin and Ethereum, as well as a number of altcoins club members can invest in.

In its first five months, Flipside Crypto’s hallmark Investment Club “Club One” substantially outperformed the Coinbase Index — which considers a market-cap-weighted allocation of cryptocurrencies available on Coinbase including Bitcoin, Ethereum, Litecoin and Bitcoin Cash — delivering 141 percent return versus 115 percent for Coinbase holdings. A Bitcoin-only investment would have produced a 92 percent return. Flipside Crypto’s “Club Two”, which launched in November 2017, has delivered 79 percent return versus 43 percent return for the Coinbase Index and 11 percent return for Bitcoin-only after three months of existence.

“We are thrilled to partner again with Dave, Jim (Myers), and Eric (Stone) on Flipside Crypto,” said Adam D’Augelli, partner at True Ventures. “They’re proven entrepreneurs and have established industry-leading algorithms for analyzing the value of cryptocurrencies. While it’s early for the space, we think Flipside could change how crypto infrastructure is built and funded.”

Flipside Crypto is currently accepting investments from accredited investors for it’s latest investment vehicles.

About Flipside Crypto

Flipside Crypto launched in mid-2017, by developing proprietary data models to evaluate liquid crypto assets and offering a series of investment portfolios related to cryptocurrencies. The company provides a full suite of services from algorithm development to acquisition, digital walleting and custody process for cryptocurrencies, as well as community tools and portfolio dashboards for investors.

Flipside Crypto’s Investment Vehicles

Flipside Crypto’s investment vehicles provide a portfolio approach to cryptocurrency investing, providing investors with diversified baskets of cryptocurrency holdings. Holdings are determined via proprietary algorithms that evaluate speculation, developer activity and utility of each cryptocurrency. Flipside Crypto has completed 6 passive investment products, providing investors a diversified set of cryptocurrencies based on its algorithms. The company is rolling out additional investment portfolio products in 2018.

About True Ventures

Founded in 2005, True Ventures is a Silicon Valley-based venture capital firm that invests in early-stage technology startups. With more than $1.4 billion under management, True provides seed and Series A funding to the most talented entrepreneurs in today’s fastest growing markets. The firm maintains a strong community that supports founders and their teams, helping True companies achieve higher levels of success and impact. To date, True has helped more than 250 companies launch and scale their businesses, creating over 10,000 jobs worldwide. To learn more visit True Ventures.

The Conundrum of Crypto Press was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.