Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Analyzing Rocket Pool’s Atlas Update

and its Effects on the Network

A lower barrier to entry for mini pool validators and its effects on the network

The Rocket Pool network underwent significant changes in April 2023 with the Atlas update. A highly awaited feature introduced in Atlas is the option to create a mini pool with just 8 ETH, instead of the previous requirement of 16 ETH. To create a validator, mini pools consisting of 8 ETH, are paired with 24 ETH from the staking pool, which is contributed by rETH holders. By implementing this change, the capital needed to operate a personal validator is significantly reduced, leading to increased profits for both the node operator and the rETH stakers. Within this article, we will examine the impact of this update on the Rocket Pool network and explore how it has influenced users’ staking activity.

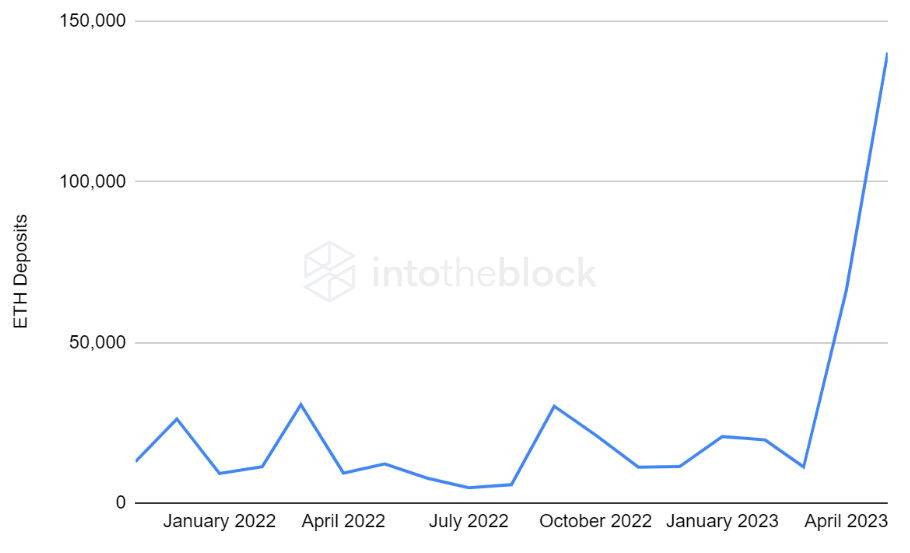

Following the introduction of the Atlas update, the network witnessed a rapid adoption, with a notable increase in users’ monthly deposits. This positive trend has contributed to the ongoing expansion of the protocol.

Source: IntoTheBlock & Rocket Pool Analytics

The monthly deposits demonstrated significant growth, surging from 11,232 in March 2023 to 66,236 in April, indicating the swift adoption of the upgrade by its users. The primary reason behind this increase was the expansion of Rocket Pool’s deposit pool, where ETH deposited by rETH holders is held until it is matched with Rocket Pool’s node operators. Throughout the period leading up to April, Rocket Pool’s deposit pool consistently remained at its maximum deposit capacity of 5,000 ETH.

The demand was primarily motivated by the incentives offered to the rETH-ETH Aura pool, enabling liquidity providers (LPs) to earn attractive returns from their deposited funds. As a result, a premium was generated throughout some time for rETH holders. Users who acquired rETH directly from Rocket Pool’s contract could subsequently sell it on Aura at a higher price, generating additional profit. This dynamic ensured the deposit pool remained consistently full. Due to the relatively high entry barrier of 16 ETH for validators, there was insufficient demand from the nodes’ side to deplete the deposit pool.

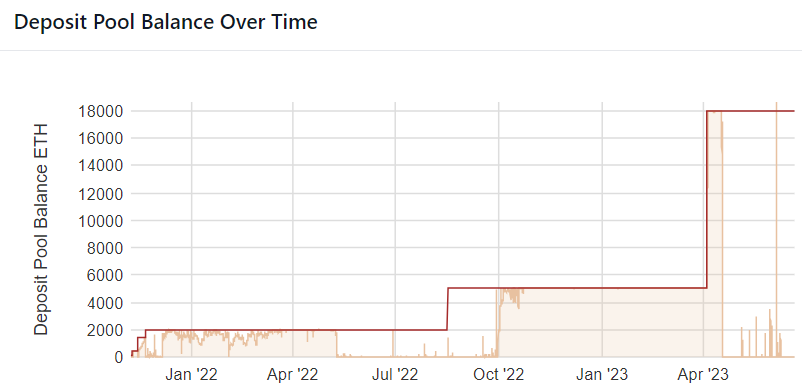

Source: Rocket Pool Analytics

The update altered the dynamics of the network, primarily by expanding the deposit pool, which enabled users to make regular deposits. Secondly, the barrier to entry for validators was reduced from 16 ETH to 8 ETH, enabling a larger number of users to establish nodes and consequently withdraw ETH from the deposit pool.

In addition to new deposits, the involvement of new node operators was crucial to leverage the network’s growth potential. In the absence of sufficient user demand to operate mini pool validators, the protocol could have reverted to the previous dynamics where the deposit pool remained consistently full over time.

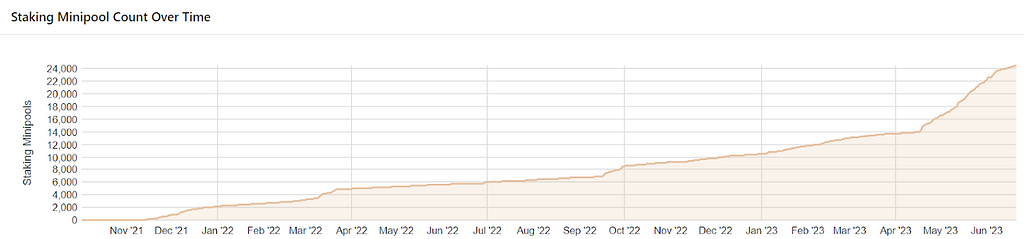

Source: Rocket Pool Analytics

The update received an equivalent level of demand from validators to establish new mini pools. The graph above clearly illustrates the exponential increase in the rate of new mini pool setups since April. The protocol has nearly doubled the number of mini pools, rising from 13,000 prior to the update to nearly 26,000 mini pools at present.

Users have the option to create new mini pools with either 8 ETH or 16 ETH. The functionality of 16 ETH mini pools remained unchanged from before the Atlas update. To establish an 8 ETH mini pool, it is necessary to stake a minimum of 2.4 ETH equivalent in RPL tokens, which stands as Rocket Pool’s governance token.

Source: IntoTheBlock’s RPL Indicators

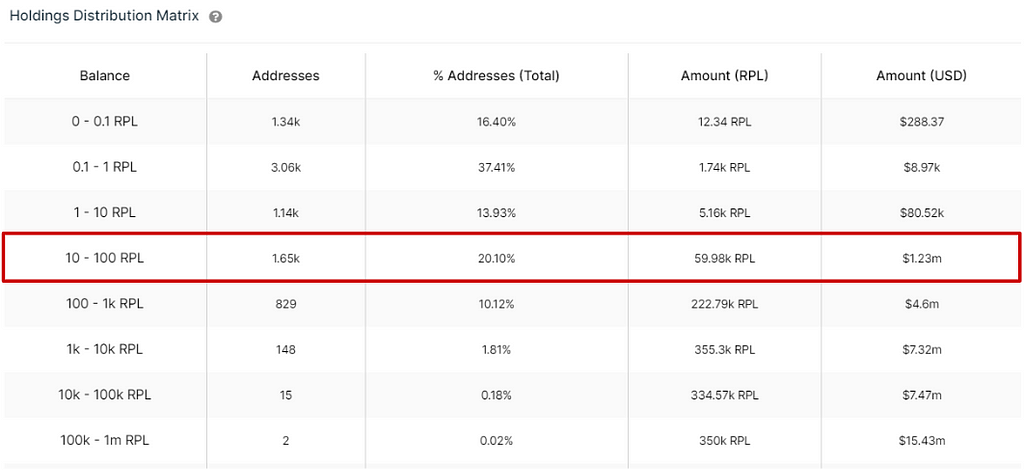

Upon examining the distribution of RPL holdings among users, it becomes evident that 20% of the addresses fall within the range of 10 to 100 RPL tokens. At current prices, the number of tokens required to stake for establishing an 8 ETH mini pool validator is approximately equivalent to the number of tokens held by users within the 10 to 100 RPL token range. Moreover, this data further confirms the users’ interest in creating 8 ETH mini pool validators, a possibility that was made possible thanks to the Atlas update.

In conclusion, the Atlas update introduced significant changes to the Rocket Pool network, including the ability to create 8 ETH mini pools, reduced barriers to entry for validators, and an expanded deposit pool. These updates resulted in a surge of user adoption, with increased monthly deposits and a substantial rise in the number of mini pool setups. The data also highlighted users’ interest in setting up 8 ETH mini pool validators, highlighting those holding a significant number of RPL tokens. Overall, the Atlas update has proven to be a catalyst for the network growth and has sparked greater participation from both users and node operators.

Analyzing Rocket Pool’s Atlas Update

and its Effects on the Network was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.