Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Thanks to a Twitter recommendation, we’ve performed an In Depth Review of Electra. If you have a recommendation for our next coin to research, let us know. Electra perfectly fits the size of coin we are looking to review and there are Pro’s and Con’s on both sides of ECA — so let’s take a look!

Electra is a hybrid POW/POS coin that uses the NIST5 algorithm. NIST5 includes features from the five SHA-3 finalist algorithms selected by the National Institute of Standards and Technology of America — hence it’s name. While we’re not experts on the specifics of each of these algorithms, the goal with the creation of NIST5 was to take the best features from these 5 winners, creating a algorithm that maximizes performance, security and efficiency.

Overview:

Electra was launched in March of 2017. Announcement on Bitcointalk here.

Website: https://electraproject.org

Discord: Invite here

Reddit: https://www.reddit.com/r/Electra_Currency/

Telegram: https://t.me/electracoineca — 5k followers, most active community for Electra.

Algo: NIST5

Max Supply: 30 billion ECA

Current Circulation: ~24. Billion (according to https://www.electraexplorer.com)

Pre-mine: 1 Billion ECA

Wallets: Desktop (Windows & Mac) and Paper Wallet

Exchanges: Crypto-Bridge.org, Coinhouse.eu, CoinFalcon.com and Fatbtc.com

Whitepaper: download it here (updated on Jan 31st, 2018)

Market Cap (on 3/13/18): ~ $17.2M/1,890 BTC

ECA price (on 3/13/18): $0.000730 /0.00000008 BTC

Additional Technical details:

Block Size: 1MB (to be increased to 2MB per 2/28/18 Open Paper)

Block Time: 5 minutes (288 blocks per day) — to be reduced to 90 seconds (960 blocks per day)

Max Supply: 30,000,000,000

Pre-mined: 1,000,000,019 (Approximately 3.34%)

Difficulty Target: Retarget occurs every 15 minutes (every 3 blocks)

Fee: 0.00001 ECA

Current POS Reward — Currently 50%, reward reducing to 10 % with annual halving (5% in the second year, 2.5% in the third year)

The Pre-mined supply has a total current market value of ~$596k. According to Electra, it’s held in escrow by a trusted Community Funds Manager. Distribution and use of funds is determined by consensus, to be used on:

- Maintaining the security and usability of the platform

- Funding further development projects as outlined by our roadmap

- Application to new exchanges

While technically a Hybrid POW/POS network, the POW phase is over, which effectively makes this POS only going forward. Electra had a “super rewards bonanza” which awarded 95% of POW coins in just 24 hours. While we like this approach compared to an ICO or Pre-Mine held by devs, we aren’t huge fans of the “early mover” type rewards. Also, the percent of the community that was aware of Electra at the point of the super rewards bonanza was likely a relatively small group. This creates a more centralized model where not only these early holders had an advantage, they maintain it through the current POS phase — via staking rewards. Into the future, as Masternodes hit the network, this early mover advantage intensifies.

According to the Electra Open Paper update on 2/28/18, the POS staking rewards will soon be reduced from 50% to 10%. With 50% staking awards, depending on how many coin holders are actually staking, the estimate was that Electra would run out of coins around August-September of 2018. The whitepaper mentioned that after max supply was reached, nodes would be kept alive only via transaction fees. When you couple this with Electra touting “nearly non-existent transaction costs” on their website…Houston we have a problem! The proposed changes to POS Rewards, Block Size and Block Time are all positives for ECA in the long-term.

Beyond staking rewards, Electra’s focus is on speed (the transaction/sec speed has not been published yet*), low transaction fees (.00001 ECA) and privacy (Optional integration with TOR, IP2network or Kovri). At this time, we’re unsure of the number of transactions/sec that ECA can handle, this will be important to understanding the scalability of ECA as a payment solution.

Roadmap — Electra Ecosystem

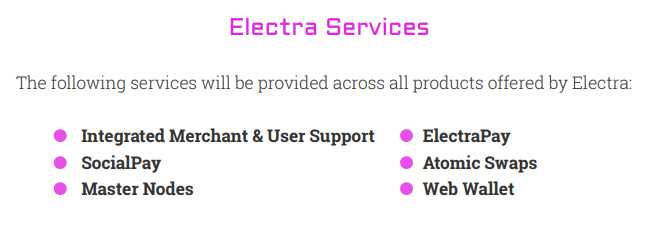

Electra is focused delivering a myriad of payment services across it’s blockchain. Integrated Merchant & User Support is highly needed in the space. Atomic Swaps are not new, but are a buzzword in many an Altcoin whitepaper. We’ve seen many current coins perform atomic swaps (LTC, BTC, ETH, DCR and VTC to name a few), but we’ve yet to see it scale to integrated use, for example, within a wallet.

SocialPay is an interesting concept and we would like to know more about how this would be used and how it would interface within Twitter (especially considering security aspects of payments).

Coinmarkets Flap:

A blemish on the growth of Electra that has since worked itself out was the shutdown of Coinmarkets. ECA was heavily traded on Coinmarkets and at one point grew to be it’s most traded coin.

When Coinmarkets abruptly shut down and many thought their holdings of ECA were gone forever, the amount of conspiracy theories that popped up were incredible. (NOTE: DO NOT KEEP YOUR COINS ON ANY EXCHANGE). FUD popped up stating that Coinmarkets and Electra were somehow associated. There were reports that their websites popped up within days from each other, and therefore must of been associated:

“they been registered the same day almost the same time !!!coinsmarkets.com and electraproject.org <<<←-?📷📷?? .”

Altlook.org was unable to substantiate any of these rumors and Coinmarkets was able to open back up so that users could withdraw their coins. It is evident in the community that they feel like Coinmarkets negatively impacted the price of ECA due to this FUD and the associated negative press. There were somewhere between 800 million ECA and 1 billion ECA on Coinmarkets at the time of the outage. This could have been a death blow to Electra if these coins would have disappeared forever…but luckily they did not.

“An upstart exchange has contacted me saying that they voluntarily added Electra and even put buy orders in exchange for Dogecoin. If you need to buy/sell ECA, check out this link: https://coinsmarkets.com/trade-DOG-ECA.htm" — Electra1 via Bitcointalk ANN (April 13th, 2017)

With the difficulty of getting listed on an exchange (a MAJOR problem in Crypto), it’s hard to not be excited when an exchange offers to list your new coin. Sometimes when an exchange is willing to list your coin too easily, we’d caution that it might just be too good to be true. Hopefully the experience that Electra went through with Coinmarkets serves as a warning for new coins to be more diligent before hyping exchanges that list you out of thin air.

What we don’t like about Electra:

The announcement of ECA by Electra1 was not without it’s bumps. The original period of 40 days with incredibly low rewards was largely criticized by the community on Bitcointalk. The “Super Rewards Bonanza” had issues as well, the number of blocks in the stage were lower than the blocks needed for the coins to mature — which created a substantial delay for everyone who participated. Couple this with the POS Rewards reduction that will come soon, it suggests poor planning at the least…incompetence at worst.

This coin was primarily the result of efforts by Electra1 with help from Bumbacoin when Electra1 ran into significant issues. One of these issues was after the POS phase started the community reported only receiving 10% gains versus the promised 50%. It was also pretty clear that early in the launch of ECA that Electra1 wasn’t spending all of this time on the project:

“I am at work so my hands are tied right now”, Electra1 via Bitcointalk ANN (May 17th, 2017)

While Electra has built out a fairly large and robust team (see them here) on their website, there is little indication of how much time any of them spend on the development of Electra. There has been some activity in Github, but potentially not as much as you would expect with a large team: https://github.com/Electra-project.

The issues with the execution of the Super Rewards Bonanza aside, we’re questionable on Electra1’s motives and strategy. Before the super rewards bonanza, there were only 43 ECA in existence. Due to the difficulty of mining and low supply, these coins demanded a high price — $50-$120. When the bonanza happened, the supply increased extremely rapidly and therefore the price would have decreased rapidly as well. This is not something that Electra1 seemed to grasp:

“Electra’s circulating supply datapoint at Coinmarketcap has been relagated from the value 43 to a question mark. They seem to have corrected the value for total supply. Normally, unconfirmed blocks are also included in Coinmarketcap’s circulating supply values for all coins but it seems they have decided same will not apply to Electra due to it’s different distribution.

Electra’s data provided to Coinmarketcap has so far complied with all of their ranking rules. So in reality, if they do decide to add Electra’s real-time circulating supply (6 billion at the time or writing), at the current price range of $50-$120, Electra will peak at number 1 on Coinmarketcap whilst fully complying to their ranking rules. Electra IS currently number 1. The only problem is, nobody can see it.” Electra1 via Bitcointalk ANN (June 12th, 2017)

Many on Bitcointalk theorized that this was an effort by Electra1 to artificially pump a coin to be #1 on coinmarketcap, thus being the first altcoin to pass Bitcoin. This press would likely of given immediate market attention to Electra and instantly boosted it’s market capitalization. This ultimately didn’t happen and Electra1 seemed a bit salty about it:

“I also announce the founding of a new exclusive club called “The Devs Who Passed Bitcoin Club”. I will be the only member for now but I think Vitalik may join the club soon. Anyways, I will try not to dwell any further on our number 1 position that occurred during the Bonanza and instead focus fully on further improving Electra.” Electra1 via Bitcointalk ANN (June 13th)

We give credit to coinmarketcap for not falling victim to this ploy by not updating the supply until it had more visibility on the supply and the price on the exchanges.

Finally, we’ve talked about the pre-mine, the Super Rewards Bonanza and the POS Rewards — but all of this raises a larger question — centralization. According to www.electraexplorer.com the top 66 wallets hold 50% of the supply of the coin. The Super Rewards Bonanza followed by POS Rewards of 50% only served to further entrench the wealth of the top holders of the coin. Also, Electra1 has admitted to staking his premine shares (read it here), which essentially increases the amount of premine beyond the original 1 billion ECA. Electra wrote the following in their whitepaper, “The cryptocurrency community must recapture the original spirit behind decentralization and the Electra Project is prepared to lead the way.” There is little indication, beyond just lip service, that Electra is set up in a way to encourage decentralization. In reality, with the launch of masternodes, the current amount of centralization has the potential of getting worse. We also have issues with POS coins with no apparent* plans for security, such as Casper on ETH. POS has higher risk for attack than POW and many coins aren’t taking the proper steps to protect their network. This problem is prevalent, not isolated to ECA, but it’s fairly also to say that ECA is likely more secure due to the NIST5 algorithm.

Electra1 stated that he’s utilizing the staked coins to “cover the initial, and possibly, future investments I have/will put up for this project from my own capital”. We feel like this is somewhat dishonest/unethical and it should be put in the header of the ANN, not buried in the comments on page 48. We advise the community to continue to track these holdings and ensure ethical standards are upheld. Here are two wallets that are associated with the premine:

EJXiQYb5tYjVdn8erLT92F6D5ZmCG2ZCvZ — 358M ECA

EVggmyfsA7krt7XsCYyh5DVe5JxDbVs5cZ — ~920M ECA

What we like about Electra

First and foremost, the marketing, brand and community is in place to potentially see a large increase in price. Go on Telegram and you get an immediate sense of the passion behind the coin. Look at the website and the whitepaper, all have been done extremely professionally (and with a “brand” focus) that can help Electra in a crypto market where hype drives price. The developers can be hard to get in touch with on technical issues, due to their workload, but there’s an army of enthusiasts that are there to answer your questions. When performing research, we actively engage with both Discord & Telegram, all of our interactions with the team were very professional.

We’ve been critical of Electra1 and some of the issues that arose for coin that is still very young. While many in the community have a different impressions of currently how involved Electra1 is in the day-to-day development of ECA, there have been some positive changes as of late. The POS Rewards reduction from 50% to 10% was necessary for the ongoing health of the coin. Many users have reported issues in the length it takes for them to get POS shares, the reduction in block time should dramatically help this. The ever growing development team appears to be focused on the right things to help increase the viability of Electra in the coming months.

We covered the issue with Coinmarkets, but it’s important to state the role that ECA has in working with Coinmarkets to get not only ECA released but other coins as well. Taking a leadership role when other coins are struggling with a common issue is commendable and something we look for in a recommended coin.

On March 8th, Electra announced a partnership with Unspecified, LLC — to help aid ongoing software development efforts. Adding technical resources will be crucial for any coin ongoing success, we hope that Unspecified, LLC will help Electra scale and meet some of the roadmap goals for 2018.

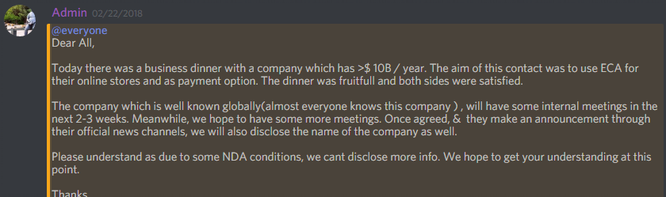

Last but not least, there has been discussion in the community regarding a pending partnership announcement from a large company:

If this pans out, it could be huge for Electra and potentially a game-changer for holders. We will keep our eyes on this over the coming weeks and see if anything comes to fruition.

Verdict: Hold or Do Not Buy

The community that supports ECA is strong and at a market cap of ~$17M there is room for considerable upside on this coin. The team has done a great job of branding and there appears to be some exciting partnerships on the horizon for Electra. If you are a current holder of ECA, we see no imminent reason for you to sell your holdings. The 50% POS rewards are likely to continue until around May and while the reduction in rewards will impact your short term profitabilty, ideally the change will strengthen the coin for future success.

With this being said, our mission is not to make investment advice, it’s to educate the community on the fundamental health of a coin. There are many instances of perceived value in this market (especially following the Dec/Jan highs), our job is to call out the most promising projects.

The centralized aspects of the coin and questionable planning of the coin’s fundamentals, lead us to be skeptical about Electra’s foundation & therefore it’s future. We are also not sold that Electra’s development team can deliver upon it’s payment focused goals, nor do we have reason to believe why a company would seek to use ECA over another payment oriented currency (such as DASH or others) — all in a post Lightning Network world. When thinking about the potential price of ECA it is important for the community to factor in the supply. There are many comments on Telegram and Discord talking about ESP @ $1.00, but even DASH would only have a value of ~$0.14 at Electra’s supply. At even $0.14 though, current ESP holders would see 200x gains.

Electra states that the coin is meant to change and adapt as best practices arise (i.e. a more innovative algorithm), and they’ve shown the willingness to make changes for the future health of the coin. We will continue to watch Electra and monitor these changes, as well as potential partnerships that could elevate the use of Electra.

* we asked the community and was unable to get an answer at this time, will update if we get an answer

We currently have no holdings of ECA and do not plan to initiate a position in the next 48 hours. This is not investment advice, continue to do your own research before buying/selling any coin. We hope that these insights and the associated links included will aid you in making an educated decision.

Sources:

https://www.electraexplorer.com

https://bitcointalk.org/index.php?topic=1848351.0

https://drive.google.com/file/d/1U9AoKmEk-hES5InAdyKINxiqd8xcaINa/view

https://cdn.electraproject.org/wp-content/uploads/2018/02/electra-white-paper_1.0.pdf

https://steemit.com/electra/@kryptonaut/electra-coin-eca-or-epic-hype-or-awesome-opportunity

Social Media: Twitter, Discord, Reddit and Telegram

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.